Who's Trounced the Fund Averages? We Have.

The average dollar invested in mutual funds has outgained the average fund. Why? Cheaper U.S. stock funds have crushed.

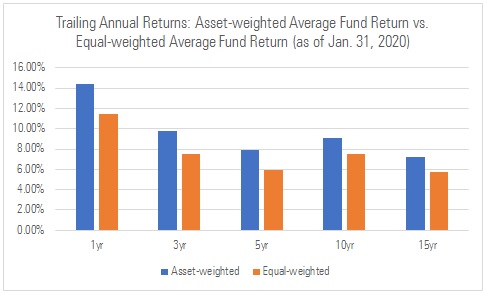

Executive Summary The average dollar invested in mutual funds earned a higher net return than the average fund did over the trailing one-, three-, five-, 10-, and 15-year periods ended Jan. 31, 2020. This performance has been consistent, with the average dollar topping the average fund in every calendar year we examined, including 2019 when it outperformed by nearly 3%. This outcome is largely explained by two factors--investors' preference for lower-cost funds, which have outperformed, and U.S. stock funds' strong returns, as such funds are home to a disproportionate share of assets. In particular, the strong performance of U.S. large-blend and large-growth funds has buoyed asset-weighted average returns.

Study We compiled the monthly net and gross returns and monthly net assets of all U.S. mutual funds for the 15-year period of Feb. 1, 2005, through Jan. 31, 2020. This included dead funds (that is, those that have been merged or liquidated away) but excluded fund of funds. The study does not include exchange-traded funds.

We multiplied each fund’s monthly return (net and gross) by its net assets as a percentage of all funds’ assets. To derive the asset-weighted average return for each month, we summed these products and compounded these monthly average returns to arrive at the compound annual returns for each period. To derive the simple average monthly return of all funds, we calculated the equal-weighted average return of all funds’ returns that month and then compounded those monthly equal-weighted average returns. We then compared the two return series.

Findings We found the asset-weighted average fund return--which approximates the average dollar's return--outpaced the equal-weighted average return over every trailing period ended Jan. 31, 2020.

- source: Morningstar Analysts

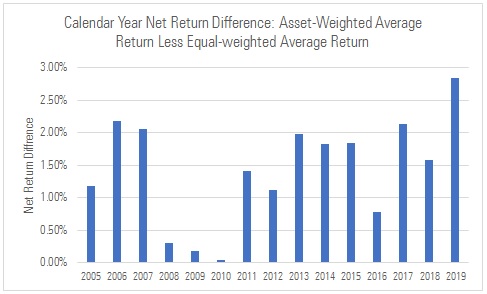

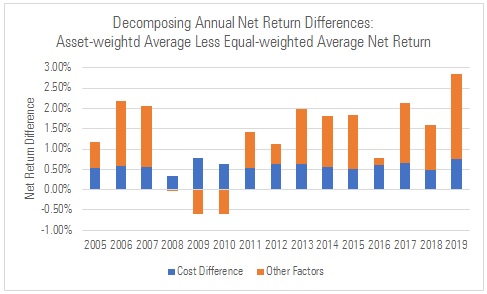

The average dollar consistently outperformed the average fund over this span. Indeed, the asset-weighted average return surpassed the equal-weighted average return in every calendar year we examined. In fact, the asset-weighted average return beat the equal-weighted average return by nearly 3% last year, the widest margin we found.

- source: Morningstar Analysts

A few factors largely explain this phenomenon. First, investors favored cheaper funds that outperformed. Second, investors overweighted outperforming asset classes and styles.

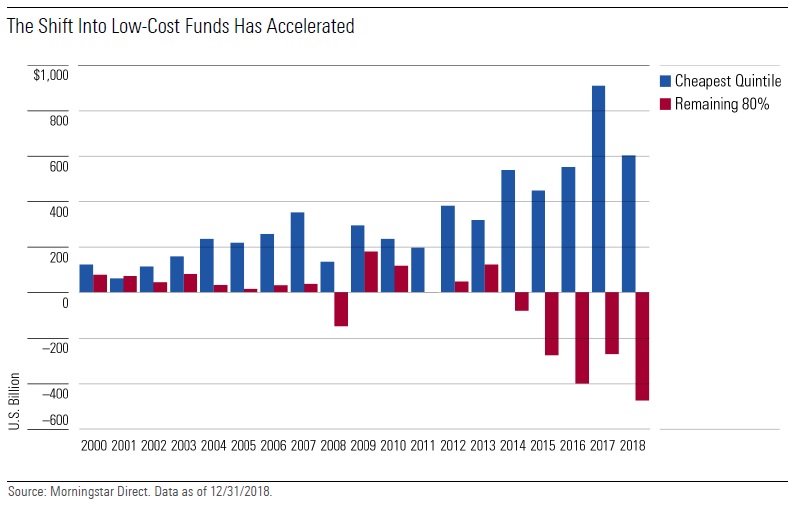

Low-Cost Funds Investors' shift to lower-cost funds has been well documented. For instance, in our annual fee study, we found that virtually all asset inflows were going to the cheapest 20% of funds.

