More Portfolio Lessons From Target-Date Funds

These all-in-one funds offer not only simplicity, but also valuable insights for DIY investors.

Back in 2019, my colleague Josh Charlson wrote about lessons from target-date funds, focusing on bigger-picture investment issues. Probably the biggest lesson of all is that there's no need to overcomplicate things with your portfolio. Target-date funds can be excellent "one and done" solutions because they offer expert management, broadly diversified portfolios, and asset mixes geared toward a specific target date that automatically adjust over time. But target-date funds also offer valuable insights for investors who prefer to build their own portfolios. Here are some of the key lessons to draw from target-date funds' sub-asset allocations, which represent the mix of assets these funds target at different points during their life cycles.

You Probably Need More Equity Exposure Than You Think Josh also covered this one in his column, but it's important enough that it bears repeating: Keeping a healthy dose of your assets in stocks is critical both early in your retirement savings years and later on.

Even if you have a relatively short time horizon and don’t want to take on much risk, it almost always makes sense to have at least some equity exposure. Because stocks and bonds generally don’t move in lock step, adding some equity exposure to a bond-heavy portfolio can improve risk-adjusted returns.

Investors are often advised to make their portfolios more conservative as they approach retirement. This advice makes sense, but taking things too far can be counterproductive. Individuals who reach age 65 in 2020 can expect to live another 19 years on average (about 18 years for men and closer to 21 years for women). Shifting too many assets into bonds and cash can stunt your portfolio’s growth potential and increase the risk that your assets won’t last long enough to sustain your spending rate throughout retirement.

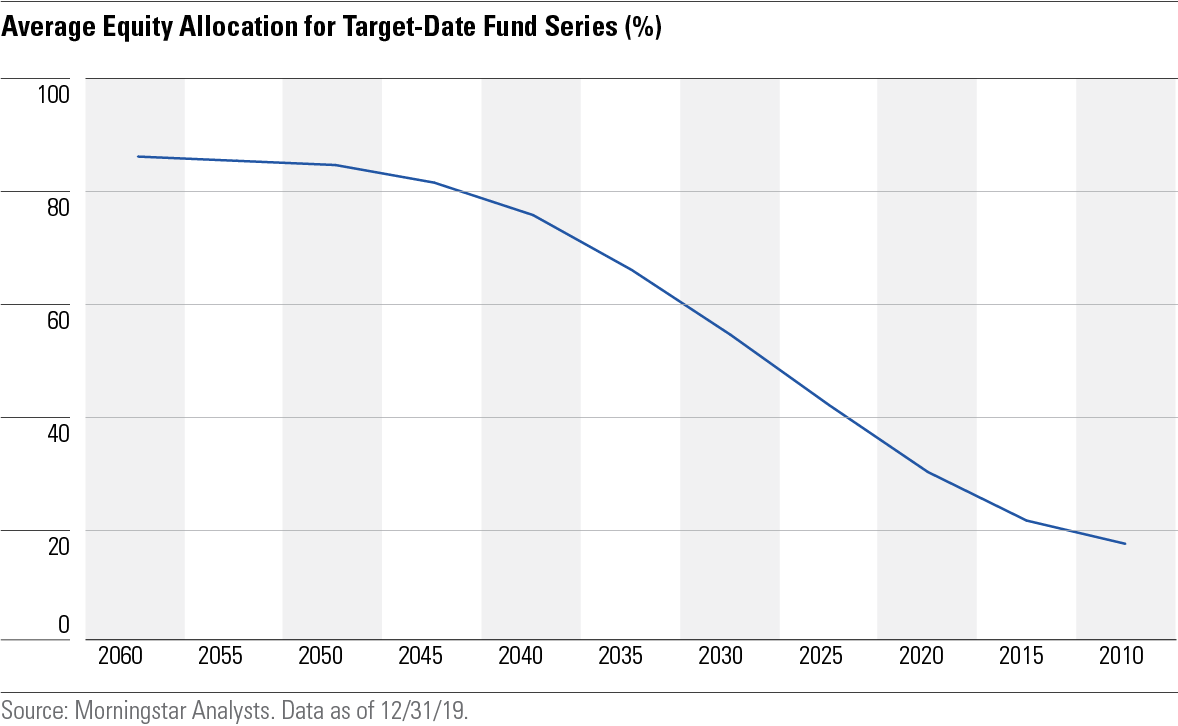

To avoid this risk, most target-date funds start with about 90% of their assets in equities for investors with the longest time horizons before retirement and gradually ratchet down their exposure. Even at retirement, though, the average target-date fund series keeps about 44% of its assets in equities and then eases this down further after retirement, eventually declining to about 34% of total assets.

