A New SEC Proposal Would Open the Door for More Leveraged ETFs

We still think they are a uniquely confusing and unsuitable investment for most investors.

A new SEC proposal could lead to a proliferation of an exotic type of exchange-traded fund: the leveraged ETF. Right now, only two fund companies offer these products--ProShares and Direxion--but that could change if the proposed rule is adopted. Fortunately for investors, it would also add safeguards to ensure that investors who purchase them have been evaluated for suitability of the product. These are confusing products with risks that investors do not usually understand, and we think if the SEC permits more of them, investors should demonstrate sufficient familiarity and understanding before making a purchase. We do appreciate the compromise the SEC is making--leveling the playing field by allowing competition in the product space and simultaneously adding safeguards so that retail investors, even in self-directed brokerage accounts, have to jump through some hoops before purchasing these products.

As we warned in 2016 and even earlier in 2009, it is hard to overstate the risks of owning leveraged and inverse exchange-traded funds. These funds are designed for a one-day holding period, a horizon over which price movements are unpredictable. In general, leveraged ETFs amplify those movements. Over holding periods longer than one day, the funds’ performance can diverge sharply from what many investors might expect.

In its recent proposal regarding the use of derivatives in registered funds, the SEC has streamlined the process for launching leveraged and inverse-leveraged ETFs that maintain a leverage level below 300%. The ETFs that limit their market exposure by providing that the fund must not seek or obtain investment results exceeding 300% of the return (or inverse of the return) of the underlying index do not have to go through a rule-filing process with the commission. This change will make these funds far easier to launch and likely more available, though we do not believe that these funds are beneficial to most investors.

Leveraged ETFs Do not Multiply Annual Returns First, it is critical to understand how these funds work because they do not do what many investors may assume, and that is to deliver a return multiple times greater than the market, owing to the leverage.

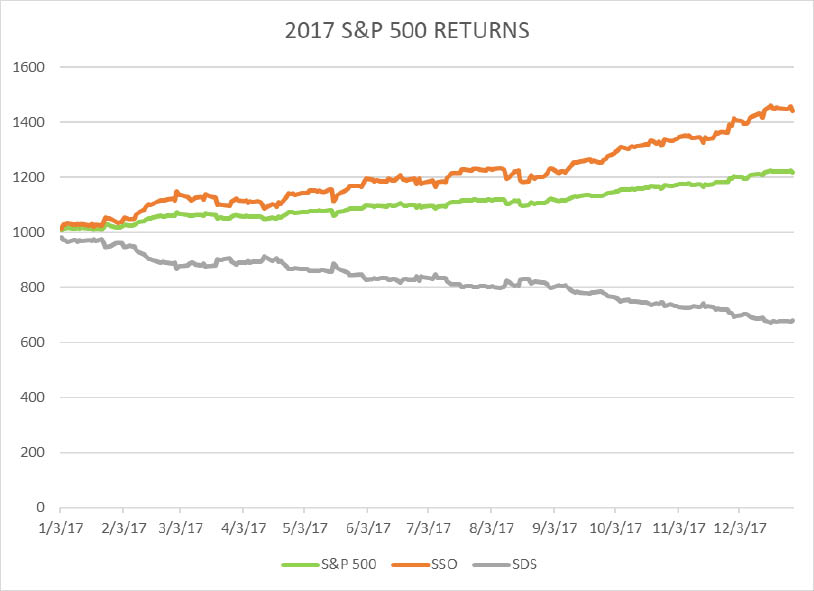

For example, take an ETF with 2 times the leverage of the S&P 500. For such an ETF, the mandate means that the fund targets maintaining exposure that equals twice the daily leveraged of the S&P 500. Examples of funds in this category include ProShares Ultra S&P 500 (SSO 2 times) and ProShares UltraShort S&P 500 (SDS negative 2 times).

If someone were to invest $1,000 at the beginning of 2017 in the S&P 500, then there would be $1,218.30 at the end of the year because the S&P 500 total return for that year was 21.83%. One might think, therefore, that twice the leverage means that the fund returned 43.66%; however, this is almost certainly not the case. Depending on the path of daily returns, the fund could have returned more than twice the annual return of the index, or more likely, less than that amount.

When any investment loses, it requires a higher return to get back to the break-even point. For example, if a fund loses 10%, it will take an 11.11% gain to get back to even. Leveraged funds magnify this asymmetry by increasing losses and resetting leverage each day to maintain a constant ratio, which can create a drag on long-term performance.

