Active U.S. Stock Funds Have Done Better Lately, But Many Have Still Fallen Short

We examine the effects of the bear market.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

(Preface: This piece examines how successful active stock funds have been during the recent bear market. But that question should be pretty far down your list of concerns, at the top of which are health, family, society, financial goals, investment plan, and asset allocation. Take care of those things first and then, and only then, you can turn your attention to how active funds have done. An article like this will hopefully come in handy at that appointed time.)

Did active stock managers succeed more often in beating their indexes during the recent sell-off? That question is timely given that some of active management’s strongest proponents have argued it will shine in a bear market. But we hadn’t seen a bear market in U.S. stocks for more than 11 years, making the assertion hard to assess. Now that we’re in a bear market, we can put active stock funds to the test.

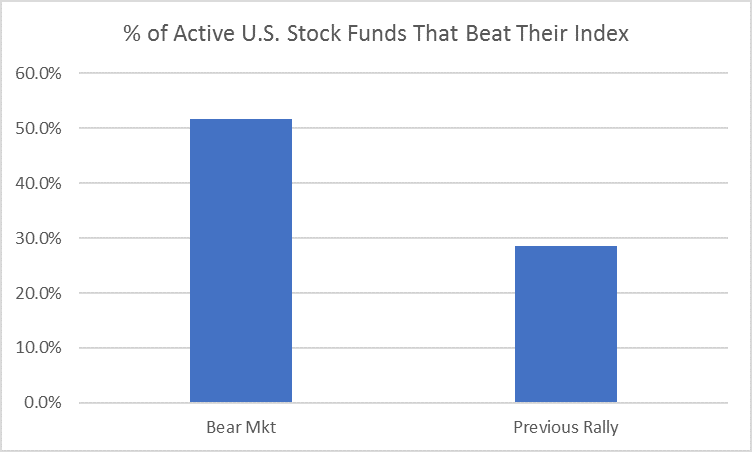

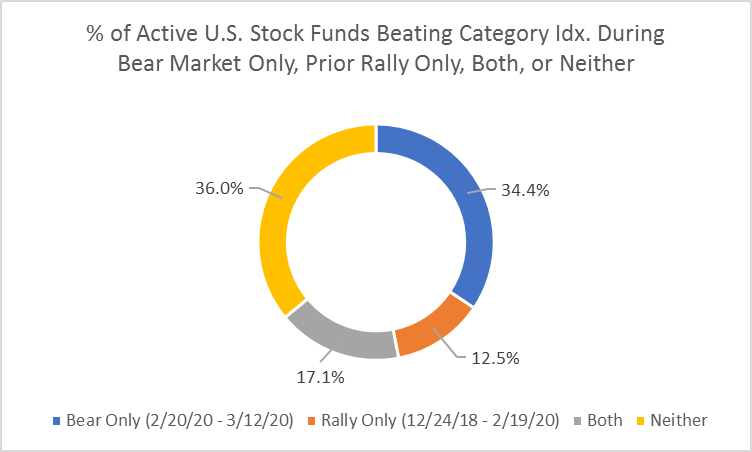

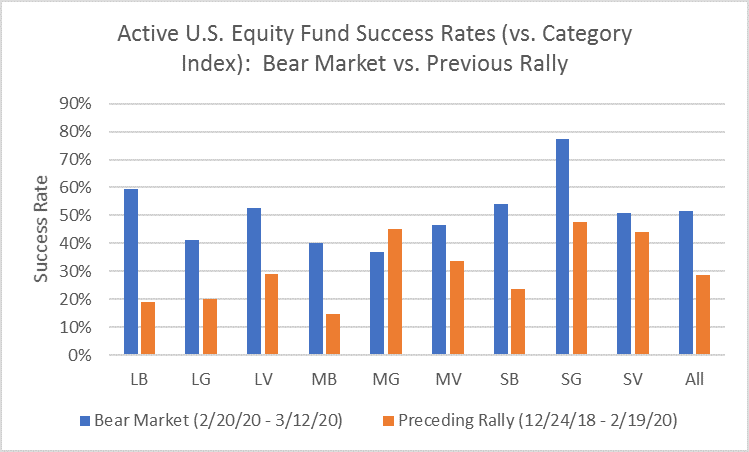

We find that 52% of active U.S. stock funds beat their indexes during the bear market (Feb. 20 to March 12, 2020). That’s an improvement from the rally that preceded it (Dec. 24, 2018, to Feb. 19, 2020), when only 29% of active funds topped their index. Yet, most of the funds that outperformed in the sell-off also lagged during the rally. In addition, those funds outperformed their indexes during the bear market to a smaller degree than they lagged them in the rally. Thus, even with the better bear-market showing, two thirds of active U.S. stock funds still lag their benchmarks since December 2018.

