It's a Bear Market, but Your Stock Fund’s Strategy is Starting to Matter

As the sell-off deepened and officially entered a bear market, the complexion of the decline shifted.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

The damage from the coronavirus-driven bear market continues to hammer U.S. stock mutual funds, but there are some signs that the sell-off, while extreme, is becoming a little less indiscriminate. As was the case before the market collapse, funds focused on larger stocks are holding up better and, in general, value strategies are performing worse, especially at the intersection of small caps and value.

In our article that looked at the initial downdraft at the end of February, we found that almost irrespective of a fund's strategy and focus, returns were similar. It was a "correlations go to 1" stock market, where all stocks were punished almost equally and indiscriminately. This dynamic was a significant change from the factor landscape of the previous three years. (A video for the Morningstar Factor Profile can be found here .)

For these articles, we're looking the universe of diversified U.S. stock funds through the lens of Morningstar Factor Profile data. This data set measures a fund's portfolio based on seven metrics: size, style, yield, momentum, quality, volatility, and liquidity. Our original screen covered Feb. 19 through Feb. 27, 2020, when the stock market began to roll over after hitting an all-time high in the Morningstar US Market Index. For this screen, we examined the relationship between factors and performance from March 1-18.

As the sell-off deepened and officially entered a bear market, the complexion of the decline shifted.

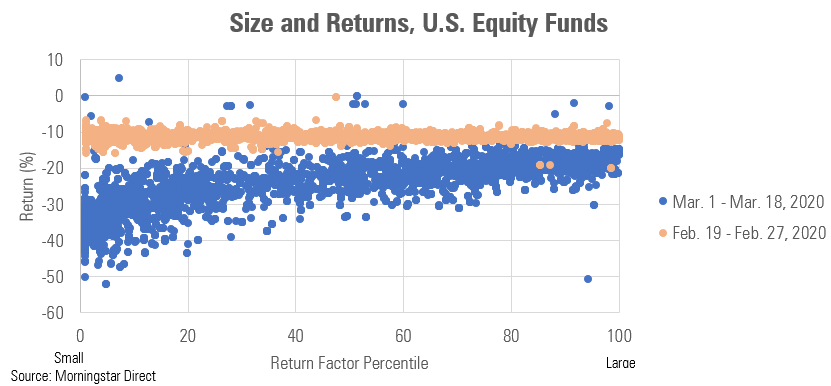

Size

From Feb. 19 through Feb. 27, size played a barely noticeable role in fund returns. But in March, funds with larger stocks have fared better. Size had the highest correlation between returns and factor percentile out of the seven factors, with an R-squared value of 0.63.

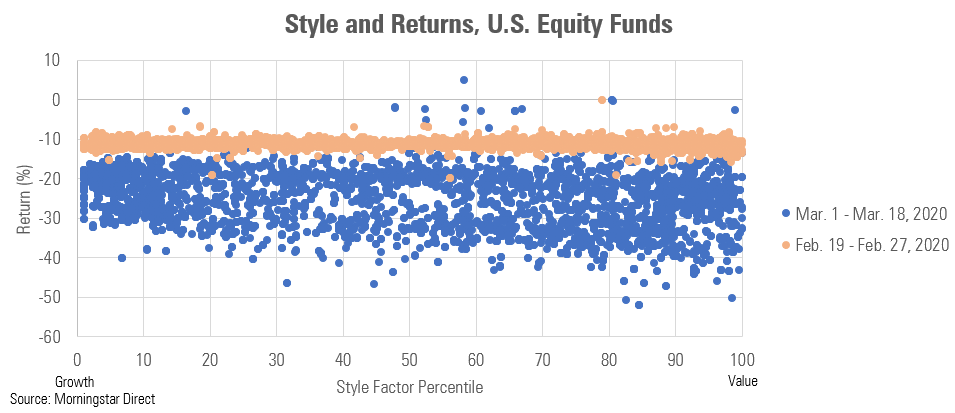

Style Prior to the market collapse, perhaps the most dominant investing trend was the significant outperformance of growth strategies over value strategies. That was visible through the style factor, a measure of where a fund falls on the value-growth spectrum.

When viewed from an overall vantage point, a slight tilt toward growth was visible, even though from a pure performance standpoint, funds in the value and growth Morningstar Categories had virtually identical average returns of negative 25% during the March period.