While the leverage ratio is constant, the leveraged level, when viewed from the perspective of the investor’s initial investment, is not. On days when the fund loses, it must reduce leverage, relative to an investor’s initial investment, to maintain a constant leverage ratio. And on days when it gains, it increases leverage from the perspective of the investor’s initial investment.

Think of the investment amount for leverage purposes as resetting daily. If $1,000 was invested at the beginning of 2017 in a strategy that is twice the leverage of the S&P 500, at the end of the first day this amount would have increased by 1.70% to $1,017.02 and decreased by 1.70% to $982.98 for 2 times inverse leverage. We also have to note that funds do not track the market return perfectly, so the tracking errors will result in slightly deviated returns from 2 times and negative 2 times. In this case, SSO returned 1.64%, increasing $1,000 to $1,016.45, and SDS would have decreased $1000 by 1.72% to $982.83.

On the second day, the S&P 500 increased by 0.60%, making the 2 times investment go up to $1,029.12 and negative 2 times go down to $971.28 by the end of the second day. Because of tracking error, SSO yielded a return of 1.18%, raising the investment amount to $1,028.42, and SDS decreased 1.14%, reducing the investment amount to $971.60.

After carrying this example out to the end of the year, by the end of 2017 we can see that resetting leverage daily changes an investor’s returns. With this daily reset, $1,000 would be $1,477.51 if invested in 2 times the S&P 500. The investor in the negative 2 times strategy would have $664.51. Given tracking error, the funds did not return these values. Instead, SSO would have turned $1,000 into $1,443.50, yielding a 44.35% return, and SDS would have turned $1,000 into $679.80, decreasing the initial investment by 32.02%. These numbers deviate, particularly in the case of SSO, from the 43.66 and negative 43.66% expected when considering the S&P’s 21.83% annual return.

