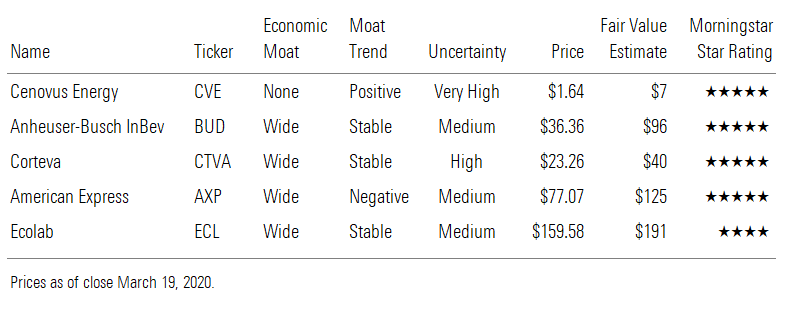

5 More Stocks We Like

As our analysts re-evaluate the companies they cover, they’re finding some exceptional bargains along the way.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

As the coronavirus pandemic threatens economic growth, our analysts are re-evaluating the companies they cover, estimating the toll the virus may take. Along the way, they're uncovering many opportunities. We shared a handful of ideas earlier this week. Today we offer five more.

We’re not suggesting that these stocks won’t fall further; they certainly may. What we are suggesting, though, is that these stocks are trading at appealing entry points given our long-term outlook for each.

Best Idea Cenovus on Sale We are lowering our fair value estimate for Cenovus Energy CVE/CVE to $7 (CAD 10) per share from $8 (CAD 11) on the basis of revised growth forecasts. Cenovus' number-one priority is strengthening its balance sheet, which will get worse before it gets better in the next two years. Recent OPEC+ supply shocks coupled with COVID-19 demand shocks have greatly depressed near-term cash flow potential. We expect Cenovus to draw down about half of its CAD 4 billion facility until the market reaches our midcycle forecast of $55/barrel West Texas Intermediate in 2022. After that, we expect the company to push toward its net debt target of CAD 5 billion. Once the dust settles, Cenovus will turn its attention to growth. We have adjusted our growth forecast to reflect the deleveraging priority.

The stock has been in a free-fall since March 5, dropping 75%, while the Morningstar Large Cap Index and oil prices have only decreased 23% and 50%, respectively. The stock is now trading near its all-time low and presents a tremendous opportunity for long-term investors. Because of the current environment, we think the market will have difficulty looking to the future. But the company has enough liquidity to weather the storm and keep the ship afloat before it can restart its cash flow generation. It could be some time before the market's concerns are fully addressed, and investors must be prepared for further volatility in the interim. But we recommend staying the course.

In our view, Cenovus' best-in-class supply costs and U.S. Gulf Coast market access will enable the company to generate enough cash flow to reshape its balance sheet and position itself for growth once new pipes are built. The company's conversion to its solvent-aided process should further increase netbacks even without pipeline expansion. Joe Gemino, senior analyst

It's Time to Back Up the Truck on BUD We are lowering our earnings estimates and fair value estimates for the European brewers to account for the value destruction caused by COVID-19 and recent currency movements. Our previous bear-case scenario has become our base case, as the coronavirus has become a global pandemic rather than a virus isolated to Asia, as in the SARS epidemic of 2003 and as it appeared to be only a few weeks ago. We are lowering our fair value estimates for Anheuser-Busch InBev BUD/ABI to $96 from $108, for Heineken HEIA/HEINY to EUR 82 from EUR 88, and for Carlsberg CARL B/CABGY to DKK 725 from DKK 840. Our moat ratings are unchanged, and we see little long-term impact to the business models or cash flow generation. The group has sold off and all are currently trading below our fair value estimates, but our pick is AB InBev, a wide-moat business with a significant cost advantage that appears egregiously undervalued. A low-probability liquidity event appears to be priced in, but we think the company has access to enough cash to navigate the downturn.

Our new base case assumes a fairly short-lived global recession, with all regions affected in similar ways. During the quarantine period, which we assume to last three months and to occur globally, we estimate that around two thirds of the on-premises channel will be decimated, mitigated to a limited degree by a shift to the off-premises channel. The net impact is a mid- to high 20s percentage reduction in revenue in the affected quarter, although the timing of the impact varies based on the geographical exposure of the business, and a high-single-digit decline for the full year. Beyond the lockdown period, we expect a global recession, with elevated unemployment rates and beverage volume recovering only gradually throughout the rest of the year. With several major sporting events being postponed rather than canceled, however, it seems likely that revenue will recover to the 2019 level in 2021, with the secular growth rate of 4%-5% resuming thereafter. Philip Gorham, director

Market Sell-Off Creates Opportunities for Ag Input Stocks; We Like Corteva Agriculture stocks, which are already cyclical, have by no means been insulated from the market sell-off due to the coronavirus outbreak. However, we see little demand impact across the agricultural sector, as our base case for 2020 assumes farmers will still plant crops globally. As such, we continue to expect a significant rebound in U.S. acres planted following 2019's lowest total plantings in over a decade due to flooding. Further, the end of the South American growing season and beginning of the harvest has so far been underway with few disruptions, and we expect companies that sell ag inputs to South American farmers will see that business holding up well.

