Best of Breed International Equity Funds

The data suggest you should focus on passively managed funds for the majority of your portfolio's international exposure, but it doesn't have to be an either/or choice.

When you’re thinking about whether to use active or passive funds for your portfolio, it’s worth considering several different factors, including how much time you have available to research, what kind of asset-class exposure you need, and whether you have the patience to put up with potential underperformance from active managers. For many investors, an all-index approach is the easiest and least time-consuming way to build a portfolio aligned with their goals and risk tolerance. It's also typically more tax-efficient for assets held in taxable accounts.

If you haven’t ruled out active funds for a portion of your portfolio, though, it’s worth taking a deeper dive into the areas where active management has the potential for outperformance, as well as areas where there it’s tough to add value versus a benchmark. A few weeks ago, I wrote about how to apply our research where active management has the greatest potential payoff or penalty for different types of domestic-equity funds. The research looked at the range of pre-fee alphas, a measure of value added versus an index, for different categories of funds. When returns tend to be tightly clustered, there's less of a potential payoff for active management. When there's a wider dispersion of returns, there's a greater potential reward--or penalty--for straying from a market benchmark.

For domestic-equity funds, investment styles such as large value and large blend tend to have the smallest dispersion of returns. With a narrow range of returns, the potential payoff from active management is relatively small, so it makes sense to focus your efforts on passively managed funds in these areas. As you move down and to the right in the Morningstar Style Box, toward smaller-cap and more growth-oriented funds, there’s a wider dispersion of returns and therefore a stronger case for considering actively managed funds.

The research shows a similar pattern for international equity funds, but the range of pre-fee alphas is generally higher on the international side. This makes intuitive sense. Global markets are bigger and more wide-ranging than any single market. International equity returns in a portfolio depend on numerous factors, including country selection, currency movements, industry returns, and stock selection. And international stocks tend to be less widely researched than their domestic counterparts. So it shouldn’t come as a surprise that active managers for international-equity funds tend to have a wide range of results as measured by pre-fee alpha. In fact, no international-fund Morningstar Categories had average pre-fee alphas in the lowest range of 1.51% to 1.75%. By contrast, both the large-value and large-blend categories landed in the lowest range on the domestic equity side.

The chart below illustrates the range of pre-fee alphas for actively managed international equity funds. Morningstar’s international equity-fund categories don’t all map to the style box, so we plotted the categories a bit differently here. The areas shaded in light green have the smallest dispersion of returns, while the dark green areas had the biggest range of returns.

These results are similar to the patterns we saw on the domestic equity side. Funds focusing on larger-cap stocks across a broad range of markets had the smallest range of pre-fee alphas. Even funds focusing on emerging markets, which are often thought of as less efficient than developed markets overall, had average pre-fee alphas on the lowest end of the spectrum. As we found on the domestic-equity side, the dispersion of returns was a bit higher for the large-growth category and higher still for smaller-cap stocks.

Even though no international-fund categories landed in the lowest range of pre-fee alphas, the dispersion of returns for most broadly diversified categories was still relatively low, meaning that there’s less of an opportunity for active managers to capture extra returns. From a portfolio-building perspective, these results suggest that it makes sense to focus on passively managed funds for the majority of your portfolio’s international exposure. If you’re trying to keep things simple, you really only need one or two international funds, and it makes sense to focus on the categories that give you the broadest exposure to international equities: foreign large-blend and diversified emerging-markets.

