Opportunities Are Arising in Software and Cybersecurity

Compared with the previous quarter, patient investors have some good opportunities.

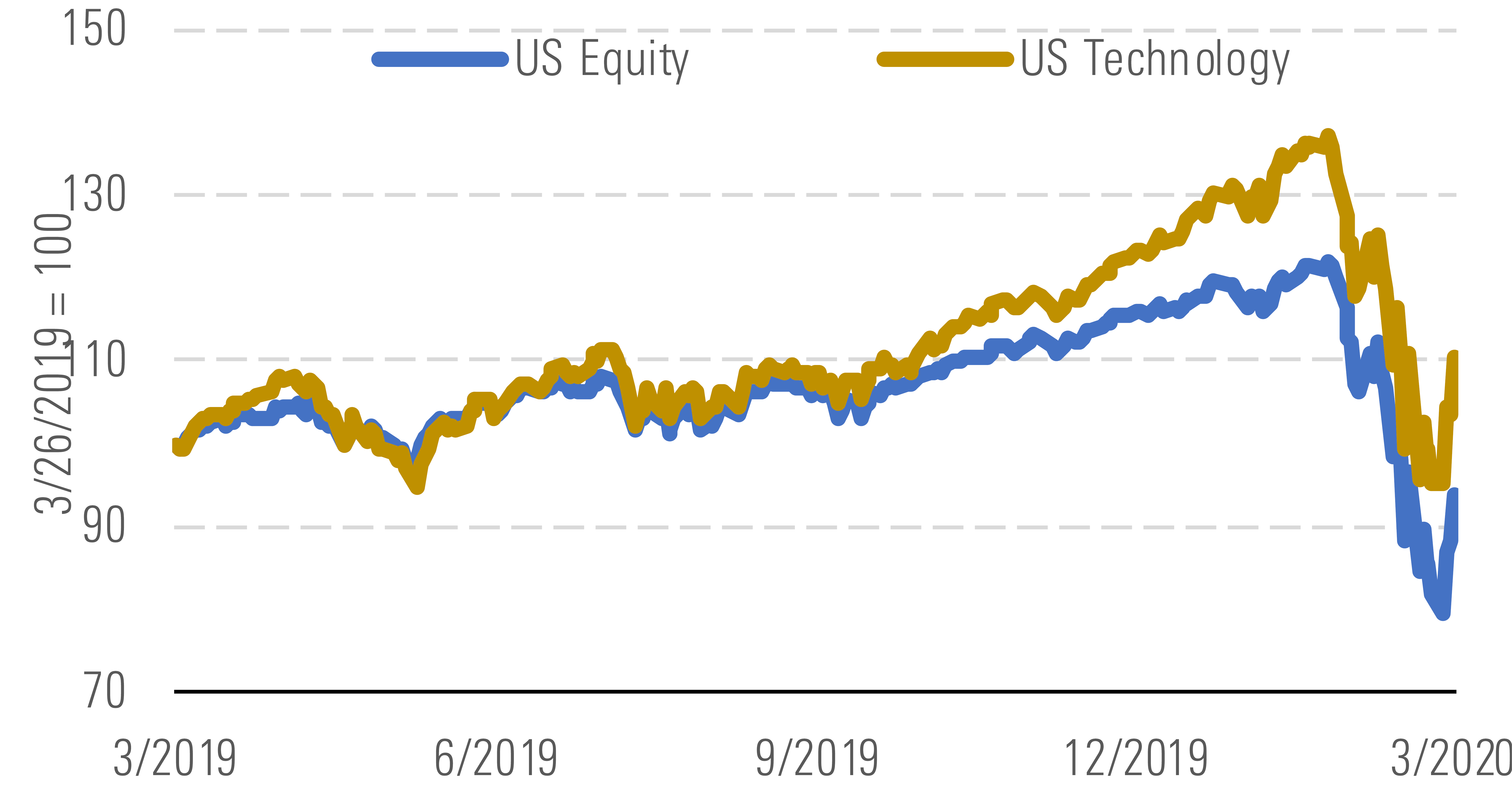

Like the broader stock market, technology stocks sold off at the end of the first quarter over concerns about COVID-19 and the likelihood of a recession in 2020. As of March 26, the Morningstar US Technology Index was still up 10.5% on a trailing 12-month basis, outperforming the U.S. equity market, which declined 6.4%. Year to date, technology was again an outperformer during the bear market, down 10.3% compared with the broader U.S. equity market, which was down 19.1%. Before COVID-19 concerns, tech fared well in late 2019, with optimism that the U.S. and China can reach trade agreements and avoid a full-blown trade war, an issue that weighed on tech in late 2018 and at times in 2019.

Tech outperformed the market at the start of the COVID-19 sell-off. - source: Morningstar

