Industrials: Most of Our Coverage Is Fairly Valued, but Business Services Looks Attractive

Equipment-rental firms are also worth watching.

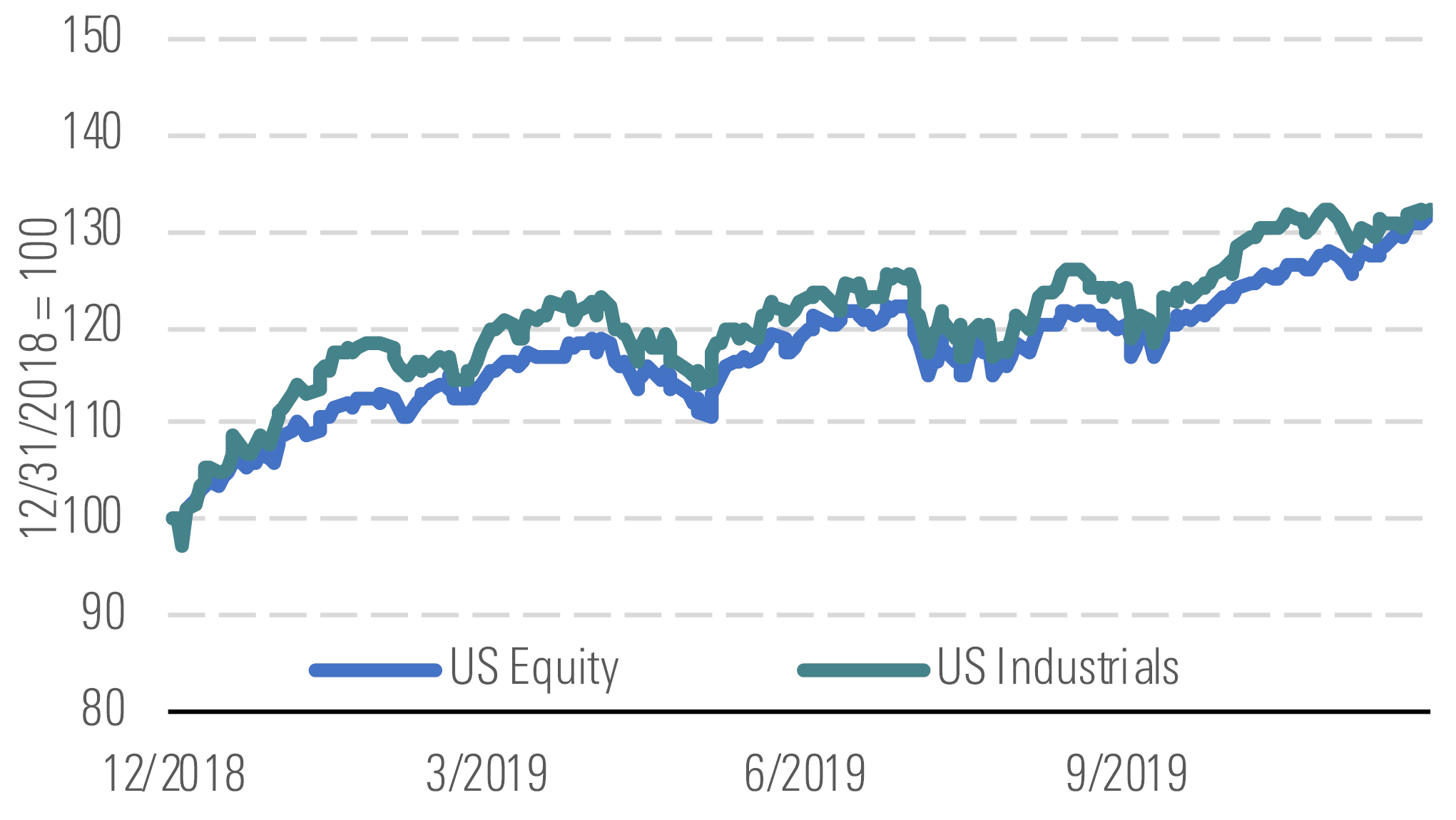

The Morningstar US Industrials Index has matched the broader U.S. equity market in 2019, despite investor concerns about trade tensions and a potential economic downturn (Exhibit 1).