Don't Stay Too Close to Home Investors often display home-country bias, or a preference for keeping the majority of their portfolios in securities domiciled in the country where they live. What's more, international stocks have lagged their domestic counterparts by a large margin over the past decade. Over the 10-year period ended January 2020, the MSCI EAFE Index has compounded returns at a paltry 5.8% per year versus 14.0% for the S&P 500. Correlations between U.S. and non-U.S. stocks have also been trending up over time, weakening the case for international diversification.

There’s still a strong argument to be made for investing outside the United States, though. The long-term performance trend for international stocks looks particularly bad right now, but that pattern probably won’t last forever. And while correlations are higher than they used to be, adding international diversification has still improved risk-adjusted returns over most periods.

Valuation is another argument in favor of including international stocks. Because they've lagged by such a wide margin, international stocks now sport more attractive price tags. The price of the S&P 500 relative to long-term, inflation-adjusted earnings (also known as the CAPE or Shiller P/E) has been at pretty steep levels, at least before last week's market drop. The S&P 500's CAPE was about 30.4 as of Jan. 30, 2020, which was near its postcrisis peak. The average CAPE for developed markets stood at 25.3 as of the same date, while emerging-markets issues traded at an average CAPE of 15.3.

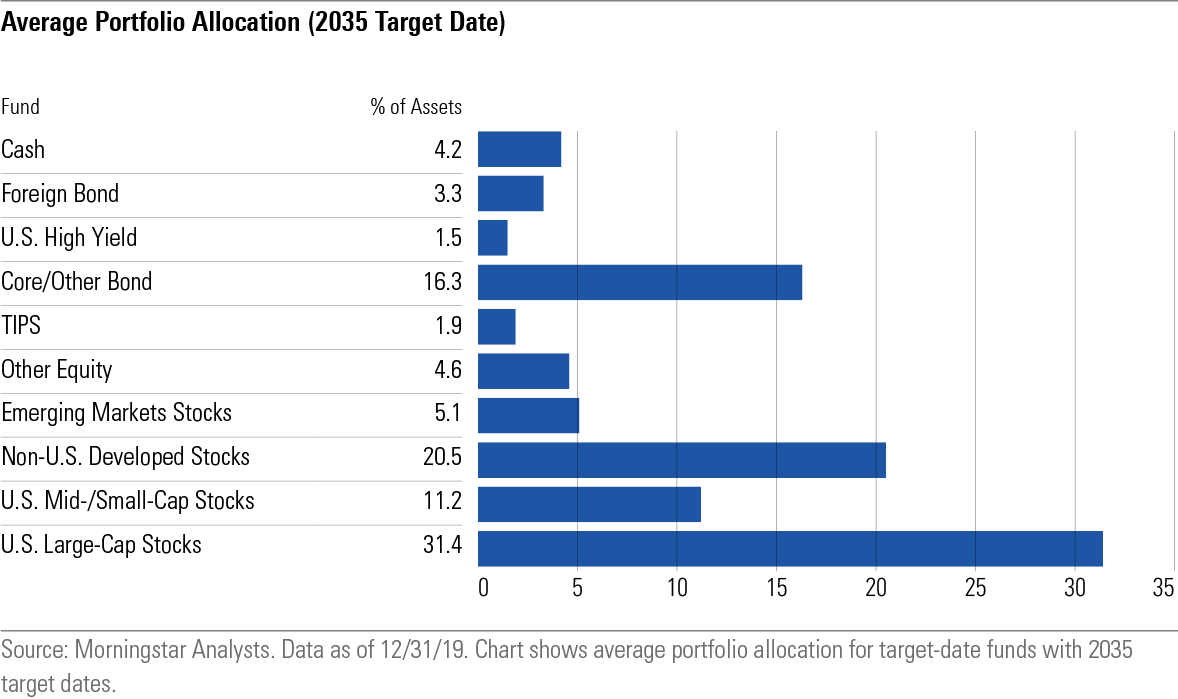

Target-date funds have actually increased their exposure to non-U.S. stocks in recent years. The average target-date fund geared toward investors retiring in 2035 has about 20.5% of its total assets in non-U.S. stocks from developed markets, plus an additional 5.1% in emerging markets.

Consider Adding Some Non-U.S. Holdings for Your Fixed-Income Allocation, Too Just as non-U.S. stocks can help diversify an equity portfolio, foreign bonds can improve diversification for a domestic fixed-income portfolio. They can also offer a slight yield advantage, although interest rates in global markets have also been in a long-term downward trend. Funds that hedge their currency exposure have also been able to take advantage of the gap in currency values to improve yields compared with similar-duration U.S. Treasuries.

