Sustainable Equity Funds Are Outperforming in Bear Market

While ESG equity funds have taken big hits this month, their losses have been less severe than those of conventional peers.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Sustainable equity funds weathered the initial stages of the downturn, on average, better than conventional funds, as I reported earlier. With global markets now in bear-market territory for the first time in more than a decade, here is an update through March 12, 2020. The takeaway: Sustainable equity funds continue to outperform on a relative basis.

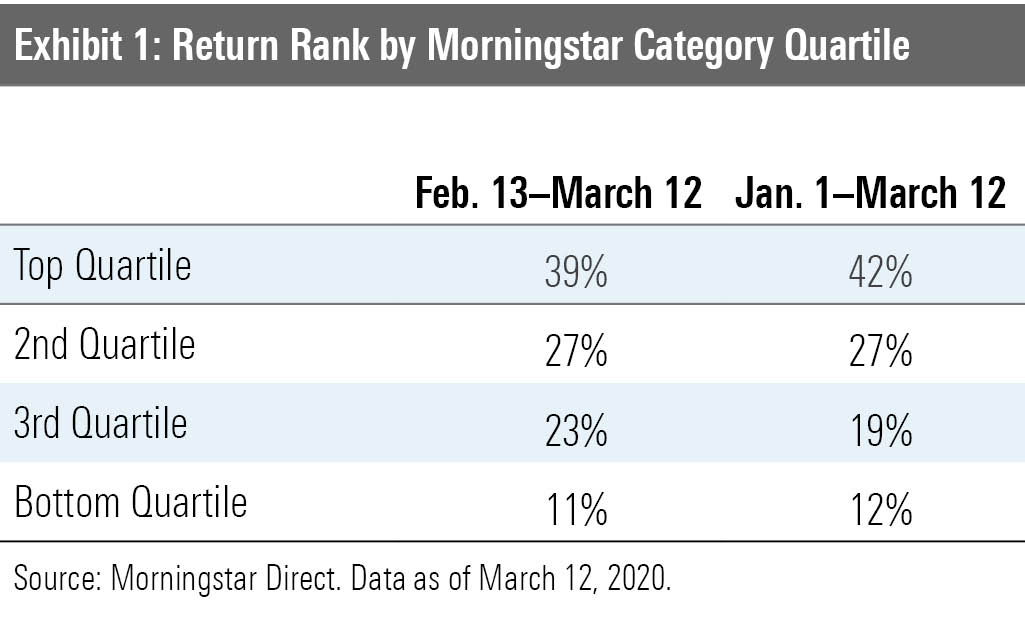

Peer-Group Comparisons I compared the trailing one-month and year-to-date returns of all 203 sustainable equity open-end and exchange-traded funds available in the United States with those of their respective peer groups. For the peer groups, I used Morningstar Categories, which contain similar funds based on portfolio characteristics like region, market cap, and style. These categories contain funds with sustainable mandates as well as conventional funds, which make up the bulk of each peer group.

The trailing one-month period began a week before the downturn started on Feb. 20, and Morningstar has calculated category percentile rankings for funds using that time period, so it is the closest match for the Feb. 20-March 12 market decline.

Over the past month, the returns of 66% of sustainable equity funds ranked in the top halves of their respective categories. More than a third, 39%, ranked in their category's best quartile, while only 11% ranked in their category's worst quartile. That means sustainable funds were over-represented in the top quartiles and top halves of their peer groups, because, by definition, 25% of all funds in each category place in each of four quartiles.

Broadening the perspective to the year to date through March 12, the relative outperformance of sustainable equity funds was even better. The returns of 69% of sustainable equity funds ranked in top halves of their respective categories. The returns of 42% ranked in their category's top quartile, while only 12% landed in their category's worst quartile.

