Primecap Can Ride Out Its Airline Stocks' Turbulence

The firm has been here before.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

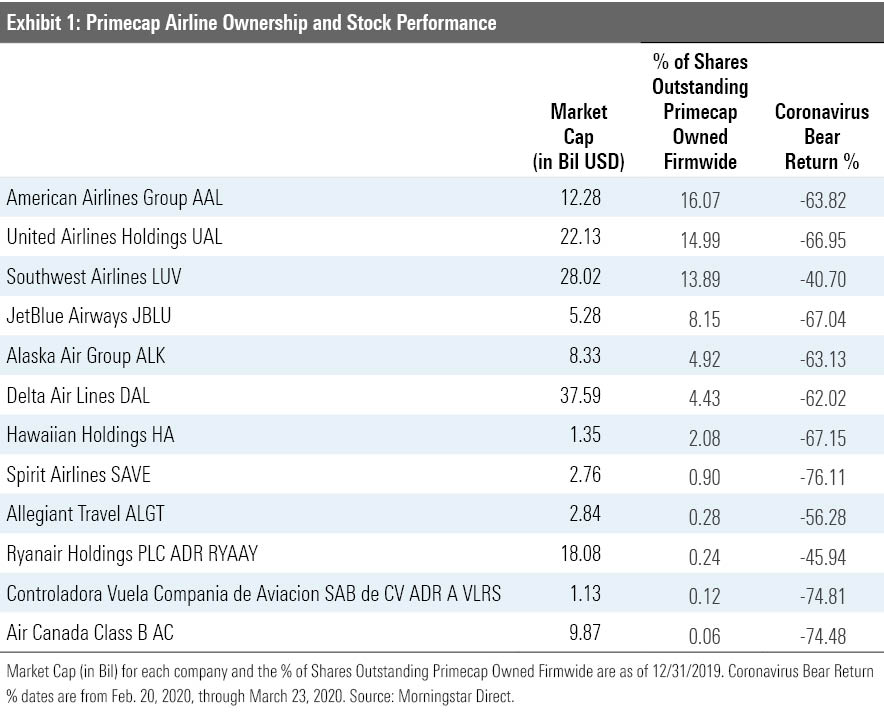

The coronavirus’ economic fallout has hit investors in airline stocks especially hard, perhaps none more so than Pasadena-based Primecap Management Company. At year-end 2019, Primecap firmwide owned 14% to 16% of the shares outstanding in three different airlines and stakes in nine other air carriers. As Exhibit 1 shows, shares of each of these airlines shed between 40.7% and 76.1% during the depths of this still-unfolding bear market (Feb. 20, 2020, to March 23, 2020), versus a 33.8% drop for the S&P 500 index.

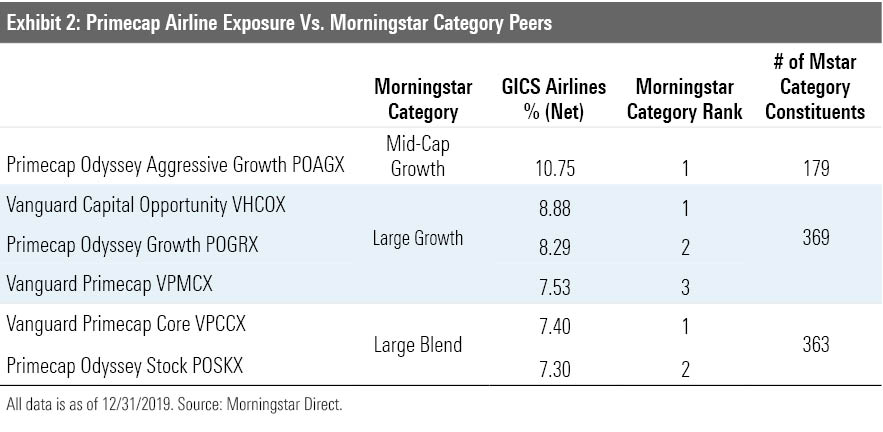

Not a single Primecap open-end fund escaped the carnage. All six had at least two airline stocks among its top 20 holdings at year-end 2019, with total exposure for each ranging from about 7% to 11%. The magnitude of Primecap's industry bet becomes apparent through the peer group comparisons depicted in Exhibit 2. Primecap Odyssey Aggressive Growth’s POAGX 10.75% stake, for example, was the highest out of roughly 180 mid-cap growth Morningstar Category peers and more than double its closest rival.