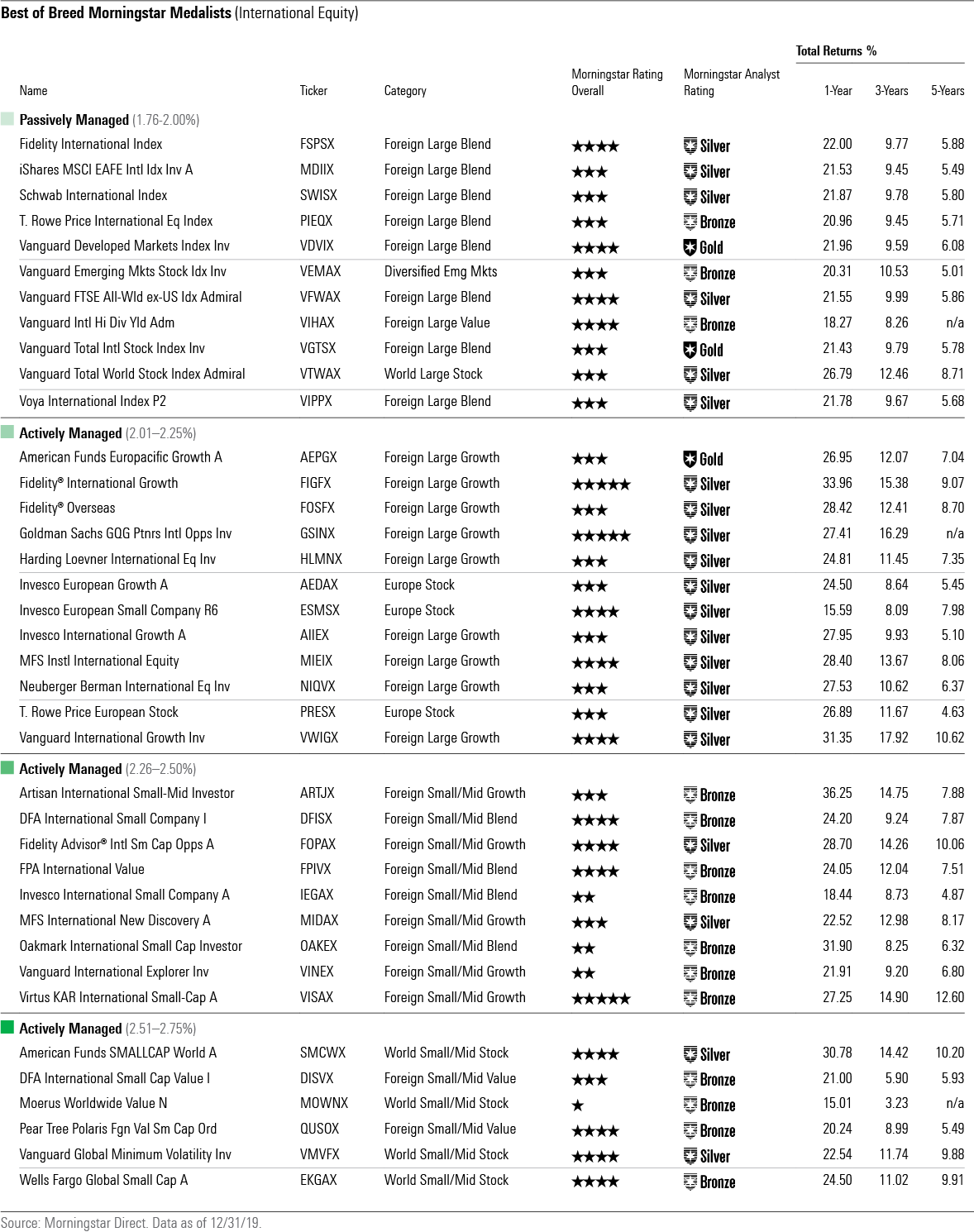

The table below highlights some of Morningstar’s Medalist funds, focusing on passively managed funds for foreign large blend and large value, world large-cap stock, and diversified emerging markets, where active managers may have a difficult time adding value, and actively managed funds for the other areas.

Passive Standouts for Core International Holdings As mentioned above, the narrow range of pre-fee alphas argues in favor of leaning on index funds for categories that can give you broad international-equity exposure. In the foreign large-blend category, there are several excellent funds to choose from, including Vanguard Total International Stock Index VGTSX, which tracks the FTSE Global All Cap ex US Index, and Fidelity International Index FSPSX, which tracks the MSCI EAFE Index. The two indexes are slightly different: the FTSE Global All Cap Index focuses on developed markets, whereas the MSCI EAFE also covers emerging markets (about 19% of the index).

