TIPS ETFs Can Help Protect From Unexpected Changes in Inflation

While nominal Treasury bonds price inflation risk into their yield, they do not protect against unexpected inflation.

Funds tracking the Bloomberg Barclays Aggregate Bond Index (“the Agg”) can be great core bond holdings. Broad and conservative, these funds offer investors exposure to an area of the investment-grade bond market that is wide enough to effectively diversify sector and issuer risk, and conservative enough to serve as ballast for an equity allocation.

While inflation risk is priced into the yield of each fixed-income security contained in the Agg, that doesn’t mean it is priced appropriately. Realized inflation can exceed expected inflation. Unexpected inflation is harmful to bond investors.

Treasury Inflation-Protected Securities can protect investors from the adverse effects of unanticipated inflation. This article will discuss the intricacies of the TIPS market and the merits of indexing TIPS exposure. I finish by highlighting some of the best TIPS exchange-traded funds on the market.

No One Expects Unexpected Inflation As their name implies, TIPS provide a degree of inflation protection, in the form of regular adjustments to their principal to reflect observed inflation--therefore protecting against unexpected inflation. These bonds are issued by the U.S. Treasury Department in terms of five, 10, and 30 years. Because they are issued by the Treasury, they present the same amount of credit risk as nominal (non-inflation-adjusted) Treasury bonds. As of January 2020, there were 44 distinct TIPS bonds with a total outstanding face value of approximately $1.5 trillion.

When considering TIPS for a portfolio, it is important to remember that inflation risk is already factored into the price of nominal Treasury bonds. Thus, TIPS are most beneficial when realized inflation exceeds expected inflation.

The breakeven inflation rate represents the spread between the yield of a nominal Treasury bond and a TIPS bond of the same maturity. It is a useful metric to gauge the difference between expected and realized inflation. But Treasury bonds carry inflation risk, which is factored into their yield via a premium which pushes the rate away from its theoretical equilibrium. As such, this spread is only a proxy.

Furthermore, in a 2016 letter, the Federal Reserve Board noted that there is greater liquidity in the nominal Treasury bond market than the TIPS market. As a result, TIPS yields also include a liquidity premium to compensate for the fact that they are relatively less liquid [1]. This pushes the yield of TIPS higher than they would be otherwise. Nonetheless, as was discussed by my colleague Maciej Kowara in his 2017 article on TIPS, the record of this measure of breakeven inflation has been a good, albeit imprecise, predictor of future inflation rates [2].

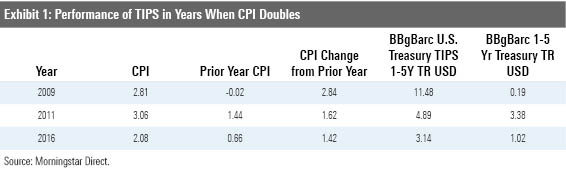

The bottom line is that TIPS prices are affected by factors other than inflation. While this can affect the degree to which they protect against unexpected changes in inflation, it does not necessarily render them useless. For example, according to data from Morningstar Direct, there were three calendar years from 2008 through 2019 during which the annual rate of CPI doubled. Exhibit 1 shows that a short-term TIPS index outperformed both a short-term Treasury bond index and inflation in each of these years.

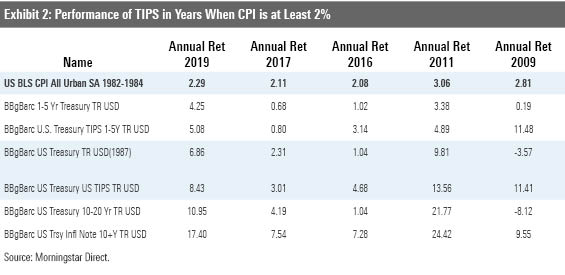

Moreover, there have been five calendar years since 2008 in which the inflation rate exceeded 2%. In each of those years a TIPS index outperformed a Treasury index of a similar maturity, as seen Exhibit 2.

The Merits of Indexing TIPS The TIPS market is large and uniform. It consists exclusively of debt issued by the U.S. Treasury Department. These securities are practically free of credit risk and they are traded frequently, meaning that price discovery is always in motion. These factors make the TIPS market conducive to indexing, as the opportunity set lacks the requisite breadth and inefficiencies that make for more a rich opportunity set for active strategies. A low-cost index fund is a difficult bogy for active managers to beat in this segment of the fixed-income market.

Assessing the Menu of TIPS ETFs When it comes to choosing from the menu of TIPS ETFs, index methodology should be at the top of investors' due-diligence checklist--as is always the case when it comes to index fund selection. In the case of indexed TIPS funds, the choices are relatively straightforward, given that all these funds draw from the same pool of relatively homogenous bonds. There are no sector or credit quality criteria to consider. Additionally, while different TIPS indexes have different liquidity thresholds, the size of TIPS issuances renders those choices largely irrelevant. The smallest TIPS bond as of January 2020 (CUSIP 912810FQ) had a face value of over $7 billion, which is larger than the minimum threshold for any TIPS index currently tracked by an ETF.

