Healthcare Moves Into Undervalued Territory After Pullback

Fears of a progressive president and changes to the healthcare system have faded.

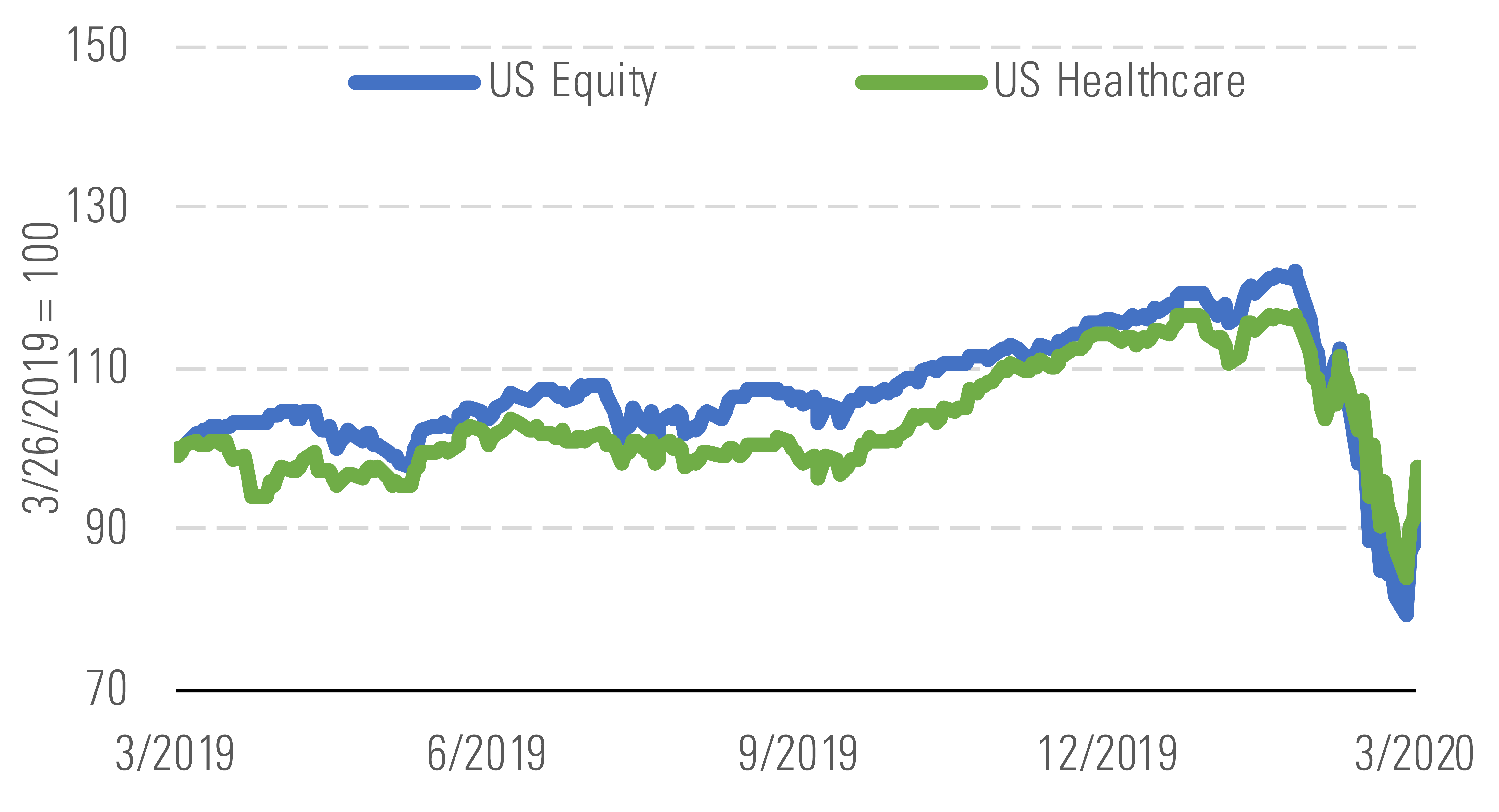

Morningstar's US Healthcare Index has decreased 3% over the trailing 12 months amid global concerns regarding the coronavirus. However, the returns have outperformed the broader equity market's 6% decline. We believe concerns about a global recession due to the coronavirus disruption are weighing on returns, but the defensive nature of healthcare is supporting returns on a relative basis. While taking a back seat to the coronavirus, the fears of a major healthcare policy change in the U.S. have faded, with the more moderate Joe Biden likely to win the Democratic nomination for president.