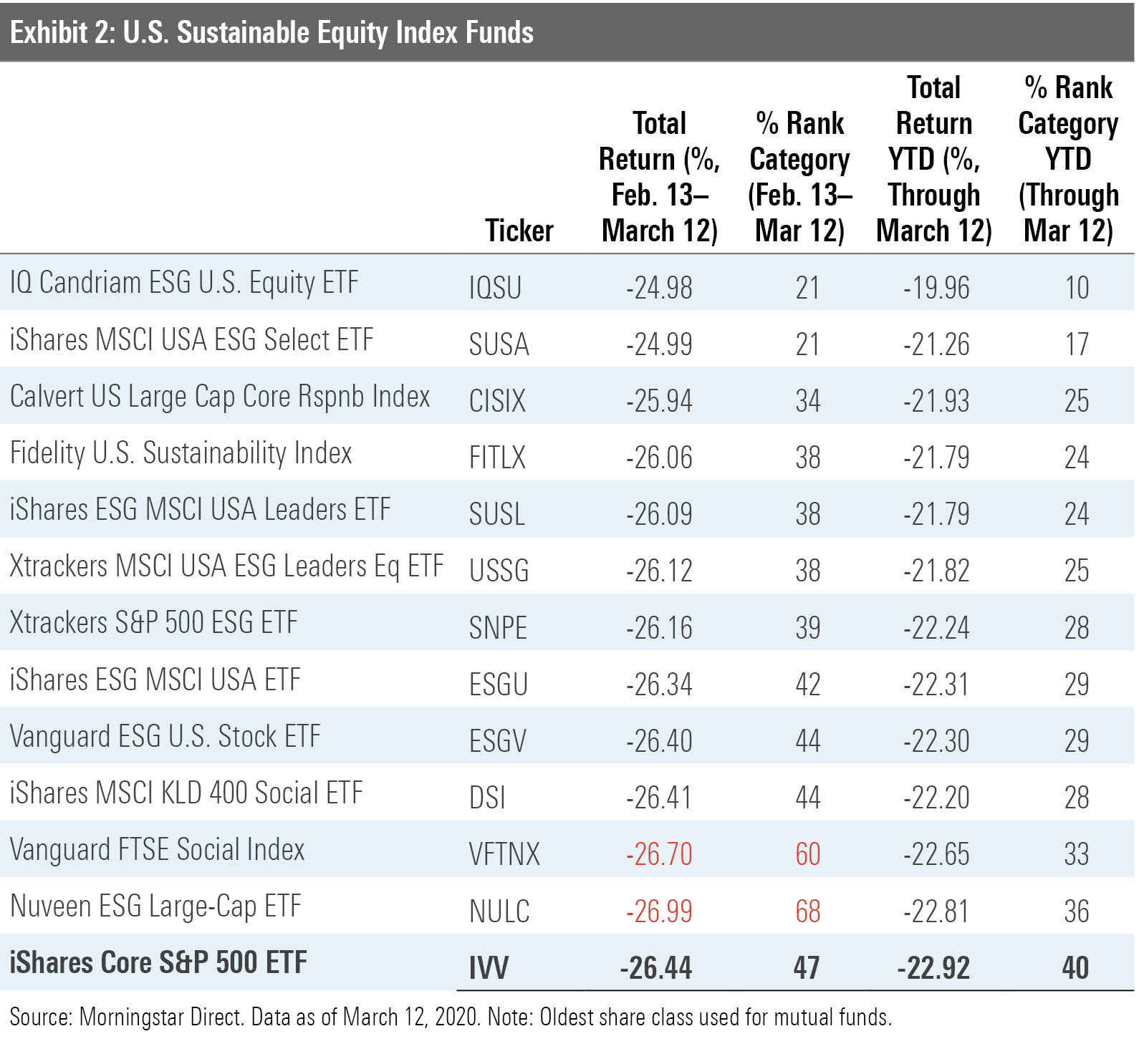

Index Fund Comparison I also compared the returns of 26 environmental, social, and governance index funds with those of conventional index funds covering U.S. stocks, non-U.S. developed-markets stocks, and emerging-markets stocks.

Ten of the 12 passive ESG funds found in the large-blend category lost less than iShares Core S&P 500 ETF IVV for the month ended March 12. While IVV lost 26.44%, the average ESG passive fund's return was negative 26.10%. For the year through March 12, all 12 ESG index funds outperformed IVV. Their average return of negative 21.92 was a full percentage point better than that of IVV.

These returns are net of expenses and thus take into account the higher expense ratios of the ESG funds. IVV has an ultralow expense ratio of 0.04%, while the expense ratios of the dozen ESG passive funds range from 0.10% to 0.25%, and average 0.16%.

The top-performing ESG fund for both the past month and the year to date was IQ Candriam ESG U.S. Equity ETF IQSU, which is based on a proprietary index developed for IndexIQ by European sustainable asset manager Candriam.

