Why and How to Index in U.S. Large Caps

Broad diversification and low fees make indexing a good bet in this competitive arena.

The names behind many U.S. large-cap stocks are familiar to investors. Titans of industry like Apple AAPL, McDonald’s MCD, and Coca Cola KO feature prominently among their ranks and in our everyday lives. They also hold meaningful sway in most investors’ equity allocations, as these firms account for the lion’s share of the total market cap of the U.S. stock market. Depending on the index family in question, they typically account for between 80% and 90% of the U.S. market. In this article, I will look at the case for indexing within U.S. large caps and highlight some of our top-rated funds offering indexed exposure within this segment of the market.

The Case for Indexing U.S. Large Caps The data shows that U.S. large caps are an area of the market where it is particularly challenging for active managers to add value, making it ripe for indexing. According to Morningstar's year-end 2019 U.S. Active/Passive Barometer, just 14.3% of actively managed U.S. large-blend Morningstar Category funds outperformed their average passive peer over the 20 years through December 2019. By way of comparison, the equivalent figure for active funds in the U.S. small-blend category was 35.5%.

Why has it been so difficult for active managers to survive and thrive in this space? A variety of factors are at play here. To begin with, it is difficult for investors to obtain (and maintain) an informational advantage within the large-cap space. Bigger companies tend to attract more scrutiny from fundamental research analysts than their smaller counterparts. There is fierce competition between well-informed investors processing and acting on this information. This tends to tether prices closer to their fundamental values compared with smaller stocks. This is evident in active managers’ relatively lower success rates in the large-blend category versus the small-blend category.

Intense competition among skilled investors magnifies the importance of costs in the success equation. Active management can be expensive. Attracting and retaining top talent, and equipping portfolio management teams to do their job well, is almost always more costly than running an index portfolio. Turnover further increases the costs of active management, as it can lead to increased trading costs, tax costs, and opportunity costs. These costs are absorbed by investors in active funds. Given that they are often higher than the costs faced by indexers, they put active funds--especially in U.S. large caps--at a disadvantage. This further explains active managers’ shortcomings in this highly efficient market segment.

Lastly, market-cap-weighted large-cap index funds mechanically sweep in all the constituents of their underlying index. This results in broad diversification and all but guarantees that index funds will participate in the upside of the small minority of stocks that will drive the majority of the market’s long-rum returns. Active managers are hired for their ability to pick mispriced stocks. As such, they tend to have more-concentrated portfolios. But high conviction doesn’t necessarily equate to higher odds of outperformance. In reality, the risk of choosing a poor manager increases [1]. Running narrower portfolios means that many active managers will either miss out on the markets’ big winners, or be underweight those names relative to a cap-weighted index fund.

Competition, costs, and concentration go a long way towards explaining active managers’ struggles in U.S. large caps and bolster the case for indexing in this market.

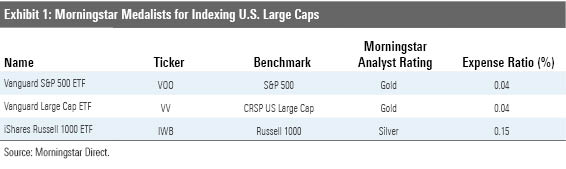

How to Index in U.S. Large Caps There is an expansive menu of funds available to investors looking to index their exposure to U.S. equities. Here, I will focus on a trio of Morningstar Medalists that provide exposure to large-cap stocks to illuminate the nuanced differences between the various large-cap indexes that cover this space. Vanguard S&P 500 ETF VOO, Vanguard Large Cap ETF VV, and iShares Russell 1000 ETF IWB are excellent options for indexing U.S. large caps. Their market-cap-weighted benchmarks offer broad diversification and low costs. These attributes will likely help them outperform the average active large-cap fund over the long haul.

