U.S. Sustainable Funds Weathering Coronavirus Correction Better Than Most Funds

Jon Hale analyzes how ESG funds are holding up.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Most of the growth of sustainable investing has taken place since the global financial crisis, much of it in the past five years, meaning that many environmental, social, and governance strategies are largely untested in market corrections.

In a bullish environment, ESG performance has been good and investors appreciate the added social and environmental impact generated. But when the rubber meets the road during market declines, will investors resort to traditionally defensive investments and no longer prioritize investing for impact if they aren’t also getting the financial return?

Based on how sustainable equity funds fared last week, which resulted in the biggest downturn since 2008, concerns over performance of ESG funds in down markets appear to be unfounded. Sustainable equity funds overall fared better than their conventional peers, and passive sustainable equity funds fared better than those following conventional market indexes.

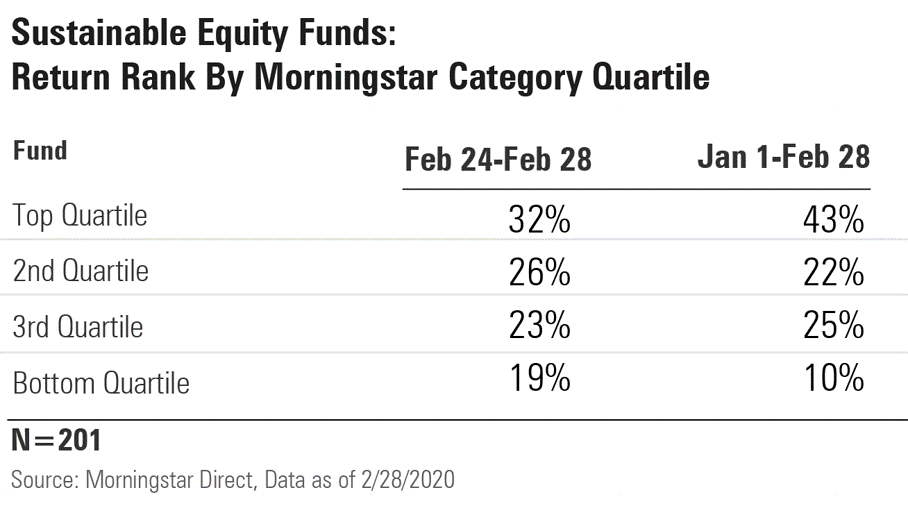

First, for the Feb. 24-Feb. 28 period, I compared the returns of all 201 sustainable equity open-end and exchange-traded funds available in the United States with their peer groups, and made the same comparison for the year to date through Feb. 28. For peer groups I used Morningstar categories, which bucket funds based on region, market cap, and style, and contain both sustainable and conventional funds. (To find the list of funds used to create this screen, see the article available here.)

During this time frame, sustainable equity funds weathered the downturn better than equity funds overall. Over the week of Feb. 24-Feb. 28, the returns of 58% of sustainable equity funds ranked in the top half of their respective categories. Nearly one third (32%) ranked in their category’s top quartile, while only 19% ranked in their category’s worst quartile. (By definition, 25% of all the funds in each category place in each of four quartiles. Sustainable funds are thus overrepresented in the top quartiles and top halves of their peer groups relative to funds overall.)

Broadening the perspective to the year through Feb. 28, the returns of nearly two thirds (65%) of sustainable equity funds ranked in their category’s top half. The returns of 43% ranked in their category’s top quartile while only 10% landed in their category’s worst quartile.