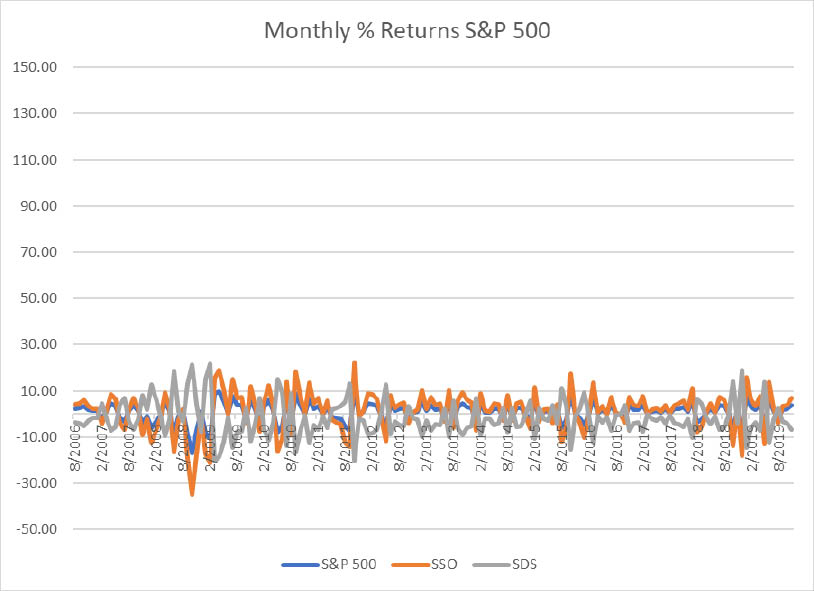

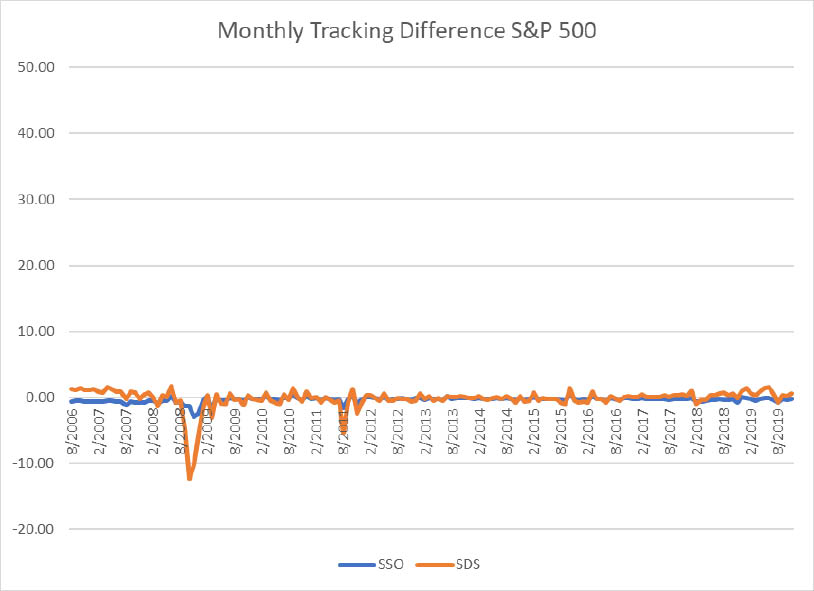

Exhibit 1 shows monthly returns of the S&P 500, SSO, and SDS during the period between August 2006 to November 2019. We can see that the S&P 500 provides a more stable, less volatile, return than the leveraged funds. Exhibit 2 shows the tracking error for SSO and SDS--how they differ from their target of 2 times and negative 2 times, respectively--over the same time period. While the tracking error is mostly insignificant, it exhibits some variation.

