Utilities: Stock Swoon Opens a Cheap Way to Play Defense Through the Downturn

Finally, some buying opportunities in the sector.

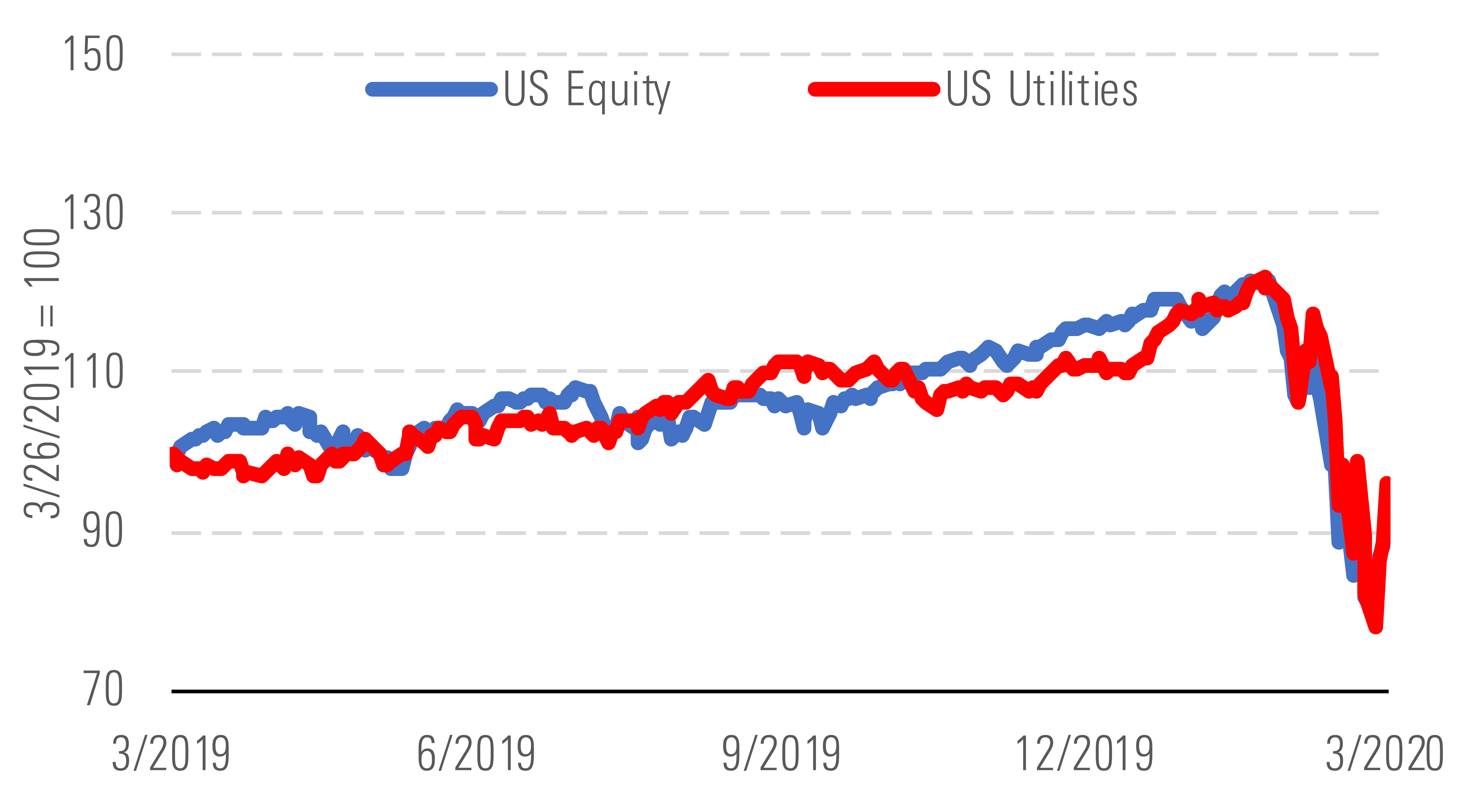

For the last two years, utilities were too cool to play defense for investors. The Morningstar US Utilities Index climbed 58% between February 2018 and February 2020, including dividends, trouncing the broader market, which was up only 36%.

