This ETF Provides Exposure to Well-Vetted Factors

Diversification is a powerful tool to control risk.

Diversification is almost always a good idea. While it's natural to think about diversification across securities, sectors, regions, and asset classes, it's a good idea to diversify across factors as well. Factors are common security characteristics that can help predict and explain returns. These include value, small size, quality, and momentum. While these factors have each generated market-beating returns over the long term, they also go through long stretches of underperformance that are difficult to predict. Value's lengthy dry spell is a great example. Investors looking to benefit from factor investing while not betting heavily on any one factor might consider iShares Edge MSCI Multifactor USA ETF LRGF.

This fund has a good chance to beat the market over the long term. Under our new ratings framework, which places a greater focus on fees, the fund warrants an upgrade to a Morningstar Analyst Rating of Silver from Bronze.

This index strategy astutely targets stocks with strong value, momentum, small-size, and quality characteristics, while taking comparable risk to the broad market. These common stock characteristics are known as factors. Although each of the four above-mentioned factors has been well-documented to produce market-beating performance, they can go through periods of underperformance. It is difficult to forecast when a particular factor may outperform, so diversifying across multiple factors can reduce the risk and magnitude of underperformance should a particular factor experience a dry spell.

The fund applies a unique integrated approach that considers the factor exposures of each holding holistically. So, it doesn’t necessarily own the cheapest stocks, or those with the best momentum, but rather targets those with the best combination of characteristics. This leads to more potent factor tilts than combining separate factor portfolios, as constituents work together. This should improve performance while pegging the fund’s risk to that of the broad, market-cap-weighted MSCI USA Index.

Despite the focus on four factors, the fund lands in the large-cap value Morningstar Category, as the value tilt has dominated over momentum since the fund’s inception. Although the fund’s value tilt is currently milder compared with the Russell 1000 Value Index, the fund typically has stronger small-size and profitability tilts compared with the Russell 1000 Value Index, which should give it an edge over the long term.

Process The fund fully replicates the MSCI USA Diversified Multi-Factor Index, which uses a holistic approach to target holdings that should deliver market-beating performance over the long run while limiting risk to the broadly diversified MSCI USA Index. It earns an Above Average Process Pillar rating.

This portfolio delivers strong factor tilts by targeting large- and mid-cap U.S. stocks with the best overall combination of value, momentum, small-size, and quality characteristics. This allows the entire portfolio to work together, helping it avoid stocks that look strong on one factor and weak on the others, which could dilute its factor tilts.

The fund uses an optimizer to maximize its exposure to stocks with the desired characteristics while keeping risk in check. It limits its risk to that of the MSCI USA Index, so the portfolio decreases tilts to factors as they become more volatile. As a result, the factor tilts will vary with time. As an example, over the course of its limited history since 2015, the fund has demonstrated a greater tilt to value compared with an equally weighted portfolio of individual value, momentum, quality, and small-size factor funds, which has been a headwind to performance as value has been out of favor.

The optimizer also limits sector and stock bets, which improves diversification. Sector weightings are held within 5% of the MSCI USA Index, which mitigates unintended bets that may not be well-rewarded.

Portfolio The fund has a high active share of 82% relative to the MSCI USA Index. As of this writing, the fund held 163 securities versus 643 for the MSCI USA Index. Top holdings by weight include technology names like Intel INTC and Apple AAPL, consumer names such as Walmart WMT and Target TGT, and utilities like Duke Energy DUK and Exelon EXC. Turnover has been consistent at about 45% over the trailing three years.