Healthcare sector index vs market index. - source: Morningstar

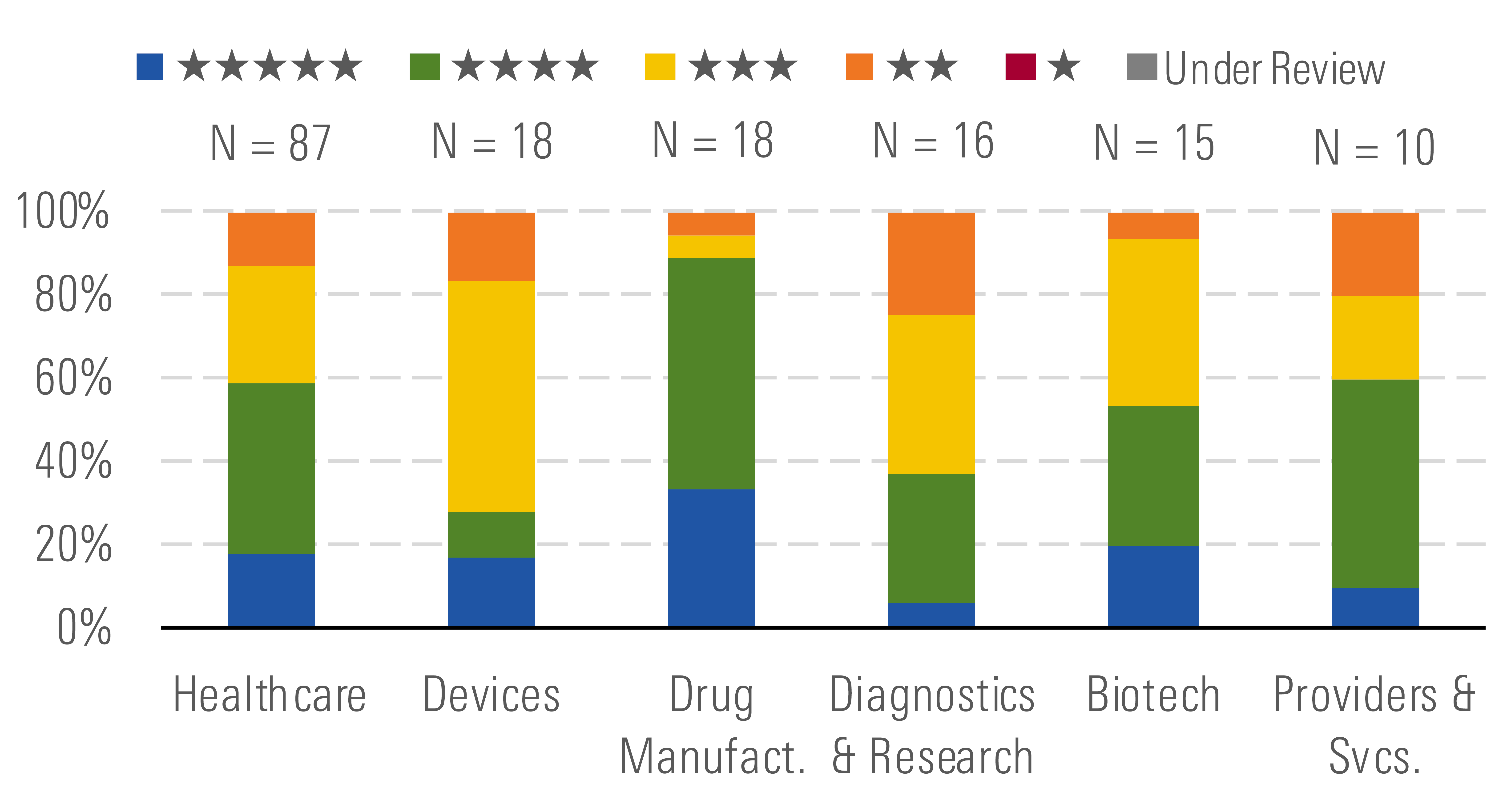

We view the healthcare sector as undervalued with the market pullback due to the coronavirus outbreak. While we may reduce our valuations in healthcare to account for near-term challenges, we expect only modest changes. Our coverage trades at a discount to our overall estimate of intrinsic value, with the median price/fair value at 0.86. Given the market pullback, we see more buys in the sector, with over half of our coverage rated 4 or 5 stars.

Star rating distribution and average P/FV for sector and industries. - source: Morningstar