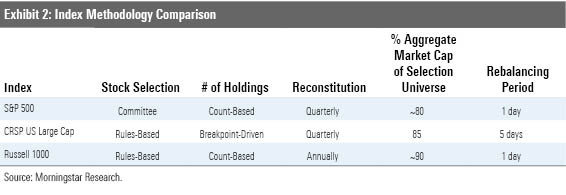

Vanguard S&P 500 carries a Morningstar Analyst Rating of Gold. The fund tracks the S&P 500, which represents approximately 80% of the total U.S. market capitalization. The index is maintained by a committee that seeks to select 500 large-cap U.S. stocks that reflect the composition of the U.S. market, from the S&P Total Market Index, and weights them by float-adjusted market capitalization. This gives the S&P 500 greater flexibility than more rules-based mechanical indexes when it comes to selecting constituents, but this flexibility comes at the expense of transparency. To be included in the index, stocks must meet market-cap, liquidity, and profitability criteria.

Silver-rated iShares Russell 1000 tracks the Russell 1000 Index. The index captures about 90% of total U.S. market capitalization. Like the S&P 500 it applies a count-based approach, including the 1,000 largest U.S. stocks from the Russell 3000E Index. It weights stocks by float-adjusted market capitalization. However, its liquidity and public float requirements are less stringent, compared with the S&P 500. Russell requires that at least 5% of a company's shares float publicly, while S&P requires 50%. The result is a slightly wider portfolio and an increment of transparency relative to the S&P 500.

Gold-rated Vanguard Large Cap tracks the CRSP US Large Cap Index. The index applies a percentage-of-cumulative-market-cap breakpoint approach when selecting stocks. Specifically, it folds in stocks representing the top 85% of the cumulative U.S. market capitalization of the CRSP US Total Market Index and calls them large caps. This group currently includes about 580 stocks. Stocks are weighted by their free-float-adjusted market capitalization. The index applies generous buffers to curb excessive trading and rebalances over five trading days to curb implicit trading costs.

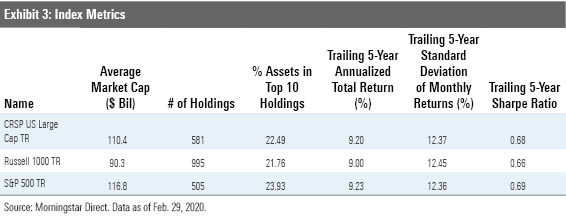

All three indexes underpinning these Morningstar Medalists can be a useful barometer (or investable representation) of U.S. large caps. That said, there are some differences between them which investors should understand. For example, because the Russell 1000 Index reaches further down the market-cap spectrum than either the S&P 500 or the CRSP US Large Cap Index, its relative performance may vary over shorter time periods when smaller stocks either underperform or outperform larger stocks. For example, from Feb. 24, 2020, through March 16, 2020, Vanguard S&P 500 outperformed iShares Russell 1000 by 0.75%.

Differences between count-based and breakpoint-driven approaches to stock selection are also worth noting. The number of holdings in the Russell 1000 Index and the S&P 500 will always be within spitting distance of the figures in these indexes’ names. Membership in the CRSP US Large Cap Index will evolve with the makeup of the market, as it is strictly breakpoint-driven. Currently, the CRSP US Large Cap Index holds 581 stocks. This is a wider spectrum than the S&P 500, but narrower than the Russell 1000 Index. The CRSP reconstitutes quarterly, but applies generous buffers and spreads trades over five days to mitigate excessive trading and minimize trading costs, which can translate into lower costs for investors.

Despite their subtle differences, the performance of the three indexes has been similar over longer periods of time. As shown in Exhibit 3, all three indexes delivered similar absolute returns over the trailing five years ending February 2020. But again, over shorter time periods, differences in performance can be larger. According to a study by Vanguard, from 2000-17, the median one-year return difference between the Russell, CRSP, and S&P large-cap indexes was about 0.6% [2].

Ultimately, the best choice for an investor will likely boil down to goodness of fit within their portfolio. These indexes are all designed to fit like puzzle pieces with other members of the same index family (mid-caps, small caps, and so on). Keeping it all in the family is the best way to avoid unintended overlap within your portfolio.

[1] Powers, R. 2019. "Equity indexes can be similar, but only to a point." The Vanguard Group, https://advisors.vanguard.com/insights/article/IWE_InvComEqtyIndxSmlrToAPnt.

[2] Bryan, A. 2019. "Portfolio Concentration Doesn't Necessarily Lead to a Significant Difference in Returns." Morningstar Research Services LLC, https://www.morningstar.com/insights/2019/05/02/focused-portfolio.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)