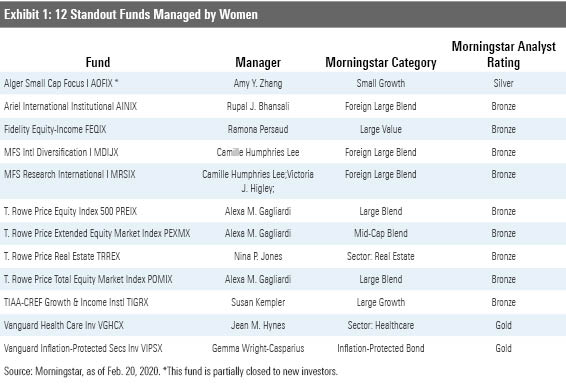

12 Standout Funds Managed by Women

These highly rated mutual funds make good portfolio building blocks.

Editor's note: This article is part of our Women and Investing special report.

When it comes to the fund industry, it’s still a man’s world.

Morningstar's latest research finds that when it comes to gender diversity, the global fund industry looks about the same as it did 20 years ago: 14% of fund managers at the end of 2000 were women, and at the end of 2019, 14% of fund managers were women, too.

Today we’re focusing on a dozen funds managed by women. Specifically, these funds all earn Morningstar Fund Analyst Ratings of Bronze or better, and hail from categories that investors frequently pluck from to build their portfolios.

Here’s a closer look at four funds from the list.

Alger Small Cap Focus AOFIX Manager: Amy Zhang Manager Start: February 2015

Note that this fund closed to some investors in 2019, but it’s a fine small-growth choice for those investors who can still get access.

Here’s what senior analyst Christopher Franz has to say in this latest analyst report:

“Management experience and a proven, distinctive approach support Alger Small Cap Focus' Morningstar Analyst Rating of Silver.

When manager Amy Zhang joined Fred Alger Management in early 2015 and took over this strategy, she was no stranger to small caps. She had long been a key contributor at Gold-rated Brown Capital Management Small Company BCSIX, helping it amass one of the small-growth Morningstar Category’s best risk-adjusted records over her 12-plus years as comanager. Zhang didn’t bring anyone from her prior firm but has adopted a similar investment approach. Here, she’s supported by four dedicated analysts but is the sole manager, which does introduce key-person risk.

Zhang’s approach to small-cap investing stands out. Rather than focusing on market cap, she defines her universe in terms of revenues, focusing on firms with operating revenues of $500 million or less whose differentiated products or services satisfy emerging needs. This focus points her to innovative healthcare and technology names, which as of March 2019 comprised more than 80% of assets in the 50-stock portfolio. This positioning presents obvious sector-specific risk, and the strategy also courts price risk relative to peers, as such companies often aren’t cheap. Still, Zhang’s preference for cash-rich firms with several years of operating history has helped avoid stock blowups, and below-average debt levels provide some solace.”

Watch: Zhang: Opportunity in Healthcare Amid Digital Transformation

Ariel International AINIX Manager: Rupal Bhansali Manager Start: December 2011

This is a solid choice for international-stock seekers--particularly those who are risk-averse.

Analyst Connor Young explains in his latest report:

“Ariel International’s experienced manager and cautious but effective approach support its Bronze Morningstar Analyst Rating.

Rupal Bhansali has been this strategy's sole manager since its December 2011 inception. Before joining Ariel Investments in 2011, she spent a decade at MacKay Shields, posting solid results at MainStay MacKay International Equity. Bhansali has 28 years of industry experience and draws support from eight others on the research team, each with at least a decade of industry experience.

Bhansali and team attempt to deliver superior returns with below-average risk. They focus on risk management first, using quantitative and qualitative screens to eliminate firms prone to impair capital and firms with questionable business models. They then dive into fundamentals, searching for durable and misunderstood businesses. For example, Bhansali believes the market hasn’t appreciated the high barriers to entry in the tire industry; thus, it has mispriced top-10 holding Cie Generale des Etablissements Michelin and Bridgestone, a smaller position that Bhansali recently added to the portfolio. The portfolio’s stake in firms with wide Morningstar Economic Moat Ratings has routinely been higher than the MSCI EAFE Index’s, as has its return on equity.

