Consumer Cyclical: Global Uncertainty Could Benefit Travel and Leisure Investors

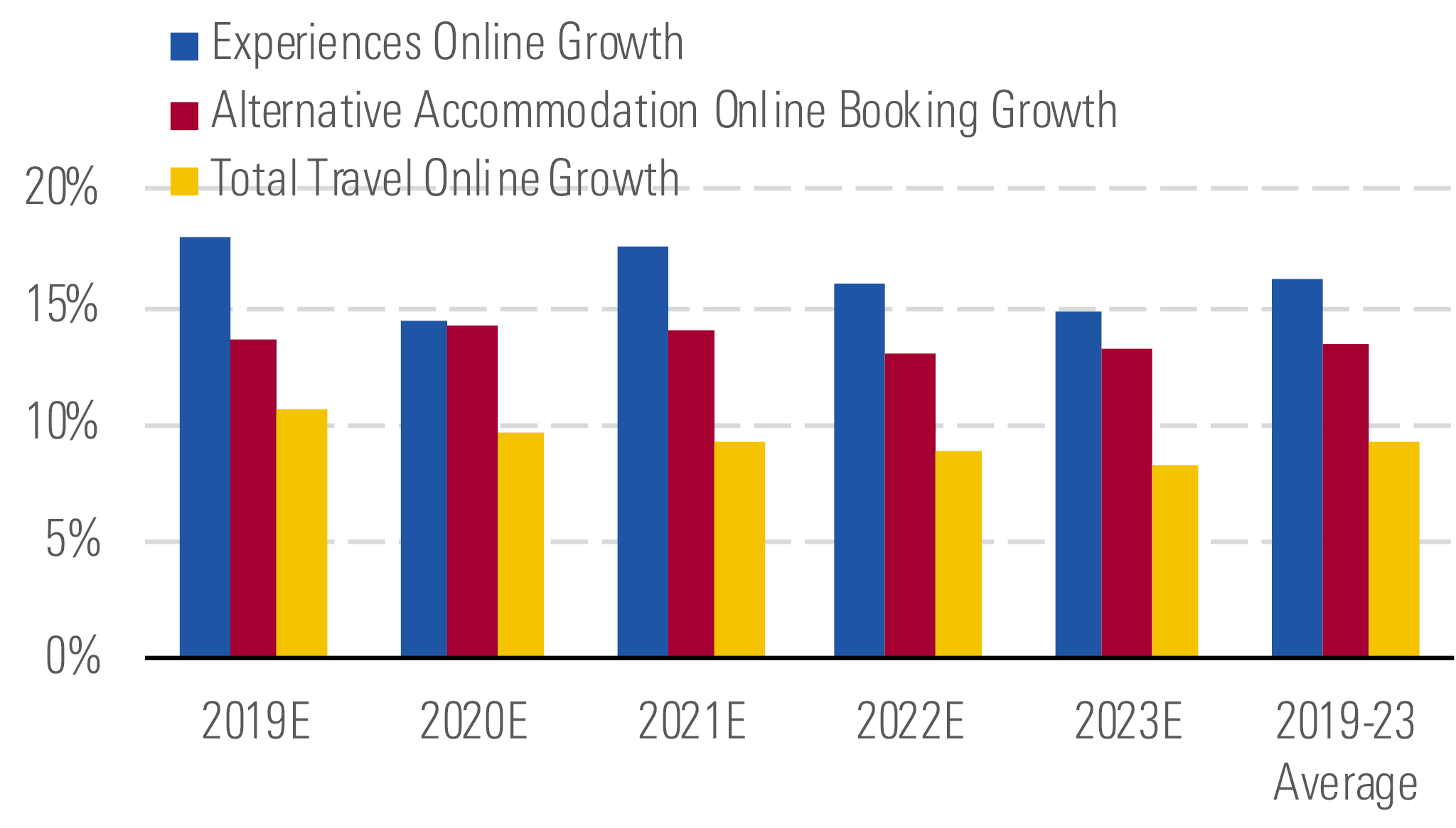

Online booking of experiences should continue to increase.

