Vanguard's Unique ETF Structure Presents Unique Tax Risks

It is important investors be aware of this risk, but it isn't worth losing sleep over.

A version of this article previously appeared in the December issue of Morningstar ETFInvestor. Click here to download a copy.

Exchange-traded funds' structural advantages make them more tax-efficient than traditional open-end mutual funds. But not all ETFs are built alike. Most of Vanguard's ETFs were established as separate share classes of the firm's mutual funds. There are pros and cons to this setup, which I'll outline here. I'll focus on the unique tax risk faced by investors in the ETF share class of Vanguard's funds, steps the funds' managers can take to mitigate this risk, and whether it is a risk worth taking.

Part Mutual Fund, Part ETF Vanguard holds a patent on a unique fund structure, a mutual fund/ETF hybrid. Most of its ETFs were bolted onto existing mutual funds. This is distinct from its competitors' ETFs, which stand on their own. Vanguard's ETF-as-a-share-class structure has some key advantages over a stand-alone ETF:

- Economies of scale. When the ETF share class of the Vanguard Total Stock Market Index fund was launched in May 2001, the mutual fund share classes had a combined $24 billion in assets under management. This scale offered important benefits to investors in the new ETF shares. Most notably, it allowed the ETF share class to sport a competitive fee from day one. At the time, the Admiral share class of the fund charged 0.15% per year. The ETF, having been simply fastened onto an existing multibillion-dollar mutual fund, was priced at parity.

- Prospective tax efficiencies. Investors in both the mutual fund and ETF share classes of Vanguard's funds stand to gain tax efficiencies from the hybrid structure. Any losses realized by sales of depreciated securities from the fund can be deposited in the fund's bank of tax-loss carryforwards to offset realized gains later. This is a small win for ETF share class investors over a stand-alone ETF. Mutual fund share class investors chalk up a more significant victory, as they gain the ability to purge low-basis positions from the portfolio in a more regular fashion via the ETF share class via in-kind redemptions.

- A more-representative portfolio. Another benefit of having the pre-existing scale of the mutual fund share classes in place is that it allows the ETFs' portfolios to be more representative of their benchmark indexes right out of the gate. Stand-alone funds with small asset bases may have to own a smaller sample of the securities in their benchmarks until they gather enough assets to more fully replicate their bogies. These benefits are directly measurable. They can be seen in high-fidelity index-tracking performance from these ETFs' earliest days.

- Greater flexibility in managing creation baskets. Vanguard's portfolio managers have somewhat greater latitude when it comes to investing new money coming into the fund relative to a freestanding ETF. Specifically, they might have more latitude to customize creation baskets for the ETF share class. If there are certain portfolio holdings that would be more efficiently added to the fund's portfolio by investing in them directly using cash on hand, portfolio managers can exclude them from ETF creation baskets. While this is a degree of flexibility that's not available to portfolio managers helming stand-alone ETFs, I'm skeptical that it yields measurable benefits to investors in the fund.

But there is a potential drawback to this structure. Shareholders of the mutual fund and ETF share classes share everything--good and bad. This means that ETF shareholders could receive taxable capital gains distributions that result from the actions of investors in the mutual fund share classes of the same fund.

An untimely mass exodus on the part of mutual fund shareholders could unlock capital gains for everyone left holding the fund, ETF investors included. There has been one notable instance where this stung Vanguard ETF shareholders in the past. Specifically, in 2009, the Vanguard Extended Duration Treasury Index fund distributed a capital gain of $11.11 per ETF share. This amounted to 10.7% of the fund's average daily net asset value per share for the year. The distribution was spurred by a combination of a brief spike in Treasury prices that began in late 2008 and significant outflows from the Institutional share class of the fund during the first six months of the year, which equaled one fourth of its end-December 2018 assets. The ETF share class (which represented 17% of fund assets as of the end of 2018) saw modest inflows during this period. This risk isn't present in ETFs that aren't linked to a mutual fund.

Don't Fret This tax risk, which is unique to Vanguard's patented structure, will always be present. That said, I don't think it is something investors in Vanguard ETFs should fret over. Here's why:

- Vanguard investors are generally a well-behaved bunch. The probability that a large contingent of Vanguard investors would rush for the exits is low. Vanguard investors don't tend to trade much, and when they do, the size of their trades tends to be small.[1] Also, a large portion of the assets invested in the firm's largest index funds is tied up in employer-sponsored retirement plans. These assets tend to be particularly sticky, given that regular investment is often automated and there are incentives to keep them in place. These factors mean that a wave of selling that might precipitate sizable capital gains distributions is highly unlikely.

- The risk can be managed. Vanguard can take steps to manage this risk. Portfolio managers can meet redemptions from the mutual fund share classes with cash flows from income, thus avoiding the need to sell securities. They can also selectively sell tax lots that have depreciated in value. Doing so can help to build a bank of tax-loss carryforwards. These realized losses can be used in the future to offset any realized gains. And the fund can also use in-kind redemptions. Notably this applies to both the mutual fund and ETF share classes. Many overlook the fact that open-end mutual funds can meet redemption requests by forking over a basket of securities to departing shareholders, just as ETFs do. This shields ongoing shareholders from the negative externalities created by departing shareholders (transaction costs and taxes). The practice is less common among mutual funds as it is practical only above certain minimum asset thresholds (Vanguard reserves the right to meet redemptions exceeding $250,000 on an in-kind basis). Most smaller investors wouldn't care to have to liquidate a portfolio of 3,611 stocks (the number held by Vanguard Total Stock Market Index as of Oct. 31, 2019) on their own. And of course, the ETF share class allows for more regular purging of low-cost basis securities when shares are redeemed. All of these tools help manage the tax risk faced by investors in Vanguard's ETF share classes.