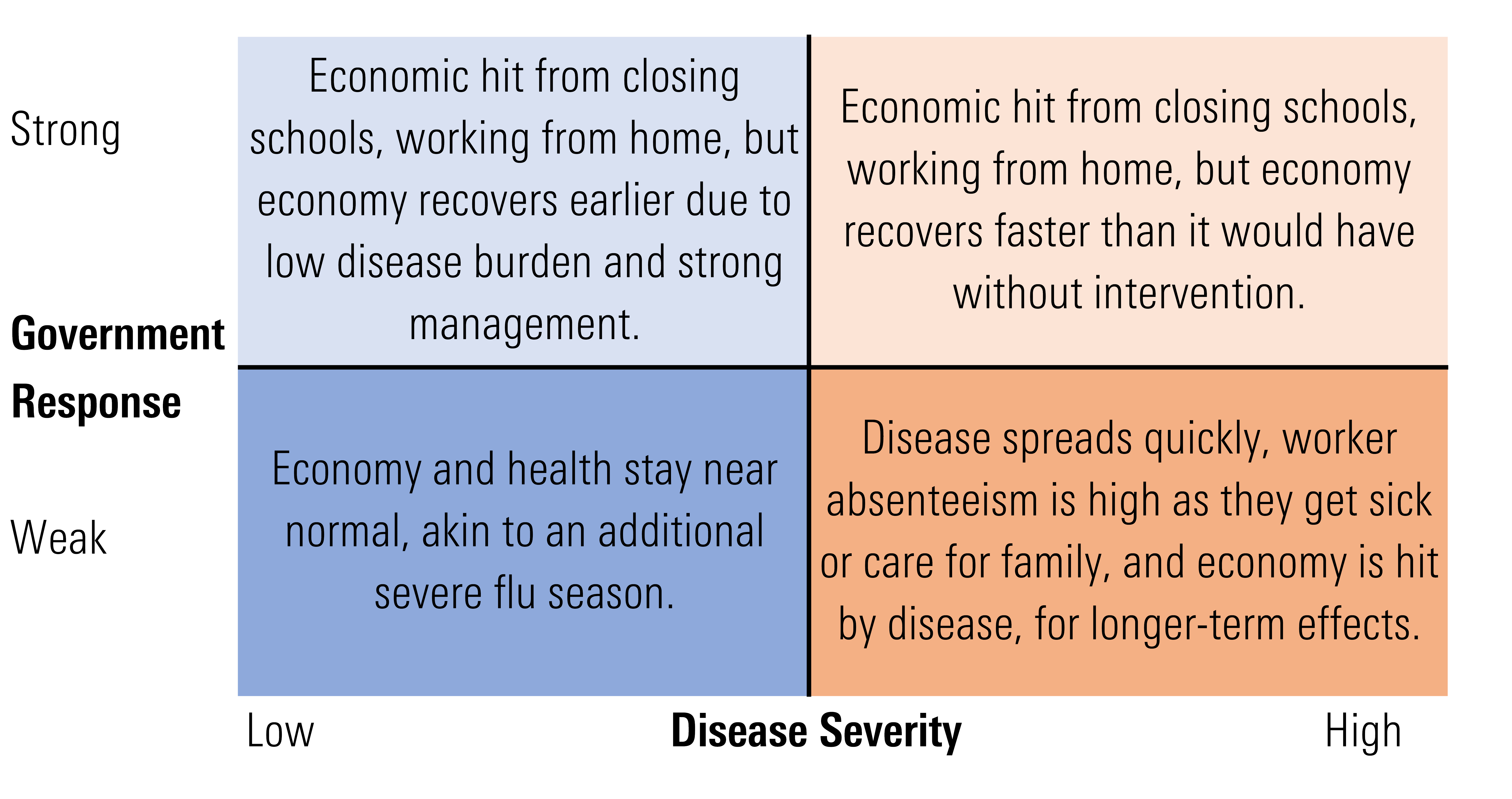

On the coronavirus, our base case calls for a strong rebound in 2021 following a recession in 2020, which should have only a modest impact on healthcare valuations. However, if the coronavirus exerts a sustained impact on the economy, with significantly higher numbers of patients unemployed and uninsured or underinsured, this could reduce healthcare demand to a greater extent. We are assuming that government efforts to reduce the near-term hit can keep most of the harder-hit industries in business and effective treatments emerge.

Strong government response minimizes long-term economic effects. - source: Morningstar

