Fed Initiatives Show Signs They're Working as Intended

They've led to a $1.6 trillion increase in Federal Reserve assets over the past month to $5.8 trillion.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

The Federal Reserve’s balance sheet has exploded over the past four weeks, increasing 37% to $5.8 trillion.

- The $1.6 trillion increase eclipses the $1.3 trillion that the Fed monetized over the 10 weeks from September 2008 to November 2008 during its first quantitative easing program to help alleviate the global financial crisis.

- It is more than 2.5 times larger than the $600 billion monetized during the second quantitative easing program from November 2010 through June 2011.

- This amount is essentially equal to the amount that the Fed's balance sheet grew from the end of 2012 through the end of 2014 during the third quantitative easing program.

Most of the new purchases have been U.S. Treasury bonds and agency mortgage-backed securities. And as dramatic as the balance sheet increase has been, it will continue to grow as the Fed expands its programs and implement its new initiatives to purchase corporate bonds and support small-business loan programs. According to Capital Economics, an economic research firm, the Fed’s balance sheet could gradually grow to $10 trillion as these new initiatives are rolled out.

How Did We Get Here? The markets plunged in late February and into early March, hit by the double impact of COVID-19 and plunging oil prices. Prices dropped so far and so fast that liquidity began to sieze up across several different asset classes. To provide a little grease to loosen the tighter financial conditions, the Federal Reserve took several actions. First, on March 3 it cut the federal-funds rate by 50 basis points in an emergency action to a range of 1.00%-1.25%. This was the first time that the Fed conducted a monetary policy action outside of its regularly scheduled monthly Federal Open Market Committee meeting since the 2008 global financial crisis. Instead of calming the markets, many investors became worried about what the Fed was seeing that forced it to conduct this emergency action. As the markets fell further, leveraged investors were forced to liquidate positions and financial conditions became even tighter. The Fed then conducted its second emergency policy action outside of an FOMC meeting, cutting the federal-funds rate to a range of 0%-0.25% on March 15. Because this occurred just three days before the March FOMC meeting, investors became even more concerned that the Fed believed market conditions were so tight that it couldn't wait until the regularly scheduled meeting.

The Federal Reserve followed up with several lending programs to support the money markets. On March 17, it launched the Commercial Paper Funding Facility and Primary Dealer Credit Facility. On March 18, it launched the Money Market Mutual Fund Liquidity Facility, and on March 20, it expanded its programs to include municipal securities. While these initiatives provided the liquidity and funding needed to allay any worries that money market mutual funds might break the buck, financial conditions across the fixed-income credit markets and equity markets continued to deteriorate.