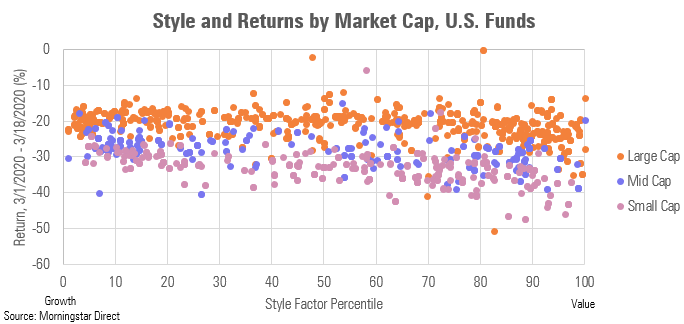

But the picture becomes clearer when market capitalization--as designated by Morningstar Category--is overlaid on the factor map. Small-value stocks are once again far underperforming, and large-cap stocks are proving more buoyant.

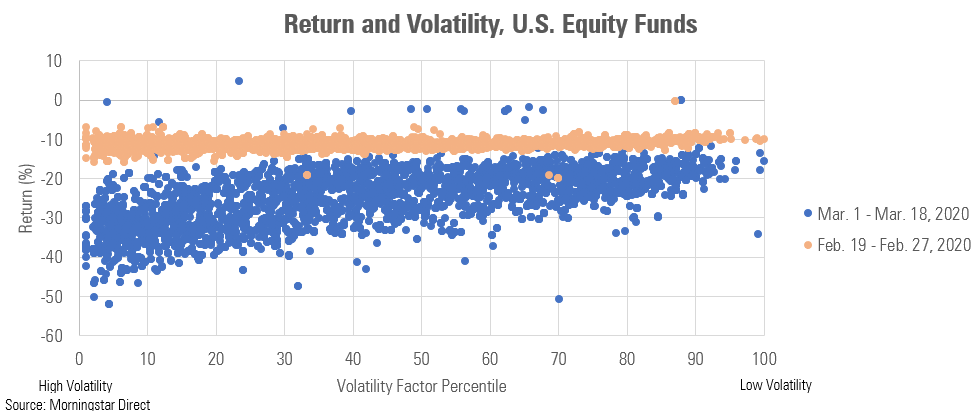

Volatility

One clear reflection of the sell-everything mentality at the start of the market swoon was that funds dominated by low-volatility stocks didn't fare much better than funds that held more-volatile shares. Morningstar's volatility factor describes the maximum observed spread in long-term returns, based on the trailing-12-month standard deviation of daily returns.

That changed in March, as funds with more low-volatility stocks outperformed their higher-volatility counterparts. With an R-squared value of 0.43, the volatility factor percentile showed the second-highest correlation with month-to-date returns.

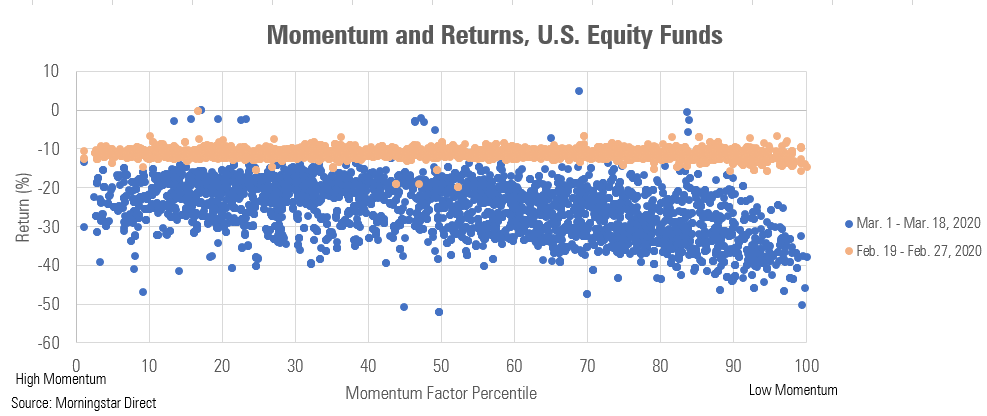

Momentum

Another factor that resumed its place as one with a strong connection to returns in March was momentum. Momentum is based on the premise that stocks that have recently outperformed will continue to do so, and those that have underperformed will stay behind. The momentum factor describes how much a stock has risen in price over the past year relative to other stocks.

Timothy Strauts, Morningstar's director of quantitative research, says the fact that low-momentum stocks are once again underperforming shouldn't be much of a surprise. Many of those companies were likely already struggling on a relative basis--hence their shares' poor momentum profile--and the economic shock likely only magnifies those woes. Plus, he said, many of the higher-momentum names have been technology stocks, which could weather the downturn better.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)