Basic Materials: Opportunities Arise Amid Continued Decline in Share Prices

Most of the discounts are concentrated in only a few industries.

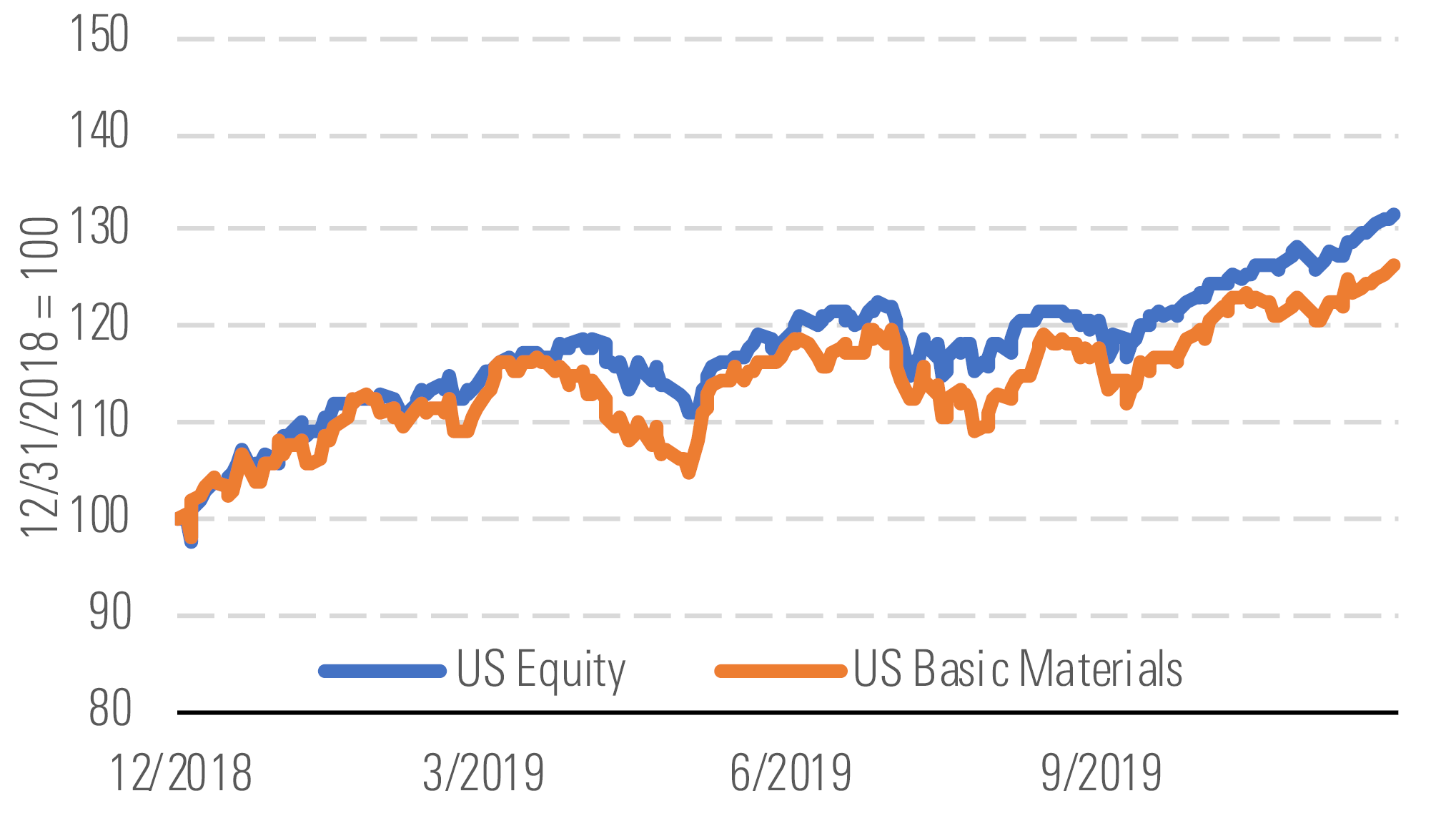

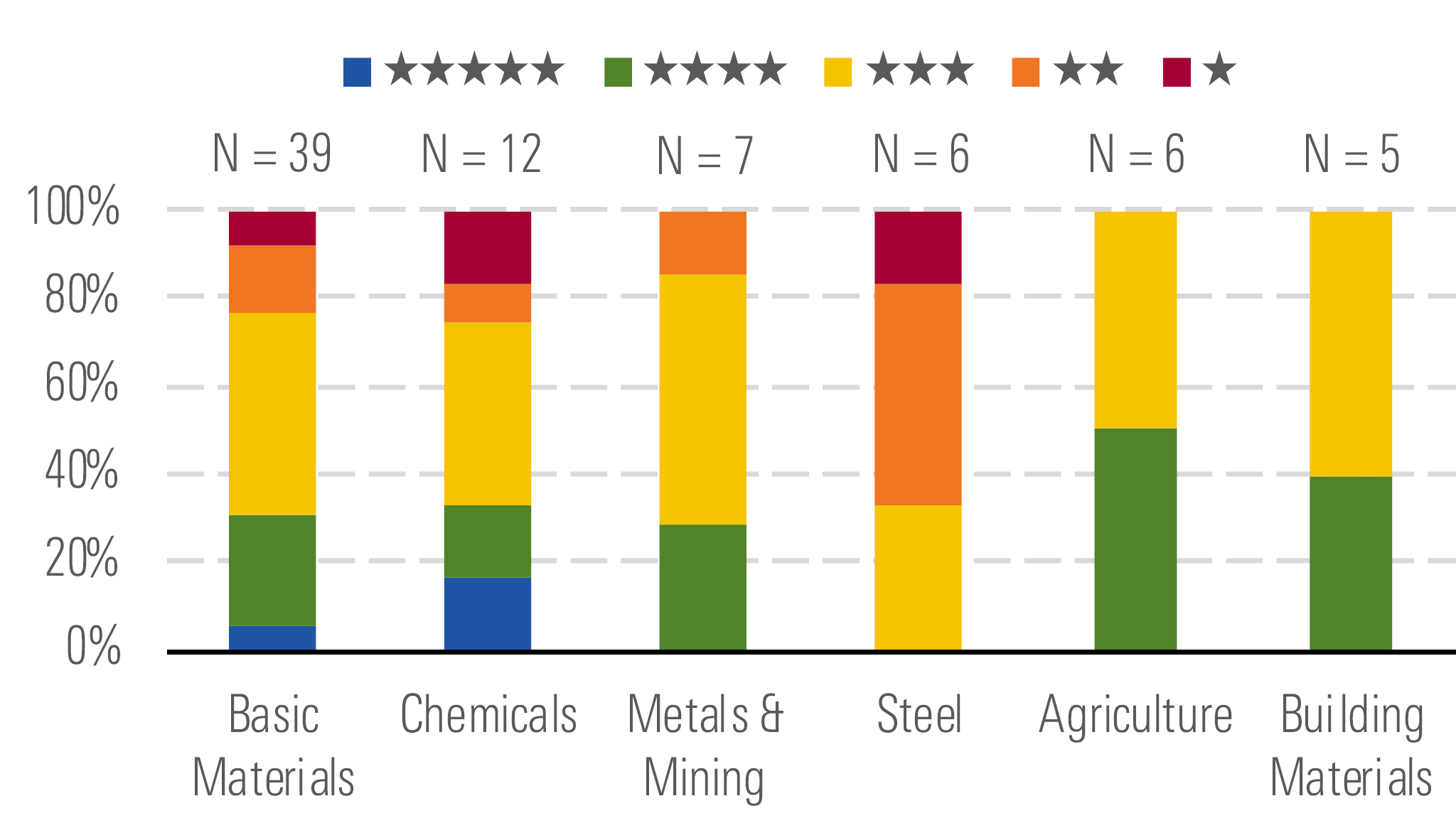

The Morningstar US Basic Materials Index has slightly underperformed the broader market by roughly 170 basis points over the past year (Exhibit 1). As a result, 30% of stocks now trade in 4- and 5-star territory (Exhibit 2).