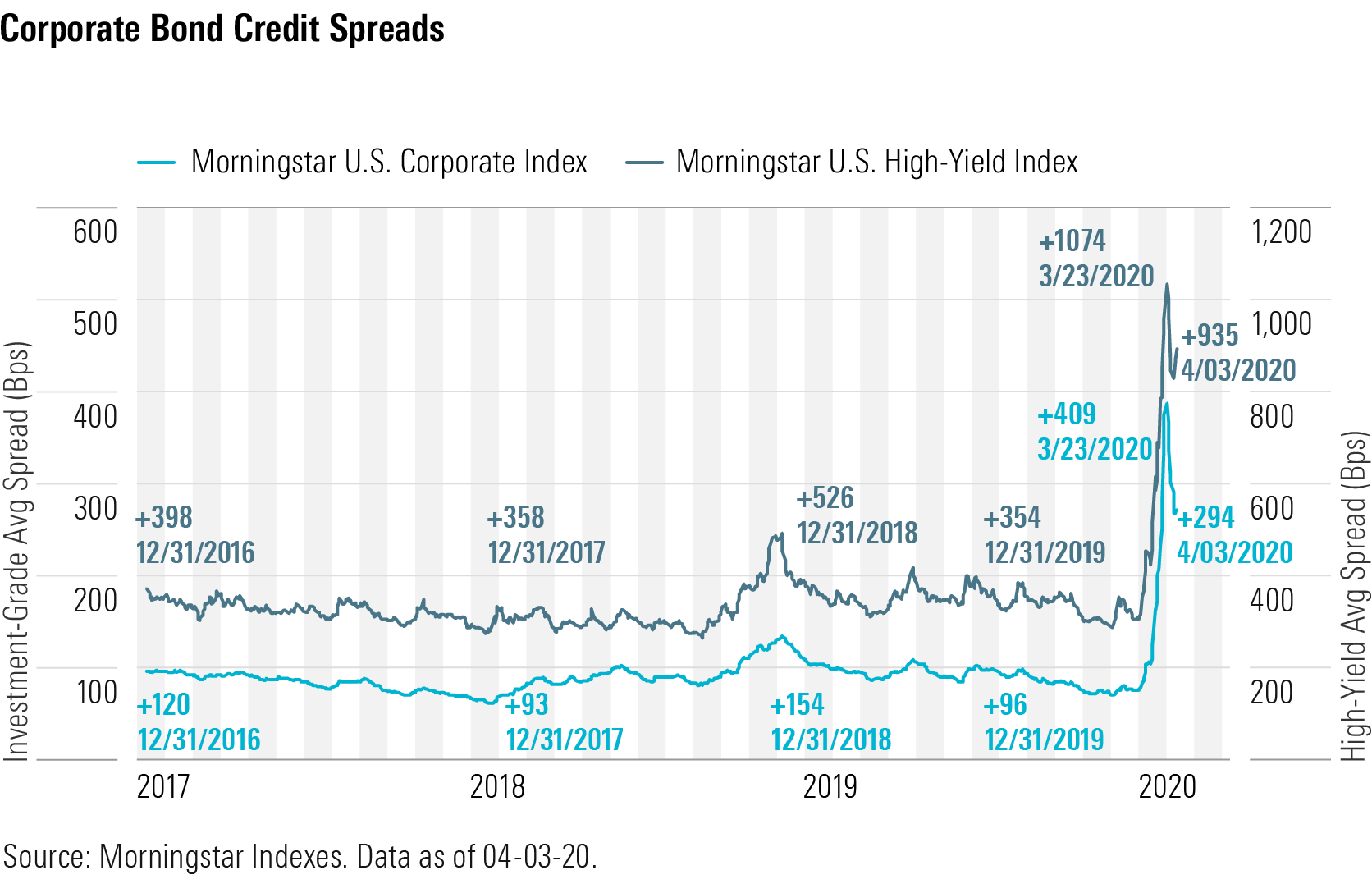

On March 23, credit spreads of corporate bonds hit their widest levels since the 2008 global credit crisis. The average spread of the Morningstar Corporate Bond Index had widened out 282 basis points since the beginning of the month to +409 basis points. The credit spread is the amount of extra yield a corporate bond earns over a Treasury bond with a comparable maturity. The higher interest rate compensates investors for the added risk of potential downgrades or default. Credit spreads widen when the economy slows and tighten when the economy expands and the risk of downgrades and defaults diminishes. In the high-yield market, the Morningstar US High-Yield Bond Index had widened 573 basis points to +1,074. In the equity markets over the same period, the S&P 500 plunged 22%. As we highlighted in Even Safe-Haven Assets Are Feeling the Pressure, in order to raise enough capital to satisfy their margin requirements, leveraged investors had switched from selling what they wanted to selling whatever they could.

Federal Reserve Dusts Off 2008 Playbook As the lack of liquidity caused the markets to seize up, the Federal Reserve dusted off its playbook from the 2008 global financial crisis. Not only did it run several of those plays, but it also developed several new ones. First, the Fed eliminated the cap on open-market operations and committed to purchase $125 billion of U.S. Treasuries and mortgage-backed securities per day the week of March 23; it would then continue to purchase Treasury bonds, MBS, and commercial mortgage-backed securities as needed to provide enough liquidity to satisfy market demands. In the past, the Fed would put a limit on the amount of securities it would purchase, but now it has an unlimited ability (now jokingly referred to as "QEternity" among bond traders) to purchase as many securities as it deems necessary to support the normal functioning of these markets.

Second, the Fed resurrected the Term Asset-Backed Securities Loan Facility. The intent of TALF is to support the funding of consumer credit such as student, auto, and credit card loans. The TALF will provide financing to institutional investors to purchase the AAA rated tranche for asset-backed securities backed by new consumer loans. By providing this financing, the TALF will maintain the normal issuance of ABS so that banks can sell their consumer loans into the ABS and use the proceeds to reinvest in making new consumer loans. (An asset-backed security consists of a pool of loans that is then divided into different tranches.)

