Here's Why You Should Rebalance (Again)

Rebalancing during a bear market can feel painful, but it pays off in the long run.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

In the simpler times of January 2020, we cautioned against the risk of letting your portfolio's equity allocation run too high in a bull market. Now that we're in the midst of the first bear market since the global financial crisis, we're resurfacing our research to focus on the impact that bear markets can have on buy-and-hold portfolios and the risks investors court by not rebalancing in extreme down markets.

In our previous article, we highlighted how letting a portfolio run in an extended bull market could lead to a portfolio with a higher drawdown risk because of its higher equity allocation. During a bear market, a buy-and-hold investor experiences the opposite. The equity allocation shrinks far faster than the allocation to bonds. For example, an investor that entered the year with a 60/40 allocation to stocks (45% U.S. equity and 15% international equity) and U.S. bonds, respectively, would have a portfolio that was roughly 50% equity and 50% bonds as of the end of March 20. If a 60% allocation to equities is appropriate given that investor's goals and risk tolerance, then rebalancing back to that equity allocation target when the portfolio is this out of whack should be beneficial over the long term. To be sure, now is also a great time to revisit previous assumptions about risk tolerance.

Rebalancing, or selling a portfolio's best performers to buy the worst performers periodically, is one of the best ways to protect against market movements altering a portfolio's risk profile. The advantages of rebalancing are especially apparent in tax-favored accounts, such as IRAs or 401(k)s, where tax implications are not a concern. Rebalancing may also be prudent in taxable accounts, but the advantages aren't as straightforward as it may trigger capital gains taxes depending on the investor's income level and capital gains exposure. As such, this article evaluates the merits of rebalancing in tax-favored vehicles.

Given how volatile stocks have been over the last month, rebalancing can also be a scary proposition. But rebalancing has historically helped portfolios rebound faster when markets do eventually turn around. To see how it has helped, we examined what the investor experience would have been like over the past 26 years without rebalancing.

The Ebbs and Flows of a Buy-and-Hold Portfolio To illustrate a buy-and-hold investor's experience, we built a 60/40 portfolio using the following indexes:

- S&P 500 (45%)

- FTSE All-World ex U.S. Index (15%)

- Bloomberg Barclays U.S. Aggregate Bond Index (40%)

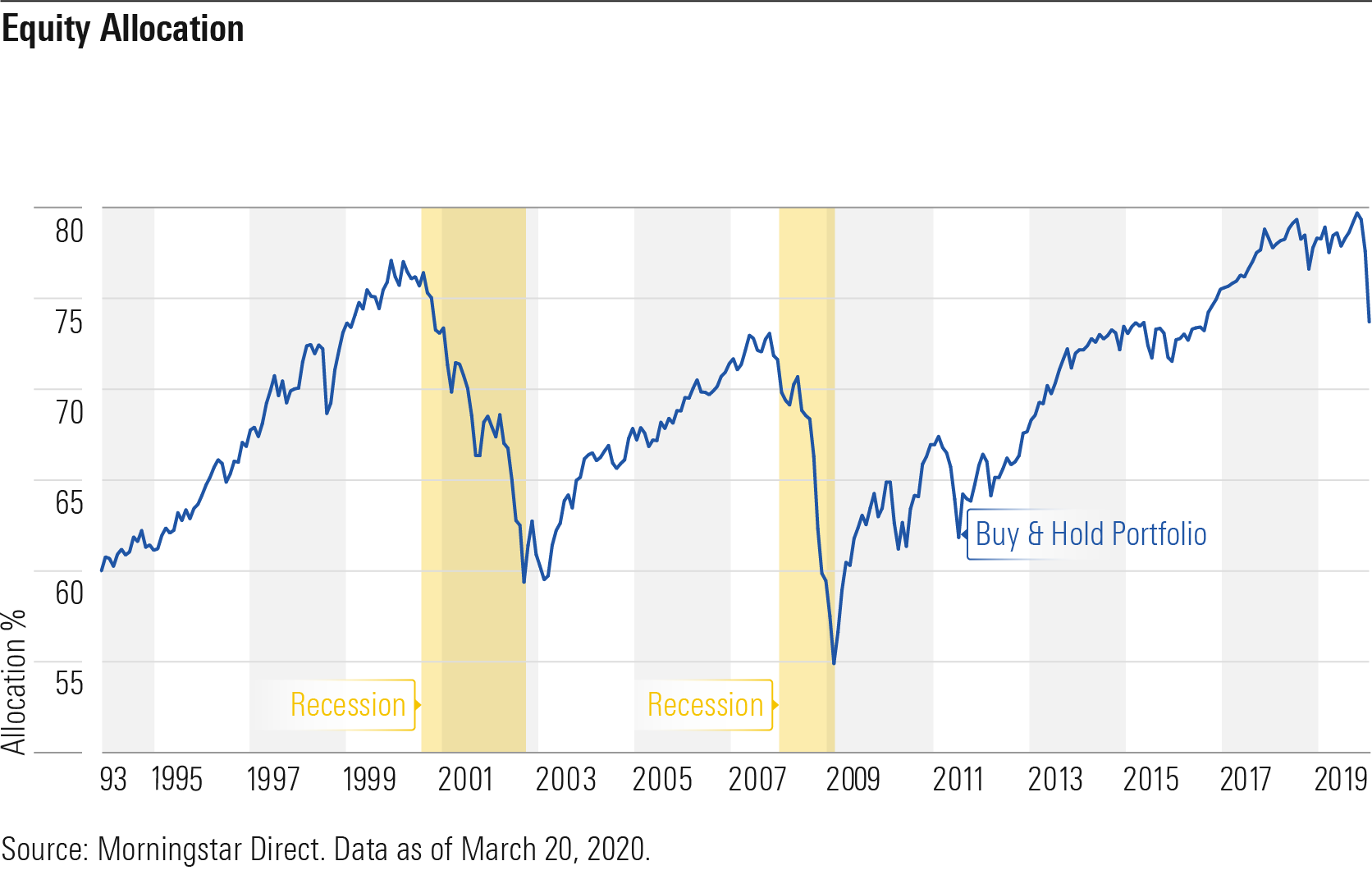

We ran the portfolio's returns from 1994 (the most recent inception date of the three indexes) through March 20, 2020, and tracked its equity allocation and drawdowns over the period. Exhibit 1 shows how the weighting in equities changed over time.

