Fund Ideas for the New Decade

Value funds plus big upgrades are worth a look.

The article was published in the January 2020 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

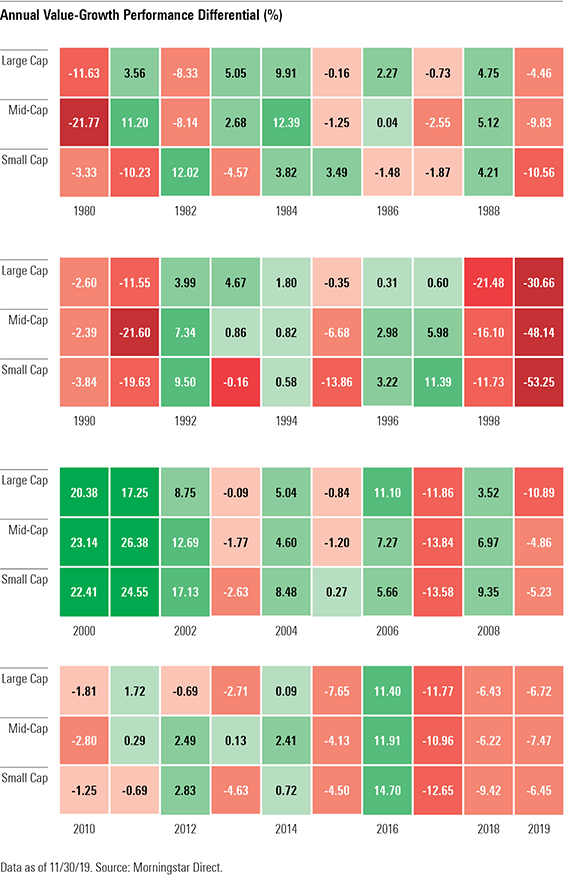

These are tough times to be a value manager. Growth stocks dramatically outperformed value for the third year in a row in 2019 and the fourth time in five years. If you look at it by decade, the '90s heavily favored growth, the '00s heavily favored value, and the last decade skewed toward growth.

Will the '20s swing back in value's favor? Quite possibly, but all market predictions should be greeted with skepticism even when a clear pattern exists. Nothing is ever that tidy.

My colleague Tom Lauricella has produced a cool heatmap charting the relative performance of value to growth. For each year, he has subtracted the returns of growth funds from value funds at each market-cap level. This heatmap is thus a relative map. Where you see “–6.82%” for 2019, for example, it doesn’t mean stocks lost money. In fact, it was a great year for both value and growth. But growth was better, with a 31.89% large-growth return and a 25.07% gain for large value.

Thus, years in red indicate when value lagged growth rather than an absolute measure. As you can see, there’s a lot of red for the teens. AQR’s Cliff Asness had an interesting perspective on this. He said growth’s outperformance for much of the decade was due to stronger fundamental improvement for growth companies and therefore was quite sensible. However, he argues the past two years’ differential has been driven by prices rather than fundamentals and thus it may be time to “sin a little” by modestly overweighting value.

Leave it to a quant to find the most boring possible way to sin. Las Vegas, your sins on offer face no threat from Asness’ wickedness. I’m going to outbore him by suggesting merely rebalancing a lot to get back to roughly equal weightings in value and growth. If you started the decade with a neutral mix and left your holdings untouched, you probably have a significant growth overweighting today. I think it makes sense to get back to neutral.

Thus, I’ll start my ideas for next year and beyond with three kinds of value funds. My second theme will be funds upgraded to Morningstar Analyst Ratings of Gold or Silver in 2019.

I’ve grouped the value funds into four camps. Each one has a slightly different mix of characteristics.

Deep value. These are funds that buy very cheap companies that merely need to rebound to past revenue and profit levels to enjoy a good return. They are least-correlated with growth and most likely to shine should value thump growth in the coming years. They are also the riskiest as they tend to be economically sensitive.

Dividend-oriented. These funds also tend to have fairly cheap valuations, but their focus on income makes them more defensive in most downturns. On the other hand, they may have more-limited upside if they own utilities and other companies with very modest growth prospects.

Quality. These are more mainstream value investors who are more likely to own tech and healthcare alongside traditional value sectors. They also look for financially healthier companies and often have higher moat ratings (companies with barriers to entry) than their peers. The downside is that they may lag their peers in a severe growth correction.

Absolute. Somewhere between quality value and deep value lies absolute value. While they avoid the grungiest businesses, they don't embrace quality, either. Rather, they are focused on businesses trading below what their takeover values might be. They deliver straight-down-the-middle value exposure.

Deep Value DFA US Small Cap Value DFSVX has long made the most of being in the lower left-hand corner of the Morningstar Style Box. The fund follows a basically passive strategy but seeks to add value by being a provider of liquidity and screening out a few of the more dubious small-value names.