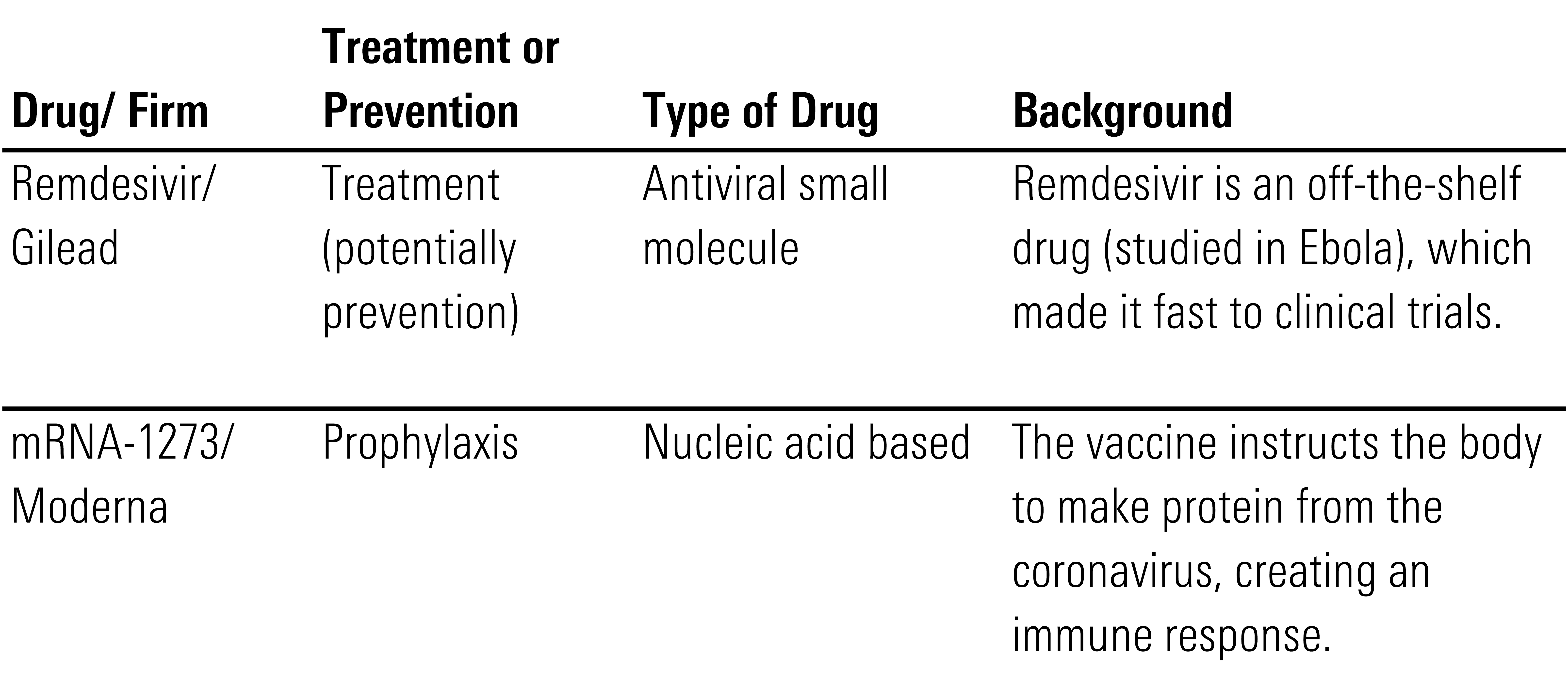

Leading coronavirus treatment and vaccine candidates. - source: Morningstar

On the near-term effects of the coronavirus, we expect critically ill patients needing essential medical services and therapies will crowd out more elective procedures, new products, and non-critical-care products. Fewer elective procedures will weigh on the device makers and service providers. Also, higher-than-expected medical costs focused on COVID-specific cases could reduce profitability for health insurers. With branded drug firms already focused on specialty drugs, we expect less impact to this industry, but drugs administered in the hospital could still feel some crowding out by coronavirus patients. Also, clinical development timelines will probably face some delays due to coronavirus disruptions. Additionally, the coronavirus impact on the credit markets could weigh on more heavily indebted companies, such as some hospital firms and companies that have recently completed major acquisitions.

Top Picks

Pfizer PFE Economic Moat Rating: Wide Fair Value Estimate: $46 Fair Value Uncertainty: Low

The market is underappreciating Pfizer's next-generation drugs, which should drive strong long-term growth. Further, the pipeline drugs focus on areas of unmet medical need, where pricing power is strong. Additionally, the company is facing very few major patent losses over the next five years, which should also support steady growth. Lastly, the divestment of the established products group Upjohn to Mylan creates a new entity with robust cash flows, likely supporting a strong dividend. Also, we expect less impact from the coronavirus to Pfizer's operations.

Zimmer Biomet Holdings ZBH Economic Moat Rating: Wide Fair Value Estimate: $178 Fair Value Uncertainty: Medium

Following a series of supply-chain, regulatory, and management upheavals over the past three years, Zimmer Biomet is beginning to return to growth as CEO Bryan Hanson's turnaround efforts take hold. We expect placement of the Rosa robot, which remains in the early stages, to help pull through large joint implants and set the stage for operating leverage gains. Additionally, while the influx of coronavirus patients will likely crowd out elective procedures, such and hip and knee replacements, we don't expect a long-term impact from that headwind.

CVS Health CVS Economic Moat Rating: Narrow Fair Value Estimate: $92 Fair Value Uncertainty: Medium

The firm's combination with Aetna should put the company in a much more attractive competitive position as the industry moves toward preferring a more integrated service offering. Lastly, investors should benefit from meaningful cost and selling synergies associated with the combination of a leading medical benefits business with the largest pharmacy benefit manager and retail pharmacy network in the country. However, the social distancing period caused by the coronavirus is a concern for the retail business, but we don't forecast this as a long-term headwind.

Data as of March 26, 2020.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)