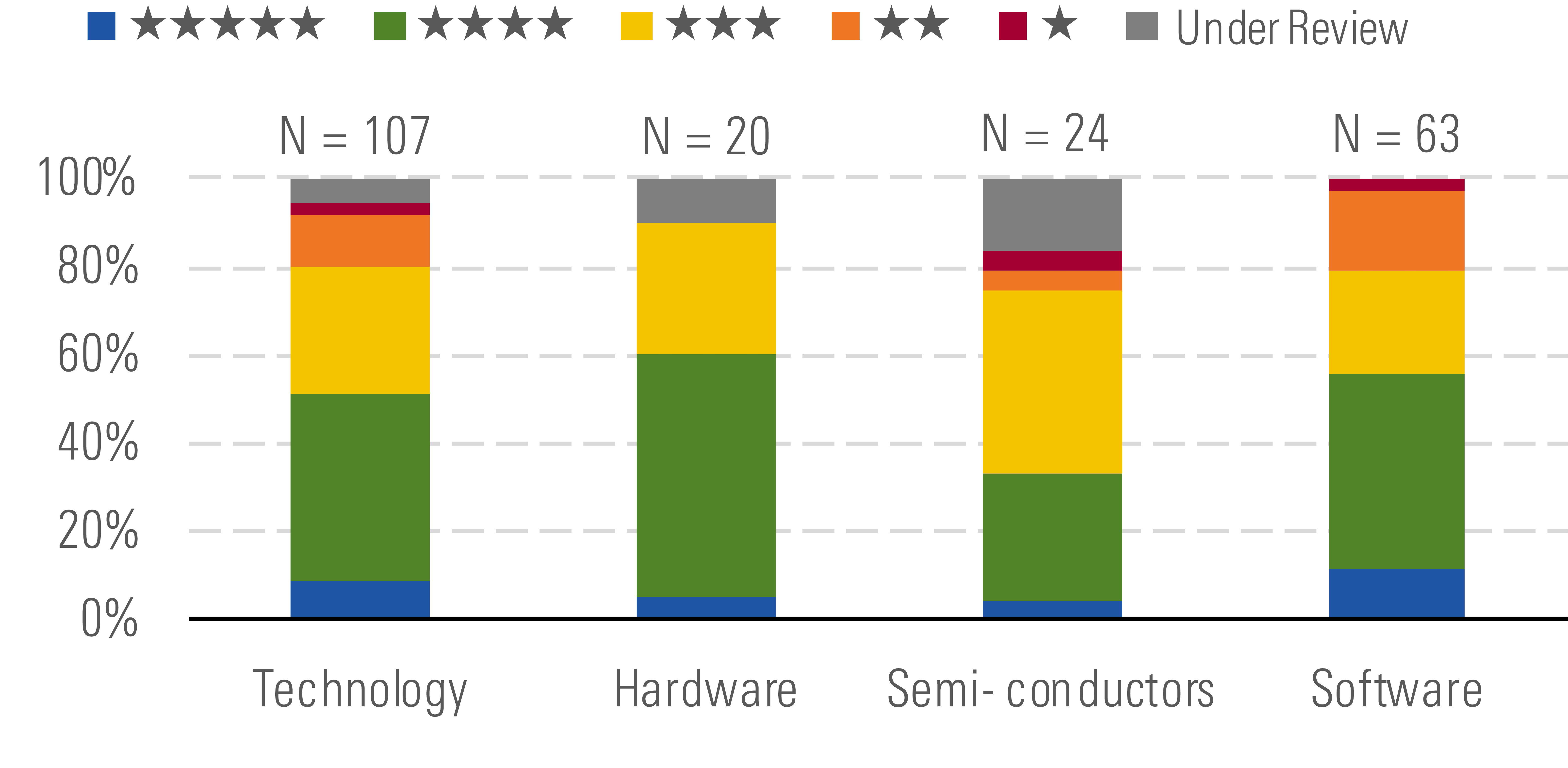

The median U.S. technology stock is 13% undervalued, in our view, which represents a rapid shift in sentiment from a quarter ago, when we had very few buy ideas. Today, we see buying opportunities for patient, long-term investors across all tech subsectors. Hardware is the cheapest subsector, as the median stock is 16% undervalued today. However, we'd point investors toward software, where the median stock is 14% undervalued and more firms tend to warrant narrow and wide economic moats. The median semiconductor stock is 8% undervalued.

Tech is undervalued in light of the COVID-19-driven sell-off. - source: Morningstar

Looking across the carnage of the U.S. technology and broader market sell-off, we think opportunities have arisen across high-quality software names like Microsoft, ServiceNow, and Salesforce.com. Each of these firms generates revenue on a subscription basis with little risk of cancellations, even as work shifts to homes and away from the office. The latter two names warrant positive moat trends as they continue to upsell new software to their existing, sticky customer bases.