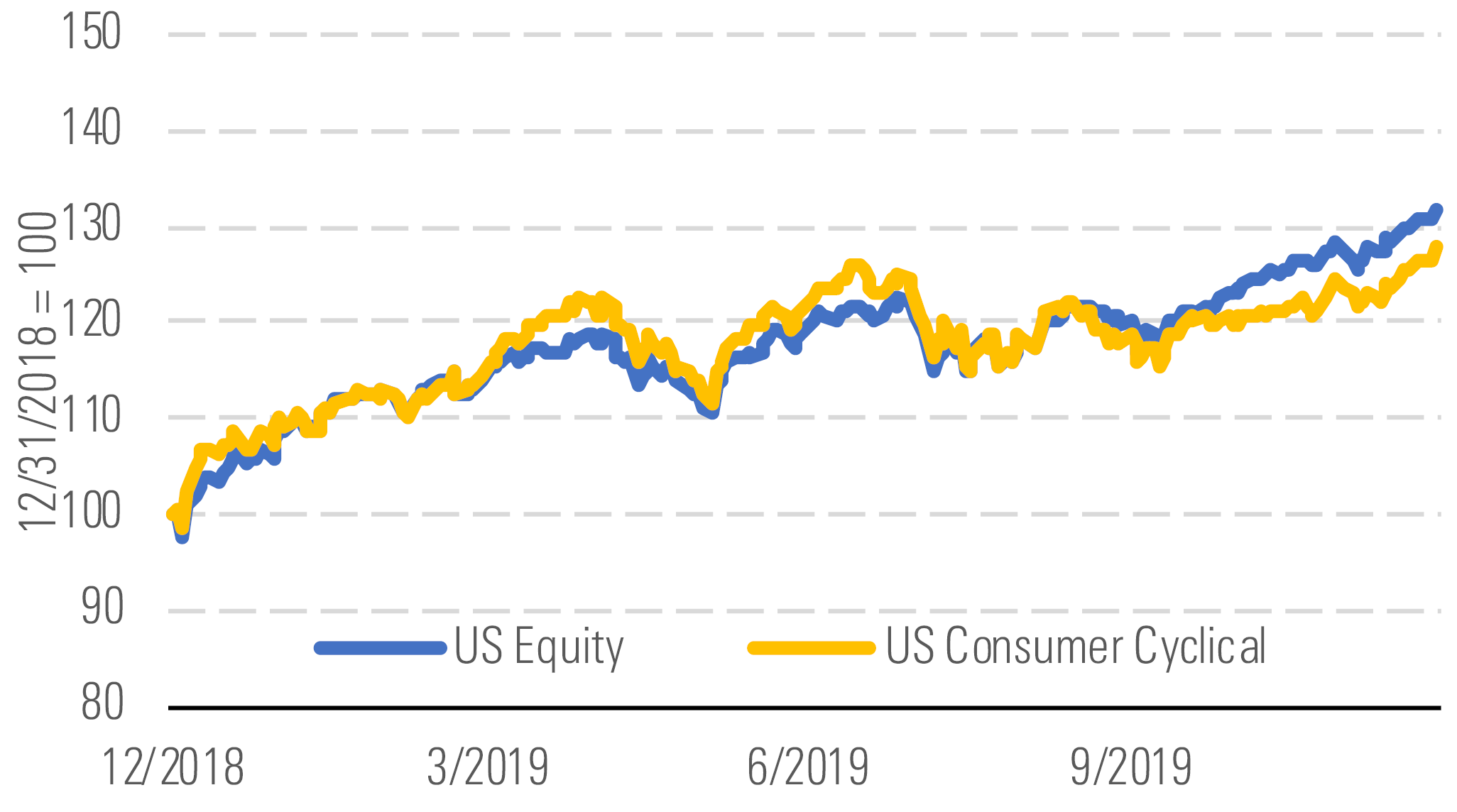

The Consumer Cyclical sector has lagged market returns recently, returning 7.1% in the fourth quarter compared with the broader U.S equity market's 9.0% as of Dec. 31 (Exhibit 1).

