Best Values Among Hardest-Hit Real Estate Subsectors

Hotel, mall, and healthcare subsectors should rebound strongly once the global crisis is over.

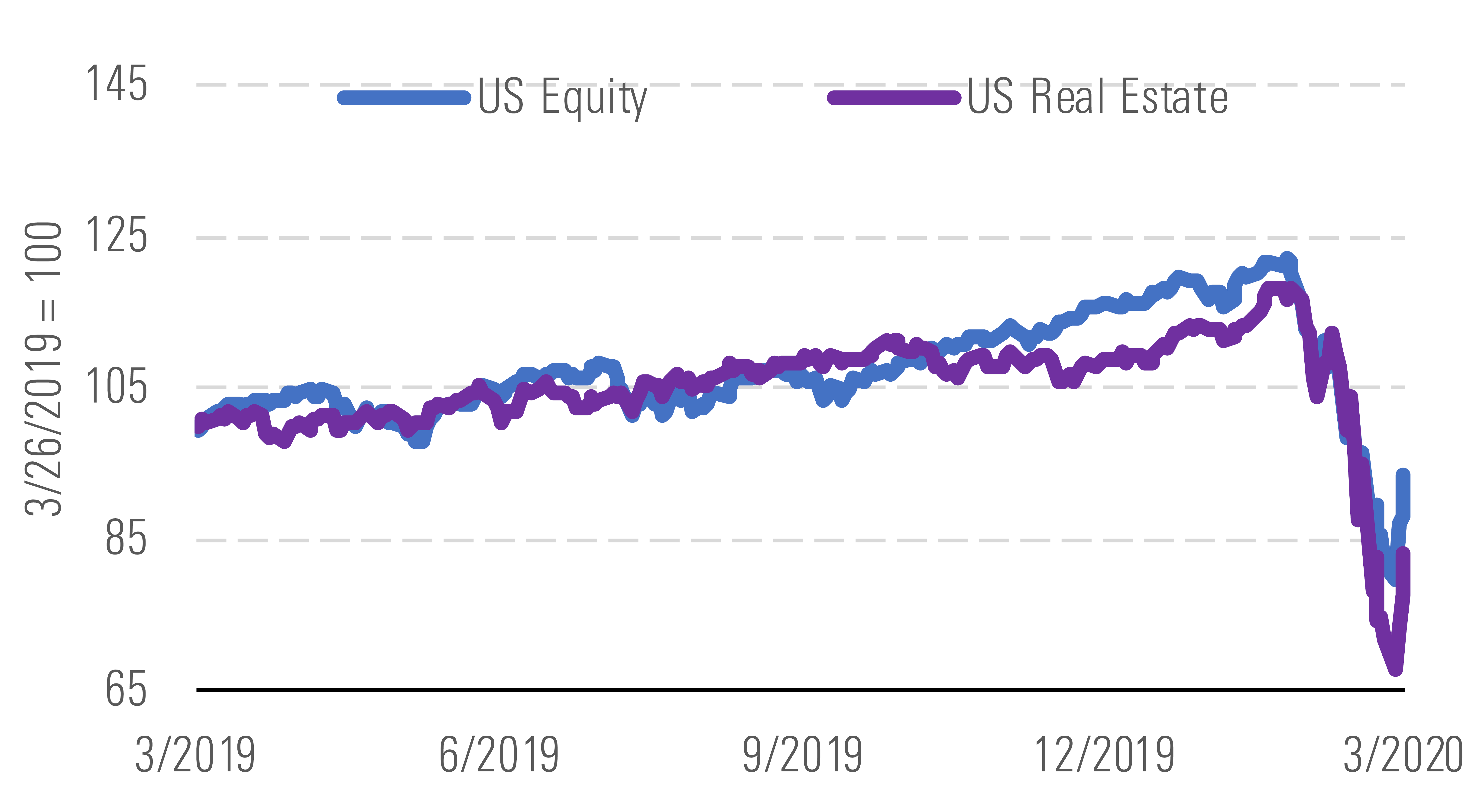

The Morningstar US Real Estate Index fell 17% over the trailing 12 months and is underperforming the broader U.S. equity market by 10.4%, with the sector trailing the broader market in the first quarter as well. However, we have seen significant divergence in real estate performance by subsector.

