Low-Vol Strategies Are Not the Same as Value, Profitability

Low-volatility strategies have different intended outcomes compared with value and profitability.

One critique of defensive-equity (low-volatility) strategies is that they're repackaged versions of two known investment styles: value and profitability. That statement implies that defensive strategies are nothing new, and investors should forgo them in favor of others that explicitly target the value and profitability factors.

There is some truth to this statement, but context matters. Low-volatility strategies have had significant but inconsistent exposure to both value and profitability. Therefore, investors who want exposure to these factors are better off with a strategy that explicitly targets those types of stocks. Those who want to reduce risk should stick with defensive strategies but should not assume they're directly exposed to value, profitability, or both.

Repackaged Factors? Robert Novy-Marx, a professor at the University of Rochester and a consultant for Dimensional Fund Advisors, conducted a thorough analysis of defensive stocks in his paper "Understanding Defensive Equity." [1] He argued that low-risk stocks (those with lower volatility and less exposure to market risk) also tended to trade at lower valuations and be more profitable than the broader market. Hence, their value and profitability characteristics drove their performance, and their low-risk nature didn't present a new phenomenon.

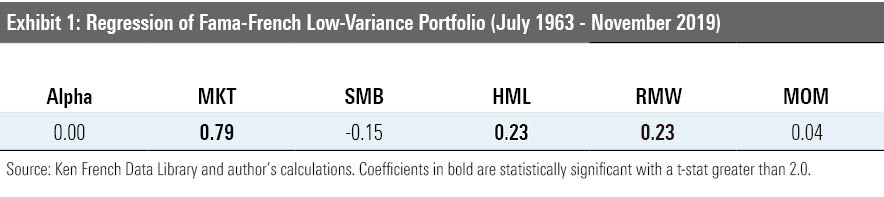

I tested the factor overlap that Novy-Marx addressed in his paper using data from the Ken French Data Library. I included five known drivers of return in the analysis: the market, size (small caps), value, profitability, and momentum. Most low-volatility indexes have a limited history, so I used the low-variance (low 20) portfolio that is also available from French's site. Monthly returns for this portfolio date back to July 1963--a much longer record than was available for any strategic-beta low-volatility fund or index.

Exhibit 1 shows the results from the regression. The market coefficient, a measure of the portfolio's exposure to market risk, was less than 1--indicating that the portfolio was less risky than the broader U.S. stock market. The portfolio also had statistically significant exposure to value (the high minus low, or HML, coefficient) and profitability (the robust minus weak, or RMW, coefficient). Simply put, these results support Novy-Marx's observation that defensive stocks have historically overlapped with the value and profitability factors.

