Turbulence Remains, but Value Remains in Consumer Cyclical

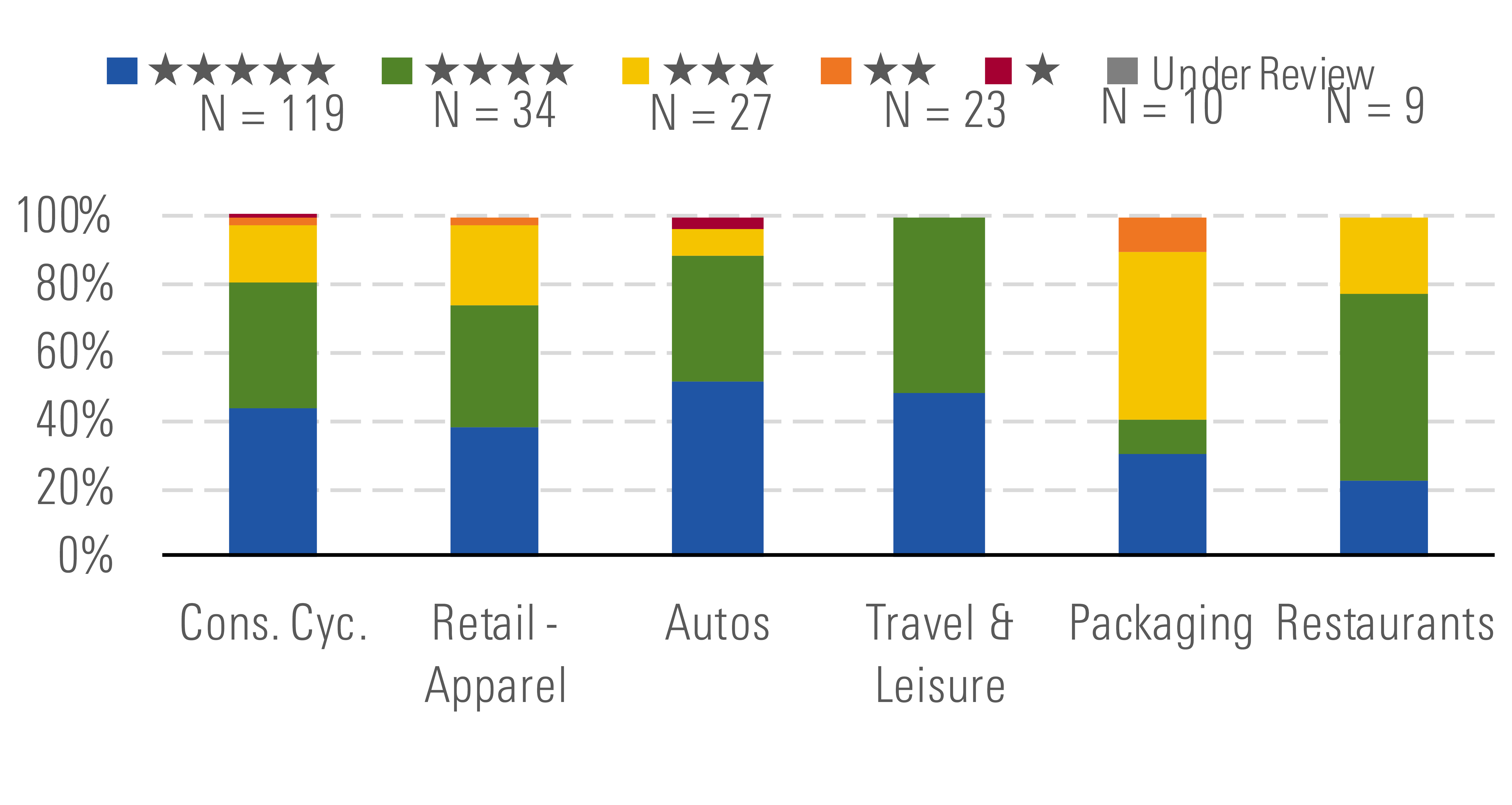

Eighty percent of the sector is undervalued, trading at 4 or 5 stars.