Real estate is down and has slightly underperformed the equity index. - source: Morningstar

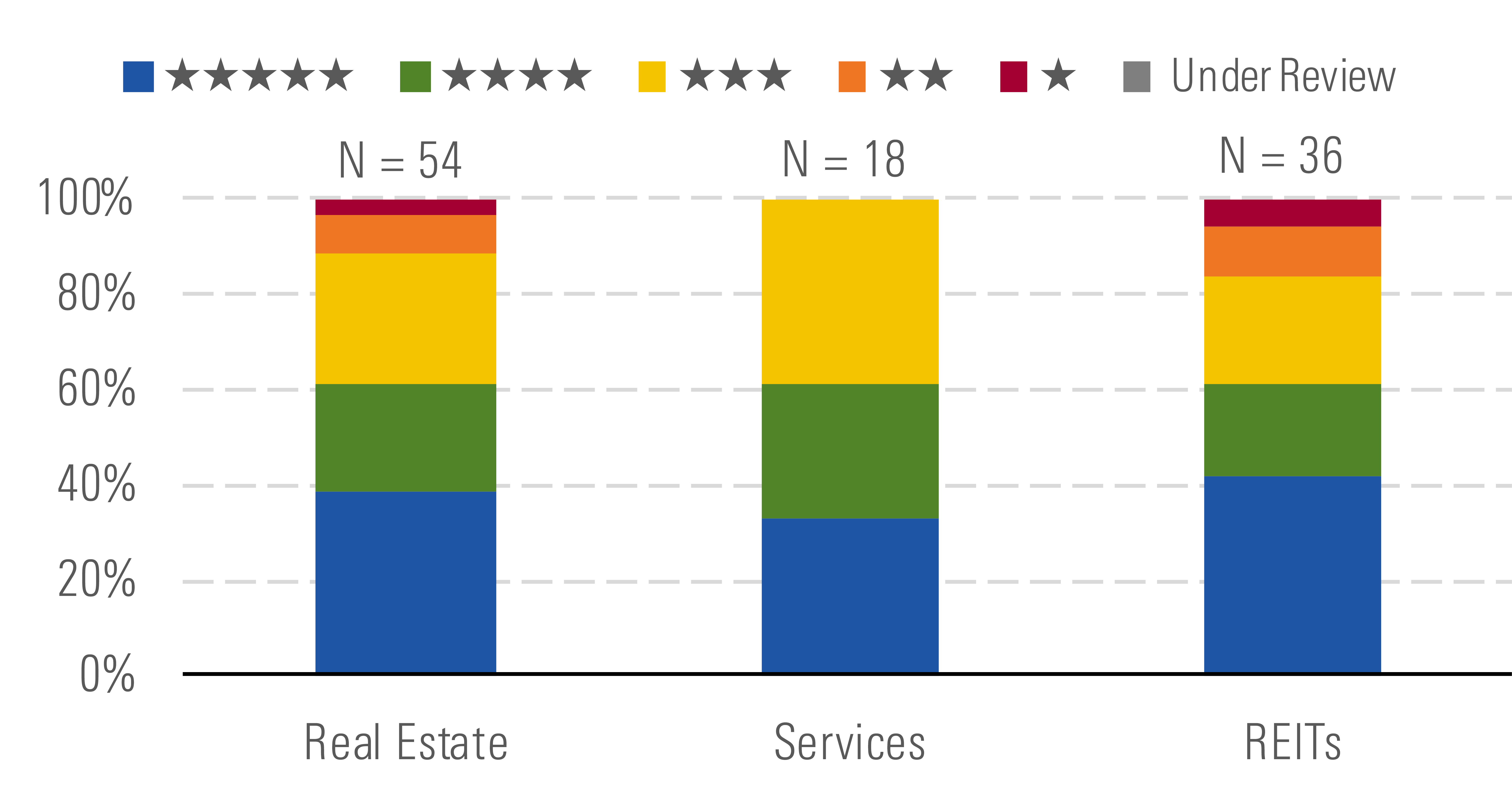

Our real estate coverage is trading at a 29% discount to our estimate of intrinsic value compared with a 3% premium to our fair value estimates on average at the end of the fourth quarter. Currently, the real estate sector is 39% 5-star and 22% 4-star, with only 11% of the total sector trading in either a 1-star or 2-star range.

4-star and 5-star companies currently represent over 60% of the sector. - source: Morningstar