It’s probably not necessary to include a separate foreign-bond allocation in the years leading up to retirement, but adding some exposure can improve diversification as your bond allocation increases during retirement. The average target-date fund series allocates about 3% of its assets to foreign bonds for investors with 15-year time horizons, increasing to 7% of assets for investors about age 75 and older.

Make Room for Some Smaller-Cap Stocks Smaller-cap stocks have lagged large-cap stocks by a wide margin in recent years. Over the past 10 years, the Morningstar U.S. Small Cap Index has posted average annual returns of just 5.6%, compared with 10.9% for the Morningstar U.S. Large Cap index. Despite this underperformance, academic evidence supports the view that smaller-cap stocks have a performance edge over longer time periods. It's also worth including smaller-cap stocks simply because they make up a large percentage of the market. Small- and mid-cap stocks currently make up about 20% of the CRSP U.S. Total Market Index.

Most target-date fund series actually underweight smaller-cap stocks relative to this benchmark but still keep a meaningful weighting in small- and mid-cap stocks (about 15% of total equity exposure).

Use High-Yield Bonds in Moderation--If at All With Treasury bond yields at all-time lows, many investors have been tempted to reach for yield by dipping into lower-credit-quality assets. Currently, the high-yield bond Morningstar Category offers an SEC yield of 4.1% versus 1.9% for intermediate-term core bond funds. However, the yield advantage on lower-quality credits (also known as the credit spread) has narrowed in recent years. That means high-yield bond buyers are getting paid less to take on credit risk. And while default rates have been low in recent years thanks to a generally strong economy, that trend will likely reverse with lower economic growth.

High-yield bond funds also don’t offer as much of a diversification advantage as other types of investment-grade bonds. Over the past three years, the high-yield category has had a 0.83% correlation with the S&P 500, compared with negative correlations for the intermediate core and intermediate government categories.

Don't Forget Inflation Protection After headline-grabbing inflation rates in the 1970s and 1980s, inflation has been pretty much a nonissue in recent years. The inflation rate in the U.S. has averaged about 1.8% over the past 10 years, compared with the long-term historical average of 3.2%.

Even if inflation remains low, it can still erode purchasing power over time. For example, if you spend $35,000 in today’s dollars for a new car, the same purchase will cost you about $42,700 in 10 years, assuming a 2% inflation rate. People who are still employed generally have a built-in inflation hedge because many employers will increase salaries to reflect changes in the cost of living each year. But after retirement, there’s a greater need to include inflation-protected assets in your portfolio.

Treasury-Inflation Protected Securities are a great way to fill that role. These bonds have a principal value tied to changes in the Consumer Price Index. When inflation increases, their principal value increases, as well. The average target-date fund allocates about 7% of its assets to TIPS for investors in retirement, gradually increasing to 9% for investors 20 years after retirement.

Cash Is Trash (Sort Of) Most target-date funds go fairly light on cash, especially in the years leading up to the target date. On average, target-date fund series hold about 4% of their assets in cash for most of the glide path and gradually increase that to 5% or 6% of assets later in the glide path. And part of the reason for holding cash is probably a side effect of incoming cash flows rather than an asset-allocation target, per se.

Assuming you already have a separate emergency fund that you could use to cover unforeseen events (three to six months’ worth of living expenses is the standard recommendation), you don’t necessarily need to include a lot of cash as part of your core investment portfolio. Similarly, people who are already retired will probably want to keep a separate account with enough cash holdings to cover one to three years’ worth of living expenses. But if you have a separate bucket for cash holdings, you don’t need to hold a lot of cash in your core investment portfolio. While cash can be valuable to help cushion your portfolio from market volatility, you can achieve a similar result by investing in other asset classes, such as short-term bond funds or TIPS.

Conclusion Target-date funds have arguably been one of the best innovations for mutual fund investors over the past 20 years. They've greatly simplified the process of building a diversified portfolio and made it easy for investors to create disciplined investment habits by adding to their 401(k) plans with each paycheck. Because they're so easy to use and also popular default choices for retirement plans, they're also not as prone to bad investor behavior (the tendency to pile into hot funds after they've already had a strong run and then sell after a downturn) as other types of funds.

Target-date funds also offer valuable insights for building a portfolio from the ground up. They can help inform which asset classes to use in your portfolio, in which amounts, and how to adapt your allocation over time. While it’s easy to be thrown off course by short-term market noise and volatility (such as the recent coronavirus-driven downturn), setting up a diversified portfolio and sticking with it is the better route toward meeting your long-term goals.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)