Consumer Defensive: Uncertainty Creates Attractive Valuations

Tobacco and beverage subsectors look particularly attractive.

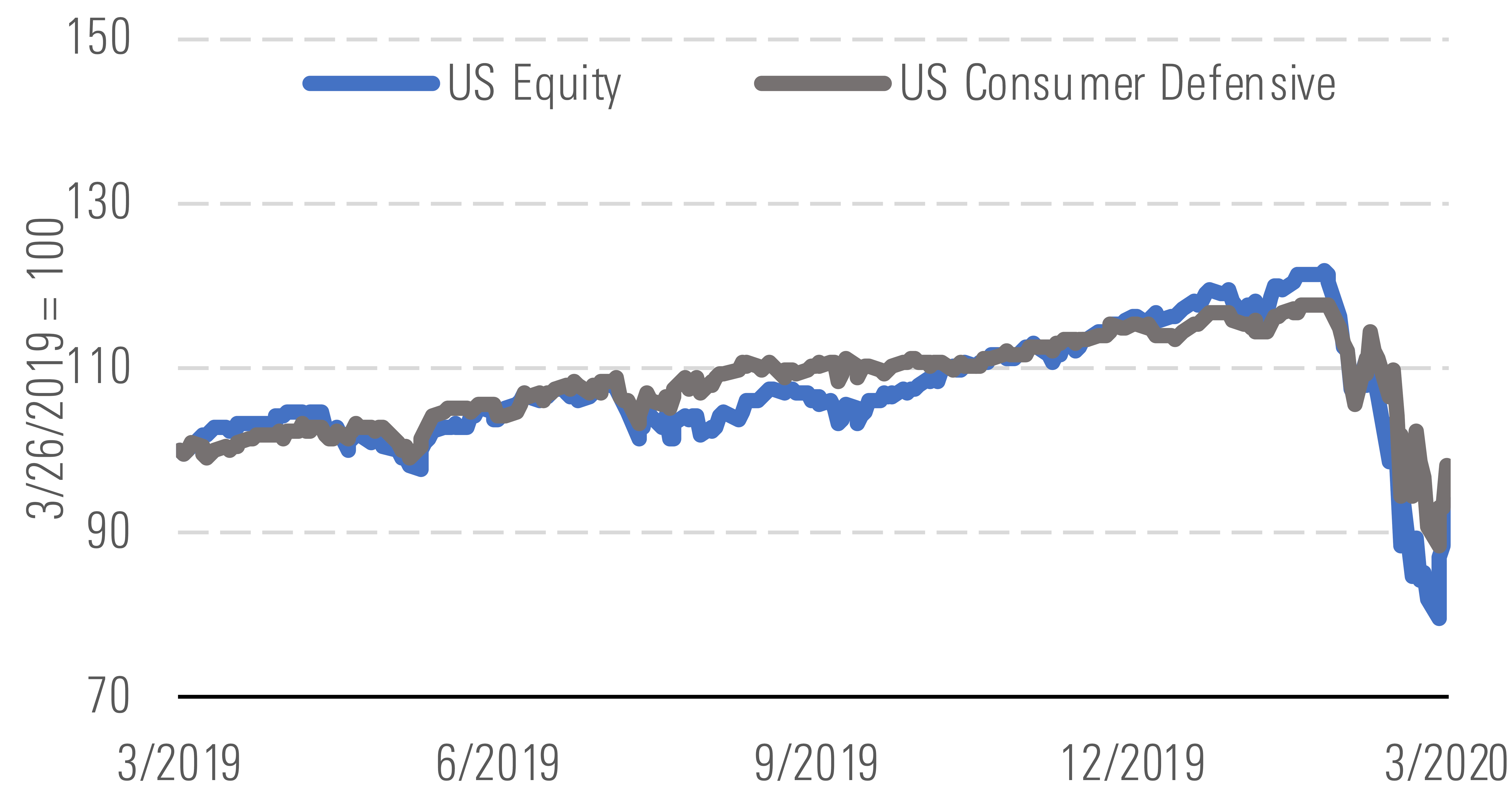

The consumer defensive sector outperformed the broader market amid extreme volatility this quarter, pulling back 14.9% compared with the market’s 19.1% drop through March 26.