Fed Devises Brand-New Plays For the first time, the Fed, by utilizing equity contributed by the Treasury Department, will be directly involved in providing support for the fixed-income corporate credit markets. As the markets deteriorated, credit spreads widened so quickly that liquidity evaporated across the corporate bond markets. Portfolio managers were unwilling to try to catch a falling knife, and issuers were unable to bring new issues to market to refinance existing debt or fund general corporate purposes.

The Treasury has committed to invest in a newly created structured investment vehicle that the Federal Reserve will then lend to and use the proceeds to purchase eligible investment-grade corporate bonds. The size of this program will be substantial, as it is estimated that the Fed will leverage the amount invested by the Treasury Department by 10 times The Fed will be able to purchase corporate bonds in the new issue market by utilizing the Primary Market Corporate Credit Facility and the secondary market through the Secondary Market Corporate Credit Facility. The secondary market facility is also allowed to purchase exchange-traded funds that invest in investment-grade U.S. corporate bonds.

In addition to providing support to large, investment-grade corporations, the Fed will implement a lending program to support smaller businesses through the Main Street Business Lending Program. This program is aimed at middle-market companies--those that are too large for small-business loans but too small to access the public capital markets. Companies with $10 million-$50 million in EBITDA typically fall into this category.

Supporting Monetary Policy, Fiscal Stimulus Program to Curb Economic Contraction While the Fed has moved swiftly and decisively to alleviate the frictions in the capital markets, the U.S. government has instituted a historic $2.2 trillion fiscal stimulus package to support individuals as well as businesses, large and small, to keep them afloat until some semblance of normalization can occur. As it equates to roughly 10% of U.S. 2019 GDP, this package is substantial and will provide significant downside protection to the individuals and businesses that will be hardest-hit by the shut-in orders. However, this program comes with a cost, as we forecast the 2020 U.S. federal deficit/GDP ratio will increase to 17%, up 1,200 basis points from 2019.

According to Coronavirus Update: Long-Term Economic Impact Forecast to Be Less Than 2008 Recession, we expect that current social distancing efforts will begin to reduce the number of COVID-19 cases by the end of May and we will be able to begin lifting restrictions in June and July. We anticipate that different waves of drug treatments will help those infected with COVID-19 and that we will see a vaccine introduced in 2021.

With these projections as our base case, we forecast a 2.9% contraction in U.S. GDP in 2020. However, we think that the scope of the shutdown to disrupt the economy in the long term is probably overrated. In the aforementioned report, we provide the analysis as to why we expect only a 0.9% decrease in GDP over the long run. For example, about 70% of GDP is from businesses that are exempt from orders, and about half of the businesses that aren’t exempt can continue with remote operations. Additionally, the fiscal stimulus should prevent a collapse in demand. The global equity markets are pricing in a greater amount of economic contraction than we forecast.

Early Signs That Fed's Initiatives Are Working as Intended Since the Fed expanded its myriad alphabet soup lending programs on March 23, the corporate bond market and equity markets have rebounded solidly. In the equity markets, since the Fed announced these programs through April 3, the S&P 500 has rebounded 11% as the technical pressure from forced sellers has abated and investors are able to focus on businesses' fundamentals. After being locked up much of March, the corporate credit markets have opened up. The average spread of the Morningstar Corporate Bond Index has tightened 115 basis points to +294 basis points and the Morningstar US High-Yield Bond Index had tightened 139 basis points to +935.

