Are Sustainable Equity Funds Doing What They Claim to Be Doing?

For the most part, yes, but many fall short on some dimensions.

The universe of sustainable funds has grown rapidly over the past five years. U.S. investors can now choose from more than 300 open-end and exchange-traded funds that have sustainable investing at the core of their investment strategy. About two thirds of those strategies are equity funds.

These funds, however, are not all alike. Some focus on evaluating companies on the material environmental, social, and governance issues facing them and their industries. These are often operational policies and performance in areas like carbon emissions, pollution, treatment of workers, and overall business ethics. Others focus on particular themes--such as low carbon, gender diversity, and so on--or on selecting companies based on the social value of their products and services.

But how well are sustainable equity funds doing what they claim to be doing? It's a hard question, and one that carries with it the dreaded insinuation of "greenwashing" for those judged to be falling short. In my recently published Sustainable Funds U.S. Landscape Report, I evaluated sustainable funds using the Morningstar Sustainability Rating as well as Morningstar Portfolio Carbon Metrics and fund proxy voting data.

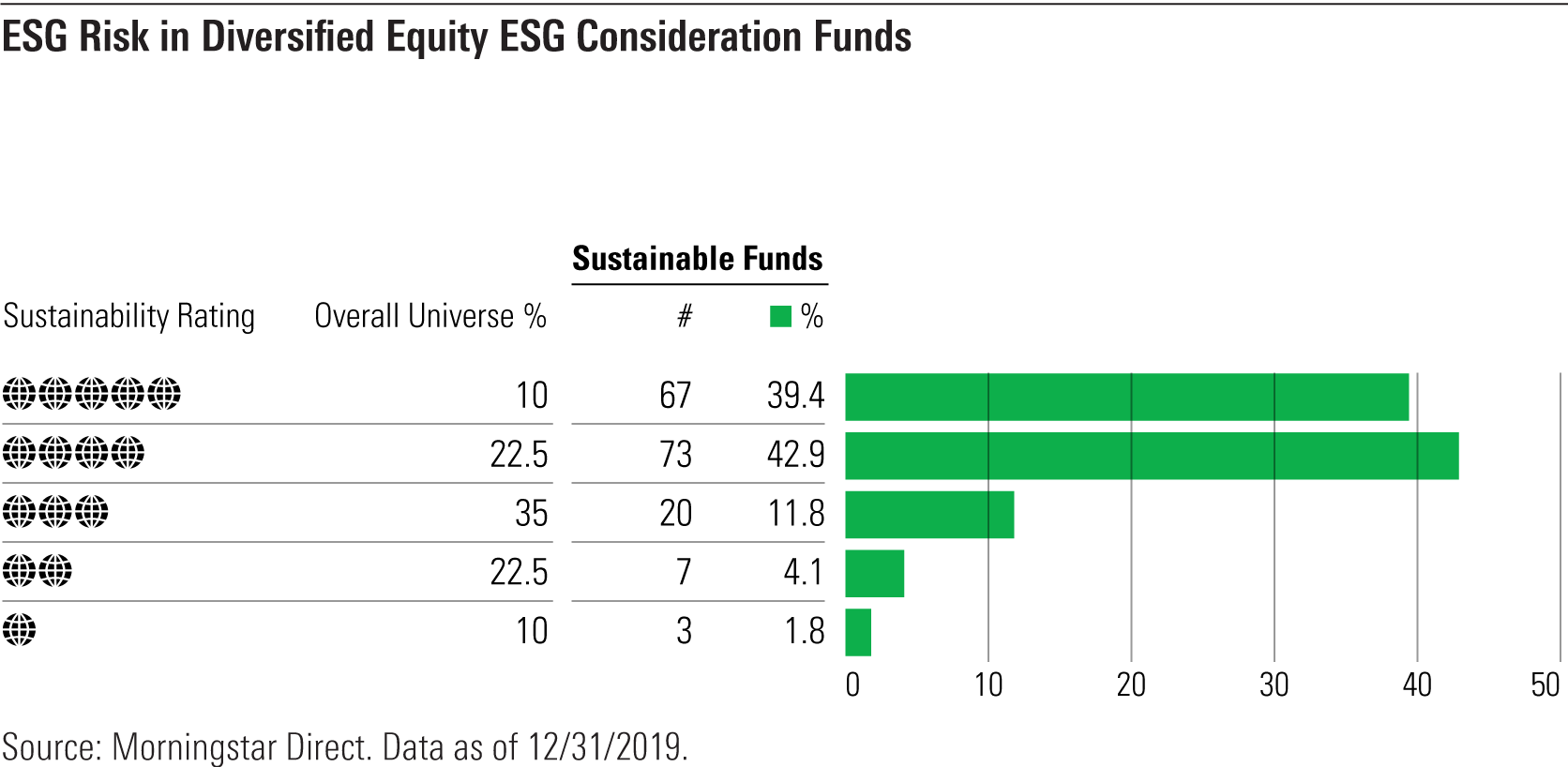

Sustainable Funds and the Morningstar Sustainability Rating First, let's take a look at the extent to which sustainable funds are actually investing in sustainable companies and how they differ from the rest of the fund universe in their exposure to sustainable companies. The Sustainability Rating can help answer these questions.

