8 Sturdy Dividend Stocks

We think the payouts on these undervalued names are sustainable.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

As the novel coronavirus threatens the health of the economy, many companies are trying to shore up their liquidity. Some--such as Occidental Petroleum OXY, Apache APA, and Targa Resources TRGP--have cut their dividends. Others--including Boeing BA, Ford F, and Macy’s M--have suspended theirs entirely.

“If a company has a shaky balance sheet, struggles with solvency, or experiences share price volatility due to questions regarding its long-term viability, future dividend payments may be in jeopardy,” explains Dan Lefkovitz, a strategist for Morningstar’s Indexes group.

Lefkovitz argues that “Distance to Default” is an especially useful health screening tool for dividend payers today.

"Distance to Default is a measure of balance-sheet strength," he says. "It gauges the likelihood of bankruptcy. It looks at leverage and volatility and gauges whether the sum of a firm's assets are at risk of falling below its liabilities."

Watch: How to Approach Dividend-Paying Stocks During Volatility

In an effort to find attractively priced companies with defensible dividends in the face market uncertainty, we turn to the Morningstar Dividend Yield Focus Index. A subset of the Morningstar U.S. Market Index (which represents 97% of equity market capitalization), this index tracks the top 75 high-yielding stocks that meet our screening requirements for quality and financial health--with Distance to Default being one of those measures.

How are the index constituents chosen? For starters, only securities whose dividends are qualified income are included; real estate investment trusts are tossed out. Companies are then screened for quality using the Morningstar Economic Moat and Fair Value Uncertainty ratings. Specifically, companies must earn a moat rating of narrow or wide and an uncertainty rating of low, medium, or high; companies with very high or extreme uncertainty ratings are excluded. We then screen for financial health using our Distance to Default measure, which uses market information and accounting data to determine how likely a firm is to default on its liabilities. The 75 highest-yielding stocks that pass the quality screen are included in the index, and constituents are weighted according to the total dividends paid by the company to investors.

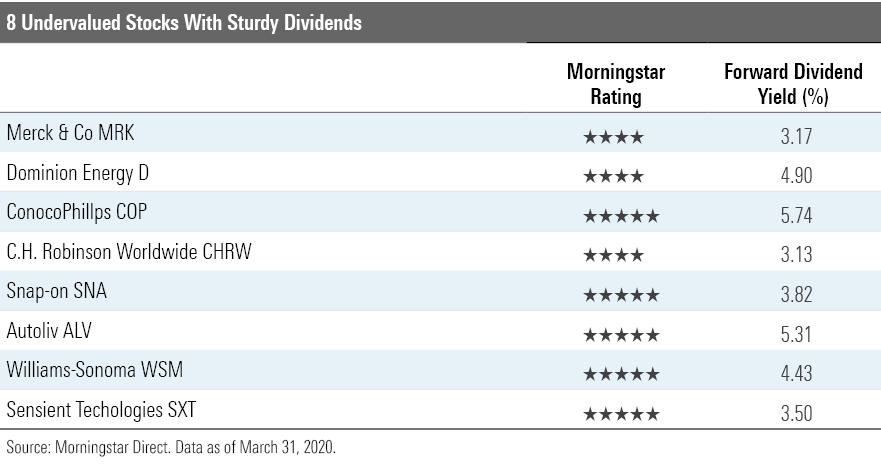

Eight of the companies added to the index during its latest reconstitution in March are undervalued according to our metrics today.

Here’s a little bit about two of the names from the list.

ConocoPhillips COP "Differentiating itself from peers big and small, ConocoPhillips has laid out a 10-year plan that calls for restrained investment, steady growth, improving returns, and importantly, a focus on returning cash to shareholders.

"Through high-grading and cost improvements, the company has reduced the oil price necessary to earn a 10% return on capital to below $40 per barrel. This low cost of supply should allow it to continue investing through the cycle. It plans to invest $7 billion per year on average through 2029, which should deliver production growth of about 3% annually, driving growth in annual free cash flow to $7 billion per year in 2029 from $2.5 billion currently. Central to its plan is its target to return 30% of operating cash flow to shareholders per year, ultimately culminating in $20 billion in dividends and $30 billion in buybacks between now and 2029.

"Its growth plan rests largely on its unconventional assets, specifically its Permian position. While the company holds acreage in the Bakken and Eagle Ford, production growth in both these regions will be limited. Meanwhile, the Permian will grow from less than 100,000 barrels of oil equivalent per day today to 400,000 by 2029, lifting overall unconventional volumes to 800 mboe/d by 2029 from about 450 mboe/d currently.

"Growth will also come from Alaska, where production is expected to grow from less than 200 mboe/d today to nearly 300 mboe/d by 2029. Canada will be another area of growth thanks to the company’s unconventional Montney position, which could see volumes grow from about 25 mboe/d today to 250 mboe/d by 2029.

"The plans make ConocoPhillips a compelling option in the energy sector, given its ability to grow and return cash to shareholders. Surely it will be tested in the current environment, where oil prices have fallen below our estimated cash flow break-even of $40/bbl. However, it’s only reduced capital spending by 10% in 2020 and is continuing to repurchase shares, albeit at a reduced rate, but a prudent use of capital considering the sharp drop year to date. Given its low debt and cash balance, the dividend looks safe.”

Allen Good, strategist

Williams-Sonoma WSM "We have reduced our fair value estimate to $68 from $72 per share on narrow-moat Williams-Sonoma after incorporating full-year results into our model, including 6% brand comps and an 8.6% operating margin. While these metrics were largely in line with our forecasts, we now believe 2020 will be materially affected by the global spread of COVID-19 and have embedded sales declines of 16% in 2020, as we expect retail stores could be closed for the remainder of the first quarter (mid-March to the end of April) as well as a significant part of the second quarter. Additionally, given the disruption in both the supply chain and the labor force, we anticipate the return to demand could take a few quarters and, as such, model EPS falling around 45% in 2020 as costs deleverage.

"Longer term, we expect demand to return to a more normalized rate. We project that total sales will grow at a 4% average clip in 2022 and beyond after COVID-19 subsides, supported by low-single-digit retail sales growth and 3% average e-commerce growth. We forecast EBIT margins rising modestly after COVID-19 from improvements in the supply chain and infrastructure, which could be held back by higher spending if the firm sets up an owned brick-and-mortar network internationally. Over time, we forecast gross margins around 37% as volumes increase, while selling, general, and administrative expenses modestly leverage from 2019 levels (27.8%). This generates operating margins of nearly 10% by the end of our forecast.

We have reassessed the uncertainty of Williams-Sonoma and maintain our medium rating. The firm has little liquidity risk, with just $300 million in long-term debt on its balance sheet and access to a $500 million credit facility (with a $250 million accordion). There is cash on hand, about $430 million at the beginning of November, to help cover expenses like operating lease obligations, which assures us that the near-term risk profile of the firm remains unchanged.”

Jaime Katz, senior analyst

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)