Time for a Second Look at REITs

Real estate has lagged lately, but it’s still worth including in a portfolio.

Real estate investing is one of those topics that spurs division. From time to time it’s either lauded as investing’s saving grace or derided as something to be avoided at all costs. In this piece, I’ll take a more balanced look at the pros and cons, as well as the role real estate holdings can play in a portfolio.

First, some definitions are in order. For the sake of this article, I’ll focus on investing in equity real-estate securities, primarily real estate investment trusts. REITs are companies that own and/or operate real estate properties, including shopping malls and other retail outlets, office buildings, warehouses, apartment buildings, and hotels.

Key Findings

- Real estate (specifically REITs, as measured by the FTSE NAREIT All Equity REITs Index), has lagged the broader market for the past four years, but outperformed the S&P 500 by more than 1 percentage point per year, on average, over the period between May 1972 and December 2019.

- Real estate is a cyclical industry that has suffered sharp losses during periods of financial crisis, such as 1990 and 2008.

- Real estate has generally shown a low correlation with both equities and fixed-income securities, and can improve risk-adjusted returns when added to a portfolio over longer periods.

- Real estate has historically held up well during periods of higher inflation.

- REITs are required to distribute 90% of their taxable income to shareholders and therefore typically work best in tax-deferred accounts, although recent tax-law changes allow taxpayers to take partial deductions for pass-through income received.

- It's worth carving out a portion of your portfolio for real estate, but keep in mind that the industry is highly cyclical and subject to idiosyncratic risks.

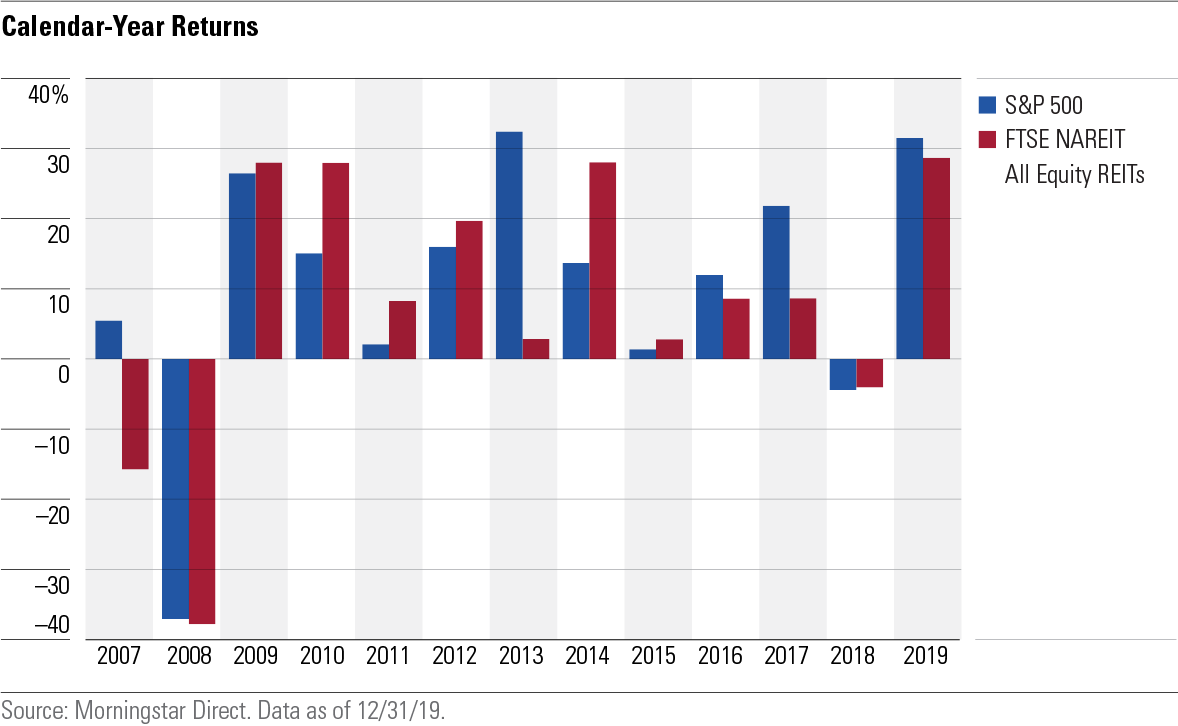

The Long-Term Performance Edge From a short-term performance perspective, the real estate sector doesn't look great. After bouncing back nicely in the wake of the 2007-08 financial crisis, real estate has lagged the broader market for more than four years running. Things look better over longer time periods, though. Over the period from May 1972 through the end of 2019, the FTSE NAREIT All Equity REITs Index posted annualized returns of 11.8% per year, compared with 10.6% for the S&P 500 over the same period.