Sector returns continue to trail the market. - source: Morningstar

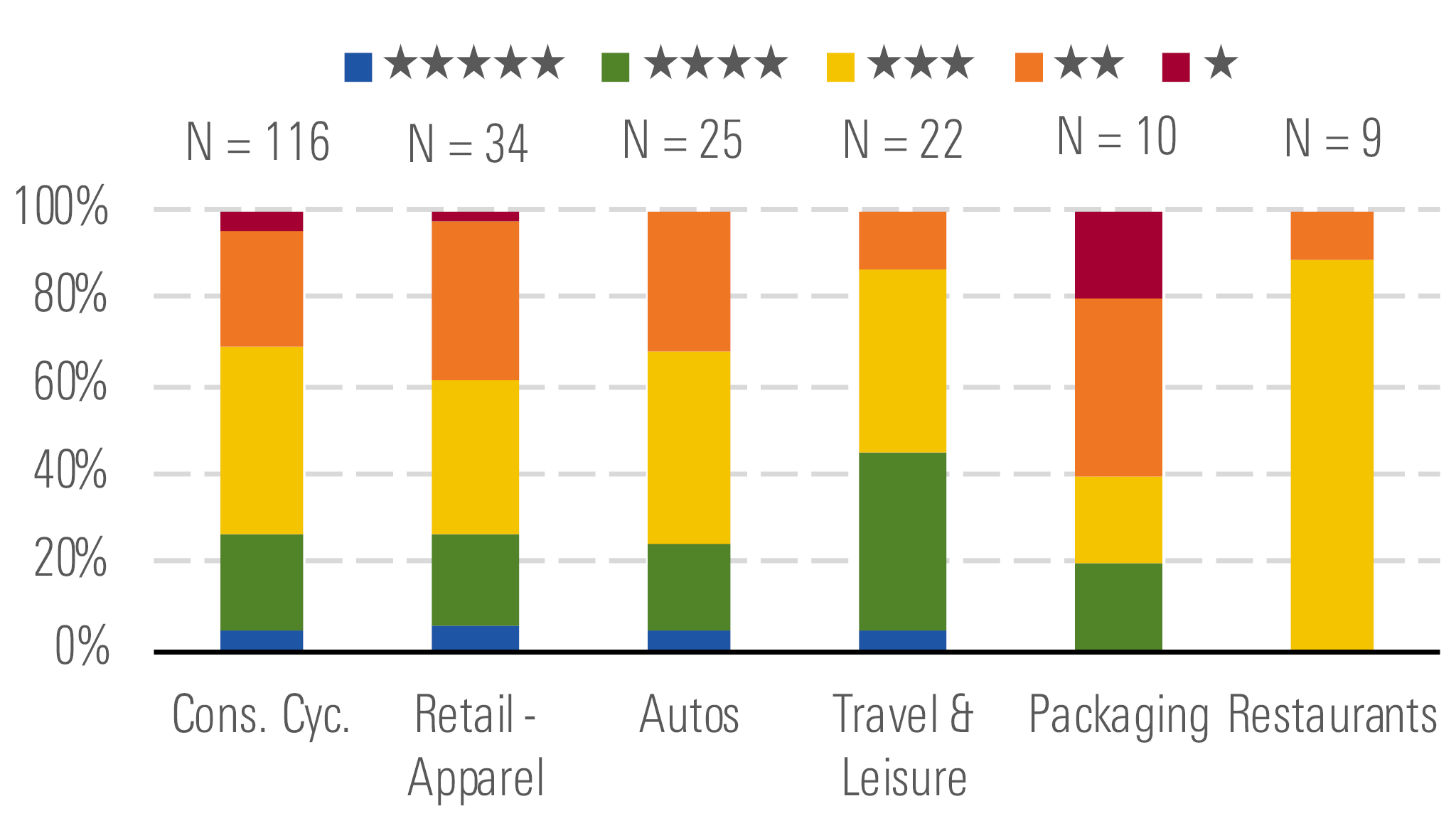

The sector appears fairly valued, as the median stock trades at just a 2% discount to our median fair value estimate and 74% of the stocks rated as 1, 2, or 3 stars (Exhibit 2). One area that we find overvalued is packaging, where the median price/intrinsic value shows a 22% premium, leaving little leeway for returns. However, those looking for a bargain in the sector may want to take advantage of the global uncertainty plaguing travel and leisure, which trades at a 12% discount to our valuation. Just under half of the stocks in the sector hold 4- or 5-star ratings, making it an attractive area for long-term investors.

Travel and leisure looks ripe for investment opportunities. - source: Morningstar

