Roth Conversions Can Be Even More Compelling in This Market

You may want to convert your IRA ASAP.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

I've previously written about why it's a good time to consider Roth IRA conversions, focusing on the current low tax rates. But the current market situation makes an even greater argument for initiating Roth conversions.

Let's look at the four reasons to go all in on Roth conversions now:

1. We have historically low tax rates. The Tax Cuts and Jobs Act produced some of the lowest tax rates in recent history, and they are unlikely to stick. Most Americans expect income tax rates to increase in the future. This seems like a safe prediction considering the growing size of the deficit combined with today’s historically low rates. That means traditional IRA owners will likely be looking at a higher tax rate applied to both principal and growth when they make withdrawals in the future.

2. The markets have dropped. Current IRA values are lower than they were. Yet we all expect recovery at some point. Converting now when values are lower will cost less in tax now and allow future recovery growth to go untaxed.

3. Inherited IRAs must now be fully distributed within 10 years. New tax laws have eliminated stretch IRAs. That means heirs inheriting IRAs will pay taxes at higher rates over a shorter period. Converting to Roth will avoid higher taxes down the road for heirs.

4. IRAs are subject to required minimum distributions, Roth IRAs are not. Accordingly, Roth IRAs can substantially increase net worth over time versus traditional IRAs.

Conversion Considerations As of 2010, taxpayers can convert an unlimited amount of an IRA balance to a Roth. That comes with the cost of recognizing taxable income in the amount of the conversion, but it also means the permanent avoidance of tax on future growth in the account.

For any taxpayer with a year of negative taxable income, it makes sense to do a Roth conversion to the extent that no tax is generated. For those in a low tax bracket, it might make sense to convert an amount that will take full advantage of the lower bracket. For those in higher tax brackets, the decision is not as easy.

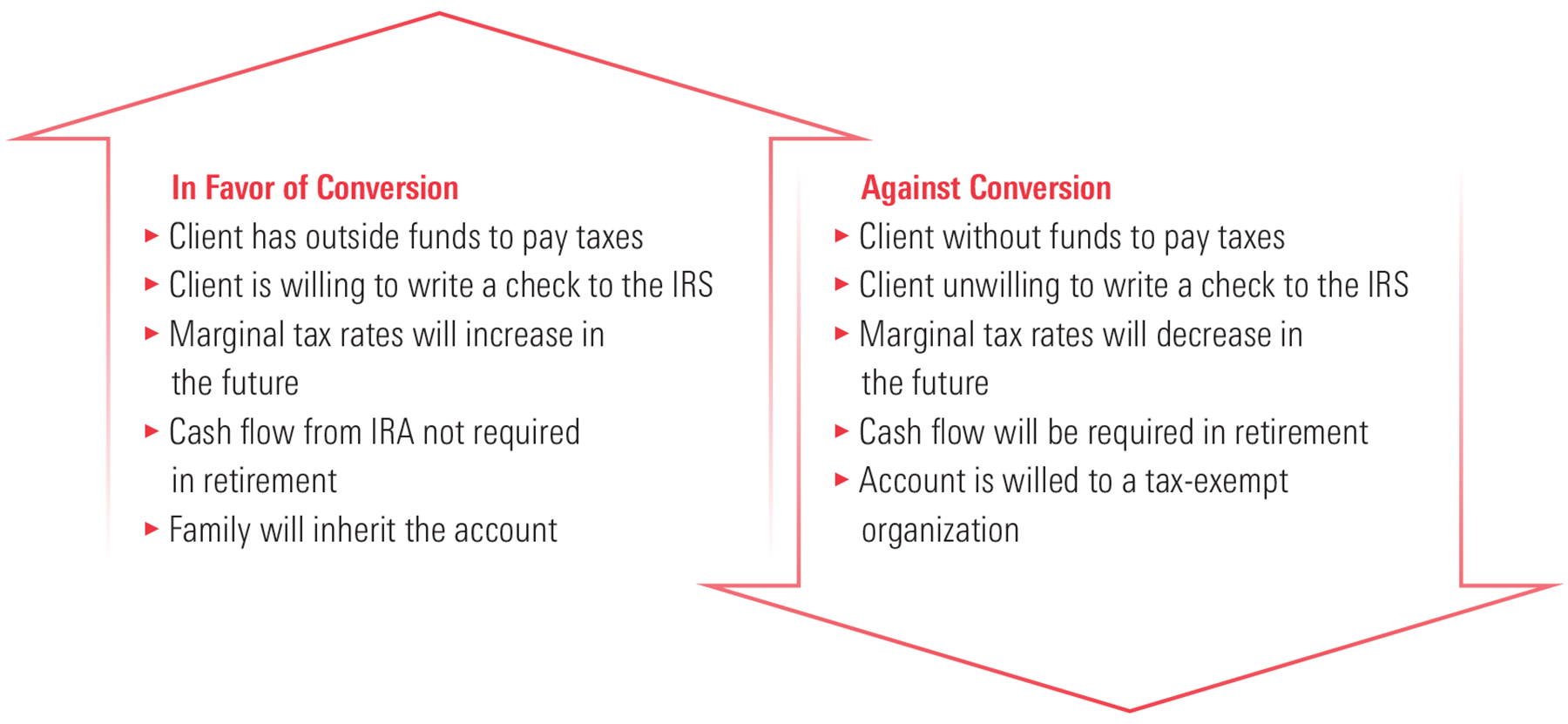

Per my previous article on Roth conversions, the general guidelines are shown below.

The factors in the “against” column can be stop signs. If there are no outside funds to pay taxes, then converting an IRA to a Roth means withdrawing IRA money to cover the tax payments as well, resulting in additional tax cost. If marginal rates are likely to decrease in the future, it might be beneficial to delay Roth conversion. And, if the funds must be depleted over time for cash flow purposes during the retirement years, the immediate tax on the Roth conversion may not be offset by avoiding tax on future growth. Finally, if the IRA is to be left to a charity that won’t owe taxes on the funds, taxes on a conversion won’t be offset by a tax savings later.

Good Timing Converting to a Roth during a market downturn can provide a significant tax advantage. For example, let's say your client has an IRA worth $80,000 that drops to $70,000 during a market dip. Converting at this point would trigger tax on only $70,000 even if the account recovers by the end of the year.

Advisors should seriously consider Roth conversion for clients, even for those who were not good candidates in the past. Of course, each client is different, and more detailed tax considerations need to be taken into account, such as impacts on Social Security taxability, surtaxes, and state income taxes. But given historically low tax rates and high market volatility, this might be the time to convert as much as possible to a Roth.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)