- source: Morningstar Analysts

- source: Morningstar Analysts

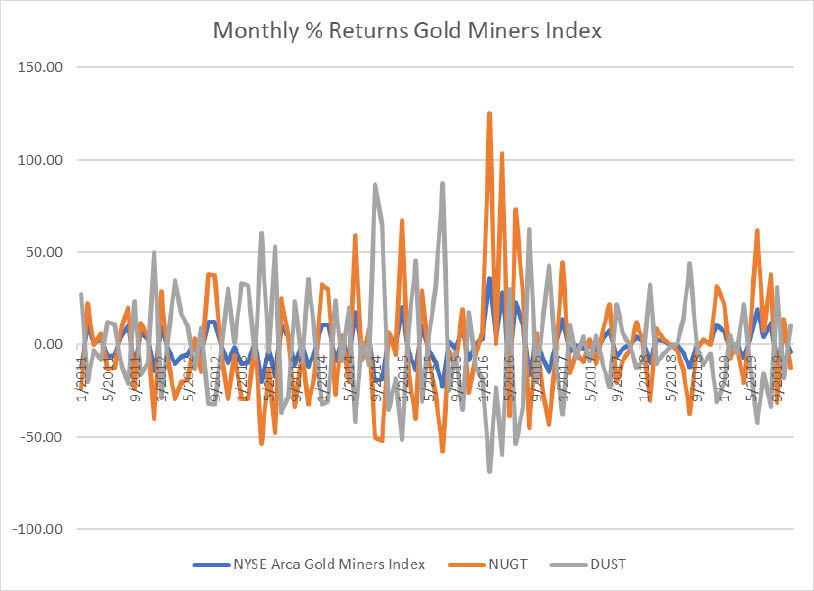

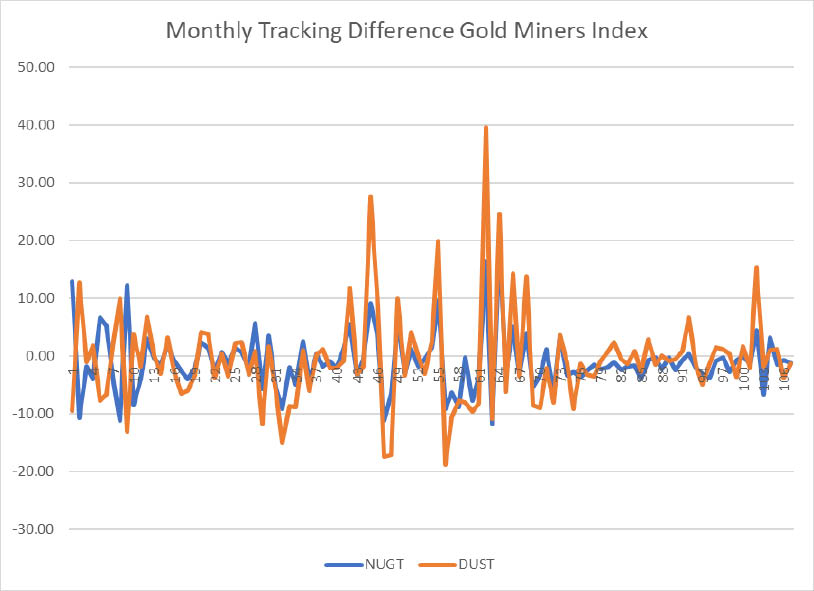

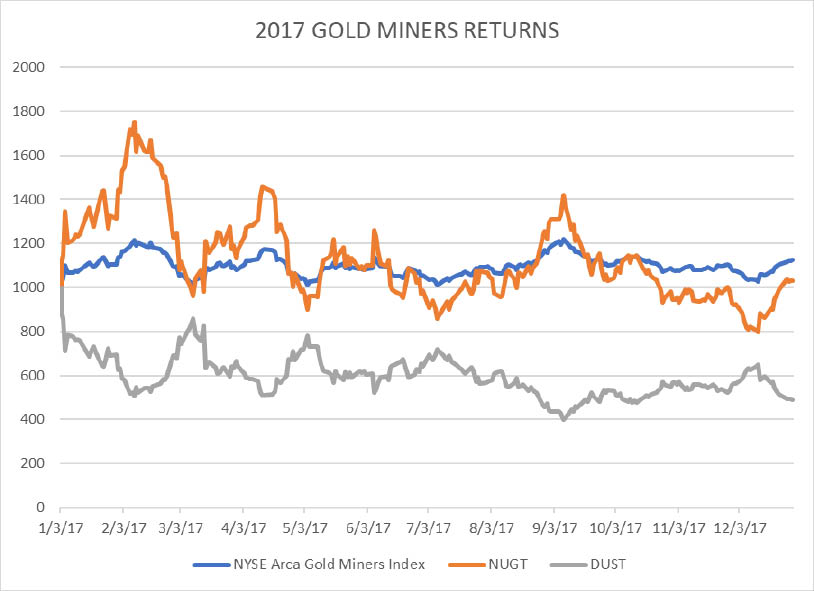

Leveraged funds based on sectors are even more volatile than the S&P 500. Looking at the same year, 2017, a $1,000 investment in the NYSE Arca Gold Miners Index (GDM) should have returned 12.47% to $1,124.70 at the end of 2017. It might be expected, therefore, that a 3 times leveraged fund would return more than 36%. Instead, the 3 times leveraged Direxion Daily Gold Miners Index Bull 3X NUGT resulted in a shockingly low 3.73% return. The inverse leverage Direxion Daily Gold Miners Index Bear 3X DUST (targeting negative 3 times the index) decreased by 51% to $490.00, far worse than negative 3 times the index. These differences from expectations result from both the daily reset aspect of leveraged ETFs as well as the tracking error of the funds. Exhibit 3 graphs the returns of the NYSE Arca Gold Miners Index, NUGT, and DUST during the period of January 2011 to November 2019. The significantly greater volatility of the funds rather than the index is evident from this graph. Exhibit 4 graphs only the tracking error between each fund and its target during the same period and makes apparent the significant tracking error of both funds.