If you’re looking for a separate emerging-markets fund, Vanguard’s Emerging Markets Stock Index VEMAX offers exposure to a broad range of markets in Asia, Latin America, and Eastern Europe. Although the fund’s Investor share class is closed to new investors, the Admiral shares are still available with a minimum initial purchase of $3,000.

The world large-stock category might be appealing because it offers global equity exposure in a single package. One of the better funds here is Silver-rated Vanguard Total World Stock Index VTWAX, which tracks the FTSE Global All-Cap Index. World large-stock funds can be a bit tricky to use from a portfolio perspective, though, because you have to look under the hood to determine how much international-stock exposure you’re really getting. Funds in the world-stock category have non-U.S. stock weightings ranging from as low as 15% of assets to as high as 74% of assets. If you decide to invest in a world-stock fund, make sure the level of international exposure is in line with what you expected and check for overlap with other international-focused funds you might own.

Active Picks for More-Specialized Areas Shifting to the right of the alpha spectrum, the foreign large-growth and Europe stock categories have generated pre-fee alphas ranging between 2.01% and 2.25%. That means there's more room for active managers to either outperform or underperform by straying from market benchmarks. The foreign large-growth category includes the venerable American Funds Europacific Growth AEPGX, which has excelled by using a team of managers who each independently run portions of the portfolio. The category also includes several other diversified foreign-stock funds that don't necessarily label themselves as growth but happen to tilt toward that area of the style box. This orientation can boost returns during more bullish markets; in 2019, for example, the average foreign large-growth fund posted total returns of 27.83%, compared with 21.59% for the foreign large-blend category.

The Europe stock category is another area that had a slightly higher range of pre-fee alphas. These funds offer specialized regional exposure that you don’t necessarily need for a diversified portfolio. However, contrarian investors may want to tilt a small portion of their portfolios to this area after it’s been out of favor. For example, the Europe stock category lagged more diversified foreign large blend funds in 2017 and 2018, but subsequently pulled ahead in 2019.

Small- and mid-cap international funds demonstrated the highest range of pre-fee alphas, suggesting that there’s more potential for active management to add (or subtract) value. These areas can also be attractive because they’re less closely tied to the U.S. markets and therefore offer better diversification benefits than larger-cap issues. Fidelity International Small-Cap Opportunities FSCOX draws on Fidelity’s extensive analyst team to find companies with a competitive advantage that can benefit from longer-term industrywide trends. MFS International New Discovery MIDAX has also delivered above-average long-term returns while keeping risk in check, although it’s heavier on mid-cap stocks and lighter on small-cap issues than some of its peers.

Other standouts here include American Funds SMALLCAP World SMCWX, which currently has close to equal stakes in U.S. and non-U.S.-based stocks. Like Europacific Growth, it relies on a fundamental, research-based approach and divides its portfolio among multiple managers. Vanguard Global Minimum Volatility VMVFX, which also has roughly equal stakes in U.S. and non-U.S. stocks, has kept risk well below average by targeting stocks from the FTSE Global All Cap Index with lower levels of expected volatility or different performance characteristics (lower correlations) that can help reduce the portfolio’s overall risk profile.

Overall, there’s much to be said for choosing either active or passive funds depending on where active management has the greatest chance of adding value. But keep in mind that the potential for outperformance cuts both ways: There’s no guarantee that an actively managed fund will deviate from its benchmark on the upside rather than the downside. For that reason, actively managed funds can be more difficult to own. If you’re not willing to sit tight through the occasional off year--or if you’re not willing to put in the extra time to research and monitor actively managed funds--you’re better off sticking with funds that track an index rather than trying to deliver alpha.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)