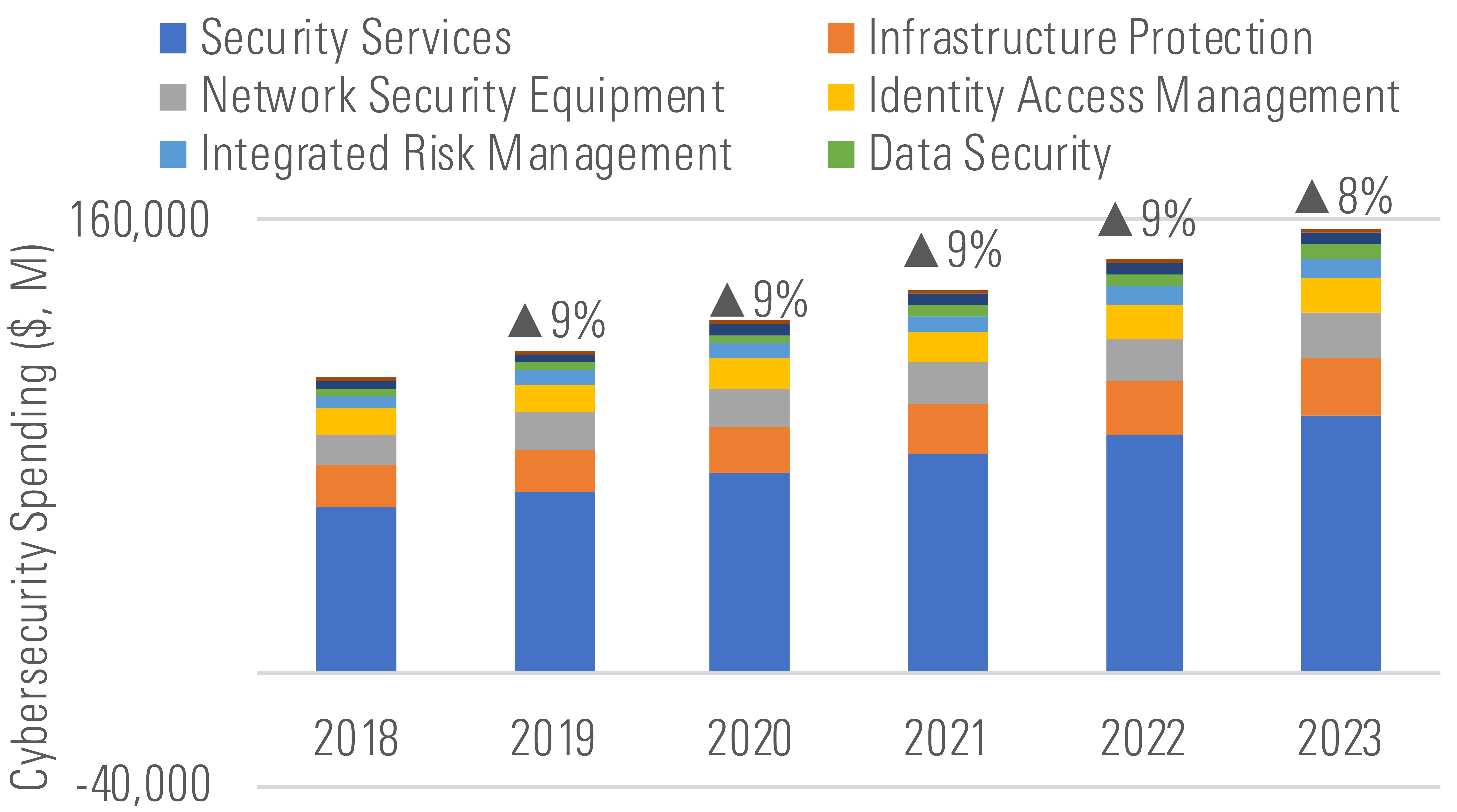

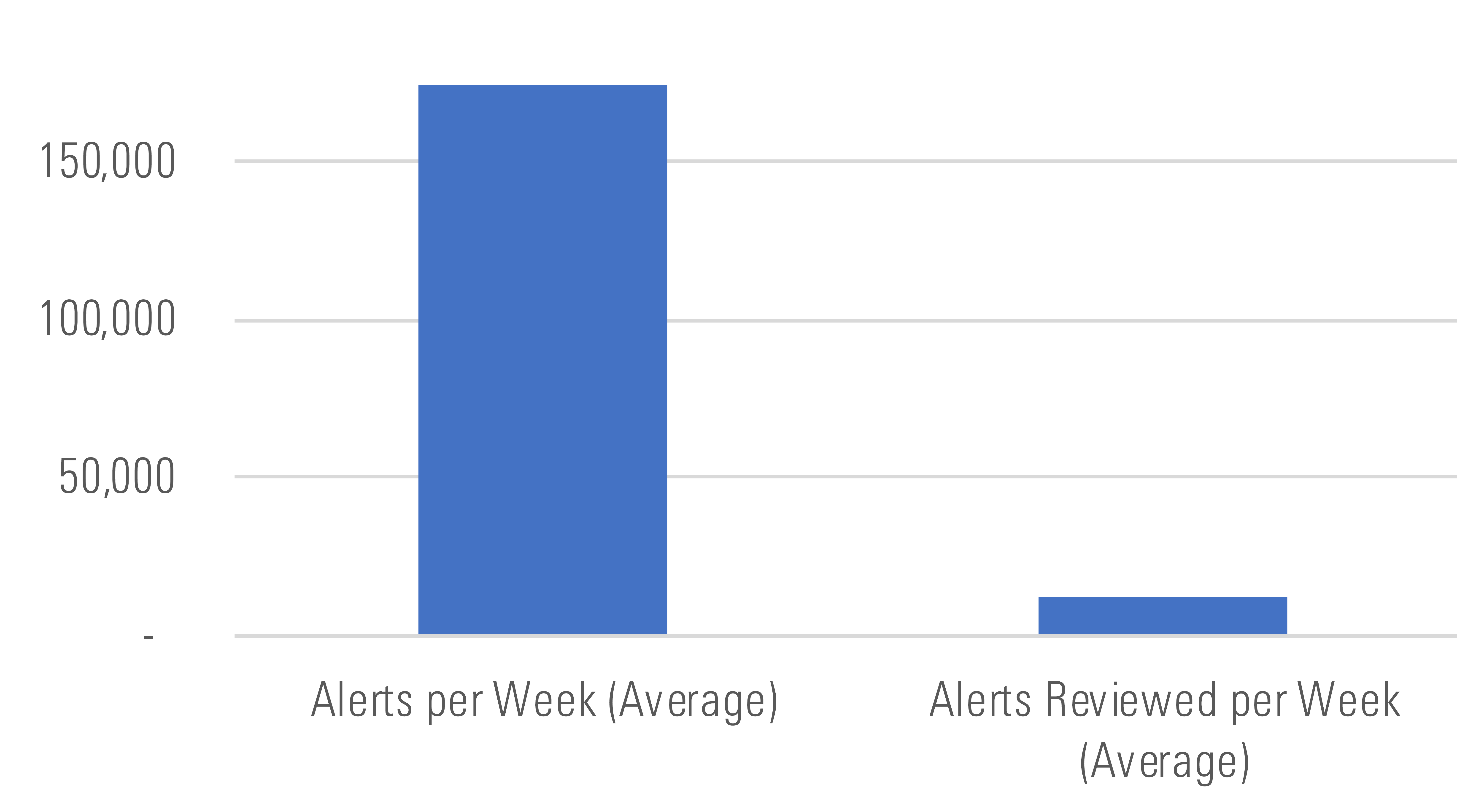

Cybersecurity may also represent a bit of a relative haven. Besides their subscription revenue model, additional cyber solutions are likely needed as more people work remotely. IT departments have to decipher whether incoming data traffic represents a remote worker or a bad actor, and in turn, grant access to the various software and solutions that each employee needs to be productive. We think the $100 billion-plus cybersecurity market will grow at a five-year CAGR of 9%. Meanwhile, IT managers face too many alerts and not enough time to review them all, a trend we don't see slowing down with an increasingly mobile workforce.

Cybersecurity spending should rise at a 9% CAGR through 2023. - source: Morningstar

IT managers face too many cybersecurity requests to review. - source: Morningstar

Top Picks

Palo Alto Networks PANW Economic Moat Rating: Narrow Fair Value Estimate: $305 Fair Value Uncertainty: High