- source: Morningstar Analysts

- source: Morningstar Analysts

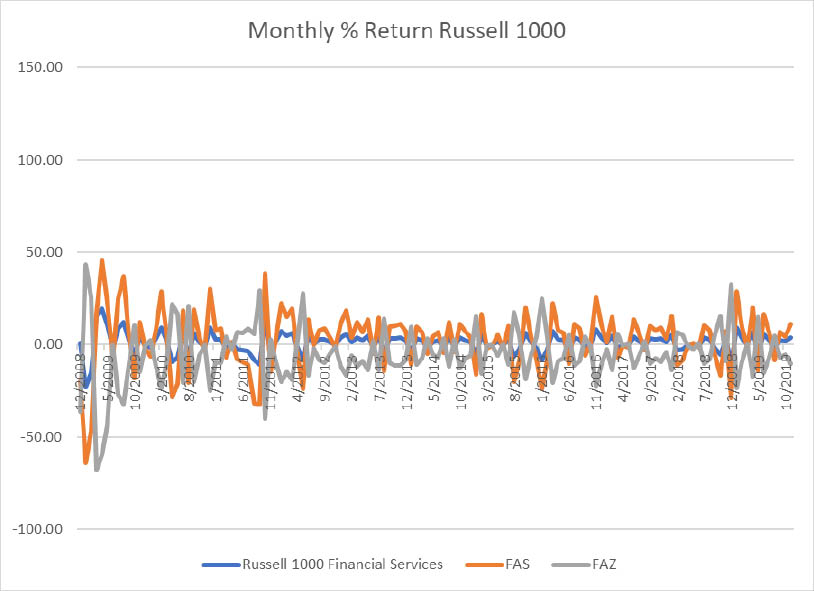

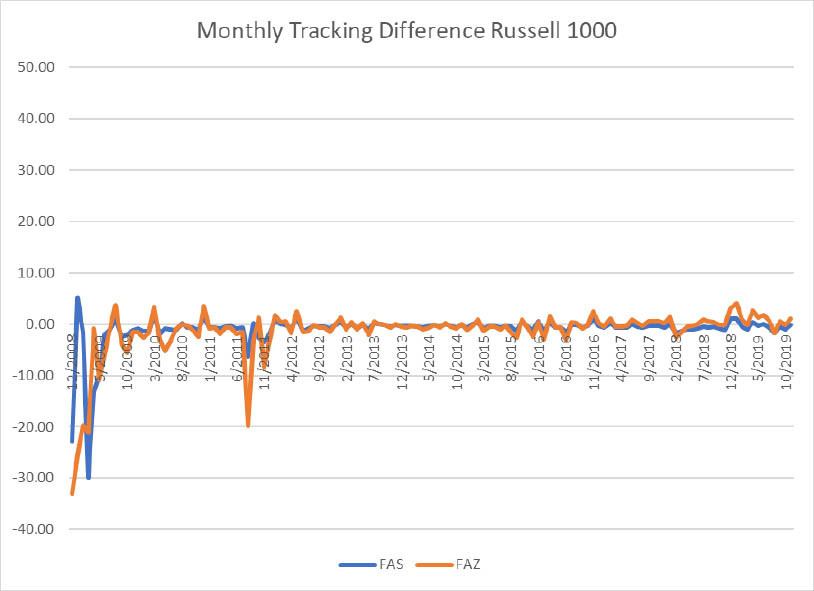

Similarly, investing $1,000 in the Russell 1000 Financial Services Index would result in seeing the index increase by 21.69% to $1,216.90 by the end of the year. In this case, the leveraged funds were not worse for investors than if they had invested in 3 times the index. The Direxion Financial Bull 3X FAS yielded returns of 67.38% to $1,673.80, and the Direxion Financial Bear 3X FAZ decreased by 46.18% to $538.20. Exhibit 5 shows the Russell 1000 Financial Services Index returns plotted along with FAS and FAZ during December 2008 to November 2019. Again, the greater volatility of the funds relative to the index is apparent, though not as stark as in the case of the Gold index. Exhibit 6 shows the tracking error for each fund against its benchmark. These tracking errors have been reasonably stable and low since 2012. The point here is not that investors cannot make money from these funds (of course they can), but that investors should use caution--since leveraged ETF offerings are far more volatile than the average ETF offerings and not straightforward in their mechanics.

- source: Morningstar Analysts

- source: Morningstar Analysts

Exhibits 7, 8, and 9 show how an investment of $1,000 in an index strategy would have fared over the long term as compared with an investment in the leveraged funds for each index. In general, the leveraged funds show a lot of variability compared with the indexes and do not necessarily produce a multiple of the index annual return.

- source: Morningstar Analysts

- source: Morningstar Analysts

- source: Morningstar Analysts

Concluding Thoughts: While There Are Guardrails, Buyer Beware The volatility of leveraged ETFs and their complexity make them unsuitable for most ordinary investors. The SEC is proposing to potentially make them much more widely available by making it easier for issuers to start them. We applaud that the Commission recognizes their risks and wants brokers to help investors be wary of these products.

Under the SEC proposal, brokers have obligations to assess suitability of these products for their clients--regardless of whether in conjunction with a recommendation or simply for a self-directed account. The proposed rule requires brokers to approve their customers' accounts to engage in the buying or selling of leveraged ETF shares. A broker may approve one of their customer's accounts if they have "a reasonable basis for believing that the customer has such knowledge and experience in financial matters that he or she may reasonably be expected to be capable of evaluating the risks of buying and selling leveraged/inverse investment vehicles." Additionally, a broker "must seek to obtain" the customer's investment objectives, their estimated liquid net worth, and their investment experience and knowledge, among other information. Investment experience is described to include "knowledge (e.g. the number of years, size, frequency and type of transactions) regarding leveraged/inverse investment vehicles, options, stocks and bonds, commodities, and other financial instruments." We recommend that brokers institute meaningful filters to implement this requirement and develop processes to transition existing accounts to go through this approval process in an effective manner. Brokers should be extremely cautious when advising their clients to choose these products under this standard and when considering the overall requirements of the recently finalized Regulation Best Interest. In fact, we think that in most cases, the duty of a broker will be to educate their customers about the risks and counsel against the addition of leveraged ETFs to an otherwise diverse portfolio.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)