The holdings-based Sustainability Rating relies on company-level ESG risk assessments that focus on the most financially material ESG issues facing a company and its industry. Funds are rewarded for selecting companies in lower ESG-risk industries and for selecting the lowest ESG-risk companies in any industry. We award globes based on how well a fund scores relative to its Morningstar Category, which includes both sustainable and conventional funds.

Sustainable equity funds have significantly lower levels of ESG risk embedded in their portfolios. More than four in five (82%) receive the highest ratings, 4 or 5 globes, compared with only a third of funds in the overall universe. Only 6% of sustainable equity funds receive the lowest ratings, 1 or 2 globes, compared with a third of funds in the overall universe. Based on the Sustainability Rating, then, most sustainable equity funds do appear to be walking the walk.

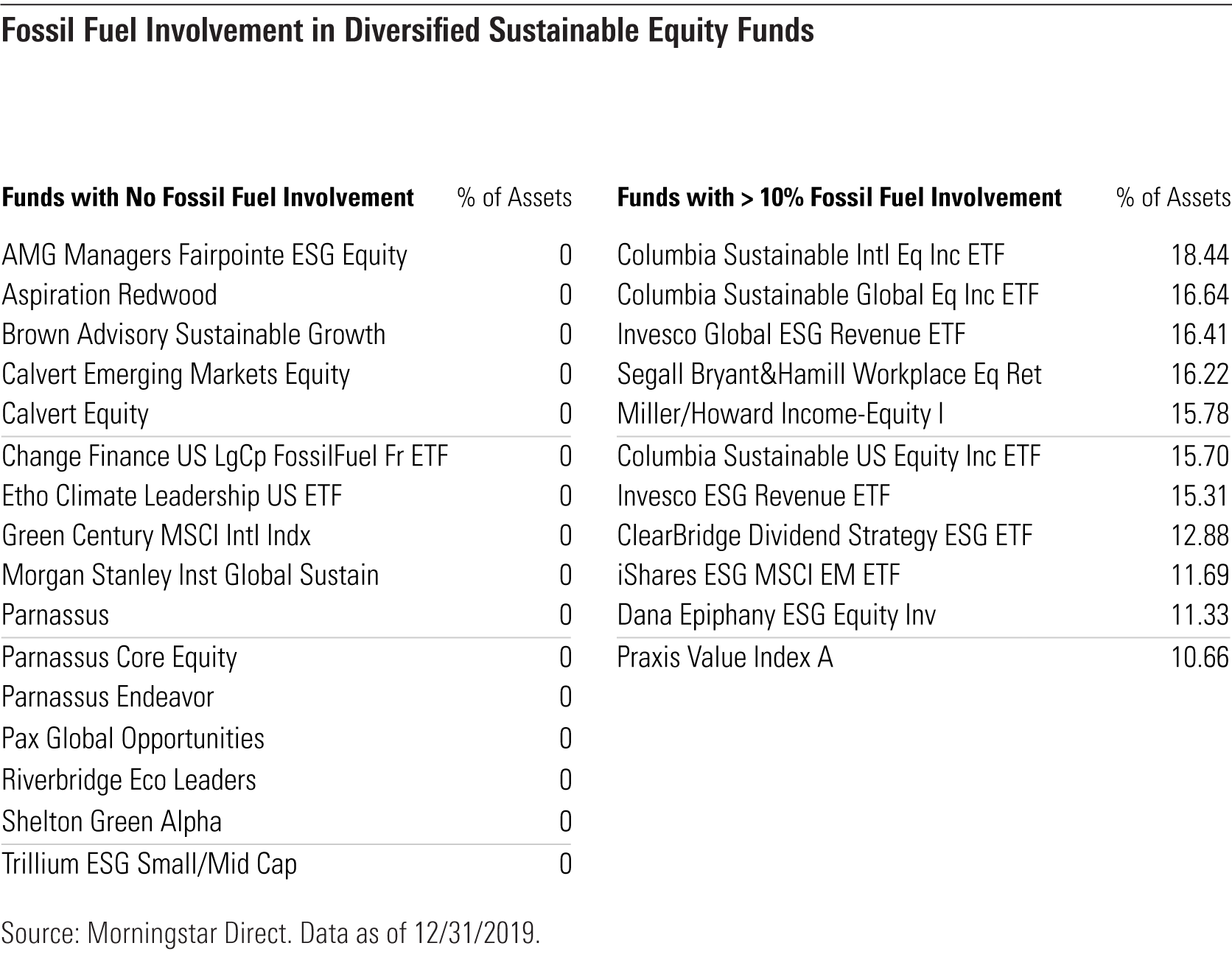

Low-Carbon and Fossil-Fuel-Free Sustainable Funds Next, we turn our attention to how sustainable equity funds are positioned on climate change. Because climate change is such a big issue and one that is closely associated with sustainability, we may expect many sustainable funds to be fossil-fuel-free and most to have a lower carbon footprint than conventional funds.

