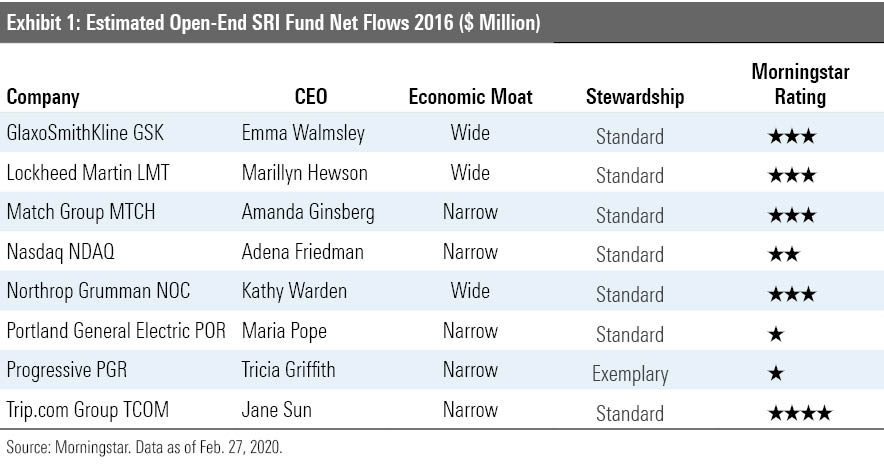

8 Standout Companies Run by Women

These firms have carved out economic moats and are led by female CEOs.

Editor's note: This article is part of our Women and Investing special report.

Buying a stock simply because the company’s CEO is a woman doesn’t make any more investment sense than buying a stock simply because the company’s CEO is a man.

Instead, you want to examine fundamentals, consider valuation, and apply whatever other investment metrics matter to you before buying. Moreover, CEOs come and go. That female-run company may be led by a man---and vice versa--soon enough.

But given that International Women's Day is right around the corner, today we're looking at women-led companies through the lens of economic moats: We're sharing eight companies with Morningstar Economic Moat Ratings of wide and narrow that have females at the helm. These firms have all carved out competitive advantages that should allow them to thrive for the next decade or more.

Watch: What is the Morningstar Economic Moat Rating?

Here’s a closer look at three of the stocks from the list.

Lockheed Martin LMT Marillyn Hewson assumed the CEO role of the world's largest defense contractor in early 2013. Before that, Hewson held 18 different leadership positions over 30 years, spanning multiple businesses. That experience provides her with a deep understanding of the firm's history, culture, and customers, says analyst Joshua Aguilar.

Here’s what Aguilar has to say about Lockheed’s wide--and growing--moat:

“Decades of experience dealing with arcane government regulations coupled with a leadership position in high-tech areas such as combat aircraft, transports, missiles, and helicopters provide Lockheed with strong intangible assets and lock its customers into long-term relationships with the company. In many instances, the U.S. Department of Defense has no choice but to use Lockheed because there are no other qualified bidders. In missiles, Lockheed and Raytheon effectively compete in a duopoly with other players only capturing a small portion of the U.S. market. In certain segments, such as manned combat aircraft, where we believe Lockheed will be the sole U.S. supplier by 2025, the company enjoys efficient scale dynamics. These intangible assets, customer switching costs, efficient scale in certain segments, and historical returns well above its cost of capital and above peers lead us to assign Lockheed a wide moat rating.”

In early February, we increased our fair value estimate for Lockheed to $412 from $385 after the three major credit rating agencies upgraded Lockheed’s debt ratings--which led to a decreased cost of debt assumption.

As of this writing, the stock is fairly valued according to our metrics.

Nasdaq NDAQ Adena Friedman has been CEO of narrow-moat Nasdaq since 2017--and we think her deal-making experience is a plus, asserts analyst Colin Plunkett, particularly as the company pivots away from its exchange business, developing new products in data and expanding its technology offerings.

Plunkett notes:

“Nasdaq is making the transition from being solely an equity exchange to a diversified data and technology company. Although Nasdaq's market services business accounts for a little less than half of operating income, investors should focus on the company's expanding information services (45% of operating income) business, which provides the market data that investors need in order to trade. Historically, exchanges gave this data away to encourage trading. Now, Nasdaq and other exchanges increasingly view this intangible asset as a profit center. We expect a majority of Nasdaq's operating income will be realized through data sales while becoming less dependent upon highly cyclical trading volume.”

Shares look pricey according to our metrics.

Progressive PGR Tricia Griffith became CEO of the narrow-moat insurer in 2016 after previously serving as COO of personal lines. When she ascended to the CEO role, Griffith had nearly 30 years of experience at the firm, with responsibilities across its operations. We award the firm Exemplary marks for stewardship. Management has done a great job of allocating capital to high-return businesses, observes senior analyst Brett Horn. Further, management has proved to be innovative: Progressive was the first to offer online policy quotes and comparisons as well as 24-hour claims service.

Here’s what Horn has to say about the business overall:

“Progressive is one of the strongest franchises in the insurance industry, and it is currently firing on all cylinders. The auto industry had seen an uptick in costs in previous years, as a multitude of factors ranging from low gas prices to distracted driving pushed up claims. This compressed industry underwriting margins, but Progressive and the industry have executed a more than sufficient pricing response. Progressive has fully moved past the issue, and underwriting margins are now at the low end of its historical range. However, we view this as a cyclical phenomenon and expect mean reversion over time. Pricing increases appear to have stalled, which would be the first stage of this process.

Progressive is also currently benefiting from an aggressive move to expand its reach, having acquired homeowners insurance operator ARX in 2015. We're skeptical that the homeowners business will match the returns on Progressive's legacy business and believe that it potentially introduces greater volatility. But the ability to bundle homeowners and auto has allowed Progressive to broaden its demographic reach and increase its penetration among relatively affluent customers. This has reignited growth in its historically dormant agent channel and makes this expansion value-creative overall, in our view.”

Shares are overvalued today according to our metrics.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)