Correlations Going to 1: Amid Market Collapse, U.S. Stock Fund Factors Show Little Differentiation

We don't see connections between portfolio characteristics and returns when looking through the lens of our Factor Profile data.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

There’s an old saying in the financial markets that, during a time of crisis, “Correlations go to 1.”

The meaning here is that when there’s a panicked rush to the exits--as global stock markets have seen amid the spread of the coronavirus--all stocks are punished equally and indiscriminately. And fund investors have seen this sell first, ask questions later exodus in their portfolios.

While losses may just feel like losses, all market declines aren’t alike. Often a market drop will see the asset classes or sectors that had done the best heading into the sell-off reverse course and post the largest declines. In that kind of environment, investments that had lagged tend to be more buoyant. In addition, in an orderly stock market retrenchment, defensive sectors such as higher-yielding stocks will also outperform.

But that hasn’t been the case during the coronavirus market collapse.

This sell-everything environment can be seen first through overall returns. On average, all nine categories of U.S. diversified stock funds lost between 10.8% and 11.6% starting from Feb. 19--when the S&P 500 hit a record high--and Feb. 27. That margin is a very narrow range for a chaotic market.

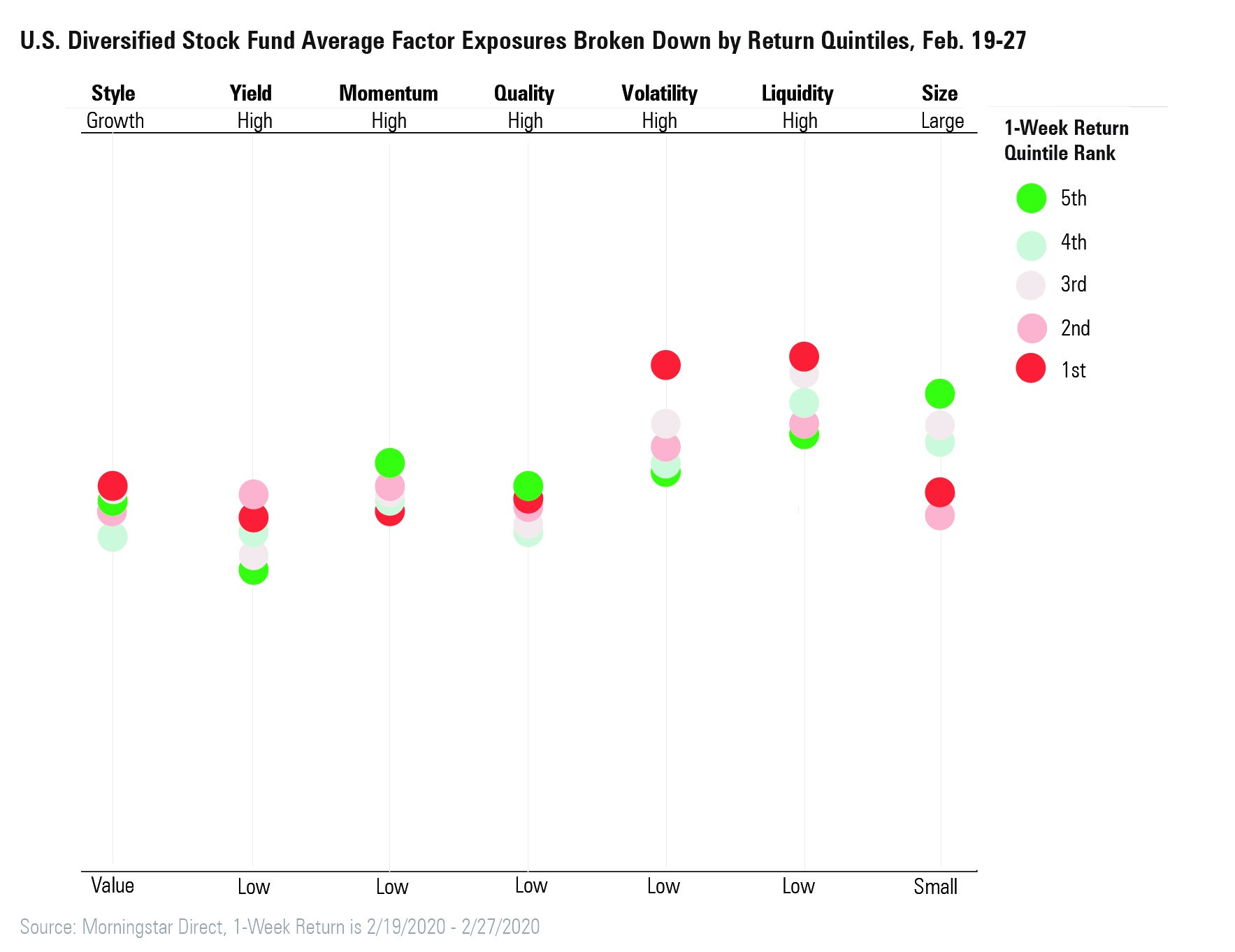

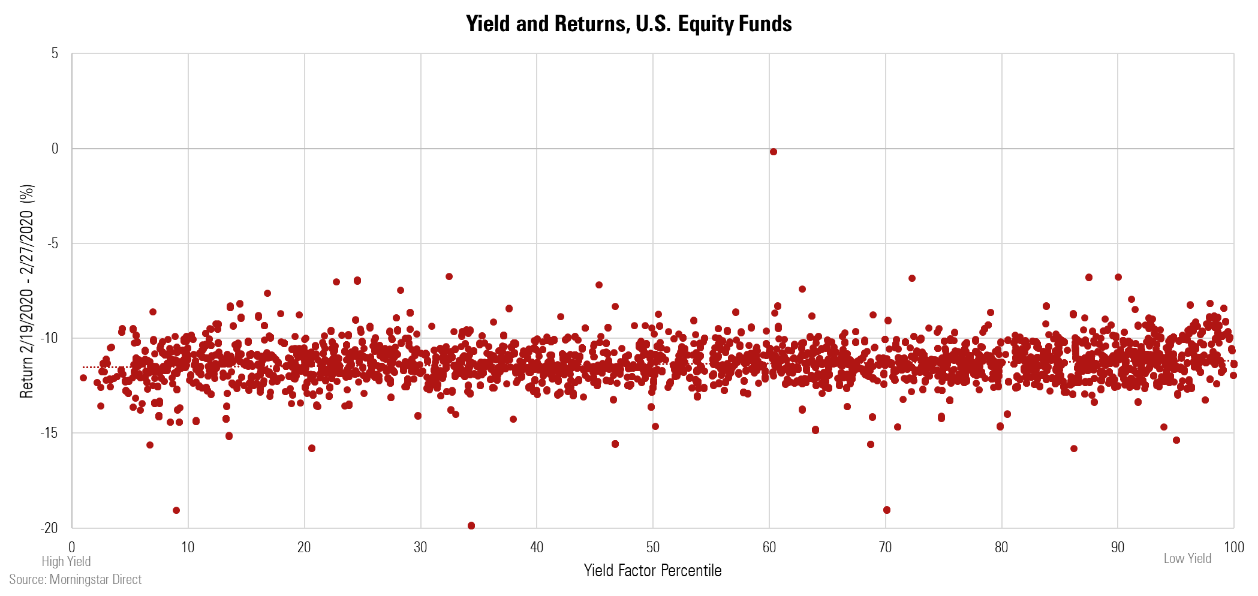

The run-for-the-hills mentality also became clear when we scouted for connections--or, in this case, a lack of connections--between portfolio characteristics and returns by looking at funds through the lens of Morningstar’s Factor Profile data. This data set measures a fund’s portfolio based on seven metrics: size, style, yield, momentum, quality, volatility, and liquidity.

When we measure fund performance against these factors, we can see clear patterns of a “correlations go to 1” market. For this article, we focused on the universe of U.S. diversified-stock funds.

Between Feb. 19 and Feb. 27, whether funds tended to invest in growth or stocks, high yield or low yield, or strong or weak momentum, there was little overall differentiation. There was only a tiny bit more shelter to be found from the storm in funds focused on lower-volatility stocks.

As highlighted in our article "What’s Driving U.S. Stock Fund Returns? ,” during the three years ended Dec. 31, funds focused on the biggest, fastest-growing companies or stocks that were already on an uptrend performed better than funds that loaded up on smaller, undervalued companies or those without a clear uptrend or downtrend in place.