The primary differentiator among TIPS ETFs is the range of maturities included in their underlying indexes. Thus, the first-choice investors face is between short-, intermediate-, and long-term exposures. For instance, as of January 2020, the average effective duration for the Pimco 1-5 Year US TIPS ETF STPZ, which tracks the ICE Bank of America 1-5 Year US Inflation Linked Treasury Index, was approximately three years. Meanwhile the average effective duration of the Pimco 15+ Year US TIPS ETF LTPZ, which tracks the ICE Bank of America 15+ Years Index, was approximately 22 years.

Given that a key factor in selecting TIPS ETFs is the desired maturity band, it is important to understand how well TIPS across these bands protect against inflation.

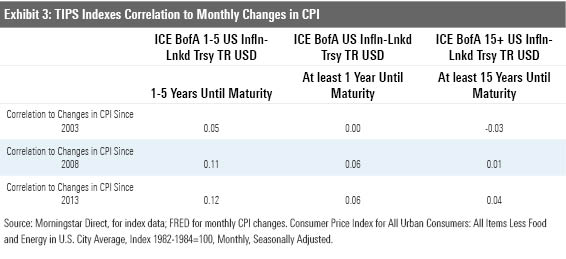

Exhibit 3 below shows the correlation between monthly changes in CPI and the monthly performance of a short-, intermediate-, and long-term TIPS index. Across all three periods, the ICE Bank of America 1-5 Year US Inflation Linked Treasury Index demonstrated the strongest correlation to changes in CPI.

Longer-duration TIPS are less sensitive to fluctuations in CPI largely because they are more sensitive to changes in nominal interest rates. Interest-rate risk also explains why short-term TIPS are weakly correlated to changes in CPI. Nonetheless, given their relatively greater sensitivity to changes in inflation, short-term TIPS are likely to be a better inflation hedge than their longer-dated counterparts.

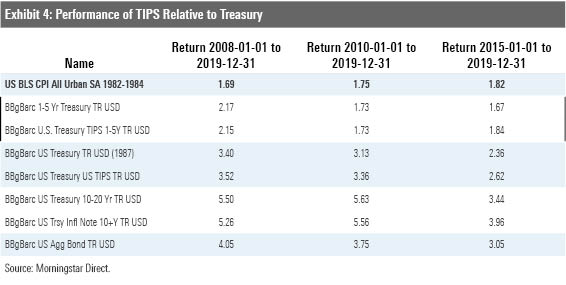

Each of the three indexes would have provided effective inflation protection from January 2008 through December 2019, in that they each delivered an annualized return in excess of inflation. Although only the intermediate TIPS index outperformed its Treasury index counterpart during this time frame, the results are slightly more compelling during the previous 10- and five-year periods, as seen below in Exhibit 4:

Evaluating Potential Options As is the case with a passive index fund in any other asset class, the evaluation of a TIPS ETF should begin with an assessment of the fund's process, which is primarily determined by its index methodology. A process that it is broadly representative of the available opportunity set, and of how active managers build their portfolios, enables a fund to capture the specific risk and return characteristics of that given market. Again, this assessment for TIPS can be boiled down to the selection of maturity band, given that these bonds are otherwise indistinguishable from one another.

Of course, it is also important to evaluate the team tasked with managing the portfolio. It takes the combined skill of teams of portfolio managers and traders for index funds to hew tightly to their benchmarks.

Given that TIPS are a narrow and homogenous sector of the bond market that is free of credit risk, there is limited potential to outperform (or underperform for that matter). Therefore, fees are an extremely important factor that should be weighed heavily by investors when comparing strategies that employ a similar process.

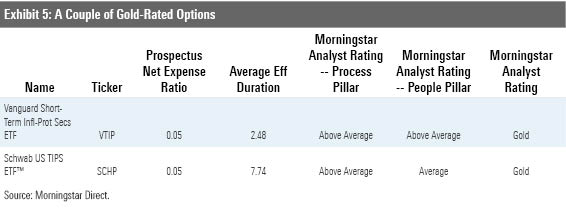

Putting it All Together The best TIPS ETFs are those that are broadly representative of their opportunity set and that charge rock-bottom fees. The ETFs listed in Exhibit 5 are our favorites on the ETF menu. These two low-cost options are compelling choices for investors seeking protection against unexpected inflation.

Vanguard Short-Term Inflation Protected Securities ETF VTIP tracks the Bloomberg Barclays US TIPS 0-5 Year Index and charges an annual fee of 0.05%. The fund invests in TIPS with fewer than five years remaining until maturity. As a result, it will be more responsive to changes in CPI relative to longer-dated funds. In recognition of the quality of its underlying benchmark, its managers’ ability to replicate its bogy’s performance with precision, and its investor-friendly fee, we recently upgraded its Morningstar Analyst Rating to Gold from Silver.

Schwab US TIPS ETF SCHP tracks the Bloomberg Barclays U.S. Treasury Inflation-Linked Bond Index, which is includes all TIPS bonds with at least one year remaining until maturity. We recently upgraded the fund’s Morningstar Analyst Rating to Gold from Silver on account of its broad benchmark, rock-bottom fee (0.05%), and ability to hew tightly to its bogy.

[1] TIPS Liquidity and the Outlook for Inflation

[2] 20 Years in, Have TIPS Delivered?

/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30aa6d58-cc92-46c5-8789-50161dc392a9.jpg)