U.S. Materials Index vs. U.S. Equity Index. - source: Morningstar

Underperformance has led to 30% of coverage in 4- or 5-star territory. - source: Morningstar

However, a closer look reveals that most of the discount is concentrated in just a few industries. Few opportunities exist among those with heavy U.S. exposure as the economy continues its extended expansion. Rather, we see discounted valuations in sectors facing idiosyncratic challenges. Market prices imply that these issues are here to stay, but we think the headwinds are temporary and ultimately surmountable.

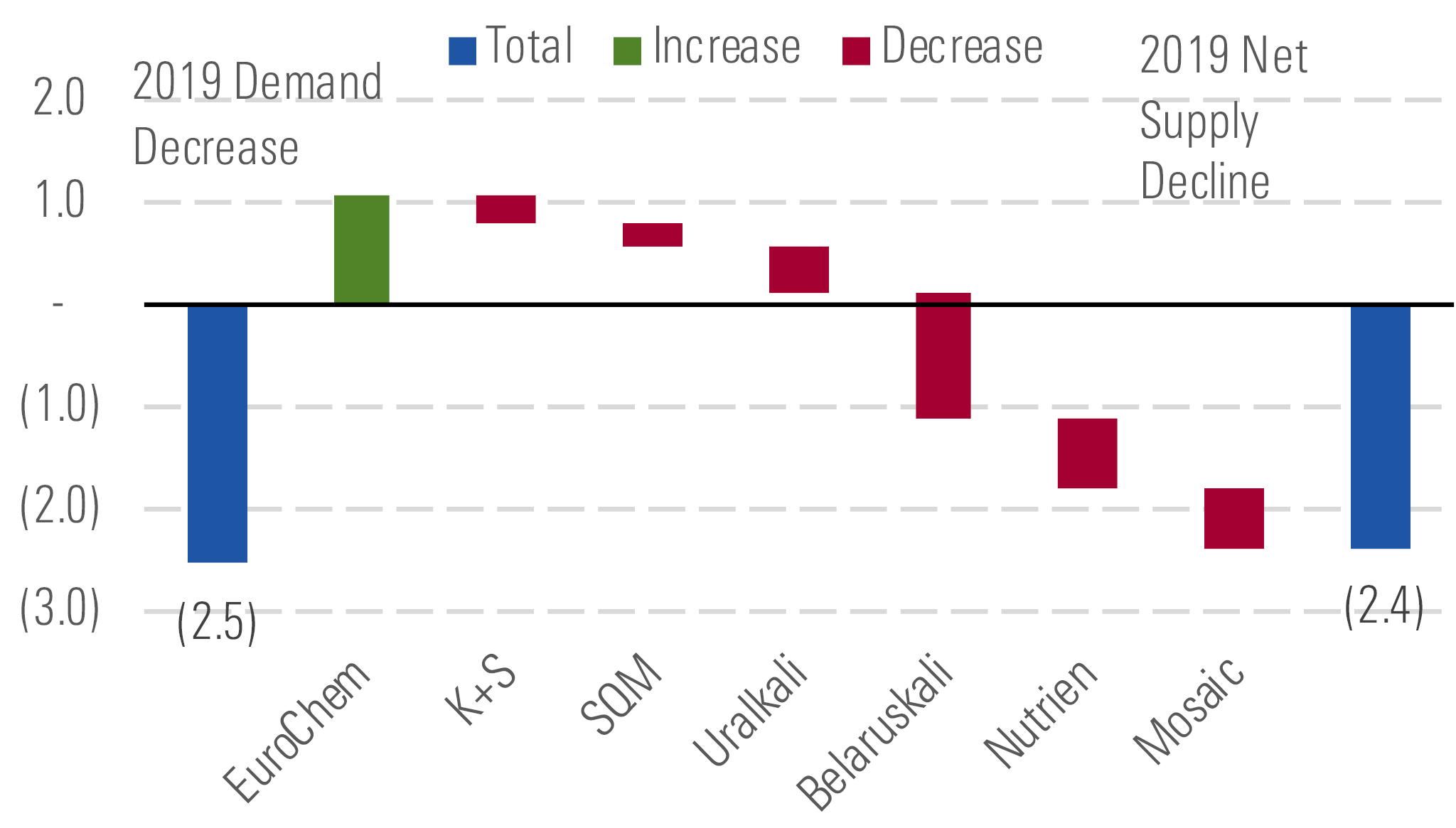

As a result of flooded fields in North America and weak palm oil prices in Southeast Asia, potash demand declined significantly in 2019, falling an estimated 2.5 million metric tons to 64.5 million metric tons. In response, all major potash producers reduced supply, nearly in line with the demand decline (Exhibit 3). While prices will remain under pressure in early 2020, we expect an eventual rebound in demand will balance the market, driving prices up to our long-term price forecast of $310 per metric ton.

Potash producers have reduced capacity in response to demand shock. - source: Morningstar

At one point in 2019, uranium spot prices had fallen 17% to roughly $24 per pound, weighed by still-weak purchase activity. The market has begun to show life, with prices recovering to $26 per pound and, more critically, enrichment demand increasing. The market-implied price suggests little recovery left, but we expect production discipline and rising demand will lead prices to recover to $65 per pound by 2022.