Industrial stocks have slightly outperformed the broader market. - source: Morningstar

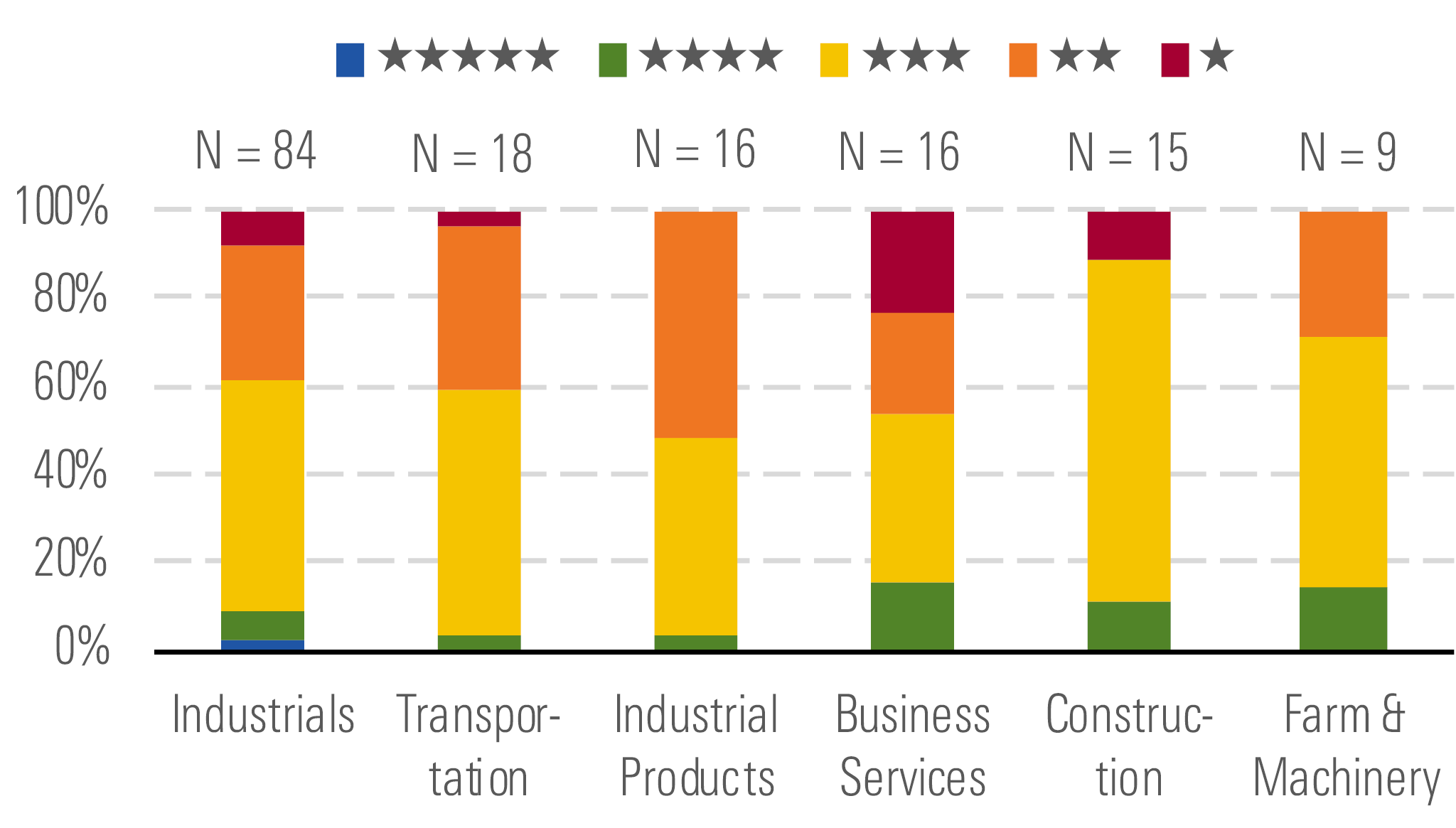

Currently, we see few opportunities in the industrials sector, as most stocks in our coverage trade in 3-star territory (Exhibit 2). The median stock we cover is priced at a 1.06 price/fair value ratio. Nevertheless, we recognize a few 4- and 5-star stocks in select industries, particularly among business services and farm/machinery firms.