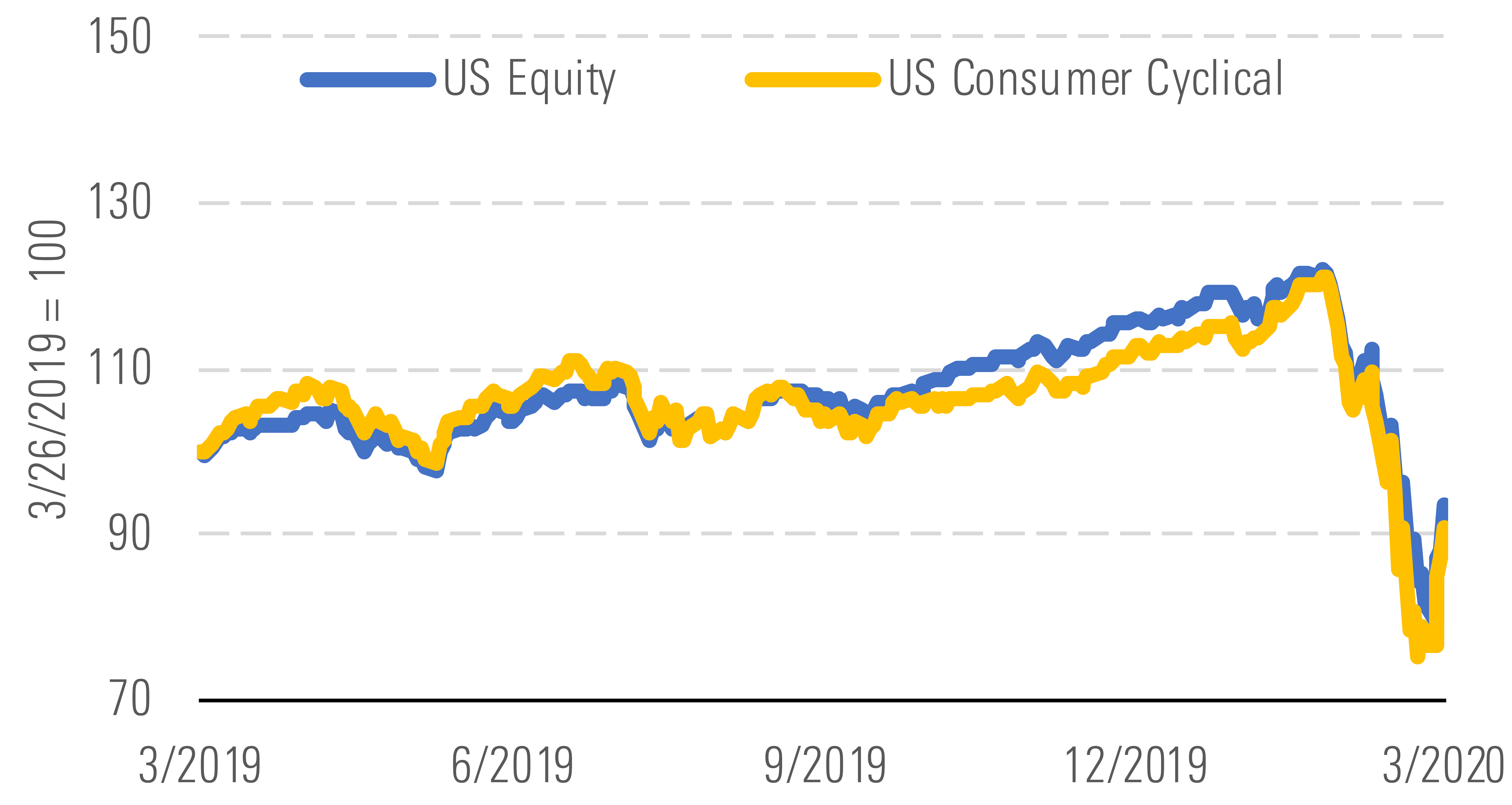

Although uncertainty surrounding COVID-19 has caused the total market to decline over the past 12 months by 6.4%, the consumer cyclical sector has been more severely affected, with 12-month returns down 9.4%. We believe this sensitivity results from investor angst surrounding the depth and breadth of the pandemic.