Utilities take sharp dive as market revalues sector. - source: Morningstar

Utilities valuations soared and yields crashed. At their peak in early February, U.S. utilities traded at a median 22% premium to our fair value estimates, an all-time high. Their 3% dividend yield was a record low. Then coronavirus fears hit the U.S. As we expected, the market punished utilities for leaving their defensive positions. Utilities dropped 37% between late February and late March, worse than the broader market. A 10% drop on March 12 and 12% drop on March 16 were the sector’s largest single-day drops in at least 30 years.

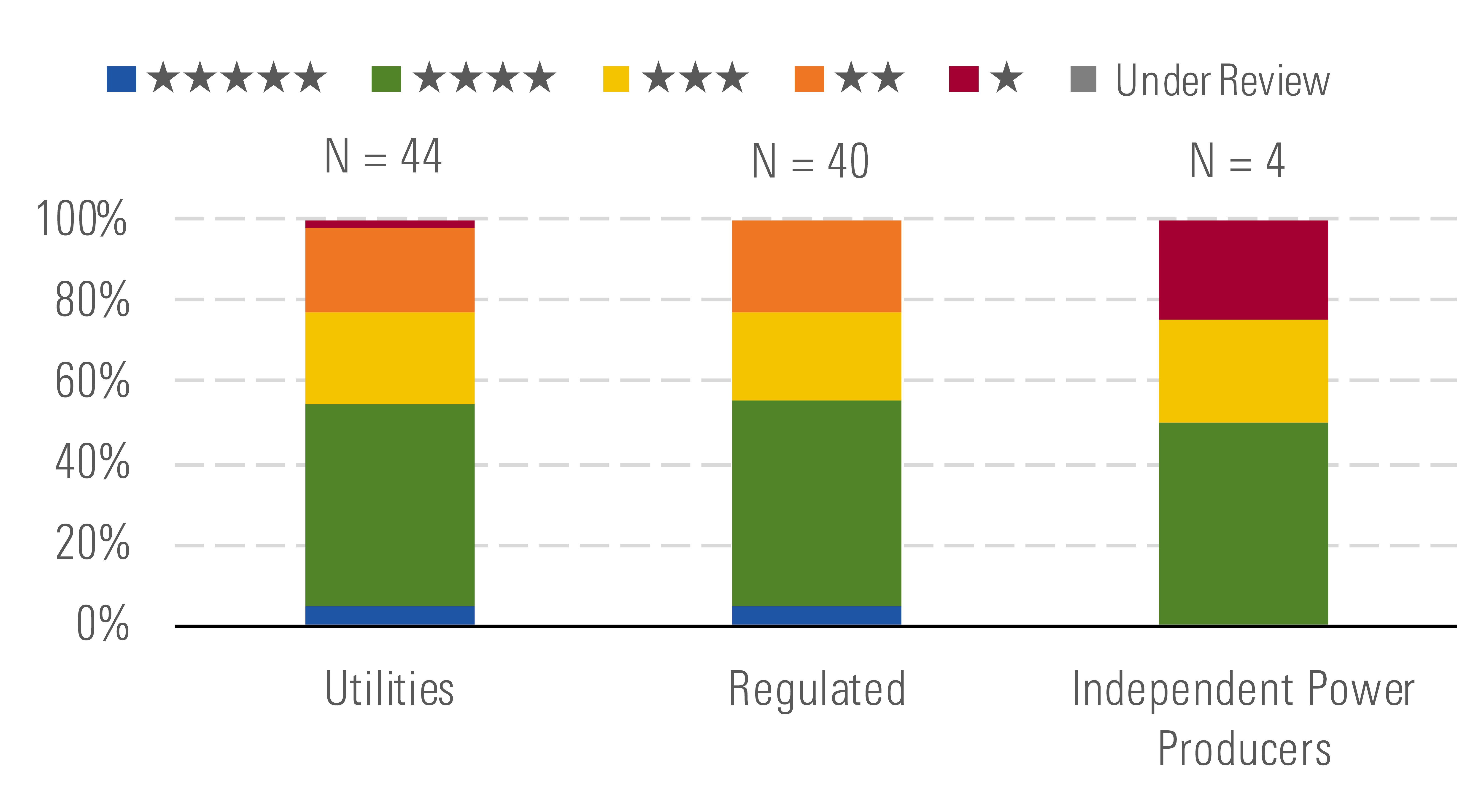

A lot of new buying options for defensive investors. - source: Morningstar

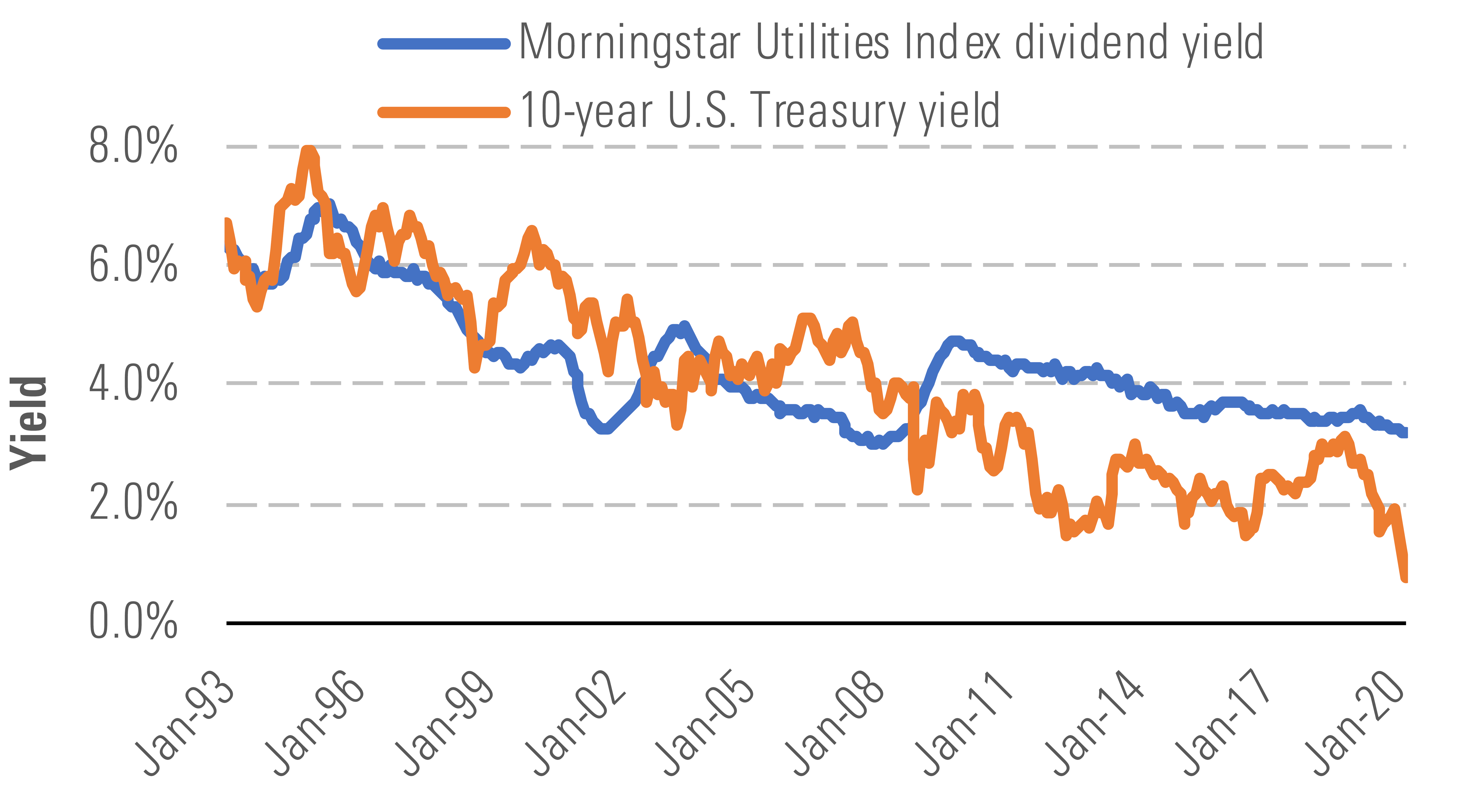

Now utilities are back where they belong on defense. Following the sector’s revaluation, we think there are buying opportunities for investors who want defense and yield ahead of economic uncertainty. Some utilities offer higher yields but lower growth; others offer higher growth but lower yields. All are cheaper than they’ve been since late 2008 and yields are historically attractive relative to interest rates.

Falling interest rates make utilities’ yields more attractive. - source: Morningstar

The coronavirus pandemic and an economic slowdown could affect utilities temporarily but much less than other sectors. Electricity and natural gas use will likely drop this year, especially if factories and stores struggle to reopen. Utilities with a high share of commercial and industrial customers could see a temporary drop in earnings.