We see attractive opportunities among business services. - source: Morningstar

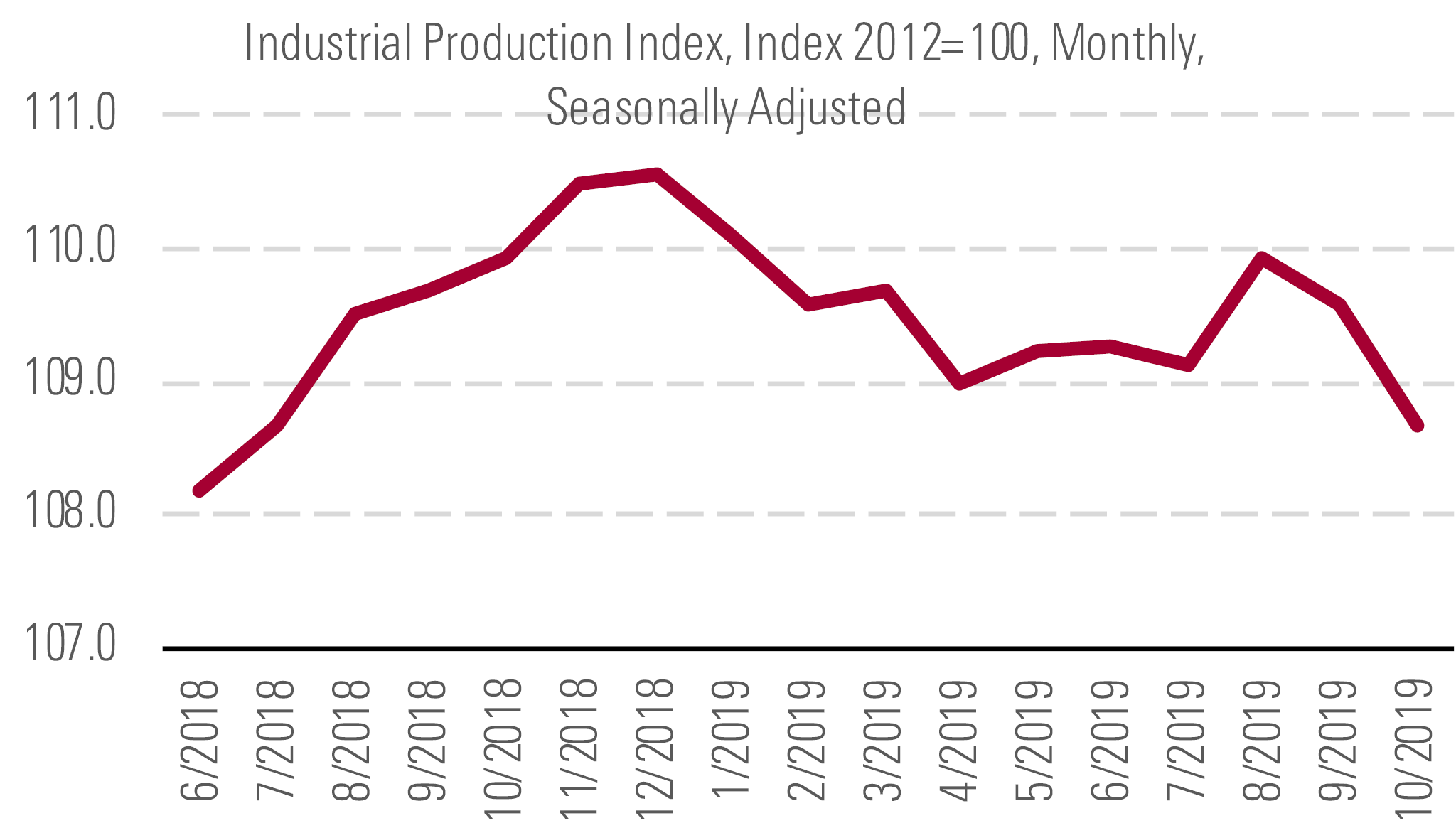

Overall, we still view the U.S. industrial sector as healthy despite growing concerns of a global economic slowdown. The recent decline in industrial production has fueled those fears as the index has steadily declined since its peak in late 2018 (Exhibit 3).

Industrial production continues to trend down, fueling concerns. - source: Morningstar

There are compelling opportunities among the equipment-rental stocks we cover, as asset-light trends that favor renting over owning equipment benefit all rental companies, but we believe larger, national firms, such as United Rentals and Herc, should disproportionately benefit. Larger rental companies can provide a broader range of services along with sophisticated technologies, which makes the rental process less onerous. This becomes more relevant for large corporate customers that may seek to negotiate terms and pricing across geographies. Given the tailwinds, we believe equipment rental companies will have a host of areas into which it can expand, including niche areas with higher returns.