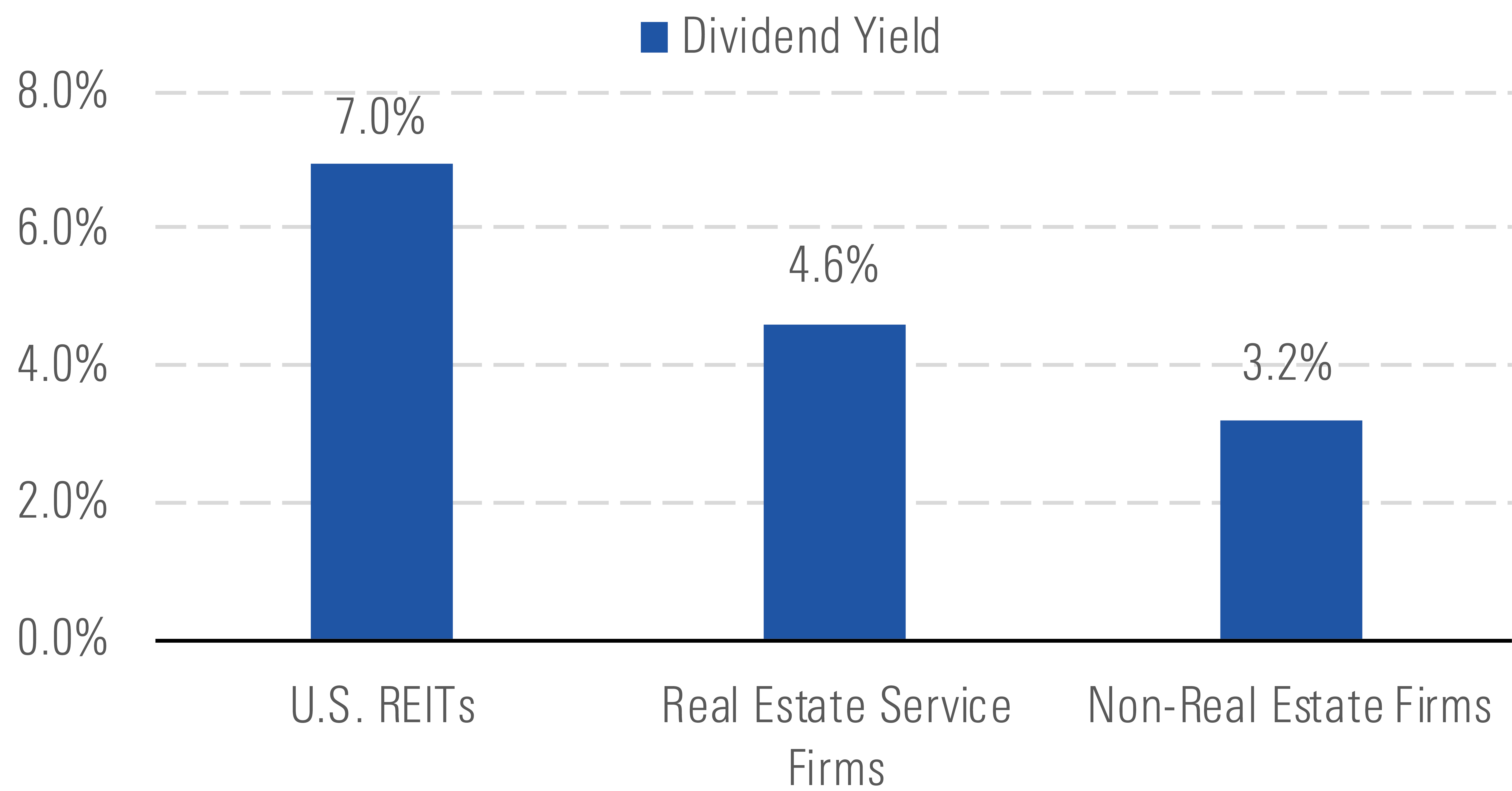

The average dividend for real estate firms is higher than the rest of our coverage. To receive tax-free status, REITs are required to pay out most of their net income as dividends to shareholders. These companies are frequently included in portfolios of income-oriented investors. As a result of the recent equity sell-off, dividend yields have dramatically increased. We currently believe that most REITs will continue to pay their dividend, making these high yields very attractive to investors.

REITs have higher dividend yields than service firms and other sectors. - source: Morningstar