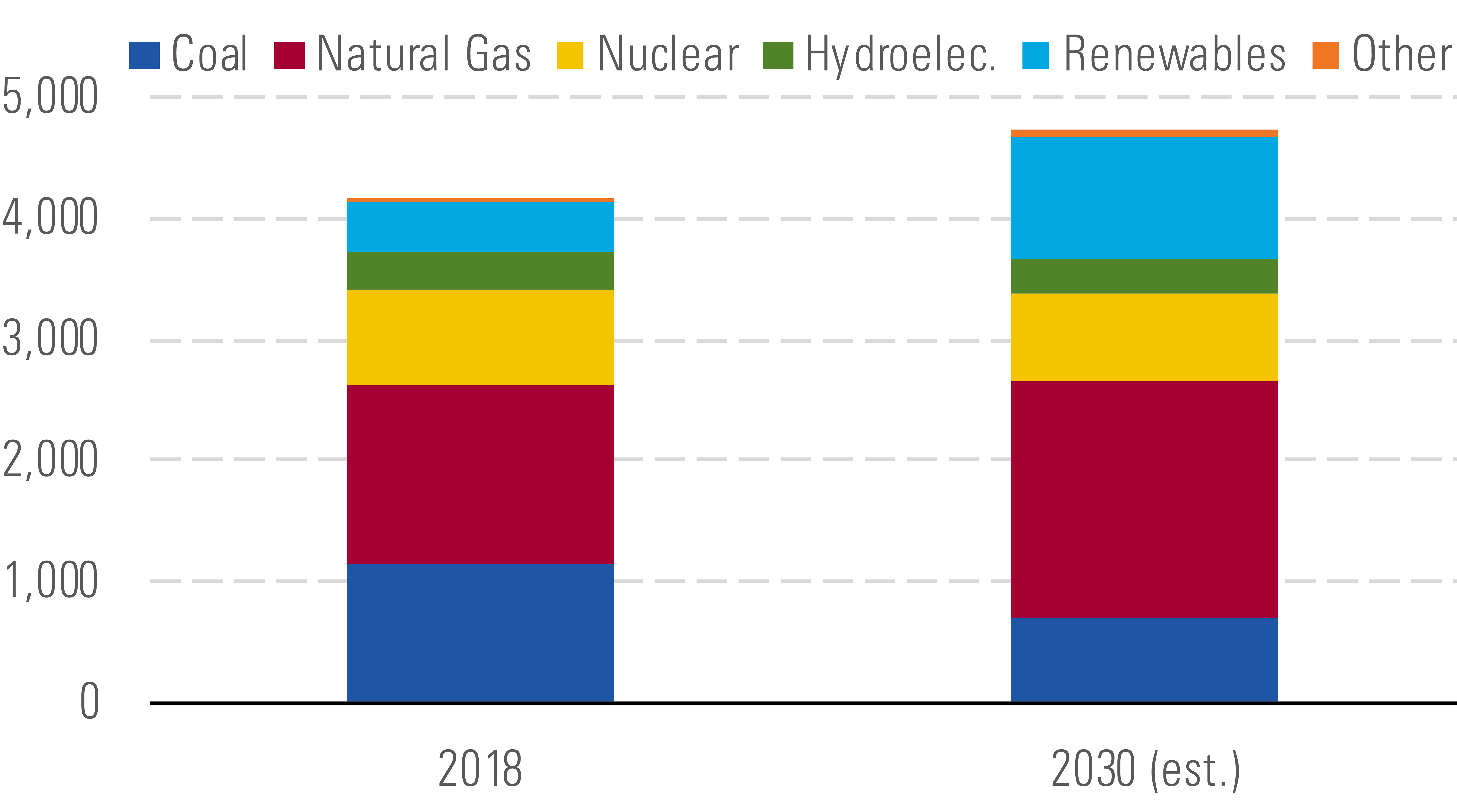

Utilities also might have to pause their growth plans. As the second-largest debt issuers behind financial firms, a seize-up in capital markets could make it difficult for utilities to fund growth projects. We think this will be temporary and widespread investment cuts are unlikely since most utilities’ plans focus on renewable energy, safety, grid modernization, and other initiatives with regulatory and policy support.

Natural gas utilities could face the most long-term risk but not because of virus or recession concerns. Policymakers in California and New York have suggested shifting customers from gas to electricity as renewable energy grows. We think this transition will take a decade or more, but the market is already incorporating this risk for some utilities with large gas operations.

Morningstar: U.S. renewable energy grows 140% by 2030. - source: Morningstar

Top Picks

Edison International EIX Economic Moat Rating: Narrow Fair Value Estimate: $70 Fair Value Uncertainty: Medium

California political risk will always be a concern for Edison. However, the state's progressive energy policies also create more growth opportunities than for most other U.S. utilities. Edison’s electric-only business, recent regulatory success, and $5 billion annual investment plan give us confidence that it can grow earnings 6% beyond 2020. Edison has stakeholder support to harden the grid against natural disasters, integrate renewable energy, and support electric vehicle adoption. Now with the stock trading at a sizable discount to its peers and a 5% yield, Edison offers a triple play of value, growth, and income.

AES AES Economic Moat Rating: None Fair Value Estimate: $20 Fair Value Uncertainty: Medium

AES has narrowed its geographic and business to markets where it has a competitive advantage or strong platform with an opportunity for expansion. Today, with a stronger balance sheet, the company has operations in 13 countries and a rapidly growing renewable energy business supported by a well-positioned battery storage joint venture with Siemens. We estimate that U.S. businesses will generate roughly 50% of pretax contributions by 2024. Returning home provides more stable cash flow from moaty U.S. businesses that should experience a tailwind from our bullish view of renewable energy growth over the next decade.

Duke Energy DUK Economic Moat Rating: Narrow Fair Value Estimate: $95 Fair Value Uncertainty: Low

We think Duke Energy’s valuation discount to peers is unjustified, given its favorable regulation and investment opportunities that support consistent earnings and dividend growth. Florida remains one of the most constructive regulatory jurisdictions, with sector-leading allowed returns on equity, automatic base-rate adjustments, and strong growth investment potential. North Carolina continues to support Duke’s growth investments in electric and gas transmission and distribution infrastructure. South Carolina's recent rate-setting decision was disappointing, but we think Duke has enough growth in the state to compensate.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)