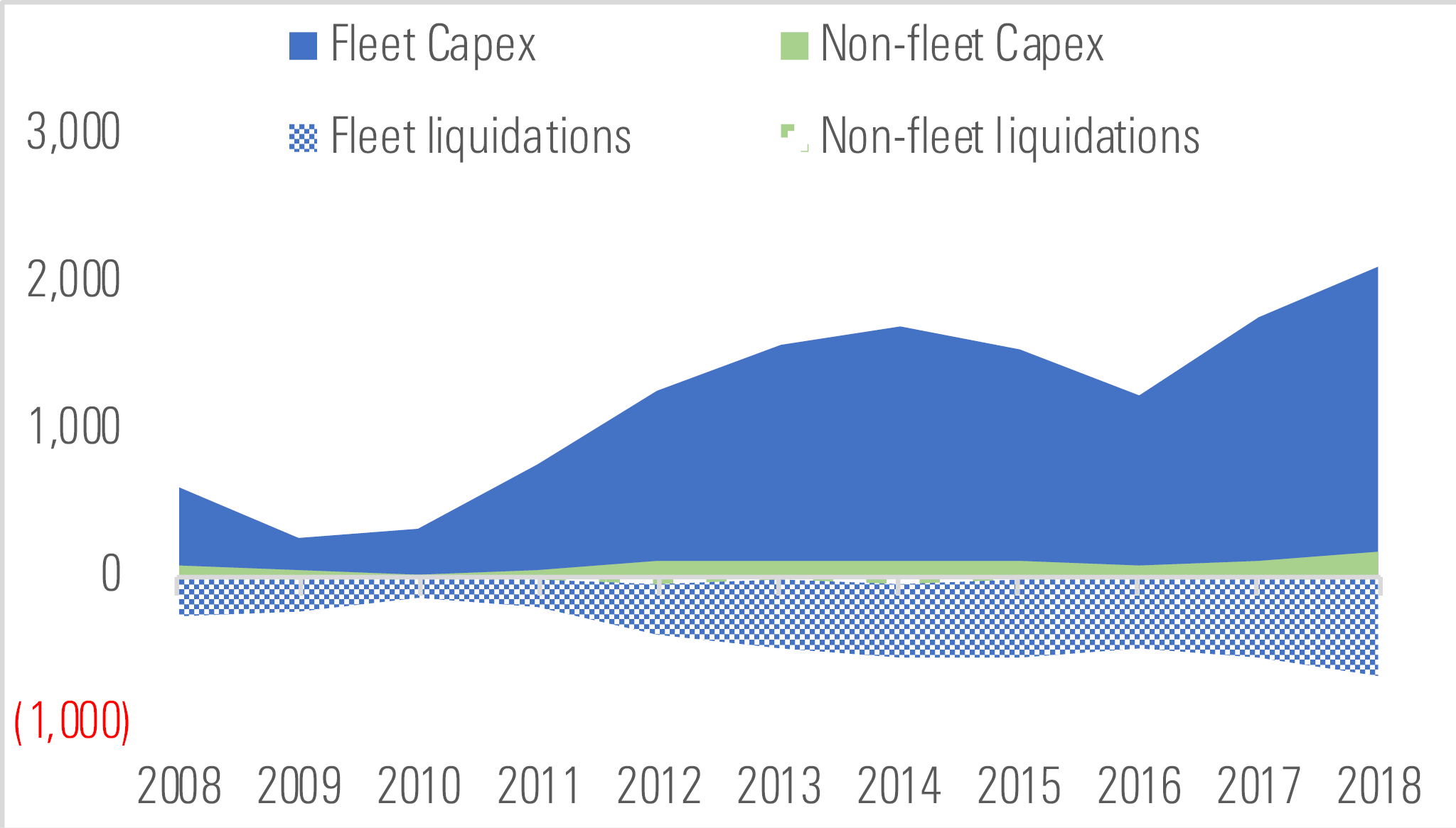

The equipment-rental market is likely to grow as a result of the increasing popularity of asset-light business models among end users, making the wide range of solutions that rental companies offer akin to Amazon’s cloud business. Asset-light strategies enable customers to be more agile over short and long time horizons. Cautious end users can choose to rent during uncertain economic conditions, presenting some insulation from downside for the rental companies. Additionally, we are encouraged by United Rentals’ ability to easily adjust fleet purchases and sales to generate free cash flow without affecting operations (Exhibit 4).

United Rentals can adjust fleet spending to generate free cash flow. - source: Morningstar

Top Picks

United Rentals URI Economic Moat: None Fair Value Estimate: $185 Fair Value Uncertainty: Medium

United Rentals’ growth trajectory will be affected by management’s execution of its existing core rental business, secular rental trends, expansion of services, and the company’s ability to find appropriate acquisitions. Maintaining the overall attractiveness of the rental option will likely require a high degree of person-to-person contact that accommodates tight customer timelines and special requests. Therefore, we estimate an average 10-year operating margin of 21%, with a midcycle operating margin estimate of 24%. We recommend shares at current levels, trading at a 19% discount to our fair value estimate.