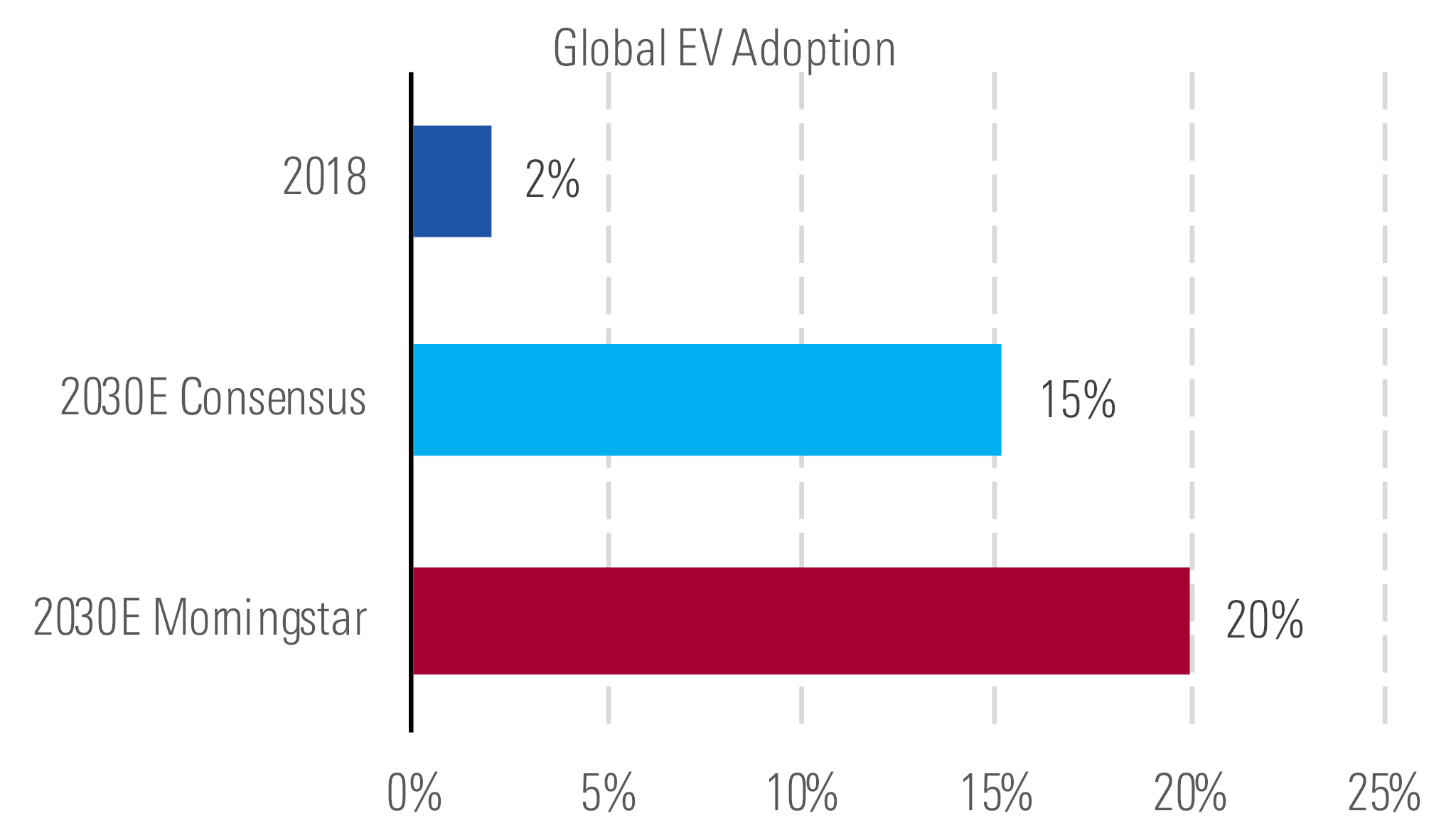

We are bullish in our long-term outlook for lithium. Although lithium carbonate prices currently sit below $10,000 per metric ton, we are well above consensus implied prices of $7,500 due to our above-consensus electric vehicle adoption forecast of 20% in 2030 versus consensus of 15% (Exhibit 2d).

Consensus underestimates future electric vehicle penetration rates. - source: Morningstar

Top Picks

Nutrien NTR Economic Moat: Narrow Fair Value Estimate: $68 Fair Value Uncertainty: High

Nutrien is our top potash pick. As a fertilizer producer and the largest U.S. agriculture retailer, 2019 profits have been hurt by the lowest U.S. acres planted in over a decade. However, we forecast a full recovery in retail profits in 2020 as agriculture demand is restored. Further, as a low-cost potash and nitrogen producer, Nutrien should benefit from a recovery in prices over the next several years. Meanwhile, the company also continues to reduce its unit production costs in both businesses, driving higher profits.

Cameco CCJ Economic Moat: Narrow Fair Value Estimate: $16.50 Fair Value Uncertainty: High

The uranium market remains plagued by subdued activity, which has continued to weigh on the uranium price. However, at today’s prices, significant production would be operating at a loss and only continues to operate due to long-term contracts signed at higher prices. Current supply would fail to meet existing demand without significant losses, let alone meet future demand arising from China’s continued nuclear fleet expansion. The still-improving supply/demand balance should help increase uranium prices, allowing Cameco to eventually resume full operations at more attractive margins.

Albemarle ALB Economic Moat: Narrow Fair Value Estimate: $120 Fair Value Uncertainty: High

Narrow-moat Albemarle currently trades at a more than 40% discount to our $120 fair value estimate, as the market is concerned that lower lithium prices will weigh on profits. With low-cost lithium production, Albemarle is well positioned to maintain decent profit margins even as lithium prices fall. Over the long term, we contend that higher lithium prices will be needed to encourage lower-quality supply to meet demand from growing adoption of electric vehicles. The current share price is an attractive entry point for a quality lithium producer.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)