Artisan Value ARTLX has the sort of feast or famine profile you expect in deep value. It finished 2019 in the top quartile of the large value category with a robust 27% return, but that followed a dismal 14.9% loss in 2018. The fund has been top or bottom quartile for six of the past seven years owing its high level of economic sensitivity.

Harbor Mid Cap Value HIMVX is run by quantitative manager LSV with an emphasis on cheap. The fund’s models look for companies that look inexpensive based on earnings, cash flow, and dividends. Cheap means out of favor, and that’s especially true in recent years as you can see from unimpressive returns. But if you want to bet on a value revival, this fund could be a good choice.

Absolute Diamond Hill Small Cap DHSCX and Diamond Hill Mid Cap DHPAX look for companies trading below the firm's estimate of their intrinsic value. They run relatively focused portfolios and have proved to be strong stock-pickers. The funds feature big weightings in financials and industrials, but not so much in healthcare on the growth side or energy on the deep-value side.

Dividend-Oriented Want some income and defense to go with your equities? Dividend-oriented or equity-income funds are what you want. Vanguard Equity Income VEIPX is an easy choice because its low costs allow nearly all of the portfolio's dividends to flow to shareholders. It's not exciting, just effective.

Although equity-income is generally a large-cap thing, there are dividend-payers in small- and mid-cap territories, too. Principal Small-MidCap Dividend Income PMDAX is there to scoop up the best of them. Managers Dan Coleman and Dave Simpson look for stocks with market caps from $1 billion to $10 billion at the time of purchase, dividend yields of 2.5% to 7.0%, and payout ratios under 60%. Within that universe, they seek out companies with strong balance sheets and competitive advantages.

Quality Dodge & Cox International Stock DODFX could probably fit in Absolute value, too, but I put it here because it has well above the category average in wide-moat stocks. Dodge & Cox's chief advantage is the skill and experience of its managers and analysts rather than a remarkable strategy. They are just very good at finding value.

AMG Yacktman YACKX loves brand names like PepsiCo PEP, Procter & Gamble PG, Disney DIS, and Microsoft MSFT. But it is firmly in the value camp because Stephen Yacktman and Jason Subotky are stingy about the prices they pay. And in a throwback to funds of yore, they’d rather let cash build than buy at an unappealing price.

Artisan Global Value ARTGX also cares about quality and price. It emphasizes balance sheets, too, and that kept it out of trouble in the 2008–09 bear market. It holds more in tech and almost nothing in energy and materials. The team is led by Dan O’Keefe, and it is not related to the team running Artisan Value.

Upgrades to Gold and Silver It's not easy to get to the top two rungs of our ratings. So, each of these funds deserves a close look. They offer a compelling mix of fees, process, people, and parent that few can match.

Baird Aggregate Bond BAGIX and Baird Short-Term Bond BSBIX were elevated to Gold as we got to know the team around Mary Ellen Stanek better. We want to see depth of managers and analysts because success is more sustainable when it owes to more contributions and because eventually the leader will retire. It also feels rather timely because conservative bond funds like these have been a bit out of favor recently but will be welcome when the economy hits the skids.

BlackRock High Yield Bond BHYAX continues to impress us since Jimmy Keenan took the helm in 2009. The fund makes good use of BlackRock’s analytical capabilities including those for bank loans and investment-grade bonds.

Dodge & Cox Global Bond DODLX shows that Dodge has successfully brought its domestic bond strategy to the rest of the world. Although there are issues not faced in the United States such as currency risk and sovereign default risk, it has proved up to the task, and a champ so far.

Fidelity Select Health Care FSPHX is one of the best sector funds because Fidelity has one of the best teams of sector analysts in healthcare.

JPMorgan Equity Income OIEIX manager Clare Hart has made this into one of the best equity-income funds around. Compared with other equity-income funds, this one leans heavier on cash flow growth and return on equity--buying better businesses rather than chasing the highest dividends. That adds to its defensive appeal.

T. Rowe Price International Disciplined Equity PRCNX is a rare thing: a great but undiscovered T. Rowe Price fund. Federico Santilli has nine years at the helm of this fund’s institutional clone and five years at this one; combined, though, the funds have only about $400 million. Stocks have to clear a number of tests to get in the portfolio, including excess returns above their cost of capital, shares below fair value, and good management. That leads to a blend portfolio that works as a core holding.

Vanguard Short-Term Inflation-Protected Securities VTAPX gives you inflation protection without much interest-rate risk. That makes it a useful tool.

Wasatch Small Cap Growth WAAEX was upgraded to Gold as we became comfortable with the job J.B. Taylor has done since taking over for Jeff Cardon in 2016. Taylor has maintained the fund’s appealing risk/reward profile thanks to his ability to find companies with sustainable competitive advantages.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)