8 Compelling Stocks

These high-quality names were recently added to the Morningstar Wide Moat Focus Index.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this cluster of high-quality names performed over time? Pretty well: The index has beaten the S&P 500 during the trailing one-, three-, five-, and 10-year periods.

With those performance numbers on the index's side, its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves right-sizing positions.

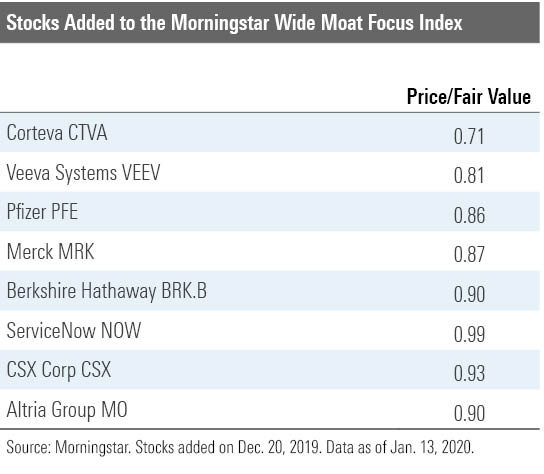

After the most recent reconstitution on Dec. 20, 2019, half of the portfolio added eight positions and eliminated eight. The index now holds 48 positions.

The Additions Three of the new additions to the index hail from the healthcare sector: Veeva Systems VEEV, Pfizer PFE, and Merck MRK. Though healthcare stocks as a group enjoyed 22% returns in 2019, they lagged the gains of the broader market.

"The heightened fears around potential healthcare policy changes have increased the sector's uncertainty and weighed on healthcare's relative performance," explains director Damien Conover. Drugmakers, in particular, are in the cross hairs of U.S. politicians, and therefore are in general overvalued. Not surprisingly, two of the three healthcare names added to the index are drugmakers.

{Deep Dive: Healthcare: Overvalued, But Opportunities in Drug and Biotech}

The remaining additions hail from a hodgepodge of sectors.

Though Corteva CTVA--a leader in the development of new seed and crop chemicals products--faces some short-term risks, we think new launches over the next several years will boost profits, argues analyst Seth Goldstein.

{Deep Dive: Market Too Focused on Corteva's Near Term }

We suspect that fears that Berkshire Hathaway's BRK.B size will damp future growth, and succession questions have kept investors on the sidelines, explains strategist Greggory Warren. We think the company can still increase book value per share at a high-single to low-double-digit rate annually.

{Deep Dive: 5 Reasons to Consider Buying Berkshire Hathaway}

ServiceNow NOW leverages its position in workflow automation to deepen its relationship with existing clients in IT and more broadly with human resources and customer-service-specific products, assesses analyst Dan Romanoff.

We think CSX Corp CSX CEO Jim Foote has continued to drive the high performance at this railroad that legendary former leader Hunter Harrison began before his death in 2017.

Although the U.S. cigarette market is in secular contraction, Big Tobacco--including index addition Altria Group MO--should continue to benefit by consistently pricing its products above the rate of volume declines, maintains director Philip Gorham.

{Watch: Dividends and Big Tobacco}

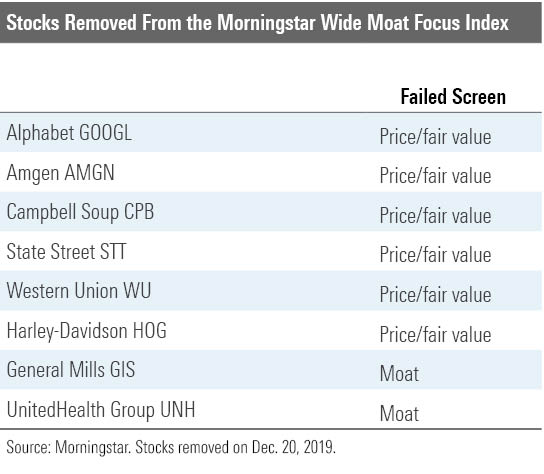

The Removals Both General Mills GIS and UnitedHealth Group UNH were removed from the index because of moat downgrades.

We reduced General Mills' economic moat rating to narrow last summer. Explains analyst Rebecca Scheuneman:

"We are lowering our moat rating for General Mills to narrow from wide, given our reduced conviction that the firm can report economic profits for the next 20 years in the face of secular headwinds related to evolving consumer nutritional preferences. Consumers have been eschewing processed fare in favor of fresh items found on the store's periphery, which has slowed the firm's category growth. However, we are confident that General Mills still has a competitive edge, as its brands remain dominant in their categories and command pricing power. We believe the firm is the leader in categories representing about a third of total food spending, which makes it a valued partner for food retailers, another aspect of its competitive edge. We also think the firm has a cost advantage, evidenced by superior margins and scale-based benefits."

We knocked down UnitedHealth's economic moat rating to narrow from wide in November, after taking a fresh look at U.S. health insurers and pharmacy benefits managers as a group.

"The U.S. health system continues to put significant financial pressure on many U.S. citizens, and we think medical insurers and pharmacy benefit managers will remain key targets of regulators looking to improve the U.S. healthcare system," notes senior analyst Julie Utterback. "These organizations may continue to face significant event risk that could cut into profitability eventually." We therefore no longer feel confident enough to endorse a wide moat rating, which would suggest excess returns for at least the next 20 years.

{Deep Dive: Checkup for Healthcare Moats}

The remaining six stocks--Alphabet GOOGL, Amgen AMGN, Campbell Soup CPB, State Street STT, Western Union WU, and Harley-Davidson HOG--were pushed out by stocks that were trading at more attractive price/fair values at the time of reconstitution.

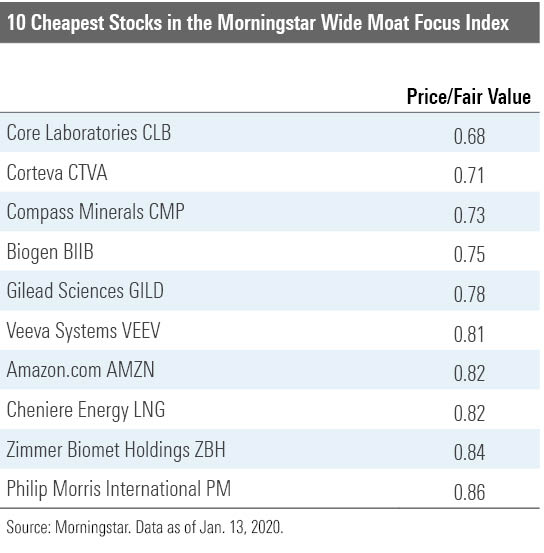

High-Quality Stocks in the Bargain Bin Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Jan. 13.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)