Value and Momentum Fall Out of Favor, but for How Long?

Here's a look at some strategies that combine the two factors and how they have fared.

Combining the value and momentum equity factors has been a longtime winning strategy. However, that approach has lost its luster in recent years. Here, we'll look at some strategies that combine the two factors and how they have fared.

First, how have these factors fared on their own? We'll start with value. No equity factor works in all market environments, but the value factor underperformed pretty much throughout the recent 10-year bull market. Deep-value mandates, or those that invest in the cheapest stocks based on metrics such as price/earnings, price/book, or price/sales ratios, have been challenged for several years. For example, LSV Value Equity LSVEX, which has a Morningstar Analyst Rating of Silver, has fallen to the bottom decile of the large-value Morningstar Category over the trailing one- and three-year periods. Another example is Neutral-rated PGIM QMA Mid-Cap Value SPRAX, which has fared even worse, landing in the mid-cap value category's worst-performing decile over the trailing one-, three-, and five-year periods. Both funds exemplify not only the underperformance of value versus growth but, more specifically, the underperformance of deep value (or low-price multiple stocks) versus relative value (stocks that trade closer to a market multiple).

The momentum factor looks at stock prices' tendency to continue to rise if they have been going up and, conversely, continue to decline if prices have been trending down. The addition of the momentum factor has long been a complementary factor to value by helping investors avoid value traps. Momentum has not fared much better, though. An example of this is AQR Large Cap Momentum Style AMOMX. Just as its name indicates, the strategy targets stocks with momentum ranking in the top third of its selection universe. It has fallen to the bottom quartile of the large-growth category over the trailing two-year period and the bottom half over the trailing three-, five-, and 10-year periods.

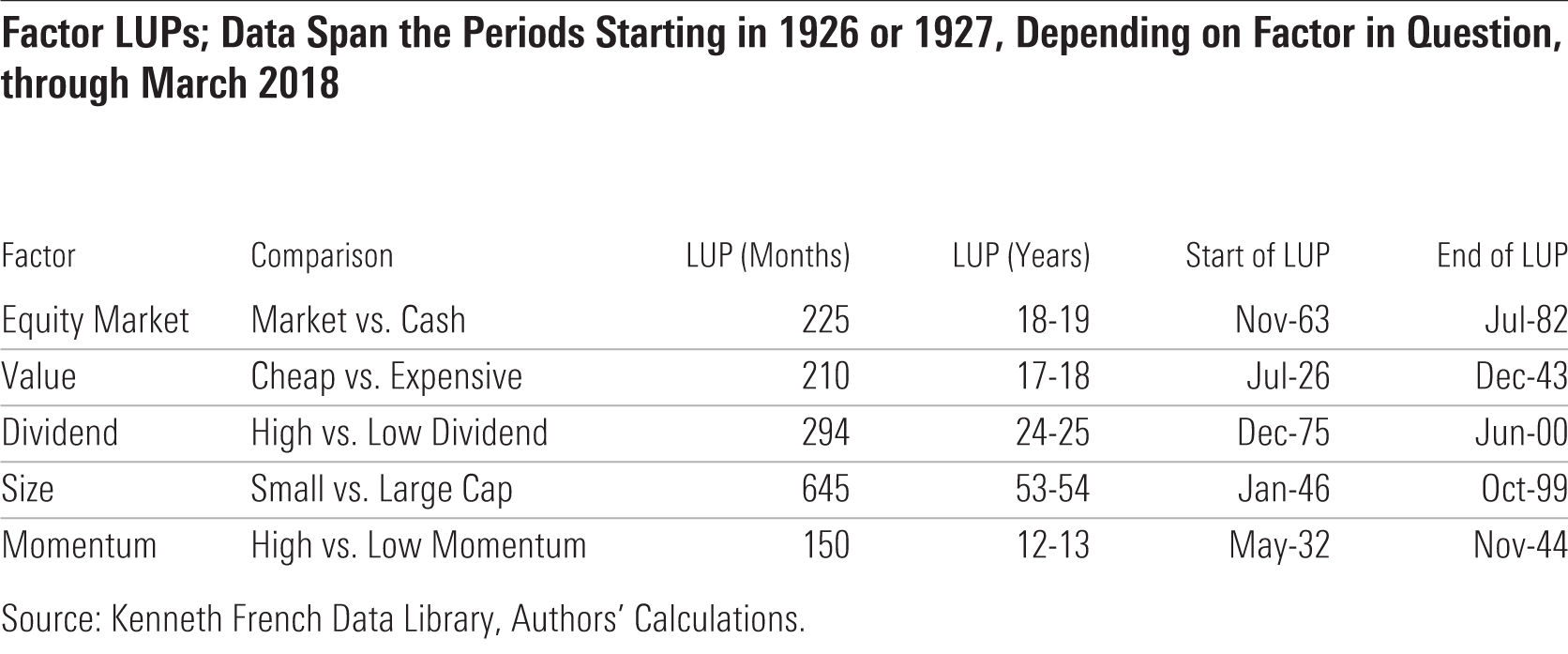

So, what happens when both factors fall out of favor and how long can that persist? Morningstar's Maciej Kowara and Paul Kaplan concluded that factors can underperform for several years or even decades at a time. In another paper titled "How Long Can a Good Fund Underperform Its Benchmark?," the authors introduced the concept of longest underperformance period, or LUP. In brief, for a fund that outperformed its benchmark over some time frame, such as 15 years, LUP is the longest stretch during which the fund underperformed that benchmark.

Here, we borrow that concept and apply it to factors. For the value factor, the authors compared the performance of the 30% cheapest stocks with the performance of the 30% most expensive stocks, while for the momentum factor, they used the average of the three highest-momentum deciles as a proxy for high-momentum stocks and the average of the three lowest-momentum deciles as a proxy for low-momentum stocks. The table below illustrates the findings; however, here we will focus just on the value and momentum factors.

We'll look at a hypothetical portfolio that places a 50% weight on the value factor and a 50% weight on the momentum factor. This portfolio delivered excess returns relative to the market in every rolling 10-year period from January 1927 through March 2005. Starting March 2005, the approach modestly underperformed the market for two rolling 10-year periods and then resumed its winning ways, albeit briefly. However, it reversed course soon thereafter and the approach has been challenged ever since. Indeed, in the last 56 rolling 10-year periods, or since July 2005, this approach has underperformed the market. While the underperformance of the value factor (cheap stocks outperforming expensive ones) has been well documented, momentum's own fall from grace has been less broadcast.

Value and momentum have historically offset one another. In other words, the two factors are negatively correlated. If value and momentum are negatively correlated then together the two factors are infallible, right? Wrong. One example of this is Alpha Architect Value Momentum Trend ETF VMOT. It falls in the worst-performing decile in the long-short equity category over the trailing one- and two-year periods. Even a more broadly diversified factor-oriented strategy like Vanguard Strategic Equity VSEQX, which draws upon the valuation, growth, quality, momentum, and management-decision factors, has had a tough go, lagging its typical mid-cap blend category peer over the trailing one-, three-, and five-year periods through February 2020.

Our examples illustrate that both value and momentum have been out of favor, and it is uncertain when these factors will bounce back. While these factors should outperform over the long term (and have historically), they can go through long stretches of underwhelming results. Further, during times of market duress, correlations often go to 1 and could further impair strategies that rely on a factor-based approach. Nevertheless, investors are likely better off weathering the storm than trying to time the efficacy of factors or different investing styles.

/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c5cfeb1b-84bd-4fc2-9ea1-ed94bbd92e9f.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fadee740-dfeb-494d-95b1-c462d0ac1f59.jpg)