Consumer cyclical sector more sensitive to recent market angst. - Morningstar

Overall, the sector appears undervalued, with the median stock trading at a 33% discount to our price/fair value estimates. Eighty percent of the sector trades in 5- and 4-star territory, creating opportunities for investors to find value within all areas, but particularly in travel and leisure firms, which are trading at a median discount of 45% to our fair value estimates.

5- and 4-star stocks make up a large portion of the sector. - Morningstar

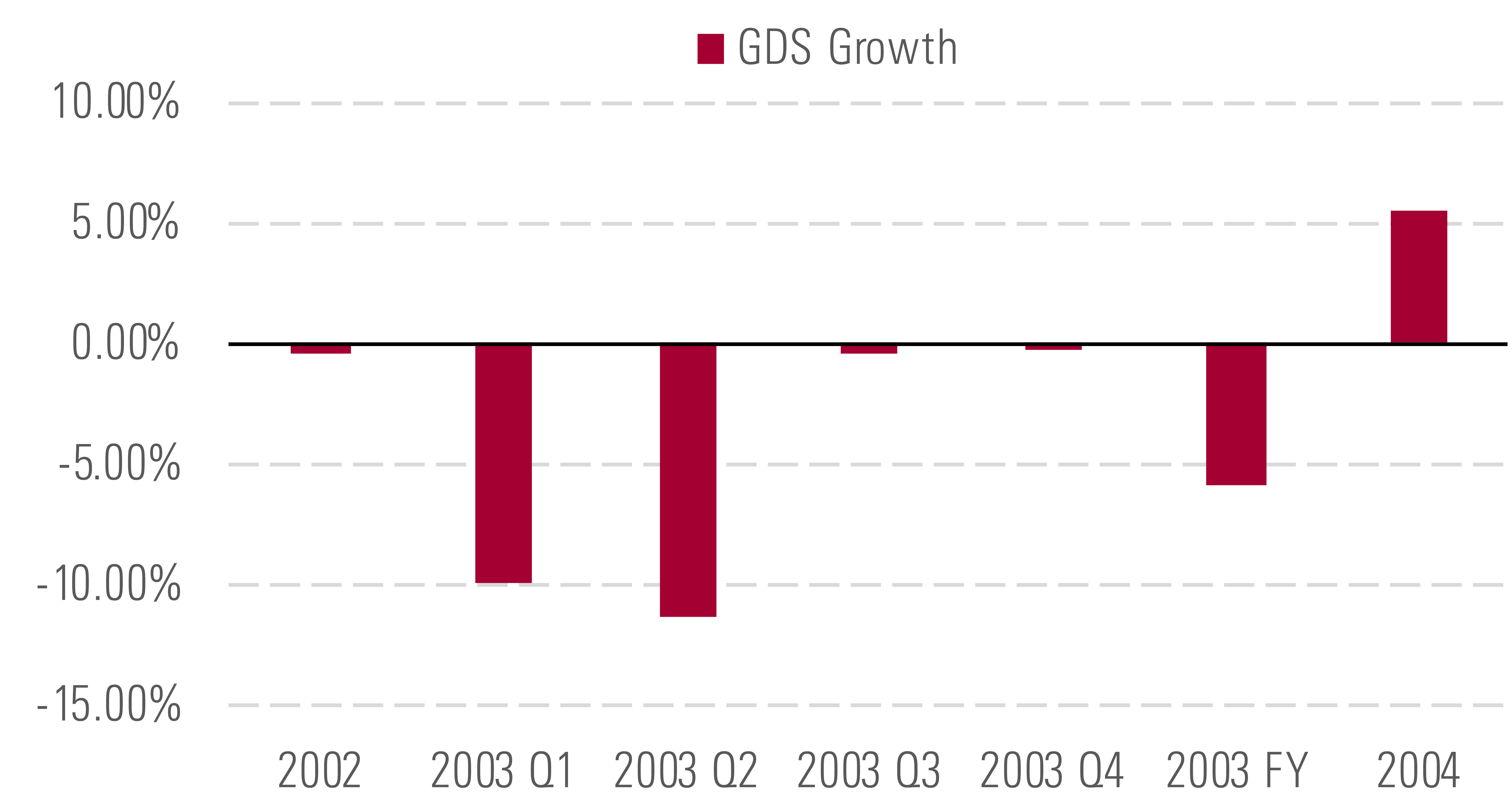

The large discount to intrinsic value the travel and leisure subsector offers stems from volatility due to COVID-19. We expect travel demand to wane in the short term due to expanding travel restrictions, but when considering the impact of SARS (2003), we believe any impact will reverse over a longer horizon. According to the global distribution system, which processes the majority of online travel bookings, SARS prompted demand declines of 5.9%, which were followed by booking growth of 5% in 2004. With Wuhan, China, starting to slowly move toward normal working practices, we believe weak travel demand will remain through the second quarter before rebounding in the latter half of the year. We now foresee revenue growth at a mid- to high-single-digit clip in 2021, with sales reaching 2019 levels in 2022.

Using SARS as a guide, we think revenue growth will resume in 2021. - Morningstar