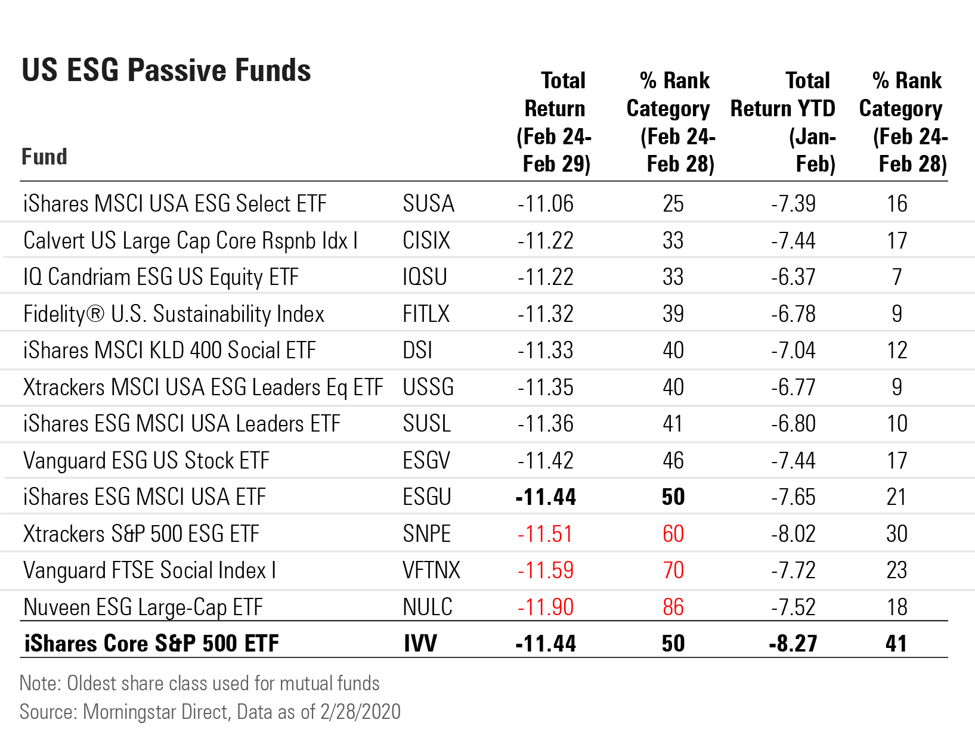

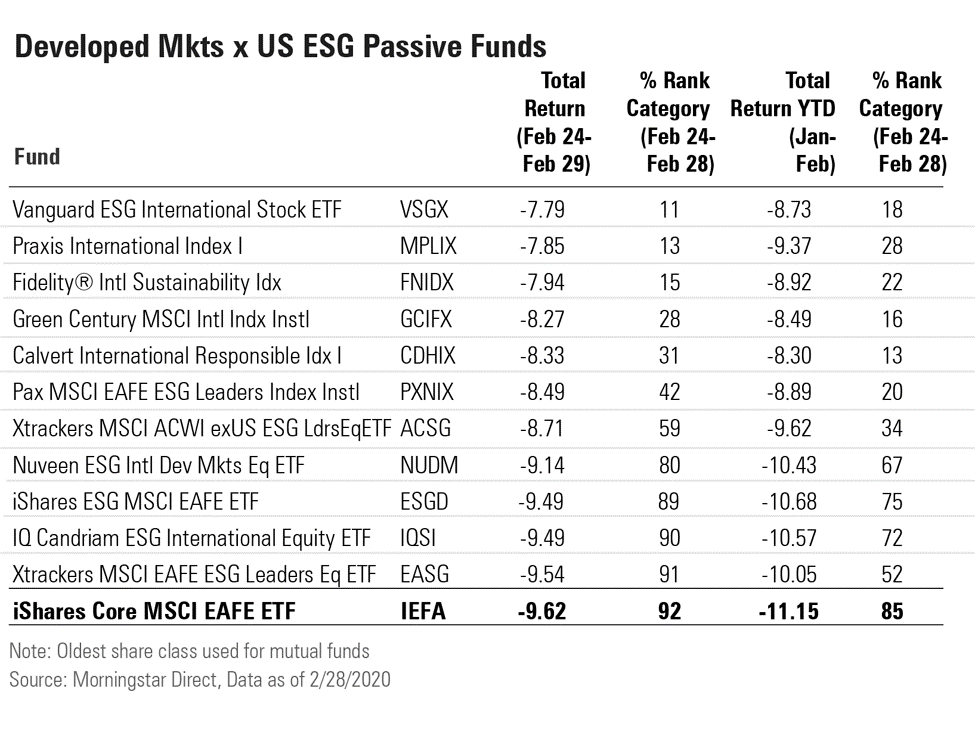

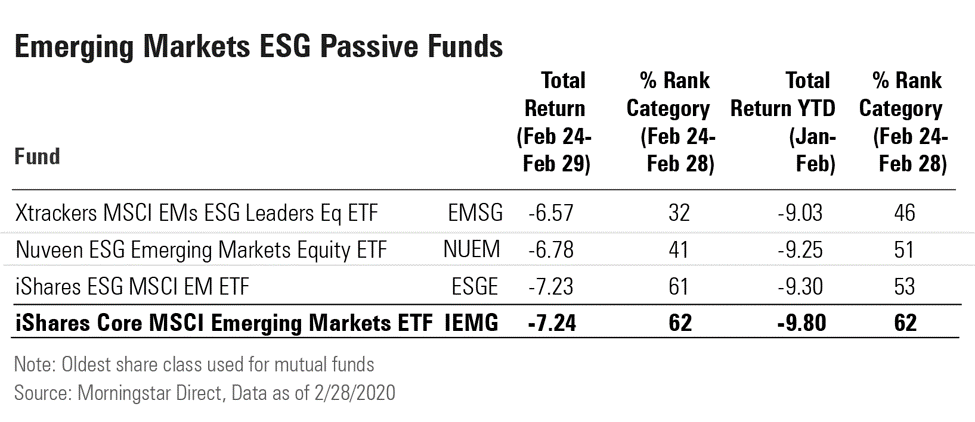

Second, I compared the returns of passive ESG funds with those of conventional index funds covering U.S. stocks (S&P 500), non-U.S. developed-market stocks (MSCI EAFE), and emerging-markets stocks (MSCI Emerging Markets). Across all three regions, ESG indexes held up better than funds tracking the conventional indexes from Feb. 24-Feb. 28 and for the first two months of 2020.

Of the dozen passive ESG funds found in the large-blend category, eight of 12 performed better than the iShares Core S&P 500 IVV for the week ending Feb. 28 and one matched IVV’s return. For the year through February, all 12 passive ESG funds have outperformed IVV.

Of the 11 passive ESG funds found in the foreign large-blend category, all outperformed iShares Core MSCI EAFE IEFA for the week ending Feb. 28 and for the year through February.

Of the three passive ESG funds found in the diversified emerging-markets category, all outperformed iShares Core MSCI Emerging Markets ETF IEMG for the week ending Feb. 28 and for the year through February.

We don’t know, of course, how long the coronavirus correction will last, and obviously, ESG equity funds cannot escape losing money when stocks are in correction territory. But sustainable funds are weathering this downturn better than their conventional peers.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)