Much of that performance owes to a strong rebound in the wake of the 1990 banking crisis. After the commercial building boom of the 1980s, the real estate market suffered heavy losses starting in 1989. With loan values collapsing and banks in crisis, new construction ground to a halt in 1990. This reduction in supply set the stage for a rally when the economy started improving in the early 1990s. At the same time, the REIT industry was experiencing huge growth in investor demand. As a result, the sector posted double-digit total returns during most of the 1990s and early 2000s.

That trend abruptly reversed in 2007, when the FTSE NAREIT Index dropped 17.8%, followed by a 37.3% loss in 2008. Commercial real estate suffered outsize losses during the credit crisis because there was less debt financing available for transactions; at the same time, many investors were forecasting increased pricing pressure and lower occupancy rates. As the market recovered over the next few years, REITs outperformed the broader market up until 2013, when the spike in interest rates made other income-producing assets more attractive.

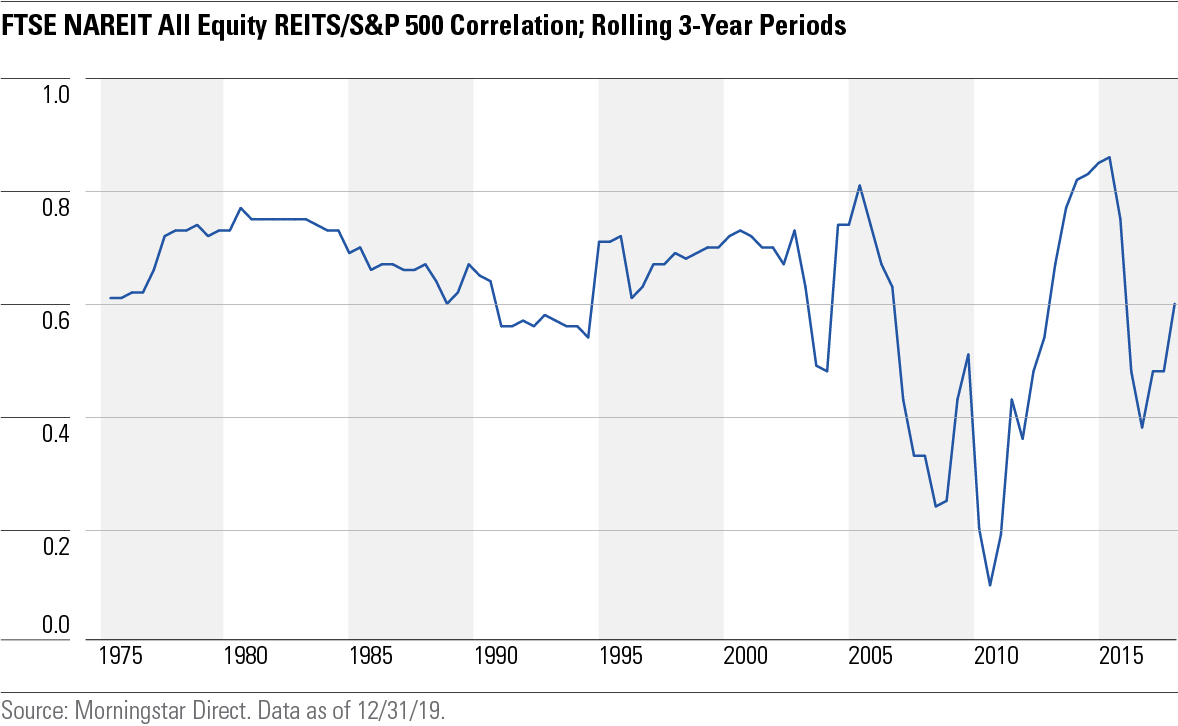

Diversification Benefits Because its performance can be highly cyclical and idiosyncratic, real estate has generally had a lower correlation with both equities and fixed-income securities than most other asset classes. Over the period from 1972 through Dec. 31, 2019, the correlation between the FTSE NAREIT Equity REITs index and the S&P 500 has averaged about 0.56. (A correlation of 1.0 would indicate two assets moving in perfect lockstep, and zero would indicate no correlation). The correlation with fixed-income securities (as measured by the Bloomberg Barclays U.S. Aggregate Bond Index) has been even lower, averaging 0.24 over the period from December 1976 through Dec. 31, 2019.

Because they don’t usually move in tandem with equity and fixed-income assets, adding REITs to a portfolio can improve risk-adjusted returns, but that’s not always the case. Because the collapse in the commercial real estate market partly precipitated the broader financial crisis, both real estate funds and the overall market lost similar amounts (40% and 37%, respectively), during the 2008 market downturn.

It’s also worth noting that correlation patterns can change dramatically over time, as shown in the chart below. Since 1975, the rolling three-year correlation between REITs and the broader equity market has been as low as 0.10 (in early 2004) and as high as 0.86 (in early 2015). The odds are that you’ll get some diversification benefit from investing in real estate, but there aren’t any guarantees.