Consumer defensive has taken less of a hit than the broader market. - Morningstar

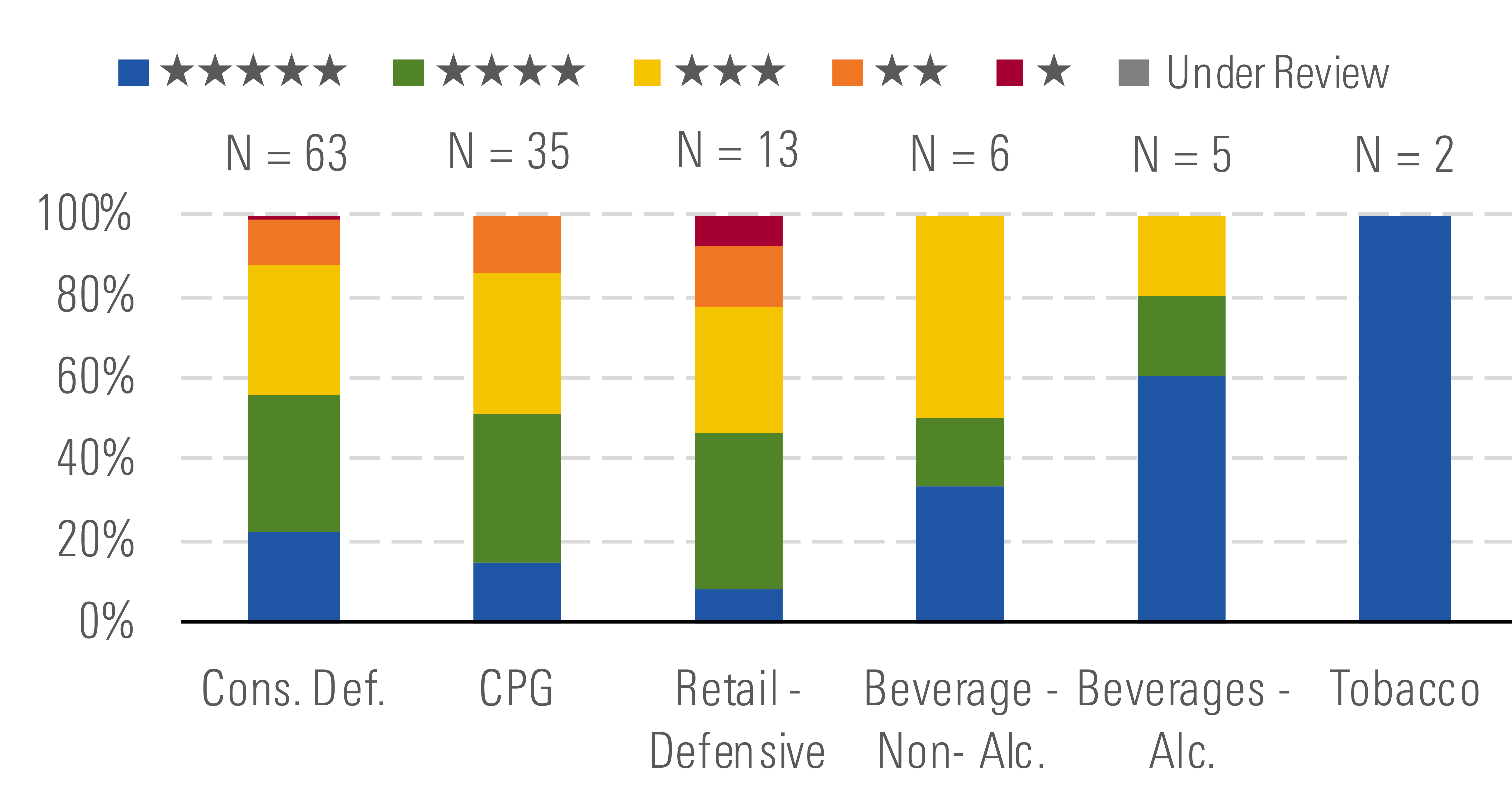

While the market carnage has created a vast array of opportunities across all sectors, we now see the consumer defensive space as offering more attractive valuations relative to the high-single-digit premium the sector traded at over the past few quarters. In this vein, the median consumer defensive stock in our coverage now trades at a 14% discount to our fair value estimates. Digging deeper, we perceive the tobacco and beverage categories (both nonalcoholic and alcoholic) as particularly attractive, with the names we cover in these industries trading 31%, 9%, and 35%, respectively, below our intrinsic valuations.

In the sector, tobacco and beverage names look especially attractive. - Morningstar

Amid the recently mandated shelter-in-place orders and social distancing initiatives due to COVID-19, grocery stores have struggled with bare shelves as people rushed to stock up on food and household supplies during this uncertain time. This has been particularly evident in the rash of purchases of nonperishable items since the first U.S. local transmission case of COVID-19 was confirmed in late February. Despite increased consumption of food and other packaged goods at present, we believe consumers will likely opt to destock pantries over time. As such, while we think food producers supplying the retail channel should benefit as food consumption shifts to the home (modestly aiding near-term sales and profits), we don’t expect gains to continue at this pace over a longer horizon.

Consumers are stocking up on essentials during this uncertain time. - Morningstar