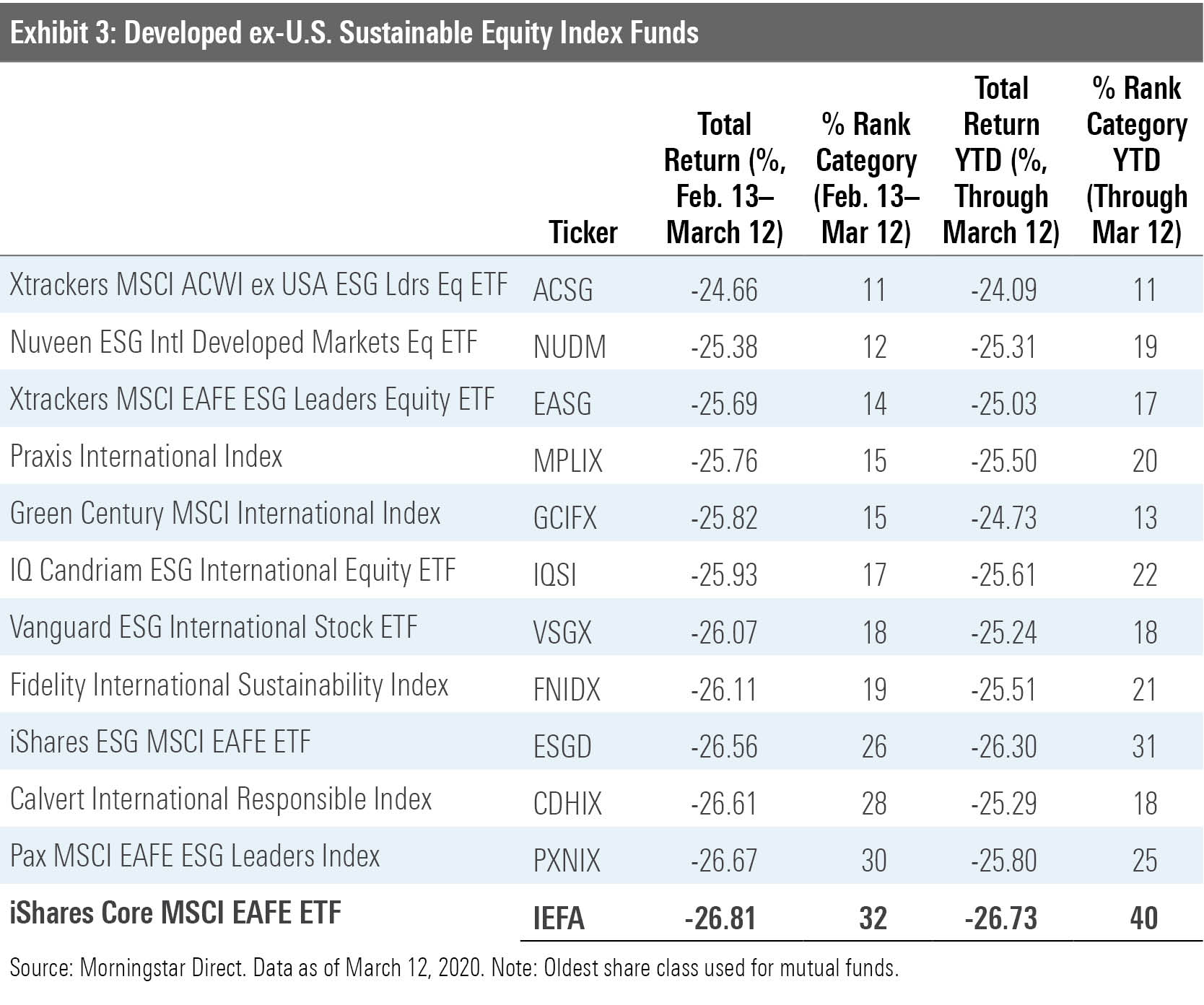

The story is even better for ESG indexes focused outside of the U.S. All 11 passive ESG funds in the foreign large-blend category outperformed iShares Core MSCI EAFE ETF IEFA for the month ended March 12. While IEFA lost 26.81%, the average ESG passive fund return was negative 25.93%. And, for the year through March 12, all 11 ESG index funds outperformed IEFA. Their average return of negative 25.31% was well ahead of IEFA's negative 26.73% return.

As with the comparisons of U.S. funds, these returns are net of expenses and thus consider the higher expense ratios of the ESG funds. IEFA has an expense ratio of 0.08% while the expense ratios of 11 ESG passive funds range from 0.14% to 0.98%, and average 0.34%. Five funds have expense ratios between 0.14% and 0.20%.

The top-performing passive international ESG fund for both the past month and the year to date was Xtrackers MSCI ACWI ex USA ESG Leaders Equity ETF ACSG.