The portfolio's equity allocation grew to 76% from 1994 through August 2000, leading into the first major bear market of the 2000s. It again peaked just before the start of the financial crisis in October 2007, with 73% in equities. At the end of 2019, the allocation to equities reached its highest level over the entire period, nearing 80% of assets.

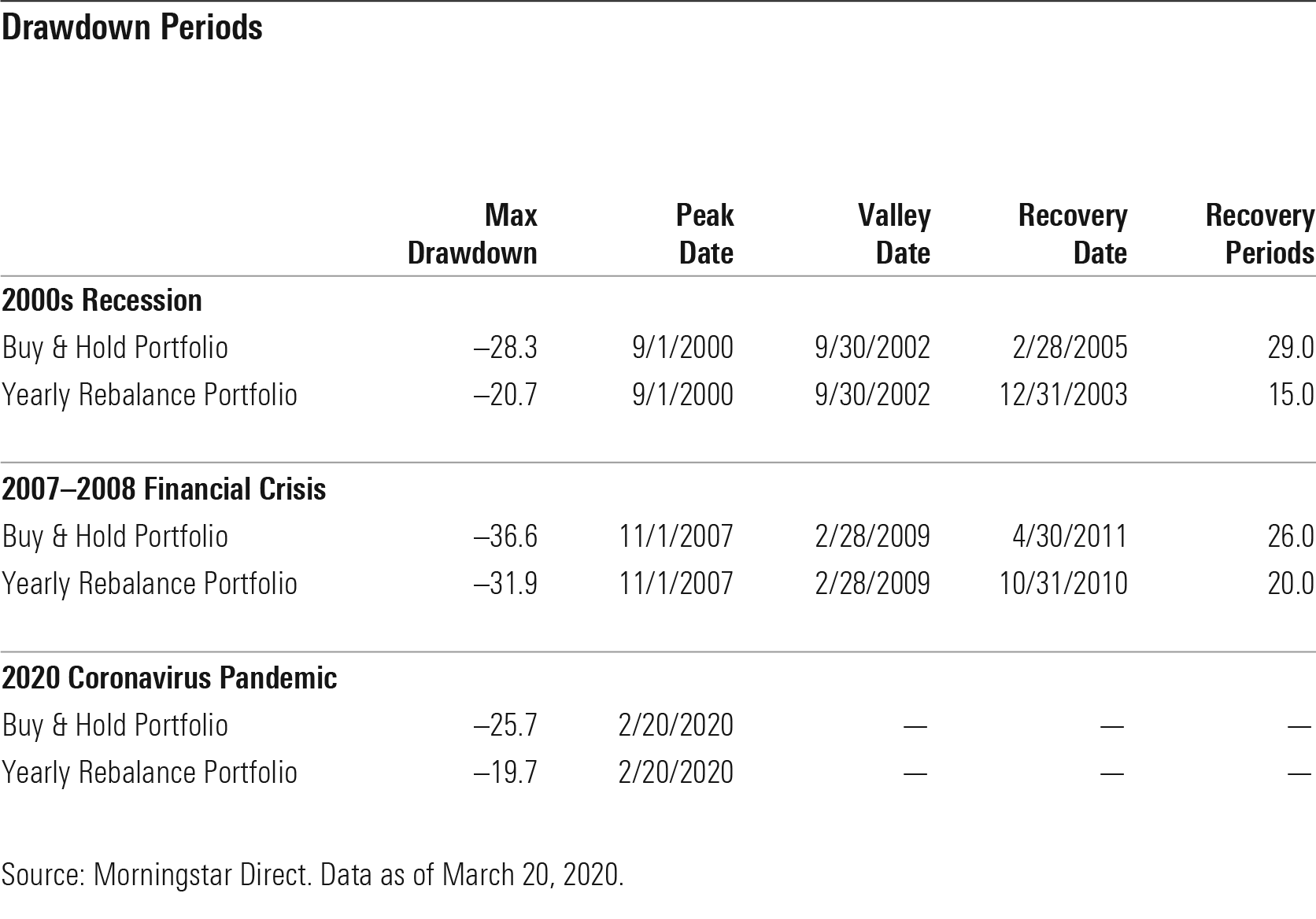

Unfortunately, the elevated allocations heading into the last two bear markets meant more pain during those drawdowns and a longer wait to recover those losses. Exhibit 2 shows the max drawdown during both periods and how long it took the portfolio to recover its losses compared with the same portfolio rebalanced annually at the end of each year, arguably the simplest rebalancing strategy. It also includes the current drawdown through March 20.

The most relevant part of this historical analysis for investors today is the longer recovery periods faced by the portfolios that didn't rebalance when things finally did start to turn around. This is because in both prior periods, the buy-and-hold portfolio entered the recovery phase with a lower allocation to stocks than the portfolio that regularly rebalanced while having to climb out of a deeper hole. The length of the current bear market is uncertain, but the implications it has for your portfolio are not. Maintaining allocations in line with the strategic target by rebalancing should help keep your portfolio and long-term goals aligned during this volatile time.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)