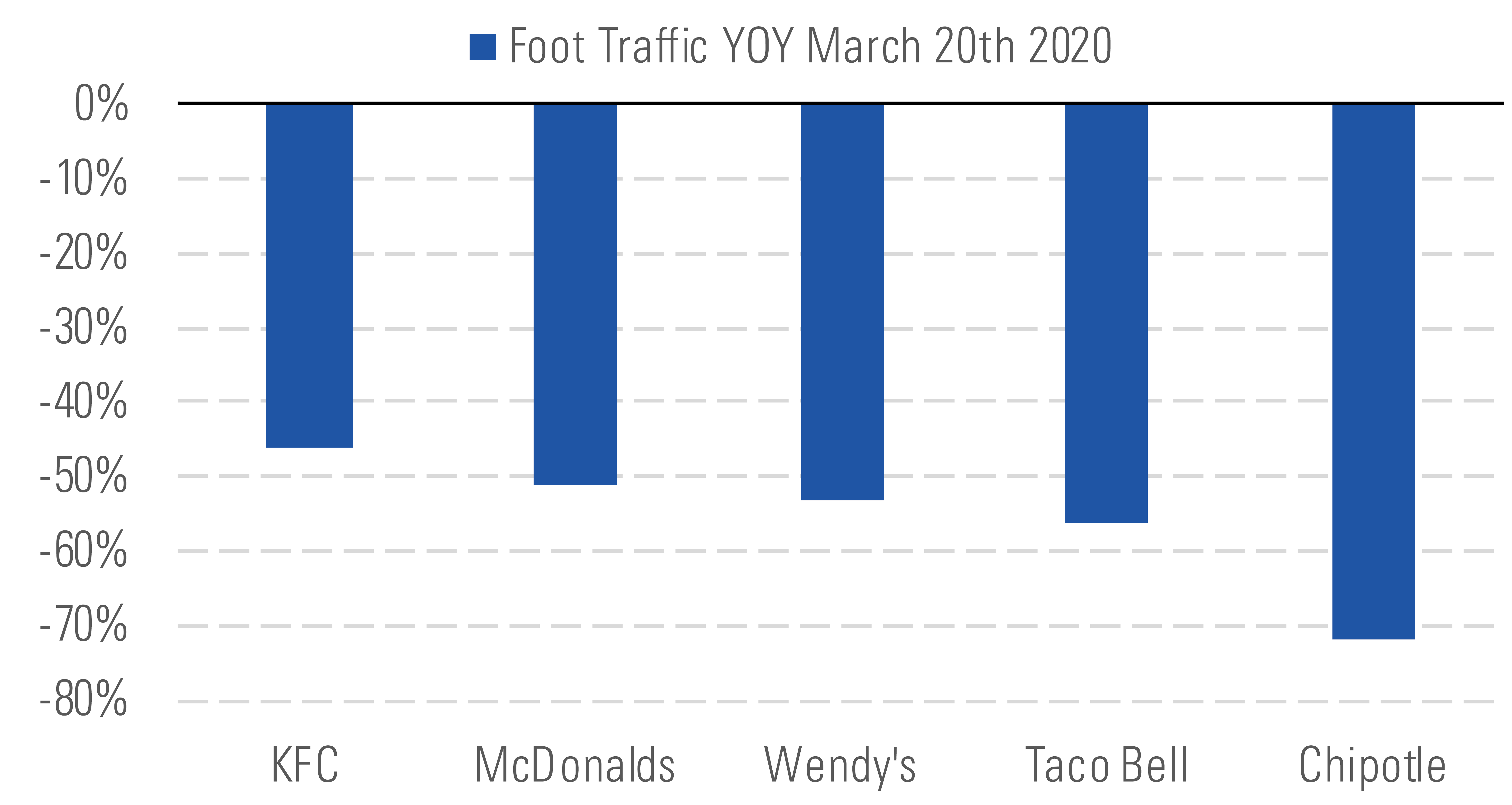

Another subsector we think has been unfairly punished is the restaurant space, trading at a median 36% discount to our fair value estimates. Several U.S. markets have restricted dine-in service in an effort to curb the spread of COVID-19, and we expect severe guest-count declines for at least the next two months (in line with the pronounced recent pullback in traffic) and an uneven traffic recovery into the back half of 2020. However, we believe restaurants that have made technological advancements, those that are value-oriented, or operate with a franchise system with healthy balance sheets are well positioned to weather near-term headwinds. We think most U.S. quick-service chains will experience at least high-single-digit to low-double-digit comp declines for the year, while casual-dining chains are looking at comp declines of 30% or more.

Quarantine measures mean foot traffic decreases for popular chains. - Morningstar

Top Picks

Hanesbrands HBI Economic Moat Rating: Narrow Fair Value Estimate: $27 Fair Value Uncertainty: Medium

We believe long-term opportunities at Hanesbrands have long been overlooked by the market and, with shares trading at a nearly 70% discount to our valuation, view it as an opportunity for long-term investors. Although we expect uneven results in its innerwear business, we believe its Champion brand has solid growth prospects and aligns with fashion trends. We forecast Hanes’ activewear will achieve sustainable 3% annual growth in the long term. Additionally, we anticipate Hanes’ adjusted operating margins will improve to 15% in 2023 from less than 14% in 2019 as the company improves manufacturing efficiency.