Yet what we find is that less than one third of sustainable funds avoid investing in fossil fuel. Only 91 of the 303 sustainable funds are fossil-fuel-free or even "low carbon" by prospectus. And of the 184 funds that receive a Morningstar Portfolio Carbon Risk Score, slightly less than half receive the Morningstar Low Carbon Designation, which requires lower-than-average fossil-fuel involvement but not complete avoidance.

Focusing on diversified U.S., non-U.S., and global-equity sustainable equity funds, I found only 16 with no fossil-fuel involvement in their most recent portfolio.[1] Another 11 funds had less than 1% fossil-fuel involvement. By contrast, 35 sustainable funds had fossil-fuel involvement in 7.5% to 10% of assets, and 11 had more than 10% fossil-fuel involvement. For comparison, major equity indexes have about 10% of assets with fossil-fuel involvement.

Narrowing the scope to what is considered the worst fossil fuel, thermal-coal exposure, sustainable funds do somewhat better, with 47 funds having no exposure and another 26 with less than 1% exposure. At the higher end, 34 sustainable funds have thermal-coal exposure between 3% and 5% of assets (thermal coal takes up around 4% of global indexes). Nine sustainable funds have thermal-coal exposure of 5% or more.

Investors should be aware of differences in how funds define being fossil-fuel-free. For example, three State Street ETFs use the term "Fossil Fuel Reserves Free" in their names. They exclude companies that own "proved and probable coal, oil, and/or natural gas reserves used for energy purposes" but still have overall fossil-fuel exposure ranging from 4.3% to 7.4%.[2]