In addition to potential diversification benefits, real estate also holds value as a hedge against inflation. Because property owners can pass along most increases in their underlying costs to tenants by raising lease prices, real estate boasts a built-in inflation hedge. It can also benefit from greater demand during periods when surging economic growth leads to higher inflation. While inflation hasn’t been a major issue for the past couple of decades, real estate has historically held up well during periods of higher inflation. Over the period from 1972 through the end of 1979, for example, inflation averaged about 8% per year in the United States. The FTSE NAREIT All Equity REITs Index posted average annual returns of 10.64% over the same period, outpacing both inflation and the broader equity market.

Yield and Tax Issues Because they're required to distribute nearly all their income to shareholders, REITs can offer above-market yields. At the individual equity level, U.S.-based stocks in the real estate sector have paid out an average yield of 7.26% over the trailing 12-month period ended December 2019. This yield advantage is much more muted on the mutual fund side, though. The average real estate fund has paid out 2.67% over the same period. That compares favorably with current yields for the S&P 500 (about 2.2%) and the 10-year Treasury (about 1.5% as of this writing), but it's not a huge advantage. That partly reflects the drag of underlying expenses, which average about 0.92% of assets for real estate mutual funds.

Because of their legal structure, REITs don't pay corporate taxes on their earnings. Instead, they're required to pay out at least 90% of their income as dividends to shareholders, who eventually pay ordinary income taxes on the dividends they receive. For that reason, we've typically recommended that investors only hold REITs and REIT funds in tax-deferred accounts, such as 401(k)s and IRAs. However, the tax-law changes that went into effect in 2018 make REITs and REIT funds slightly more attractive for taxable accounts. Taxpayers can now deduct up to 20% of income earned through qualified publicly traded partnerships and REITs that operate as pass-through entities. The IRS has issued guidance clarifying that this deduction also applies to taxpayers who own mutual funds that invest in REITs. (Note: Check with your tax advisor for more details about this deduction.)

Real Estate's Role in a Portfolio Another important consideration is how much of your portfolio to invest in real estate. If you take a "market basket" approach, which uses the overall size of the market as a starting point for setting portfolio allocations, you'd end up with a significant chunk of your portfolio in real estate. As of the end of 2018, the U.S. commercial real estate market totaled an estimated $16 trillion, compared with about $45.8 trillion for equities and $39.2 trillion for outstanding debt based on 2017 data from the Securities Industry and Financial Markets Association. In other words, real estate translates into a roughly 16% slice of the total market pie.

Not coincidentally, pensions and endowments often target 10% to 20% of their total assets for real-estate holdings. Some investment experts have also argued in favor of sizable real estate weightings. For example, Princeton University economics professor Burton Malkiel (famous for writing "A Random Walk Down Wall Street") recently advocated that longer-term investors invest as much as 15% to 25% of their equity holdings in real estate.

Given that real estate is both highly cyclical and subject to periodic downturns, though, I’d hesitate to recommend investing quite that much. While it’s tough to pin down the “right” number for any allocation, we can look to target-date funds for some examples of best practices on the institutional side. On average, target-date funds that invest to build assets for a planned retirement date of 2035 have about 72.3% of their assets invested in equities, of which about 4.3% is invested in real estate (including REITs and real estate operating companies). That translates into a weighting of about 6% equities.

While REITs can help fill a role in providing income during retirement, keep in mind that they’re ultimately equity securities, not bonds. Their risk profile is much more like stocks than fixed-income securities. So if you decide to carve out a portion of your portfolio for real estate and have an overall stock/bond mix that you’re aiming for, your REIT holdings should count toward the equity total.

Investment Options As mentioned above, individual stocks can offer significantly higher yields than those offered by funds because they don't have additional layers of costs, such as management fees and operating expenses. On the downside, they tend to be more volatile than mutual funds or ETFs. In addition, many REITs and other real estate stocks focus on a specific type of real estate (such as healthcare, hotels, industrials, office space, or residential properties) or specific regions of the country, which can make them more prone to downturns in the areas they invest in.

On the mutual fund side, there are two lower-cost standouts: DFA Real Estate Securities DFREX, which carries a Morningstar Analyst rating of Gold and is only available through certain financial advisors or retirement plans; and Silver-rated Vanguard Real Estate Index VGSIX. Fidelity Real Estate Income FRIFX has also earned above-average risk-adjusted returns and an attractive 12-month yield by investing in both debt and equity securities. There are also roughly 30 exchange-traded funds focusing on real estate, almost all of which have lower expense ratios than their mutual fund brethren.

On balance, it’s worth setting aside a portion of your portfolio for real estate given the potential for diversification benefits and long-term outperformance. Just make sure you’re willing to suffer through some periodic downturns along the way.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)