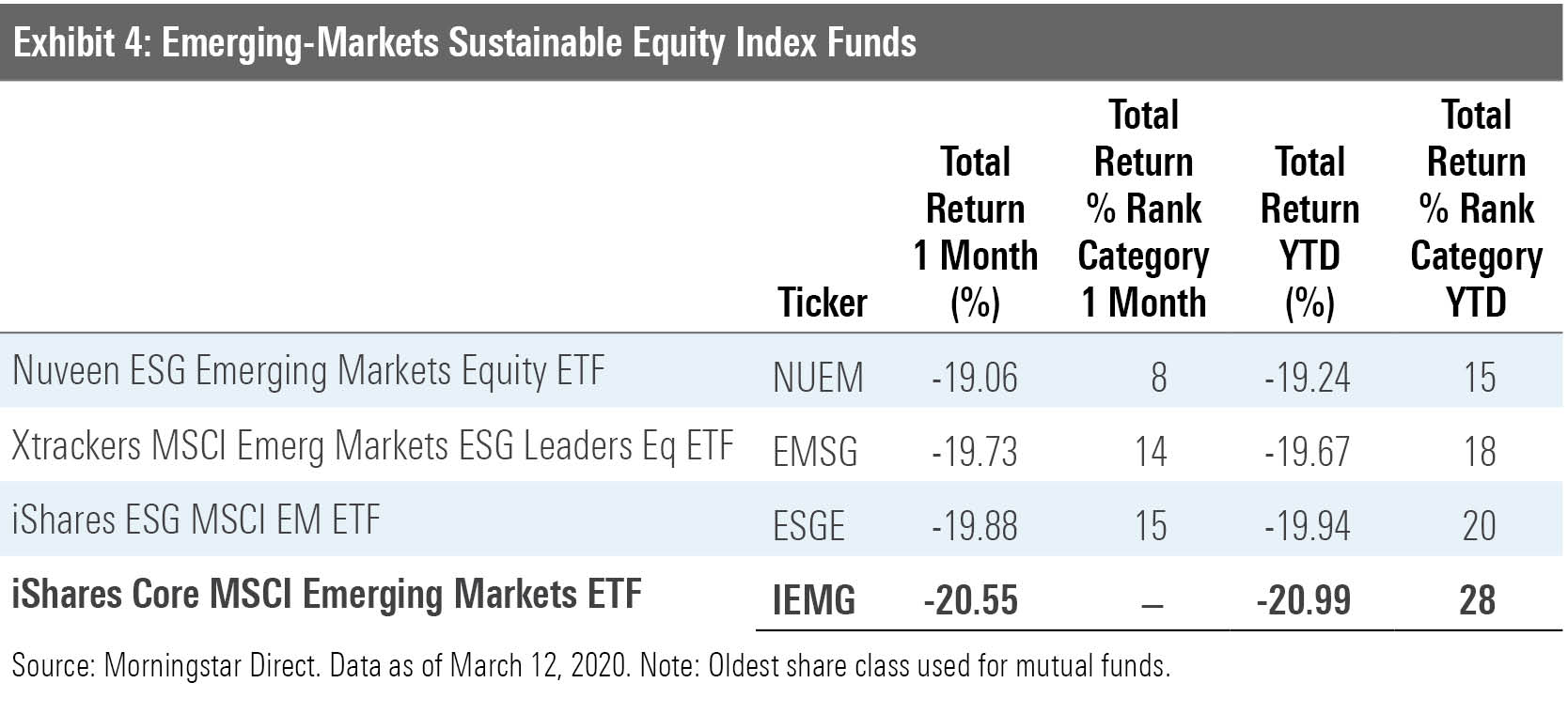

The three emerging-markets ESG index funds outperformed iShares Core MSCI Emerging Markets ETF IEMG over both periods. They posted an average return of negative 19.56% for the month ended March 12, nearly a percentage point better than IEMG's return. For the year to date, the three ESG funds outperformed IEMG by 1.37 percentage points. The ESG funds also had to overcome higher expenses (0.20%, 0.25%, and 0.40% compared with IEMG's 0.14%).

Most of the growth in sustainable investing has taken place since the global financial crisis, much of it in the past five years, meaning that most ESG strategies have not been through a bear market. Although sustainable funds have performed well relative to their conventional peers over the past five years, many investors have adopted a wait-and-see approach to see how these funds fare during market turmoil.

To be sure, sustainable equity funds have taken big hits during the past month, but they have been smaller than those of their conventional peers. Because so many sustainable funds are less than 10 years old--many of them not even five years old--this is their first test in a down market. It's one that most sustainable funds have passed pretty well.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)