In the remainder of this piece, we review the key takeaways from our analysis of active U.S. stock funds’ recent performance.

Key Takeaways

- 52% of active U.S. stock funds beat their indexes during the sell-off. This improved on the prior rally—from Dec. 24, 2018, through Feb. 19, 2020—when 29% of active funds beat their indexes.

- source: Morningstar Analysts

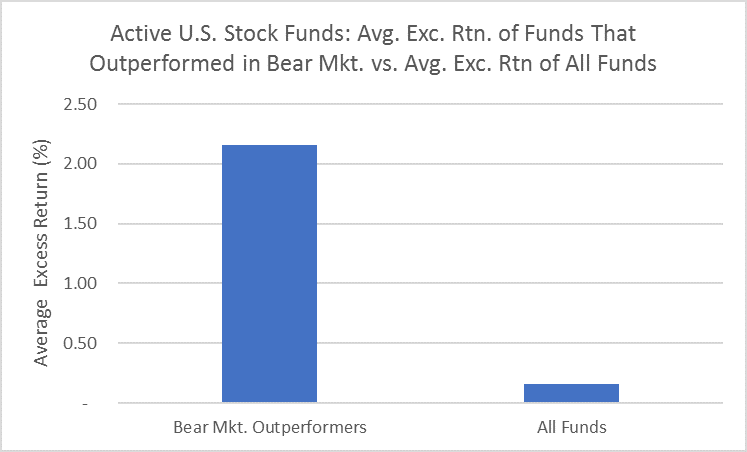

- Among active U.S. stock funds that beat their index, the average margin of outperformance during the bear market was 2.16%. The average excess return among all active U.S. stock funds during the sell-off--including those that lagged their indexes--was 0.16%.

- source: Morningstar Analysts

- Of the 1,845 active U.S. stock funds that have been in existence since Dec. 24, 2018, 17% beat their indexes in both the rally and the subsequent bear market. Two thirds of the 950 active U.S. stock funds that beat their indexes during the bear market lagged during the preceding rally.

- source: Morningstar Analysts

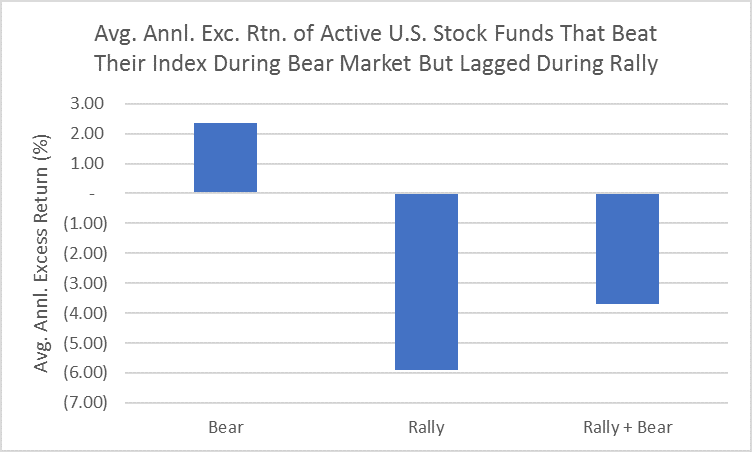

- With respect to active U.S. stock funds that beat their indexes in the bear market but lagged during the rally (34% of all funds), their average margin of outperformance during the bear-market sell-off was 2.34%. However, because these funds lagged their indexes by an average 5.89% during the rally, they are still underwater since Dec. 24, 2018, when the rally commenced.