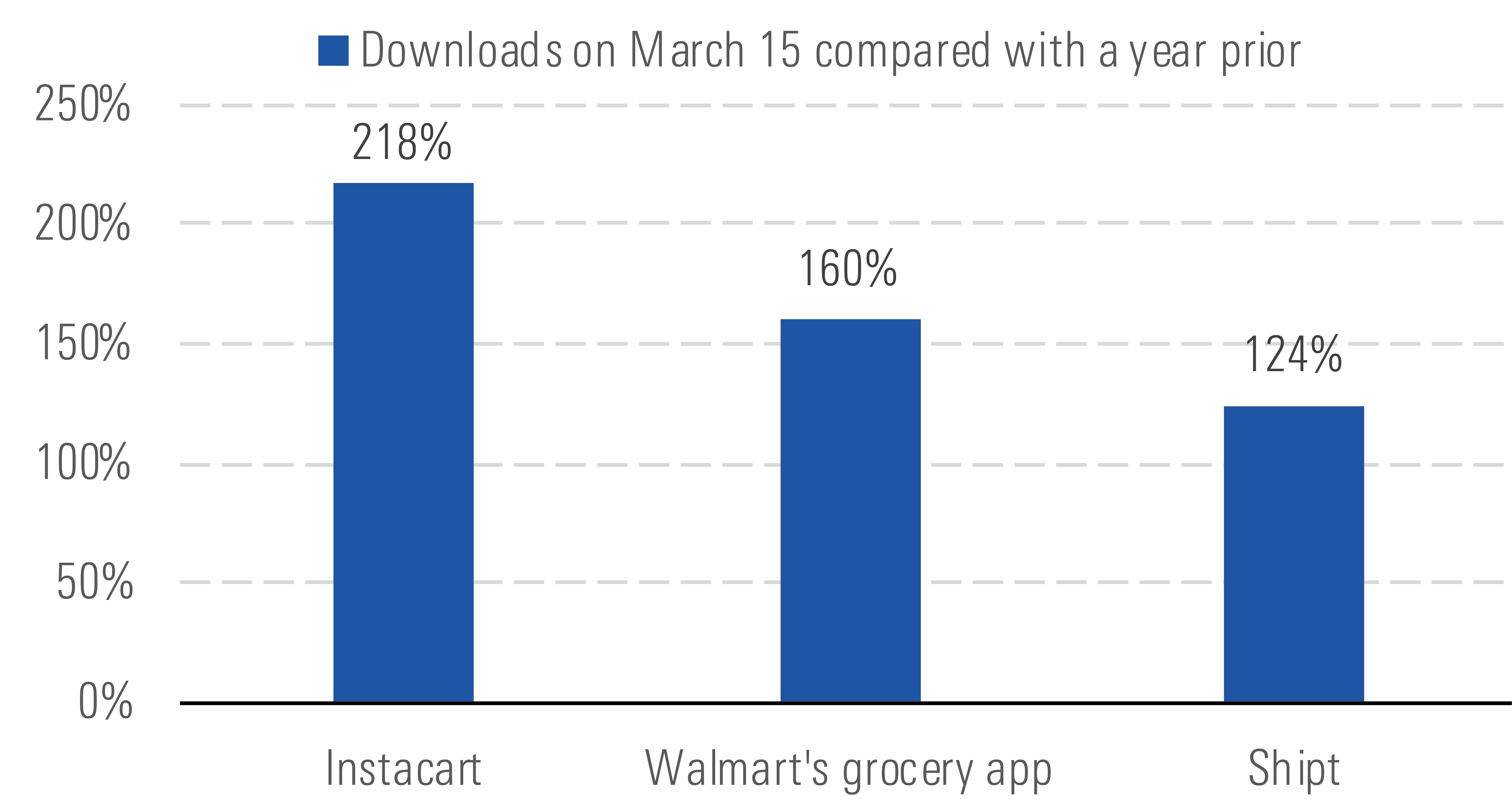

In thinking about the impact for defensive retailers, though, this landscape could ultimately increase the longer-term adoption of online grocery ordering as people download retailer apps to avoid public places. In our view, these trials could expand beyond nonperishables to include fresh items (produce and protein), which customers have been reluctant to purchase through e-commerce because of quality concerns. However, while this could aid retailers that already maintain an omnichannel presence, digital sales remain more costly than conventional in-store transactions (though increasing use should provide some scale benefits), and so heightened adoption may add to a pre-existing profit headwind.

Increased downloads of grocery shopping apps may bolster adoption. - Morningstar

Top Picks

Anheuser-Busch InBev BUD Economic Moat Rating: Wide Fair Value Estimate: $96 Fair Value Uncertainty: Medium

We think investors should consider wide-moat Anheuser-Busch InBev, trading more than 55% below our assessment of intrinsic value. While sales will take a significant hit from COVID-19 in 2020, we expect revenue growth to return to normal in 2021. AB InBev is the most leveraged among the brewing group, but the risk is more than priced in. Under our assumptions, the company will have access to short-term liquidity and additional cash if the sale of the Australian unit is completed. Growing faster than the sector, AB InBev continues to create value through high margins and returns on invested capital that exceed its cost of capital.