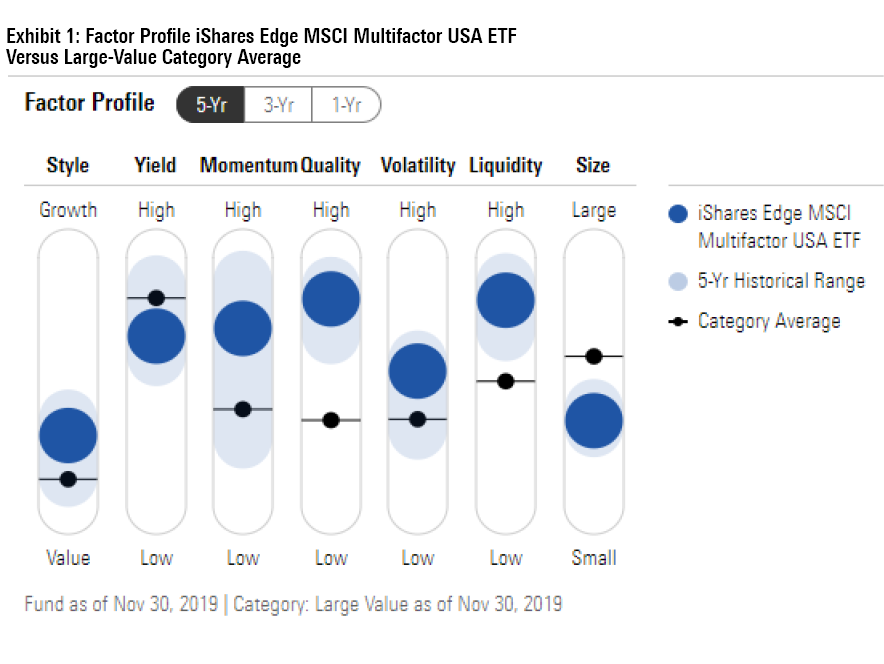

Overall, the fund’s factor tilts are within expectations, given the investment process. The Morningstar Factor Profile tool indicates that, compared with the average fund within the large-value category, this fund is slightly less value-oriented, although the value exposure has been stable since inception, while its momentum exposure has seen wider variation. Also, the fund’s quality tilt has been higher than average and the size tilt has been smaller. These were among the most stable and persistent tilts.

Consistent with these observations, the average price/book and price/earnings ratios of the fund’s holdings are lower compared with the parent index (MSCI USA Index) but not as low as the Russell 1000 Value Index. Similarly, the weighted average market cap of the fund’s holdings is roughly one third that of the MSCI USA Index. Additionally, the fund displays a lower debt/capital ratio compared with the MSCI USA Index, although its return on invested capital has been marginally higher.

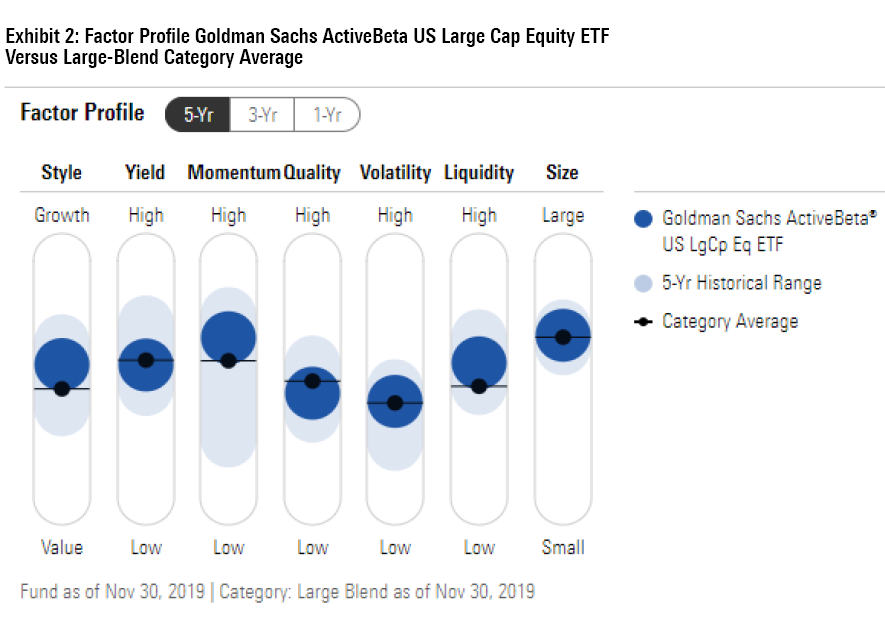

Morningstar’s Factor Profiles in Exhibits 1 and 2 show that this fund tends to have more-pronounced value, small-size, quality, and momentum tilts than Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC, which tends to take less active risk.

The fund constrains its sector weightings to the MSCI USA Index, so its sector weightings only differ from the Russell 1000 Value Index. As of this writing, the fund's tech sector weighting was twice as large as that of the Russell 1000 Value Index, while its financial services exposure measured half of the Russell 1000 Value Index's.

Performance From the fund's inception in May 2015 through December 2019, it beat the Russell 1000 Value Index by 77 basis points annualized, with marginally higher risk. However, it underperformed the MSCI USA Index by 162 basis points, with marginally higher risk.

The fund’s underperformance compared with its parent index owes to its value tilt. Its tilts to other factors were not enough to offset this headwind. The fund looks better compared against the Russell 1000 Value Index, not only because it tends to have a less pronounced value tilt, but also because it benefited from its tilts to momentum and quality.

From a stock-selection standpoint, favorable stock exposure in the tech, healthcare, and financial services sectors helped performance, while unfavorable stock exposure in basic materials and communication services hurt.

Over the trailing one- and three-year periods through December 2019, the fund ranked in the top quartile of the large-value category.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)