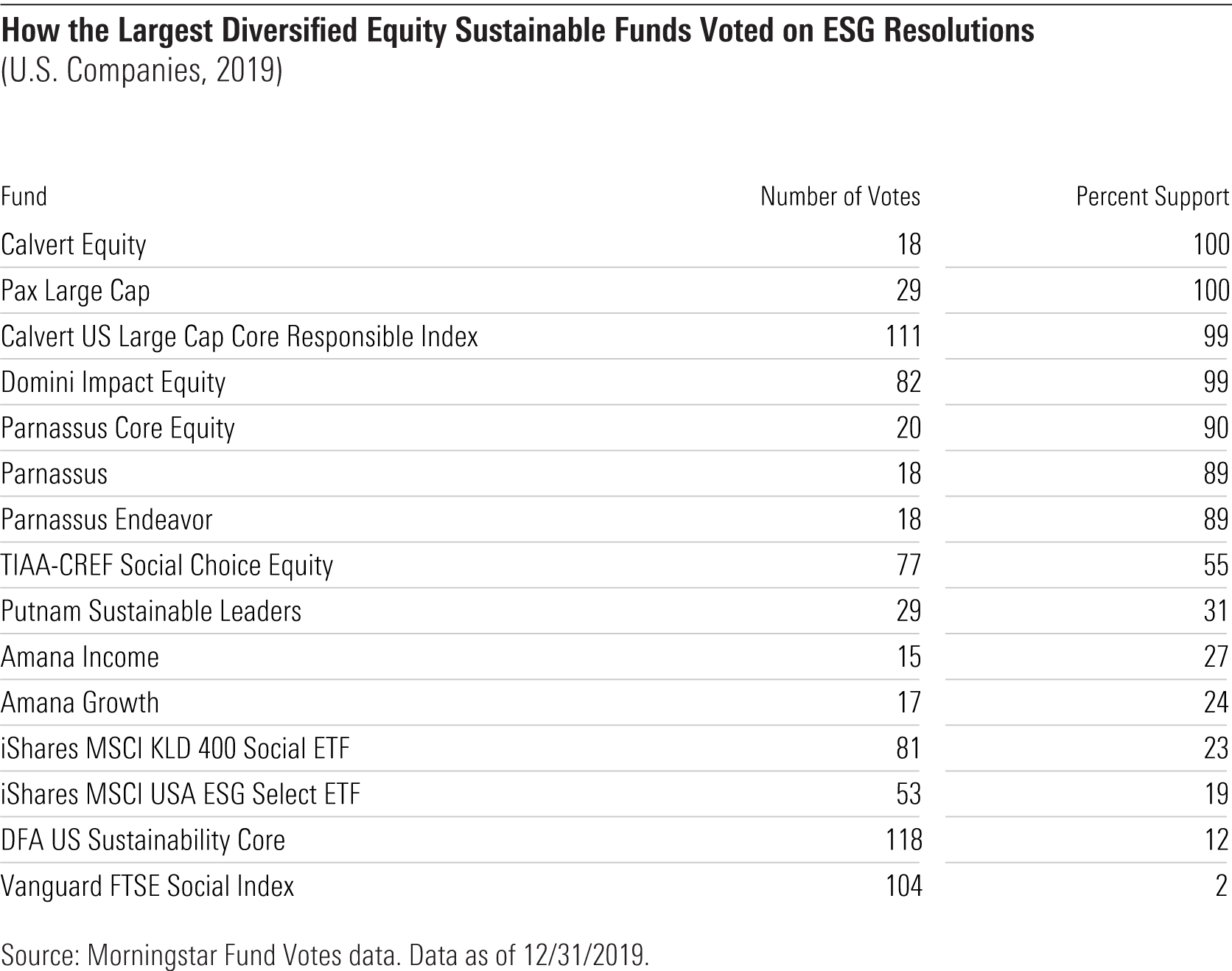

Sustainable Funds Proxy Voting Finally, let's take a look at sustainable funds' proxy voting on ESG-related shareholder resolutions. Active ownership--how a fund engages with the companies it owns, votes proxies, and seeks to provide measurable impact beyond financial return--is an increasingly important part of a sustainable investment strategy. Yet it is not necessarily the case that funds following a sustainable investing mandate also use their proxy votes to support sustainability in companies whose stocks they own.

Many of the issues that shareholders place on the proxy ballot directly address sustainability concerns at companies. In the 2019 proxy year, 177 such items came to vote at U.S. companies calling for better transparency around issues such as climate risks, human rights risks in supply chains, environmental stewardship, political influence, and gender pay inequality, as well as measures and policies that address diversity and the management of these risks.

Based on average support for sustainability-related shareholder resolutions in 2019, sustainable funds were significantly more likely than conventional funds to support shareholder resolutions addressing environmental and social risks. On average, sustainable funds supported these resolutions 68% of the time compared with 37% for other funds. Seventeen sustainable funds supported every resolution on which they voted.

Among the 15 largest sustainable equity funds, Calvert Equity CSIEX and Pax Large Cap PAXLX supported 100% of the resolutions, and Domini Impact Equity DSEFX and Calvert US Large Cap Core Responsible Index CSXAX supported 99%. Because the latter two funds each have hundreds of holdings, they voted on many more resolutions than the first two, which have more-compact portfolios.

By contrast, the least supportive large sustainable funds were those from Vanguard, Dimensional Fund Advisors, and iShares. Vanguard FTSE Social Index VFTAX supported only 2% of the 104 resolutions on which it voted. DFA US Sustainability Core DFSIX supported only 12%, and the two iShares funds on the list supported only 19% and 23%.

While sustainable funds supported 68% of ESG resolutions voted, on average, they exhibited the maximum range of support, literally from zero to 100%. Two smaller funds, Riverbridge Eco Leaders ECOLX and Baywood Socially Responsible BVSIX, failed to support any ESG resolutions in 2019.

Conclusion What can you expect from a sustainable equity fund when you look under the hood? First, you are highly likely to find that the portfolio is indeed tilted toward companies that are doing better than their peers addressing material ESG risks. Second, you are far less likely to find that the portfolio avoids fossil fuels, although it's reasonable to expect a somewhat lower carbon footprint than you would get with a conventional fund. Third, you are likely to find that the fund supports ESG shareholder resolutions more often than conventional funds, even though a sizable minority have disappointing proxy voting records.

As the field grows and matures, sustainable funds will come under increasing scrutiny, which I expect will result in greater focus and transparency around climate change-related issues and active ownership, two areas where many sustainable funds appear to be falling short.

[1] Our measure of fossil-fuel exposure, Morningstar Portfolio Fossil Fuel Involvement, is the portfolio's percentage of exposure to companies deriving at least 5% of their revenue from thermal-coal extraction, thermal-coal power generation, oil and gas production, or oil and gas power generation, or at least 50% of their revenue from oil and gas products and services.

[2] According to the SPDR MSCI EAFE Fossil Fuel Reserves Free ETF summary prospectus from Jan. 31, 2020, the three ETFs and their overall fossil-fuel involvement are: SPDR S&P 500 Fossil Fuel Reserves Free ETF SPYX 7.4%, SPDR MSCI EAFE Fossil Fuel Reserves Free ETF EFAX 4.3%, and SPDR MSCI Emerging Markets Fossil Fuel Reserves Free ETF EEMX 5.1%

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)