- source: Morningstar Analysts

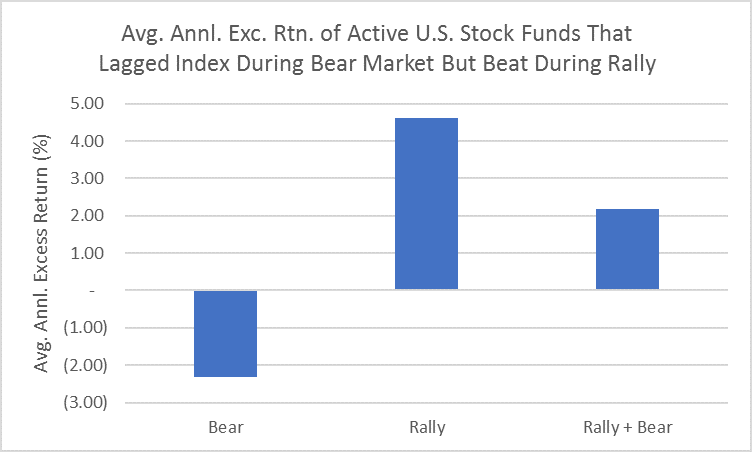

- On the flip side, the average active U.S. stock fund that lagged its index during the bear market but beat it in the rally outperformed since Dec. 24, 2018. This occurred because these funds trailed their indexes by less during the sell-off (2.32%, on average) than they outperformed them during the rally (4.62%).

- source: Morningstar Analysts

- Success rates were highest in the small growth (78% of all active funds), large blend (59%), and small blend (54%) categories during the bear-market sell-off. The large blend (59% success rate during the bear market versus 19% during the rally), mid-cap blend (40% versus 15%), and small blend (54% versus 24%) saw the biggest improvements.

- source: Morningstar Analysts

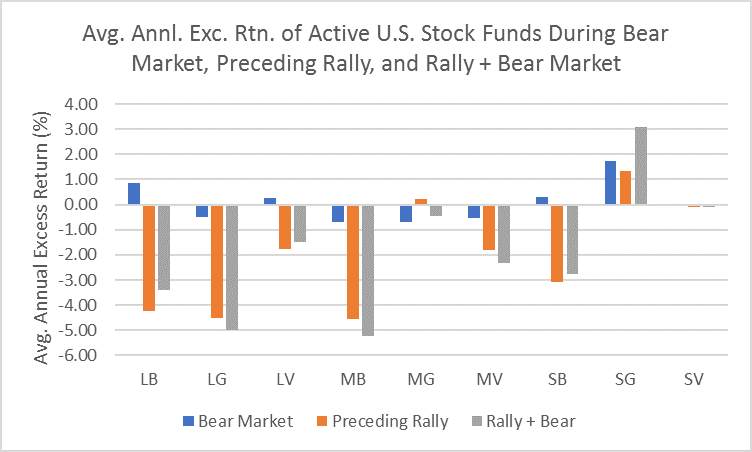

- The average active fund generated a positive excess return during the bear market in five of the nine U.S. stock categories. The small growth (1.73%), large blend (0.85%), and small blend Morningstar Categories saw the highest average excess returns among active funds. But because the margin of underperformance during the rally typically well exceeded the margin of outperformance (if any) during the bear market, it meant that the average fund in only one category—small growth—managed to top the index over the period spanning both the rally and bear market.

- source: Morningstar Analysts

Conclusion Active U.S. stock funds have performed better during the recent sell-off than they did during the nearly 14-month rally that preceded it. That said, most of the active funds that have outperformed during the bear market also lagged during the rally. Moreover, they lagged by more during the rally than they outperformed by during the sell-off. Consequently, the clear majority of active U.S. stock funds still trail their benchmarks from Dec. 24, 2018--when the last leg of the rally began--through the bear market to March 12, 2020.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)