With our outlook for planted acres largely unchanged, we forecast strong demand for ag inputs, including seeds, crop chemicals, and fertilizers. In our view, the market sell-off has created opportunities for long-term investors to pick up cheap shares. Our top ag input pick is wide-moat Corteva CTVA, which is trading in 5-star territory, more than 40% below our $40 fair value estimate.

We like Corteva because it is not exposed to the incremental price volatility of fertilizer stocks. The company is in a great financial position, with cash greater than total debt at the end of the fourth quarter. Corteva should see little disruption from international supply chain disruptions, as it manufactures all seeds locally. While crop chemicals are manufactured around the world, Corteva is not reliant on a single country and currently has around a year of inventory on hand, which should provide some buffer. Seth Goldstein, analyst

American Express' 2020 Won't Be as Bad as Many Fear Investors should expect COVID-19 to have a severe impact on wide-moat American Express' AXP revenue in 2020. However, early indications from Amex are that the fallout is not as bad as we feared. In a special call, management said investors should expect first-quarter revenue to grow 2%-4% from the previous year. It also disclosed that through the first two months of the year, revenue was up 9% from the previous year. This updated guidance implies that March revenue will contract by 6%-12%.

CFO Jeffrey Campbell said, "Taking what we saw in the first two weeks of March and then assuming things continue to get materially worse...our first-quarter revenue growth could be as low as 2% on an FX-adjusted basis. If things only get modestly worse from here in the coming days, our first-quarter adjusted revenue growth could be closer to 4%." Though it’s just one data point and we’ll need to see more, this is better than we had feared. Nevertheless, we’re decreasing our fair value estimate to $125 per share from $141. Trading at nearly a 40% discount to our fair value estimate, American Express is an exceptional bargain, in our view.

We'll caution that it's still early, and most of the impact from COVID-19 will be felt next quarter. In addition, Amex's billings are presently benefiting from a substantial increase in spending outside of travel and entertainment as consumers rush to grocery stores to stock up on toilet paper. This type of spending is unsustainable. However, if the world economy can get back on its feet by the start of June, management said spending should get a significant boost from pent-up purchase demand beginning late in the second quarter and continuing into the third quarter. This is what happened after the 9/11 terrorist attacks. Based on this, we now forecast Amex's revenue to decline 4.4% in 2020 before rebounding 10% in 2021. Colin Plunkett, analyst

Ecolab Offers Rare Value to Long-Term Shareholders On March 18, Ecolab ECL confirmed its first-quarter adjusted earnings per share guidance, which included a $0.05 reduction due to the economic impact of the coronavirus outbreak. Management said it was not yet able to estimate the full-year negative impact of the effects of the outbreak on its business.

We have reduced our institutional forecast for 2020 sales from roughly flat to down just under 5% to account for state and local restrictions on customers entering restaurants. As a result, we now forecast 2020 adjusted EPS of $5.96 versus management's guidance of $6.33-$6.53. Our model also continues to include reduced energy segment profits from lower oil prices. Having updated our model to reflect these changes, we've trimmed our fair value estimate to $191 per share from $193. Our wide moat rating is intact.

At current prices, we view Ecolab as undervalued on a risk-adjusted basis with the shares trading in 4-star territory. We think the market sell-off provides a rare opportunity for long-term investors to pick up Ecolab at a compelling discount to our fair value estimate.

Roughly half of Ecolab's institutional sales are to food-service providers, primarily restaurants; one fourth of sales come from hotels, and the remainder from long-term care and other facilities. While we expect restaurant and hotel sales to see declines, around 50%-60% are not dependent on in-store customer volume. These sales come from cleaning the "back of the house" items, such as ovens, grills, and fryers, which are required for the restaurant to remain open even if it just sells takeout and delivery orders. As a result, we think Ecolab will be relatively less affected by the restaurant and hotel slowdown than its food-service and lodging customers. As a partial offset, we expect sales growth of hand sanitizer across the institutional segment. Seth Goldstein, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)