Spin Master TOY Economic Moat Rating: None Fair Value Estimate: $31 Fair Value Uncertainty: Medium

Although our initial fiscal 2020 forecast for sales declines of 6% before the COVID-19 outbreak is tepid, we view Spin Master as well positioned to weather short-term demand decreases. Primarily, with no debt on its balance sheet and a $510 million credit facility for liquidity, we believe that compared with its larger narrow-moat peers, the company has good financial flexibility. We surmise that COVID-19 will primarily affect 2020 before normalized demand returns in 2021, and with ROIC set to average 17% over the next five years compared with our 9% weighted average cost of capital, we view Spin Master as a clear opportunity for long-term investors.

Carnival CCL Economic Moat Rating: Narrow Fair Value Estimate: $40 Fair Value Uncertainty: Very High

Carnival faces growing uncertainty as travel restrictions due to COVID-19 affect global itineraries. However, we believe COVID-19 is transitory and that the firm will begin to operate more normally in 2021. In our opinion, Carnival should be able to weather short-term travel decreases with access to $11.7 billion to ensure solvency, and while we expect return on invested capital to decrease in 2020, we expect this metric to climb back to a double-digit rate over the long term. With our pricing and capacity growth in the low- to midsingle digits over our forecast, we see Carnival as a solid opportunity for investors.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)