US Foods Holding USFD Economic Moat Rating: None Fair Value Estimate: $37 Fair Value Uncertainty: Medium

Shares of no-moat US Foods are trading at a 59% discount to our intrinsic value. Consumers are avoiding restaurants during the COVID-19 outbreak, which we expect to have a negative impact on 2020 sales. But we expect revenue growth to accelerate in 2021 as customers revert to normal. About 20% of US Foods’ sales stems from healthcare food-service and grocers, which we expect to remain strong during COVID-19 disruption, helping offset restaurant weakness. Although US Foods’ net debt/adjusted EBITDA has increased to nearly 4 times after the SGA acquisition, we think the firm has ample liquidity to weather the COVID-19 storm.

Constellation Brands STZ Economic Moat Rating: Wide Fair Value Estimate: $230 Fair Value Uncertainty: Medium

Wide-moat Constellation Brands, which owns the U.S. rights to Mexican beer brands like Corona and Modelo, is trading at a 48% discount to our estimated fair value. We believe investors are not fully appreciating the earnings power of the Mexican beer business that generates the majority of the firm’s revenue. Additionally, we think current market prices imply structural degradation to the brand equity of the firm’s largest trademarks as a result of the COVID-19 pandemic, a premise we disagree with. Constellation has impressive margins compared with its peers, which should allow it to successfully navigate near-term uncertainty.

Data as of March 26, 2020.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)