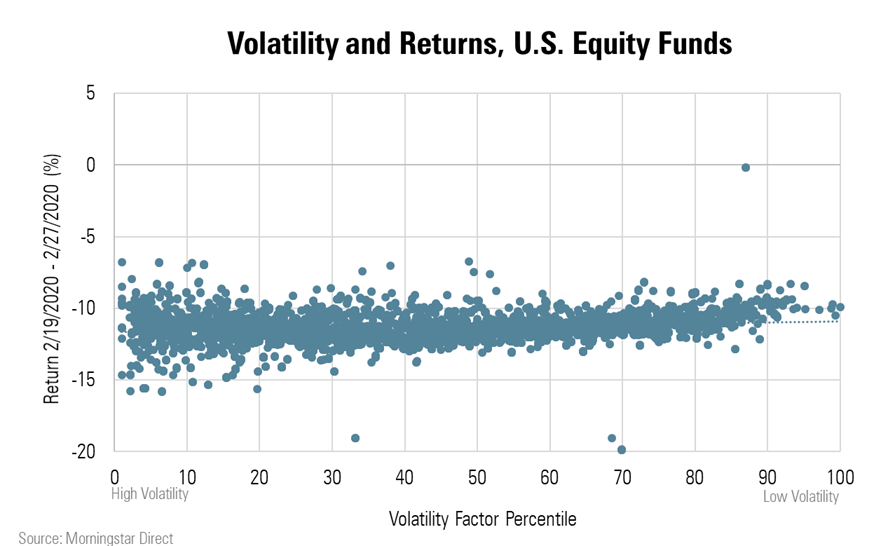

Volatility Not too surprisingly, one of the characteristics that played out slightly better over the course of the recent sell-off were portfolios dominated by low-volatility stocks. Yet, the returns are still negative across the board regardless of high- or low-volatility exposure and the gap between.

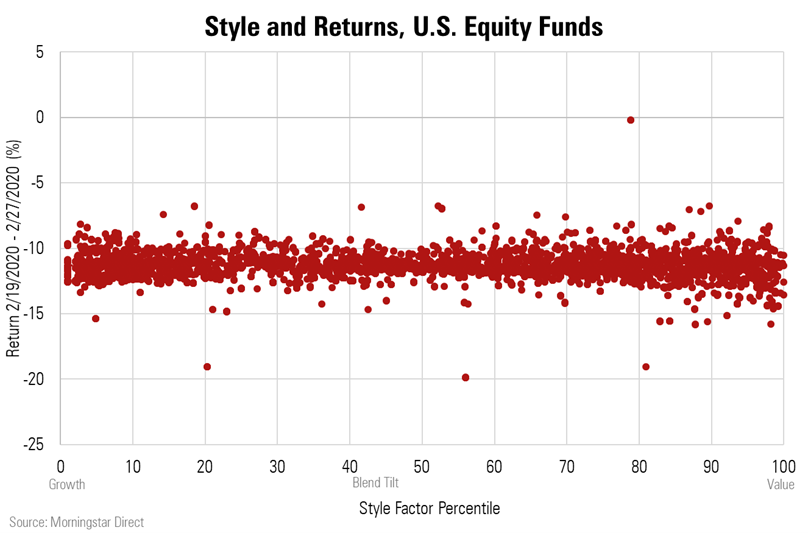

Value Versus Growth The outperformance of growth strategies over value during the market's bull run has been one of the stock market's most dominant trends in the past three years. Value funds have had only sporadic bouts of outperformance recently, such as during last August's stock market slide, which was sparked by fears of a U.S. recession.

But in the virus sell-off, there’s been little distinction.

During the Feb. 19-27 time period, value funds posted an average loss of 11.25% versus a 11.11% average drop for growth funds.

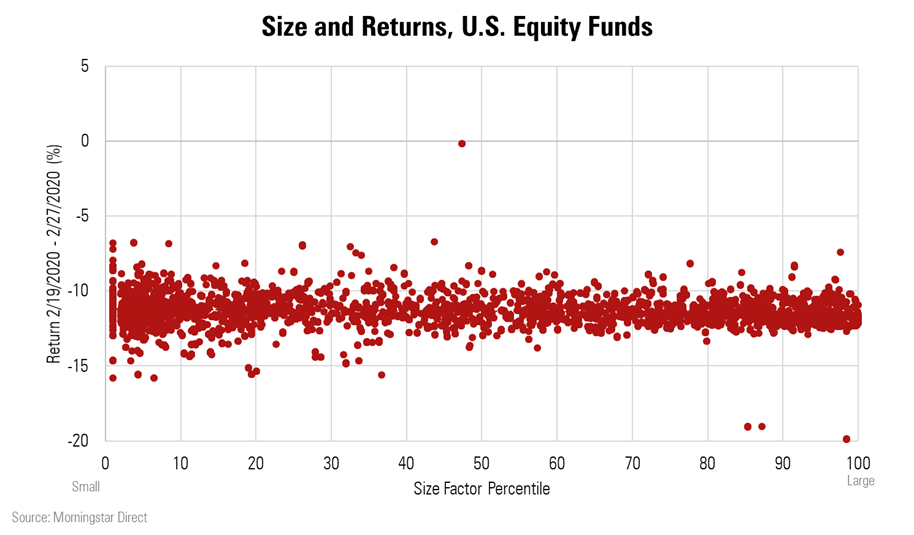

Size Another clear trend over the past few years has been the outperformance of portfolios with larger-cap stocks. But again, since Feb. 19, on average there was no material differentiation in performance based on market capitalization. Returns of small- and large-cap stocks were nearly identical since Feb. 19, with small caps posting a negative 10.94% return compared with large-cap returns of negative 11.30%.

Yield Yield can often offer investors a safe haven when markets get turbulent. This time around, yield exposure did not affect fund performance.

The full version of this article if available to Morningstar Direct and Office client here.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)