From the Archives: Pale Yale--What the Yale Model Can't Teach Retail Investors

The situations of the Yale Endowment Fund and most individual investors are worlds apart.

This column was originally published on Jan. 18, 2015.

Good for the Goose, but Not the Gander In 2000, Yale Endowment Fund's David Swensen published the most influential investment tome of this short millennium, Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment.

It was the book that launched a thousand funds.

Although ostensibly aimed at pension fund managers, Swensen's advice to extend Modern Portfolio Theory by diversifying into alternative investments was equally embraced by the retail market. The argument seemed sensible: It had worked wonderfully for Swensen, and who except for a few Tigers and Crimson does not wish to be Yale? However, retail investors implemented the strategy differently. Being either unable or unwilling to hold unregistered funds (hedge funds and private equity funds, for example), they sought instead the greater liquidity, visibility, and regulatory protection afforded by mutual funds. The fund industry responded, with alacrity. Now everyday investors could be like Dave.

Except that they were not, any more than Air Jordans made a player become like Mike. There are four major differences between Swensen's application of the Yale Model and Main Street's version: liquidity, quality, pricing, and taxes. In combination, those four items make the adaptation a pale copy of the original.

Trade Less, Make More Liquidity is the obvious starting point. Although alternatives are commonly thought to bring their benefits by giving access to a different "asset," that is not necessarily so. Often, their attractiveness comes from accepting lower liquidity, along with other unappealing features, in exchange for a higher expected return. (This column touches more on that theory.) For example, private equity and venture capital funds are solely equity investments, and hedge funds largely so. That equity exposure comes with dramatically reduced liquidity, as the funds can only infrequently be traded.

The differentiating factor, in other words, is not the ownership interest in the companies--which can be gathered by conventional means--but rather the bundle of uglies that come attached to those interests. The uglies bring the higher returns, as well as the somewhat lower correlations with the rest of the stock market (although not that much lower, as the diversification benefits of private funds are overstated). And retail investors do not hold the uglies. They hold instead shiny, clean mutual funds.

The advantage of foregone liquidity also holds true, as a general rule, for real estate. The performance of directly held properties is not the same as that of publicly traded real estate investment trusts (REITs), which tend to behave very much like small-company value stocks. But again, it's difficult for Main Street investors to emulate the institutions and buy directly held properties.

Not all alternatives are liquidity plays. Managed futures and unconstrained bond funds don't usually concede liquidity. However--and this bleeds into the third issue on the list--such funds tend to be expensive. Yale certainly pays a much lower fee for active management in those areas than does the typical Main Street shareholder.

The Right Manager, at the Right Price Quality is also an issue. Presumably, the most skilled investment managers run private funds, where they can reap higher profits than with a mutual fund, and without being pried by public eyes. To be sure, that's not the strongest argument, given the difficulty that active managers have anywhere of generating excess returns, and given that hedge funds (for one) have been distinctly ordinary during the past decade. But there is probably something to it.

There's also something to the notion that when it comes to finding the occasional gems, Yale is better positioned to manage the task than is a retail financial advisor (or investor, or Morningstar.com columnist for that matter). Swensen certainly believes so. "The only people who should get involved are sophisticated individuals who have significant resources and a highly qualified investment staff," he has stated. He would say that, of course. But while self-serving, the claim is also likely correct.

As a giant institution, Yale negotiates the fees that it pays its private-fund managers. With how much success is unclear; there's no public information about such matters. Nevertheless, the power to negotiate is one that Main Street lacks. What's more, alternative mutual funds tend to be among the most expensive registered funds in existence. Fund companies price them as specialized fare, demanding a premium fee. So while retail investors in theory should own cheaper alternatives than Yale, thereby partially compensating them for the liquidity premium that Yale collects (by owning private funds), in practice that is not so much the case.

The Taxman Cometh Finally, there are taxes. This has been the least-discussed topic of the four. Investment theory typically comes from academics who ignore the effect of taxes for simplicity, or from institutions that run tax-sheltered portfolios. However, most higher-net-worth investors, who tend to be those following Swensen's precepts (either directly or through an advisor), are largely invested in taxable accounts. It is no certainty that a portfolio that resembles Yale's will improve their fortunes; after all, to name but one example, hedge funds are notoriously tax-inefficient.

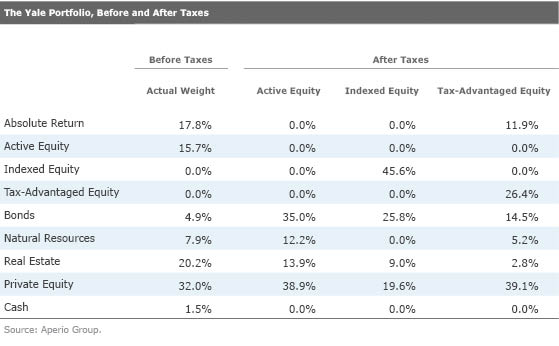

An investment firm, Aperio Group, has published a white paper entitled "What Would Yale Do if It Were Taxable?" The short answer: invest very differently indeed.

The authors derived the returns that Yale expects from each asset class through a process called reverse optimization (a nifty technique that solves for the unknown of the return forecasts by entering the knowns of the asset classes' historic standard deviations and correlations, assuming that the portfolio is efficient in the mind of its creator, and then solving for the plugs). They then estimated the tax burden for each asset class, re-ran the optimizer, and published the results.

The table contains one "Before" column and three "After" columns. That is because the authors considered three flavors of equity investing: traditional active management, index funds, and tax-advantaged management through separate accounts that can generate annual tax losses. (The latter is included because that is the firm's business.) The details of the changes are unimportant; the key is that considering taxes turns the portfolio upside down, no matter how the equity position is invested.

Also worth noting is Yale's current position in index stocks: zero. Swensen is happy to pursue active management at the right price, which he can command. As this column stated in August in pointing out that Vanguard's active stock funds are fully competitive with its index funds (on a pretax basis), low-cost active management is a perfectly valid strategy. It's hard to fill a portfolio with sufficiently cheap mutual funds, though. Active managers won't work for Main Street at the price that they charge Yale.

Summary There's nothing wrong with the Yale Model's general precept to diversify as much as reasonably possible. Harry Markowitz won a Nobel Prize for demonstrating the gains from adding imperfectly correlated assets, and deservedly so. Nor is there anything wrong with Swensen's execution. While the Yale Endowment Fund took some heat for its 2008 problems, it nonetheless has outperformed most of its institutional competitors during the past decade, as well as the vast majority of retail portfolios. It has been just fine.

However, there are very few specifics to be learned from Yale's portfolio. It cannot be for Main Street investors anything more than a shining example of the principle of diversification (and of the advantages of conceding liquidity). The conditions are too different to warrant anything more.

Note: Since this article was published, Yale has no longer "outperformed ... the vast majority of retail portfolios," because even with their 2020 struggles, U.S. stocks have performed relatively well, and everyday investors typically own more U.S. equities than does Yale's portfolio. That relative performance may well reverse. However, the situational differences between Yale's endowment fund and individual investors' circumstances remain.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)