Herc Holdings HRI Economic Moat: None Fair Value Estimate: $58 Fair Value Uncertainty: Medium

Herc will benefit from management’s ability to improve operating margins that averaged a meager 7% since it went public in 2016 to our midcycle estimate of 14% in 2028. We believe that margin expansion will come from operational improvements and from renting more specialty items that naturally have higher dollar utilization rates. With a combination of strong secular rental trends and the increased market share that Herc will achieve, we think that annual revenue growth will average 5% over our 10-year forecast. We recommend shares at current levels, trading at a 22% discount to our fair value estimate.

Wesco International WCC Economic Moat: Narrow Fair Value Estimate: $86 Fair Value Uncertainty: Medium

Wesco is poised to benefit from multiple long-term secular growth drivers, including data center expansion, power-grid modernization, and increasing demand for outsourced supply chain management. Further, Wesco is embracing digitalization and Big Data to improve its operational and financial performance, and the firm's efforts are already positively affecting results. We view the firm’s improving fundamentals, share-repurchase program, and involvement of a notable activist investor (Blue Harbour Group) as potential catalysts. Wesco’s stock looks cheap, trading at a 40% discount to our fair value.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JUWC2VJUKBCG5P3KVQJCHL5QSQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JD5KSEJFLNFLJA5XRS6YK2O24Q.jpg)