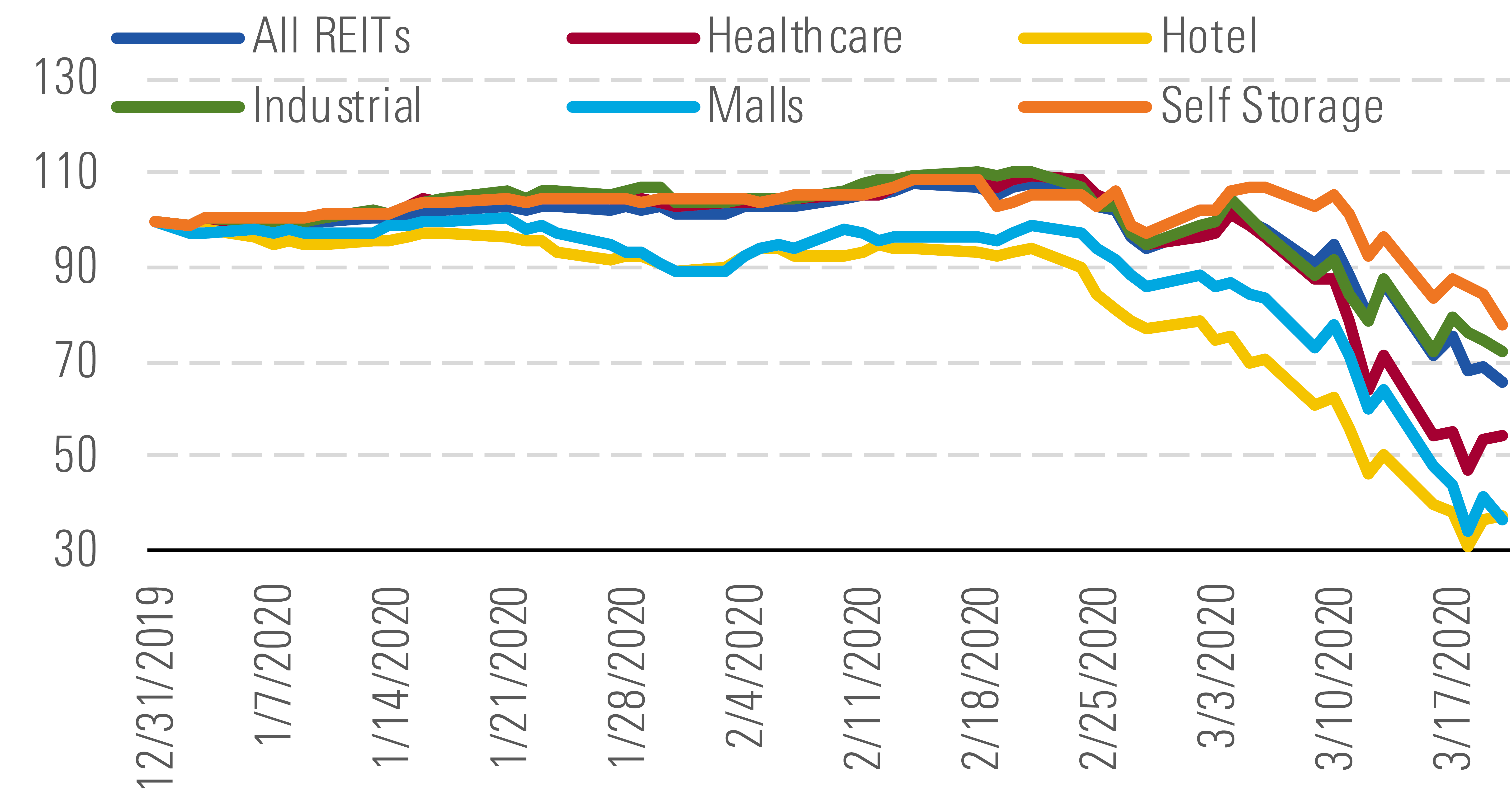

We have seen significant bifurcation in the performance of the different real estate subsectors. Those that are more sensitive to the impacts of the coronavirus outbreak have seen significantly worse total return performance year to date. With global travel restrictions, the hotel industry has been frozen and is experiencing a massive drop in revenue. Consumers have been told to stay in place and avoid public spaces, hurting the sales of the mall companies. The virus has a higher mortality rate among older people, affecting occupancy at healthcare companies exposed to senior housing. All three subsectors have underperformed the real estate sector.

Real estate subsectors most affected by the virus have underperformed. - source: Morningstar

Meanwhile, though the industrial and self storage sectors are down, they have outperformed the broader real estate sector, as they should be relatively insulated from the worst effects of the virus on the global economy. That said, we currently see some of the best values among the hardest-hit subsectors. Given our long-term outlook, we believe that the hotel, mall, and healthcare sectors will rebound and see years of strong growth once the global crisis is over.

Top Picks

Simon Property Group SPG Economic Moat Rating: Narrow Fair Value Estimate: $187 Fair Value Uncertainty: Medium

Class A malls continue to outperform other forms of brick-and-mortar retail. Over the past 12 months, Simon's tenants have produced 4.8% sales per square footage growth, and the company ended 2019 with a healthy 95% occupancy level. The stock has sold off significantly over the past month as fears of the coronavirus impact on brick-and-mortar retail sales grew