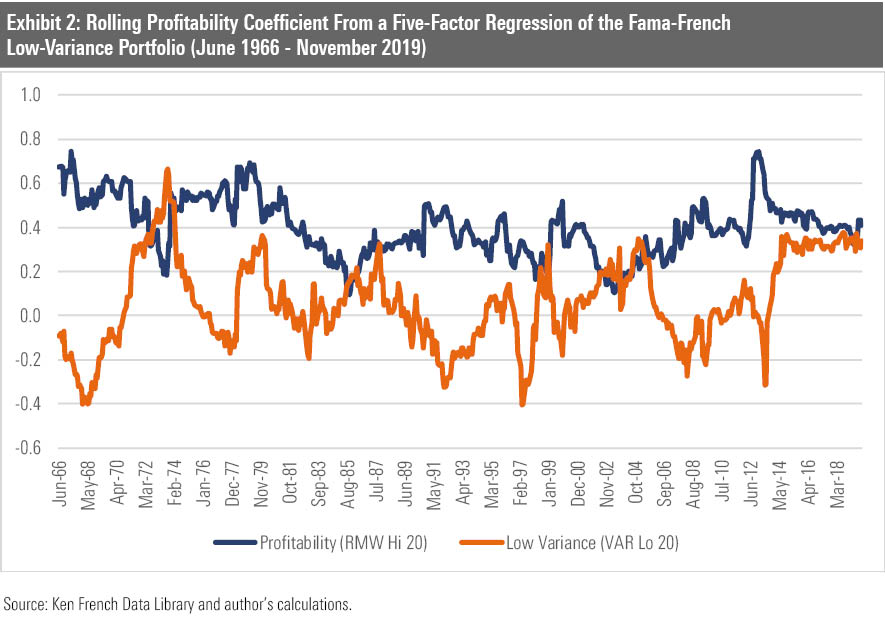

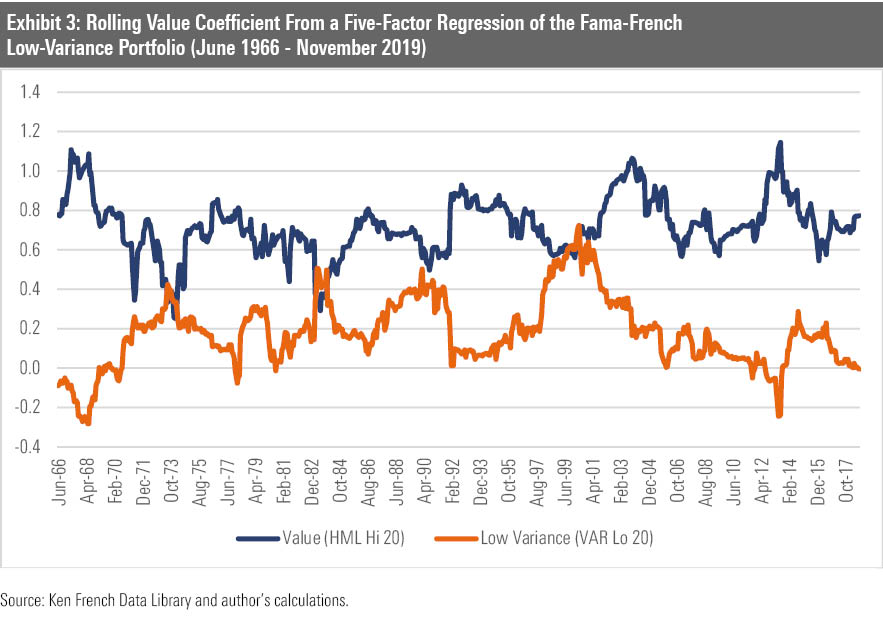

But there's more to this story that can't be captured in a single regression. To complement the above analysis, I ran a 36-month rolling regression from July 1963 through November 2019 to see how the low-variance portfolio's factor exposure changed over time. The results for the value and profitability coefficients of the low-variance portfolio are shown in Exhibits 2 and 3 alongside those for individual value and profitability portfolios.

This more detailed analysis shows that the low-variance portfolio's exposure to value and profitability was less consistent over time than portfolios that focused on the individual value and profitability factors. The takeaway is that investors shouldn't look at defensive stocks as a way to get clean exposure to the value or profitability factors. Defensive strategies don't explicitly target stocks trading at lower valuations or those that are more profitable relative to the broader market. Their exposure to both will ebb and flow over time as those factors become more or less risky.

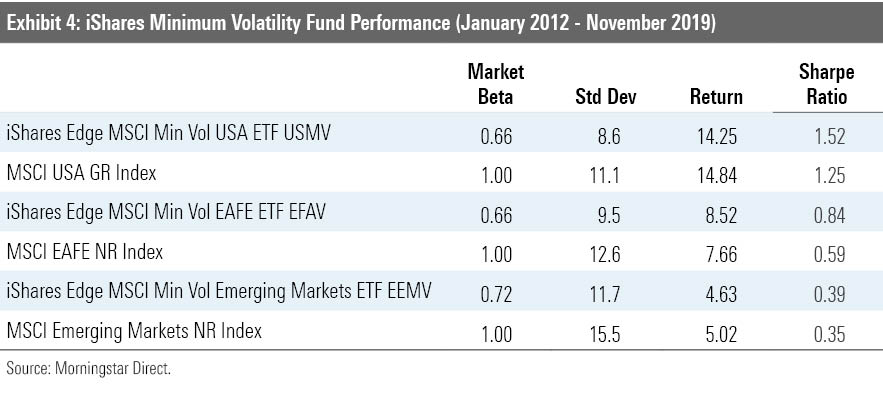

The Goal Is Risk Reduction Defensive strategies shouldn't be written off. Low-volatility strategies, as their name implies, attempt to build portfolios that are less risky than the market. To that end, they have been effective. Exhibit 4 compares the live track record of the suite of iShares Edge Minimum Volatility ETFs with their respective parent indexes. All three funds had lower standard deviations than their respective parent benchmark. Less risk (a lower standard deviation) also means these funds had higher risk-adjusted returns, as measured by their Sharpe ratios.

The live track record of these three funds speaks to the advantages and disadvantages of defensive strategies. From a total-return perspective, iShares Edge MSCI Min Vol USA ETF USMV underperformed the MSCI USA Index. Taking on less risk in a strong bull market was the main reason it lagged the cap-weighted benchmark. On the other hand, iShares Edge MSCI Min Vol EAFE ETF EFAV and iShares Edge MSCI Min Vol Emerging Markets ETF EEMV had total returns that beat their respective parent benchmarks. Both developed- and emerging-markets indexes struggled (by historic standards) over this period. So, taking less risk than the market resulted in mildly better total returns.