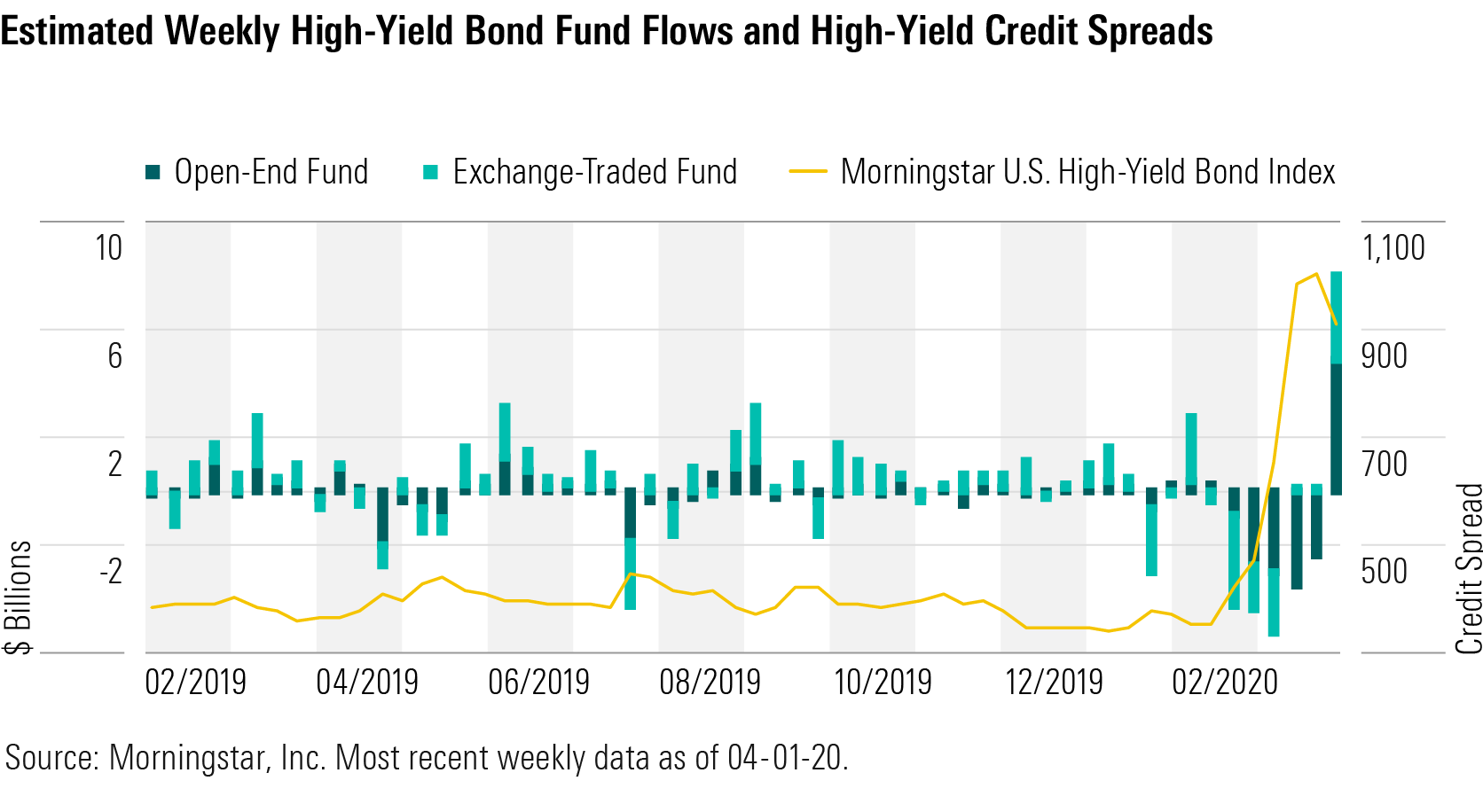

As credit spreads have tightened, the window to the new issue market has reopened. Even though credit spreads remain wider than average, many corporations have rushed back into the market to issue debt and lock in financing while they can. According to Bloomberg data, for the week ended March 27, almost $100 billion of new corporate bonds were sold, and for the week ended April 3, the market is on pace to sell well over $110 billion. To place that amount of issuance in context, the prior weekly record was around $80 billion before being broken in each of the past two weeks. Investors have also come back to the high-yield markets. Multiple firms rated below investment grade have issued new debt to strong investor demand. In fact, after suffering record outflows for much of March, dedicated high-yield open-end mutual funds and exchange-traded funds have experienced strong inflows.

For the week ended April 1, high-yield funds experienced a record-high $7.9 billion of weekly inflows. This easily surpassed the prior record of $5.8 billion. The inflows were split between $4.8 billion to high-yield open-end mutual funds and net new unit creation of $3.1 billion across high-yield exchange-traded funds.

Even though credit spreads have tightened since we opined in Corporate Bonds at Second-Widest Level in 20 Years that it would be an opportune time to rebalance fixed-income portfolios and start to layer in additional corporate credit fund exposure, we continue to see attractive value in the corporate bond sector. For investors looking for investment opportunities in the equity markets, there are multiple articles in our special coronavirus section devoted to bringing investors specific research and analysis.

This article has been written on behalf of Morningstar, Inc., and is not the view of DBRS Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)