Narrow-moat Palo Alto Networks became the firewall market leader in 2018, and we expect its growth rate to outpace peers as it expands its portfolio in high-growth areas for cloud-based cybersecurity, analytics, and automation. Complexities associated with managing a multitude of products from various software and hardware vendors and a dearth of cybersecurity talent leads our view that firms and government entities are clamoring for consolidated security platforms. We believe that Palo Alto's security platform is at the leading edge and will remain in demand as customers prefer to add on existing Palo Alto subscriptions.

VMware VMW Economic Moat Rating: Narrow Fair Value Estimate: $202 Fair Value Uncertainty: High

We believe that VMware's position as the commonality between public clouds, private clouds, and on-premises ecosystems gives it an enviable position. Coupled with VMware planting a flag that it'll be the way to deploy and use applications across any networking environment, we expect this software giant to repeat double-digit top-line growth. Shares have pulled back over soft near-term sales, concerns about broader IT spending, and VMWare's recent large acquisitions. Yet this decline overlooks VMware's thoughtful strategic shifts into hybrid-clouds and containerized applications.

Intel INTC Economic Moat Rating: Wide Fair Value Estimate: $70 Fair Value Uncertainty: Medium

Wide-moat Intel trades at an attractive discount to our fair value estimate of $70 per share. The chip titan's comprehensive product portfolio tailored to computers from the data center to the edge gives us confidence in the firm's long-term growth prospects, despite a declining PC market. We applaud Intel's scattershot approach to address challenges in computing (artificial intelligence and cloud), connectivity (5G), and memory (3D NAND and 3D XPoint). Its acquisitions (Altera, Mobileye, Nervana, and Movidius) have unlocked new growth vectors for Intel to tackle while augmenting the capabilities of its old guard in client computing and data center.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JUWC2VJUKBCG5P3KVQJCHL5QSQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JD5KSEJFLNFLJA5XRS6YK2O24Q.jpg)