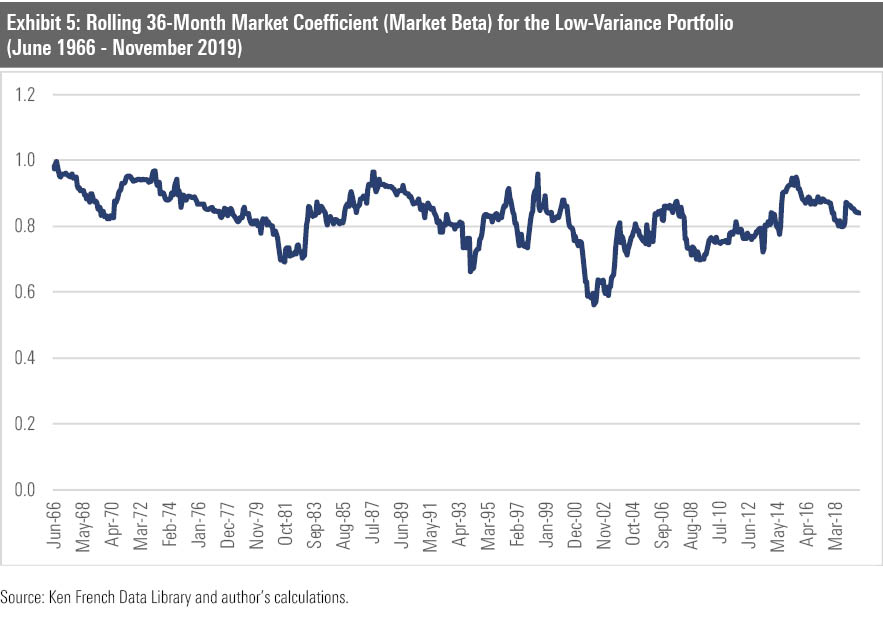

To summarize, low-volatility strategies should lag a cap-weighted index during bull markets but hold up better during downturns. They're more appropriately viewed as strategies that are less risky than the broader market. As such, their market coefficient, or market beta, should be lower than 1. Exhibit 5 shows that the market beta of the low-variance portfolio consistently ran below 1 between July 1963 and November 2019.

What's clear is that low-volatility strategies are an effective means to cut back on risk, but they won't always perform as well as a cap-weighted index. Thus, investors should view them as a risk-reducing strategy, not one that is expected to deliver market-beating total returns. They're a great alternative for investors who want exposure to stocks but with less risk than a cap-weighted index, and they shouldn't be used as a substitute for dedicated value and profitability strategies.

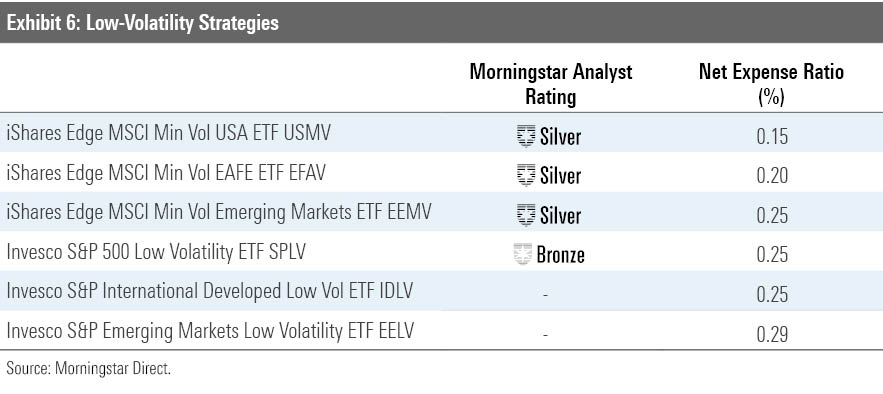

Exhibit 6 summarizes the more popular low-volatility funds that investors can access today, along with their expense ratios and Morningstar Analyst Ratings (where applicable). The suite of funds offered by iShares uses a different portfolio construction process than the Invesco suite. Those interested in evaluating the trade-offs of their processes should check out "A Framework for Evaluating Low-Volatility Funds," authored by my colleague Alex Bryan. The framework he presents explains the thought process we use to evaluate low-volatility strategies when assigning Analyst Ratings.

Reference 1) Novy-Marx, R. 2016. "Understanding Defensive Equity." NBER, Working Paper 20591 (March): http://rnm.simon.rochester.edu/research/UDE.pdf.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)