Bhansali’s focus on high-quality firms and attention to downside risk have helped the strategy fare well during challenging markets. When stocks tumbled in 2018, the strategy placed in the foreign large-blend Morningstar Category’s top decile, owing to solid financial services and healthcare picks, as well as an above-average cash stake. On the flip side, it hasn't kept up during market rallies. That was the case in 2017, when the strategy trailed its index by 8 percentage points, held back by its cash position and poor stock selection in the eurozone.”

Listen: Rupal Bhansali: FAANG Stocks Are 'Extremely Risky'

Vanguard Health Care VGHCX Manager: Jean Hynes Manager Start: May 2008

This isn’t just a great health care fund--it’s among the best sector funds Morningstar covers.

Director Tom Lancereau argues in his latest analysis: “A long-tenured manager, a deep analyst bench, a sound process, and very low fees continue to earn Vanguard Health Care a Morningstar Analyst Rating of Gold.

Lead manager Jean Hynes began working on this strategy in 1991 at subadvisor Wellington Management and started comanaging it with longtime lead manager Ed Owens in 2008. She became lead manager in 2012 when Owens retired. She is backed by strong analytical resources, including industry veteran analysts Ann Gallo and Robert Deresiewicz. The team was strengthened even further in 2018: Wellington hired one additional analyst and two research associates as it promoted two former research associates to an analyst role, bringing the team supporting Hynes to a total of eight analysts and three research associates.

The investment process capitalizes on this deep industry knowledge. Bottom-up, it focuses on innovative companies, with differentiated products or services and low valuations relative to their growth prospects. The team clearly has a long-term mindset--portfolio turnover was 11% in 2018--and looks for opportunities across different healthcare industries, resulting in a relatively more diversified portfolio than many peers, especially biotechnology-heavy funds. The strategy also has more exposure to foreign stocks than the typical peer, 25% in September 2018 versus 8%. However, it also is more focused on large caps. Its exposure to small caps was only 1.7%. The strategy size surely prevents it from venturing too far down the market-cap scale. Yet, that has not impeded its success over time as the team has generally favored larger companies even when the asset base was lower.

Overall, investors have had a less bumpy experience here. Low fees have made excessive risk-taking useless, as the strategy already has a headstart over its rivals.”

Watch: A Revolutionary Change in Health Care

Vanguard Inflation-Protected Securities VIPSX Manager: Gemma Wright-Casparius Manager Start: August 2011

This fund has proven to be a solid inflation-protection tool--and at a low cost, to boot.

Analyst Gabriel Denis says in his latest report:

“Vanguard Inflation-Protected Securities represents a compelling option for investors in the market for a straightforward inflation hedge. Led by an experienced manager and sporting rock-bottom fees, this fund continues to earn a Morningstar Analyst Rating of Gold.

As a baseline, the team keeps this fund close to its Bloomberg Barclays U.S. Treasury Inflation Protected Index benchmark. Unlike many competitors in the inflation-protected bond Morningstar Category, this fund does not court additional risk by looking for extra yield in commodities, high-yield bonds, or other assets. Yet this is not a pure index fund, and the team can add or remove risk relative to the benchmark where it has high conviction about a trade. Rather than delving into riskier sectors of the market, the team often looks to generate excess return through relative value positioning between Treasury bonds and will scale in or out of off-the-run securities when the price is attractive.

This careful investment effort has been under the sole auspices of experienced manager Gemma Wright-Casparius since April 2012. She joined the firm (and this fund) in 2011 and brings nearly forty years of investment experience, much of it spent in the rates and inflation markets. Though the team directly supporting her on this fund is small, she calls forth the support of Vanguard’s expansive quantitative, credit research, and risk-management resources. Under their cautious guidance, this fund acts as a diversifier to nominal Treasuries and provides pure exposure to inflation-hedging U.S. Treasury Inflation-Protected Securities.

The team’s vigilant stewardship and laser-focus on low fees have strongly benefitted investors over Wright-Casparius’s tenure.”

Watch: Tips for Choosing a TIPS Fund

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q27ZB7KFPZBMHFKY6IURRWJQHM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)