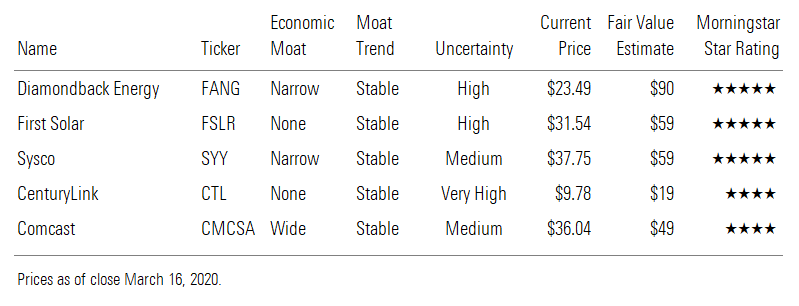

5 Stocks We Like

These names look oversold to us.

Is the market cheap? Yes, according to Morningstar's Market Fair Value measure.

The average stock in our coverage universe is about 26% undervalued today. That’s in stark contrast to the start of the year, when stocks looked about 5% overvalued. In fact, stocks haven’t been this cheap on a relative basis since 2011, according to our metrics.

Of course, that doesn’t mean stocks can’t get cheaper. About the only thing that’s fairly certain in these uncertain times: stock market volatility is likely to persist.

That being said, our analysts are revisiting the underlying assumptions of the companies they cover in light of recent events--and in many cases, they’re finding opportunities.

Here’s a look at five such opportunities.

Market Is Pricing In Sub-$50 Oil to Infinity for Diamondback: Buy We are reducing our fair value estimate for Diamondback Energy FANG to $90 per share from $106. The decrease reflects the depressed oil outlook following the collapse of the OPEC+ coalition and the continuing escalation of the global COVID-19 crisis.

Oil prices crashed March 6 after Russia surprised the market by refusing to agree to shoulder a portion of the production cuts proposed by OPEC for the wider OPEC+ partnership. The disagreement was escalated when Saudi Arabia responded with wide discounts on its oil exports, kicking off a price war. That leaves individual OPEC members free to ramp up their production and is likely result in heavily saturated oil markets for the next couple of years, materially reducing futures prices for crude. The fact that these events coincided with the worsening of the coronavirus outbreak makes things exponentially worse: Essentially, it combines a supply shock with a demand shock.

However, we think stock markets have overreacted. We think the current price for Diamondback essentially assumes that oil prices never recover from current levels. However, the marginal cost of supply is still around $55 a barrel for West Texas Intermediate--this is the price required to encourage development activity in the U.S. shale arena. Russia and Saudi Arabia do not have enough spare capacity to displace the 10 million-plus barrel/day U.S. shale industry, and we estimate the coronavirus impact on long-term demand will be marginal, even if 2020 demand plummets. Thus, further growth is required from U.S. producers in order for supply to keep up with demand after 2021, and that won't happen without higher prices. Our updated fair value estimate assumes that management runs three fewer rigs than it started the year with in 2020 and 2021, and one rig fewer afterward. We model $40 WTI for 2020 and 2021 before reverting to our midcycle price estimate of $55. David Meats, director

First Solar Faces Near-Term Uncertainty, but Long-Term Outlook Still Bullish We are cutting our First Solar FSLR fair value estimate to $59 per share from $62 after reducing our assumptions for module production and bookings in 2020 as a result of coronavirus impacts. We assume this is a temporary slowdown and are reaffirming our forecasts for 2021 and beyond.

We continue to believe First Solar's core U.S. solar market will grow rapidly during the next decade, supporting our bullish long-term outlook. We think the stock's near 50% drop during the past month offers a good buying opportunity for investors who want a clean-energy company with steady cash flow and growth. We are reaffirming our no-moat and stable moat trend ratings.

In February, management reported no coronavirus-related impacts on its supply chain in China or its factories in Vietnam, Malaysia, or Ohio. However, we now assume it faces two months of slower-than-expected production.

