How to Advise Agreeables

Contributor Michael Pompian offers ideas for working with this personality.

This is the sixth article in a series focusing on the Big Five personality traits and how they relate to the behavioral biases of investors. Over the years, I have followed a debate between the effectiveness of the Myers-Briggs test versus another widely used personality test, the Big Five. More recently, the debate has intensified. I decided to conduct a study of the Big Five. Specifically, I studied 121 investors, examining the relationship between the Big Five and investor biases. Why? Because taking the time to understand the underlying personality of the investor leads to better advice and results.

This month's article provides advice on dealing with agreeables, the subject of last month's article.

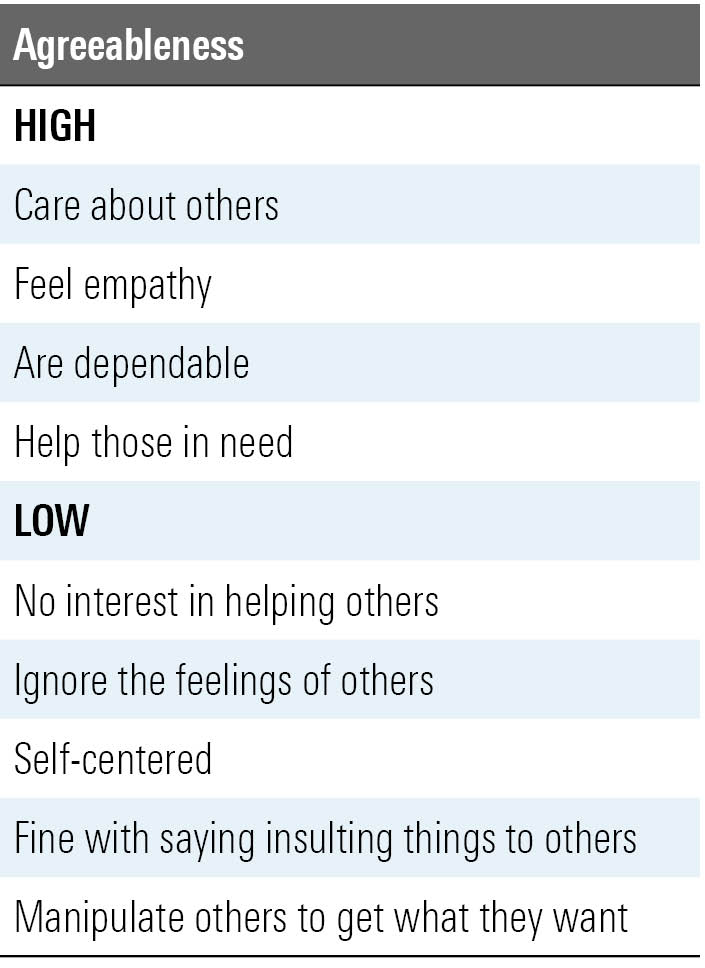

As a quick refresher, people high in agreeableness tend to be trustworthy, kind, affectionate, and altruistic. These folks tend to be cooperative and easy to work with, while those low in this trait tend to be more competitive and/or manipulative.

Working With Agreeable Investors Agreeable investors usually don't have their own ideas about investing. Rather, they may follow the lead of their friends and colleagues, or whatever general investing fad is occurring to make their investment decisions. Often their decision-making process is without regard to a long-term plan. They sometimes trick themselves into thinking they are "smart" or talented in the investment realm when an investment decision works out, which can lead to unwarranted risk-seeking behavior. Since they don't tend to have their own ideas about investing, they also may react differently to an investment proposal depending on how it's presented; that is, the way something is presented (framed) can make agreeables think and act differently. They also may regret not being in the latest "investment fad" and end up investing at exactly the wrong time--when valuations are the highest.

One of the key challenges of working with agreeables is teaching them how to refrain from overestimating their risk tolerance. An investment may appear so compelling that they jump in without considering the risks. Some don't like, or even fear, the task of investing, and many put off making investment decisions without professional advice; the result is that they maintain, often by default, high cash balances. Agreeables generally comply with professional advice when they get it, and they try to educate themselves financially. However, advising them can be difficult at times because they may not have an aptitude for the investment process.

Upside/Downside of Agreeable Investors There are certain benefits that accrue to agreeables. Since they are not overly obsessed with money, they tend to lead their lives in a somewhat lower-stress manner than others who tend to think about money on a daily basis. Also, since investing is not necessarily at the top of their minds, agreeables tend not to trade their accounts excessively--which is a big positive, since trading too much has proved to be a wealth-destroying activity. This low portfolio turnover can be a benefit in terms of lowering volatility in a portfolio, which can lead to better long-term compounded returns. Additionally, agreeables may realize that they aren't good with money and therefore wisely hire an investment advisor to help them. Advisors can help to bring discipline to the investing process, which is much needed with this investor type.

The downside to agreeables has mainly to do with a lack of discipline during the investment process, assuming they do not hire an advisor. For example, left unadvised, agreeables tend to place a lot of emphasis on investing in the latest trends--that is, those investments that have performed well recently. This can lead to investing in asset classes at the wrong time--when prices are peaking--which can lead to wealth destruction. They may also can think themselves intelligent when investments go up--fooling themselves into believing they are talented investors when it really was a rising tide that was raising all boats. This can increase risk-taking behavior, which can lead to loss of capital.

Advice for Agreeable Investors First and foremost, advisors need to recognize that agreeables often overestimate their risk tolerance. Risky trend-following behavior occurs in part because they don't like the task of investing nor the discomfort that may accompany the decision to enter an asset class when it is out of favor. They also may convince themselves that they "knew it all along" when an investment idea goes their way, which also increases future risk-taking behavior.

Advisors need to handle agreeables with care because they are likely to say yes to investment ideas that make sense to them regardless of whether the advice is in their best long-term interest. Advisors need to lead agreeables to take a hard look at behavioral tendencies that may cause them to overestimate their risk tolerance.

Advisors should challenge these types of clients to be introspective and provide data-backed substantiation for recommendations. Offering education in clear, unambiguous ways so they have the chance to "get it" is a good idea. If advisors take the time, this steady, educational approach will generate client loyalty and adherence to long-term investment plans.

Michael M. Pompian, CFA, CAIA, CFP is an investment advisor to family office clients and is based in St. Louis. His book, Behavioral Finance and Wealth Management, is helping thousands of financial advisors and investors build better portfolios of investments. Contact him at michael@sunpointeinvestments.com.

The author is a freelance contributor to Morningstar.com. The views expressed in this article may or may not reflect the views of Morningstar.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)