- The level of risk fluctuates with the markets. The level of tax risk all fund investors face is cyclical. It goes up when markets rise, and unrealized gains grow. It goes down when markets fall, and unrealized gains shrink or become unrealized losses. Investors generally tend to sell when the going gets tough and tax risk is at a low ebb. That said, the recent exodus from actively managed equity mutual funds and the torrent of capital gains distributions that has resulted prove that there always have been and always will be exceptions.

- The risk is diminishing. Vanguard's ETFs have been growing faster than its mutual funds. During the five-year period through October 2019, the 68 ETFs that are tethered to one of the firm's funds experienced aggregate organic growth (the portion of asset growth attributable to net new cash flows into the fund) of 116%. The corresponding mutual fund share classes grew 60% over that same span. As a result, the ETF share classes now represent a larger share of these funds' assets. At the end of October 2014, they accounted for 27% of all assets in these funds. By the end of October 2019 that figure had expanded to 31%. Why does this matter? Because as the ETF share classes represent a larger portion of fund assets, the opportunity for these funds to use them as a means of removing appreciated positions from their portfolios grows commensurately. This diminishes the tax risk ETF shareholders face.

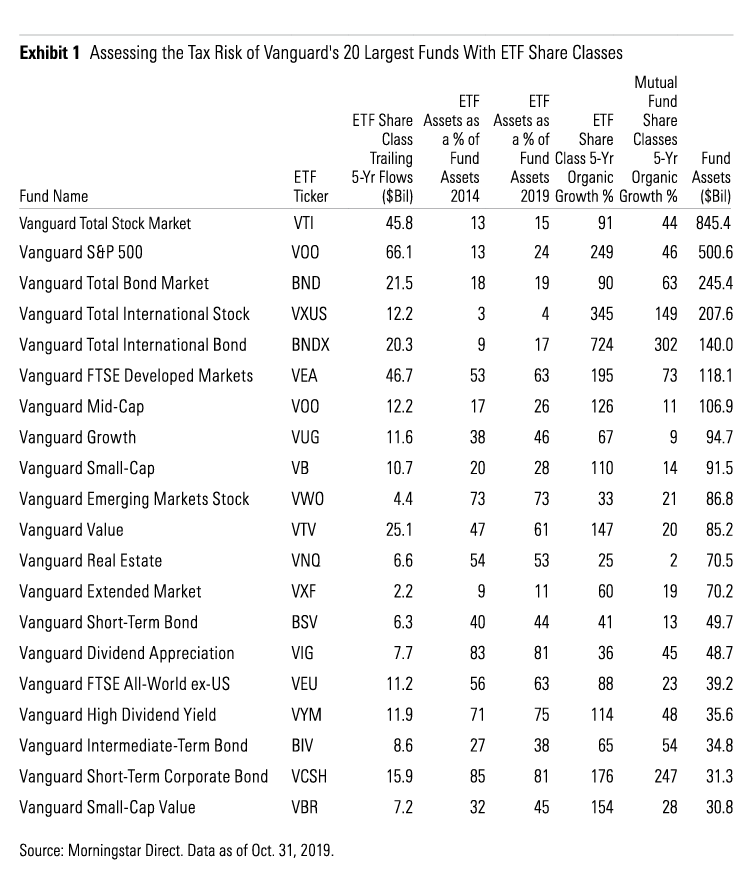

How Can Investors in Vanguard ETFs Assess This Risk? There are a few things investors can do to assess the potential tax risk faced by their Vanguard ETFs. As discussed above, one of the determinants of the level of risk is the size of the ETF share class relative to the mutual fund share classes. The greater the portion of assets invested in the ETF, the lower the risk is likely to be. That said, it is also important to understand the nature of the mutual fund share classes' investor base. For example, investors in Vanguard Total Stock Market Index may be less flighty than those in one of the firm's sector funds. The former tends to be a core holding, the latter a satellite position. Also, the former features prominently in the firm's target-date series and retirement plan menus--channels where turnover is relatively low. Exhibit 1 features data for Vanguard's 20 largest funds with ETF share classes. As of October 2019, the ETF share class held the majority of fund assets for eight of these funds. The ETF share class' share of total assets increased for 16 of the 20 funds over the past five years.

Key Takeaways

- Vanguard's ETF-as-a-share-class structure has several benefits and one key drawback: a unique source of tax risk that is absent in stand-alone ETFs.

- I don't think this is a risk that investors should fret over, as it's unlikely that Vanguard investors will flock toward the exits en masse, the risk can be managed, it varies across market environments, and it is diminishing as the ETFs are growing more rapidly than the mutual fund share classes.

- Investors can assess the level of risk in a Vanguard ETF by looking at its size relative to the fund and trying to understand the nature and objectives of shareholders in the mutual fund share classes.

[1] Clark, J.W., Utkus, S.P., & Young, J.A. 2019. "Understanding Household Trading Behavior 2011–2018." Vanguard Research. https://personal.vanguard.com/pdf/ understanding-trading-behavior.pdf

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)