among investors. Simon has long-term leases with tenants, so they should continue to receive rent even during the current crisis. While many weaker retailers may go bankrupt due to the lack of sales, we think Simon's attractive portfolio will be able to quickly fill any vacancies.

Pebblebrook Hotel Trust PEB Economic Moat Rating: None Fair Value Estimate: $26.50 Fair Value Uncertainty: High

Global travel bans resulting from the coronavirus outbreak have significantly affected the hotel industry. We think that Pebblebrook's upper upscale hotel portfolio could see almost a 50% decline in revenue in 2020 and nearly a 100% decline in operating profit. However, we think that the industry should rebound with several years of strong growth and that the company will eventually return to 2019 peak levels. While we have lowered our outlook for the company, we think that the sell-off in the name is overdone given our long-term outlook for the hotel industry.

Ventas VTR Economic Moat Rating: None Fair Value Estimate: $50 Fair Value Uncertainty: High

Ventas owns high-quality assets in the senior housing, medical office, and life science fields. While the company's medical office and life science portfolios should be relatively unaffected by the coronavirus outbreak, the senior housing portfolio is likely to experience a very significant impact to occupancies, as the virus has the highest mortality rate among senior citizens. However, while the virus will negatively affect net operating income for the industry in 2020 and potentially 2021, the industry should see strong long-term growth from the coming demographic wave of baby boomers aging into senior housing facilities.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)