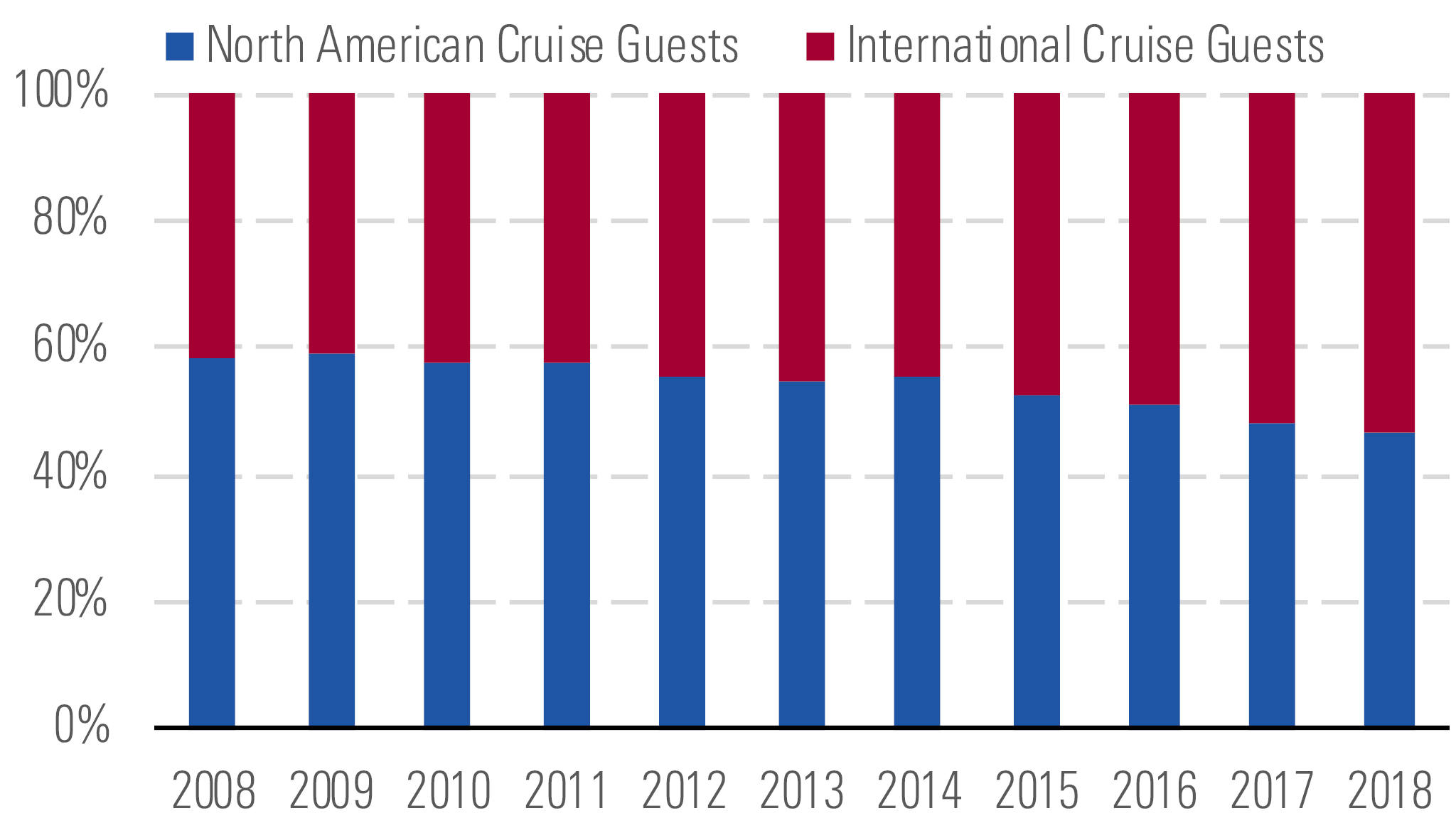

Although many of the issues causing global uncertainty, such as the Hong Kong protests and Brexit talks, have occurred abroad, U.S. travel operators are still affected by them. This volatility can dim corporate and leisure sentiment, leading to a reduced appetite for travel. As a result, domestic operators can be affected as the travel and leisure industry becomes more exposed to international clientele. For example, in the cruise industry, international guests have begun to outnumber domestic guests, increasing from roughly 40% in 2008 to over 50% in 2018 (Exhibit 3).

American travel companies are more exposed to international clientele. - source: Morningstar

Despite travel operators being more exposed to international unrest, we see potential in many of the travel companies. We believe short-term volatility may be limited by emerging trends, including the increase of online bookable experiences. Even in the face of challenges related to the impact of global unrest on travel, we expect the online booking of experiences to grow at a faster pace than online travel (Exhibit 4).

Outsize online experiences booking growth should persist. - source: Morningstar

With the sector worth $170 billion, experiences offer an audience outside of international travelers to those wishing to undertake a staycation in their own city or to give experiences to others and provide an avenue to offset any impact from reduced international travel.

Top Picks

Hanesbrands HBI Economic Moat: Narrow Fair Value Estimate: $28 Fair Value Uncertainty: Medium