Management's 2020 production forecast and cost reductions topped our outlook as of mid-February. The midpoint of management's $3.25-$3.75 earnings per share guidance range exceeded our 2020 and 2021 estimates, and the high end exceeded our 2022 estimate. We now expect 2020 earnings to come in well below management's guidance but 2021 and 2022 earnings to rebound in line with our previous assumptions.

We expect First Solar's bookings in 2020 to slow due to coronavirus effects. We now assume First Solar books 4 gigawatts in 2020. This doesn't have a material impact on our fair value estimate because we assume First Solar's bookings will rebound and continue to support full capacity even as it grows to 8 gigawatts by 2022. First Solar had a 12.4-gigawatt backlog as of late February.

Another near-term concern is First Solar's ability to close project sales, particularly those that resulted in an approximately $0.50 per share drag on 2019 earnings.

We continue to believe First Solar can reach $5 per share of annual free cash flow before growth by 2023. Travis Miller, strategist

Narrow-Moat Sysco Looks Attractive as COVID-19 Sell-Off Appears Overdone We are reducing our fair value estimate for Sysco SYY to $59 per share from $62, as we expect COVID-19-related food-service disruption to result in 2020 organic sales falling 9% (we previously expected a 2.5% increase). The deleveraging of fixed costs should reduce 2020's adjusted operating margin to 4.1% from 4.6% previously. But we expect the impact will be limited to 2020, and as such, our revenue and earnings estimates for 2021 and beyond are essentially unchanged. With the stock now trading in 5-star territory after a more than 50% year-to-date decline, we recommend that investors accumulate shares, although we caution that volatility could remain high as events unfold.

In the U.S. (80% of 2019 sales), several states have announced statewide dine-in restrictions for all restaurants and bars, allowing only carryout, delivery, or drive-thru sales. We expect many states to follow suit in an effort to contain the spread of the highly contagious coronavirus. Most states have announced that closures will last for two to three weeks, but we think the industry slowdown will last a few months, as consumers opt to avoid crowds to keep themselves healthy. Several operators have told us that they have seen a material drop-off in delivery sales in the past two weeks, despite reductions in delivery fees, so we do not expect carryout and delivery orders to materially offset the loss of dine-in business. We suspect that consumers are uncomfortable having multiple food handlers and are opting for at-home food preparation. During the spring season, we expect industry sales for independent restaurants, casual dining, and hotels will drop 80%, and we think education and government food-service sales will fall 70%. We expect healthcare food-service sales will continue to grow 5%. Sysco also has a small portion of sales (about 3%) supplying grocers, which we expect to accelerate from 5% to 10%. Rebecca Scheuneman, analyst

As Telecom Stocks Feel the Sell-Off, We'd Look at Comcast and CenturyLink Telecom stocks haven't been immune to the market sell-off surrounding COVID-19, especially over the past week, despite the industry's relatively modest exposure. We believe the decline in valuations has created two sets of opportunities: First, a handful of U.S. large-cap firms have dropped meaningfully, allowing investors to purchase shares in businesses that should deliver consistent cash flow over time at good valuations, though not at "once in a lifetime" levels, and second, risky firms with uncertain long-term payoffs that look overly beaten up.

We would include AT&T T and Verizon VZ among the U.S. companies in the first category, but wide-moat Comcast CMCSA is our favorite U.S. telecom stock currently, with the shares trading at a roughly 25% discount to our $49 fair value estimate. The COVID-19 pandemic will hurt Comcast’s theme parks and movie studio, but its core cable business (around 70% of consolidated EBITDA) and television operations within NBCUniversal should hold up very well.

The second opportunity group provides greater potential rewards than available a few weeks ago for bearing risks that have little direct tie to COVID-19. For these firms, access to capital is generally the largest concern. Dish Network DISH is the most obvious company in this category; its shares have been cut in half since mid-February. While Dish looks interesting to us, we'd wait for a larger margin of safety, given the massive uncertainty around the company's wireless network plans. Instead, we'd look at no-moat CenturyLink CTL for high return potential. The stock has dropped about 35% in recent weeks to trade at about half of our $19 fair value estimate with a dividend yield of 10%. We believe the transformation in CenturyLink's business following the Level 3 acquisition has left it in a better position than most investors realize. Mike Hodel, director

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)