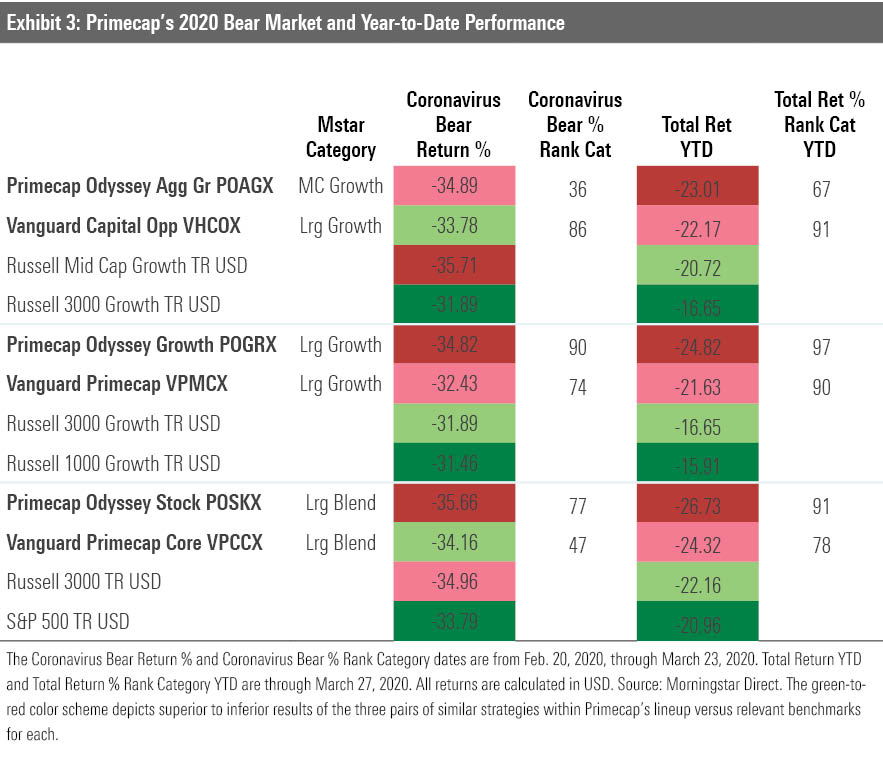

The funds owned some biotechnology, pharmaceuticals, and food staples and retailing stocks that held up relatively well, and some even rose. For example, Primecap Odyssey Aggressive Growth and Vanguard Capital Opportunity VHCOX both benefited from modest positions in the German biotech company BioNTech BNTX, whose shares shot up 59.1% during the bear market so far, thanks to enthusiasm about its partnership with Pfizer PFE to develop a COVID-19 vaccine. Yet Exhibit 3 shows that wasn’t enough to rescue the lineup from disappointing performance, which helpings of cruise lines like Royal Caribbean Cruises RCL and Carnival CCL exacerbated.

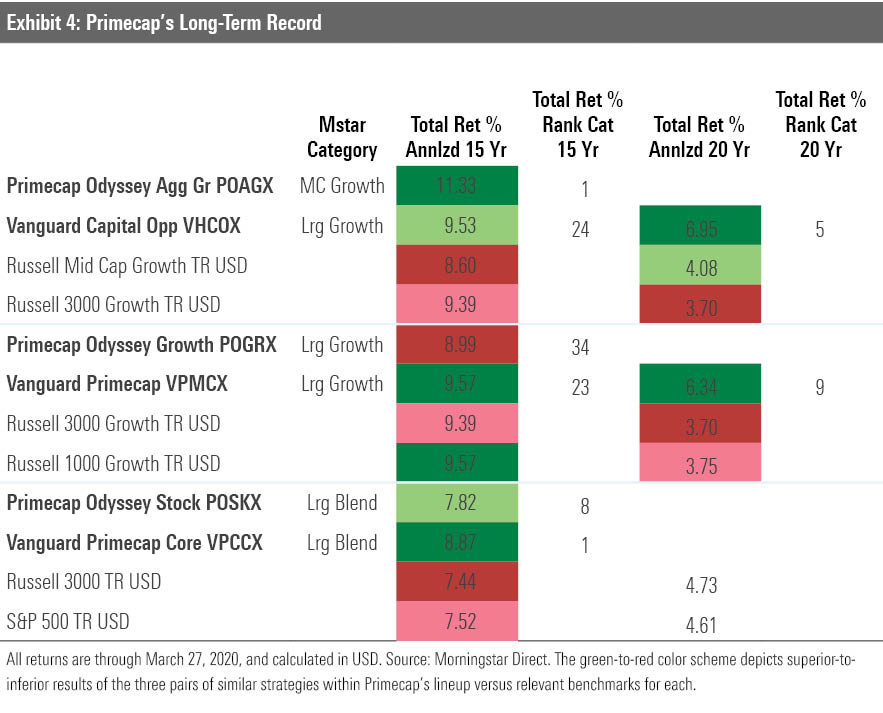

This rough patch hasn’t impaired the Primecap lineup’s long-term record, though. Over the trailing 15 years through March 27, 2020, each fund has outpaced most of its peers, and four of the six have beaten all relevant benchmarks, as have the two funds, Vanguard Primecap VPMCX and Vanguard Capital Opportunity, with 20-year track records.

Those 20-year records include three bear markets and periods when Primecap's long-standing penchant for airline stocks wreaked havoc on the firm’s results. Vanguard Primecap and Vanguard Capital Opportunity had 7.7% and 7.4% stakes, respectively, in several of the same airline companies or their predecessors before the Sept. 11, 2001, terrorist attacks, which set many carriers on paths to bankruptcy. The managers sold two airline holdings then but held fast on the other positions, in some cases not selling a single share for the rest of that year. While that’s been a contrarian view, the managers like the industry’s oligopolistic structure and favorable long-term demand trends. Not every airline pick has proved to be a winner, but Alaska Air Group ALK did. Its 8.3% annualized gain from the day the market reopened on Sept. 17, 2001, through March 27, 2020, beat the Russell 1000 Growth Index and S&P 500 by 0.46 and 1.5 percentage points, respectively.

Two of Primecap's five current managers ran money for Vanguard Primecap and Vanguard Capital Opportunity on 9/11 and during its aftermath, while two others worked as analysts at the firm. There’s no guarantee the present team will come to the same conclusions or achieve the same results. Nonetheless, the managers’ institutional memory and experience through multiple cycles and crises give them the perspective to keep their heads and stick to their process when fear and panic predominate.

The attributes that fueled the lineup’s long-term success remain intact and give it a good shot at recovering. Primecap managers possess a unique blend of price discipline, the ability to forecast businesses’ long-term earnings potential, and patience to endure volatility. The firm also has a best-in-class approach to recruiting investment talent. Each strategy retains its Morningstar Analyst Rating of Gold.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)