- source: Morningstar Analysts

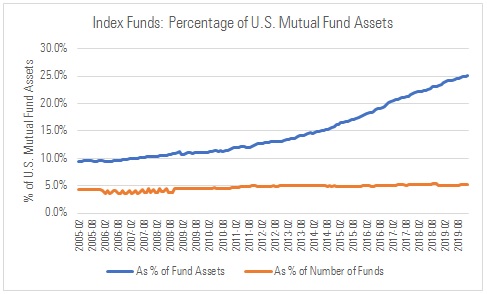

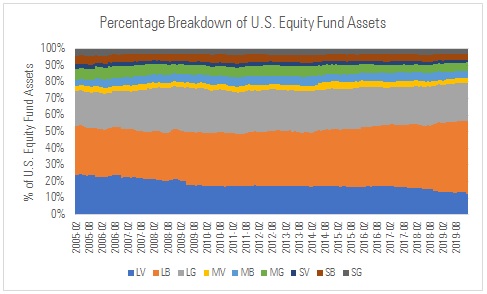

We can see that trend vividly in index funds’ share of mutual fund assets, which has risen significantly over the past 15 years, as shown below.

- source: Morningstar Analysts

While active funds still account for the lion’s share of fund assets, they outnumber index funds by a factor of around 19 to 1. This means index funds--our proxy for lower-cost funds--boast a disproportionate share of fund assets. Thus, when lower-cost funds outperform the fund averages, the asset-weighted average return will tend to exceed the equal-weighted average.

We can see this more clearly when we control for the effect of fees by calculating the difference between the asset-weighted and equal-weighted average return using funds' monthly gross returns. This allows us to decompose the outperformance into two parts--the portion explained by fee differences and the rest. What we find is that, in fact, some of the outperformance stems from fee differences but not all of it, as shown below.

- source: Morningstar Analysts

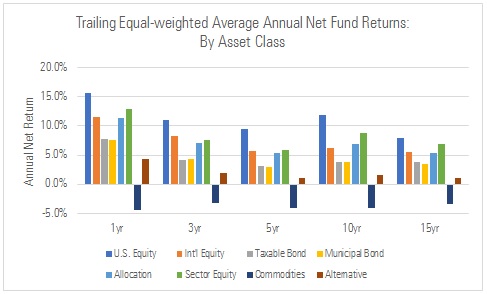

Asset-Class Mix The other big factor is the mix of assets by asset class and investment style. When investors allocate a disproportionate share of assets to an asset class that outperforms, the asset-weighted average return will top the equal-weighted return, and the opposite if the asset class underperforms.

Consider then that U.S. stock funds account for around one third of all funds but soak up over 44% of assets. What’s more, U.S. stocks have been the best performing asset class over every trailing period we examined. Taken together, these factors help to explain why asset-weighted average fund returns have been as good as they’ve been.

- source: Morningstar Analysts

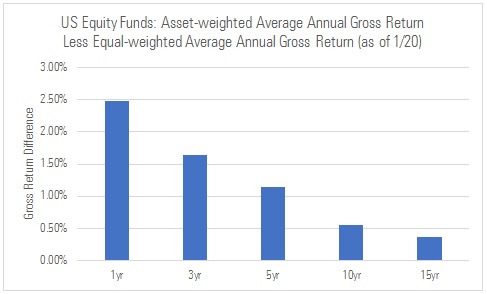

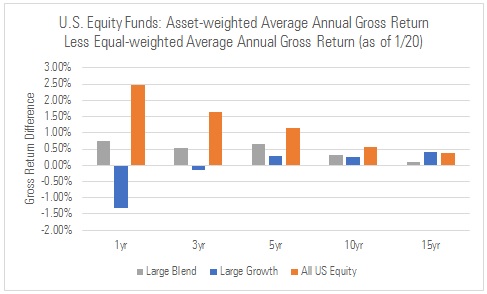

Remarkably, when we drill-down, we find that the asset-weighted average gross return of U.S. stock funds exceeded the equal-weighted average gross return over all trailing periods. That is, the average dollar in U.S. stock funds outperformed the average fund, even after controlling for fees.

- source: Morningstar Analysts

Why has this been the case? Investors have put most of their U.S. equity assets in large-blend and large-growth funds, and those categories have paced the market in recent years. To illustrate, large blend and large growth represented roughly two thirds of U.S. stock fund assets as of Jan. 31, 2020, but made up only 38% of U.S. equity fund share classes as of that date. This means investors’ stake in those styles well exceeded their share of the market by number of funds.

- source: Morningstar Analysts

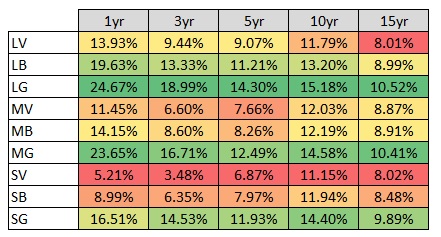

As mentioned, large blend and large growth have also been two of the best performing styles, as shown in the table below. When we take that together with the glut of assets in large-blend and large-growth funds, it largely explains why the average dollar has beaten the average fund.

- source: Morningstar Analysts;

trailing before-fee annual equal-weighted average returns as of Jan. 31, 2020.

This becomes more apparent when we go one more step and control for investment style--that is, Morningstar Category--by comparing the asset-weighted average gross return and equal-weighted average gross return of those two peer groups. When we do so, we find the gaps largely shrink away. In fact, we find that the average large-growth fund outgained the average large-growth dollar over the year ended Jan. 31, 2020.

- source: Morningstar Analysts

This reinforces the evidence that the average fund dollar has outperformed largely because assets have thronged in asset class and investment styles that have seen the strongest returns in recent years.

Conclusion Investors have fared quite well in recent years, with the average fund dollar handily outperforming the average fund. This is largely explained by investors' preference for lower-cost funds and their affinity for U.S. stock funds, to which they're overweight. While this trend could reverse if U.S. stock funds slump, the trend toward cheaper funds should help to ensure that the average dollar performs competitively when compared with the average fund going forward.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)