We believe Hanesbrands is undervalued by the market, as investors have focused on short-term problems rather than long-term opportunities. Hanesbrands’ Champion brand benefits from the "athleisure" fashion trend, and we believe it is on track to exceed the company’s target of $2 billion in 2022 sales. We also believe the market underappreciates Hanesbrands’ potential for margin expansion. We expect the firm’s operating margins will grow to 16% in 2024 from 13% in 2018, as it reduces production and distribution inefficiencies and instills best practices in its acquired businesses.

L Brands LB Economic Moat: Narrow Fair Value Estimate: $42 Fair Value Uncertainty: High

As efforts to turn around its struggling Victoria’s Secret brand have yet to take hold, we currently view narrow-moat L Brands as undervalued. While we don’t foresee the Victoria’s Secret brand chalking up any comp growth, we expect the Bath & Body Works segment to grow comps on average by 2% over the next five years. We believe that the segment will slightly offset the issues at Victoria’s Secret because fragrance-based products in the division are more insulated from e-commerce, and therefore, we have more modest sales growth expectations of only 2% on average over the next five years.

TripAdvisor TRIP Economic Moat: Narrow Fair Value Estimate: $51 Fair Value Uncertainty: High

Competition from Google has incrementally increased marketing costs at TripAdvisor, but we believe the market is underestimating how the expense line may be leveraged by the company’s expansive network. This has ultimately left the company being undervalued by the market, trading at a roughly 44% discount to our valuation. Plans to reduce operating costs by $70 million and higher-than-expected growth in sales in experiences and dining (19% compared with our 18% expectation in the third quarter) make us optimistic about this narrow-moat name, and we expect sales to grow on average by 6.2% over the next five years.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)