Consumer Defensive: Some Industries Are Showing Resistance to E-Commerce Threat

Tobacco and alcohol firms are trading below our fair value estimates.

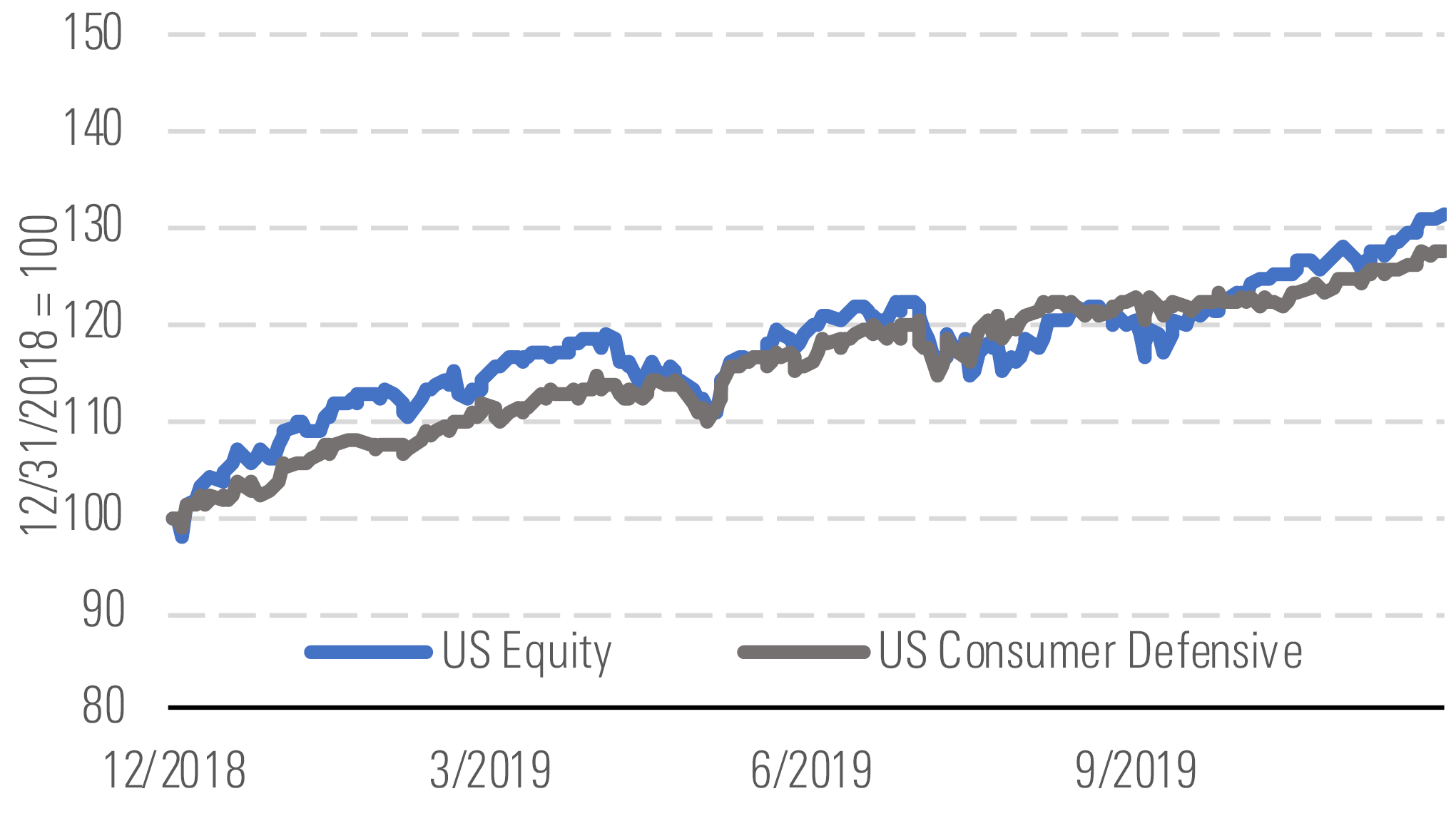

The consumer defensive sector has lagged market performance this quarter through Dec. 5, returning 3.8% compared with the market's returns of 9.0% (Exhibit 1).

The consumer defensive sector performance has cooled. - source: Morningstar

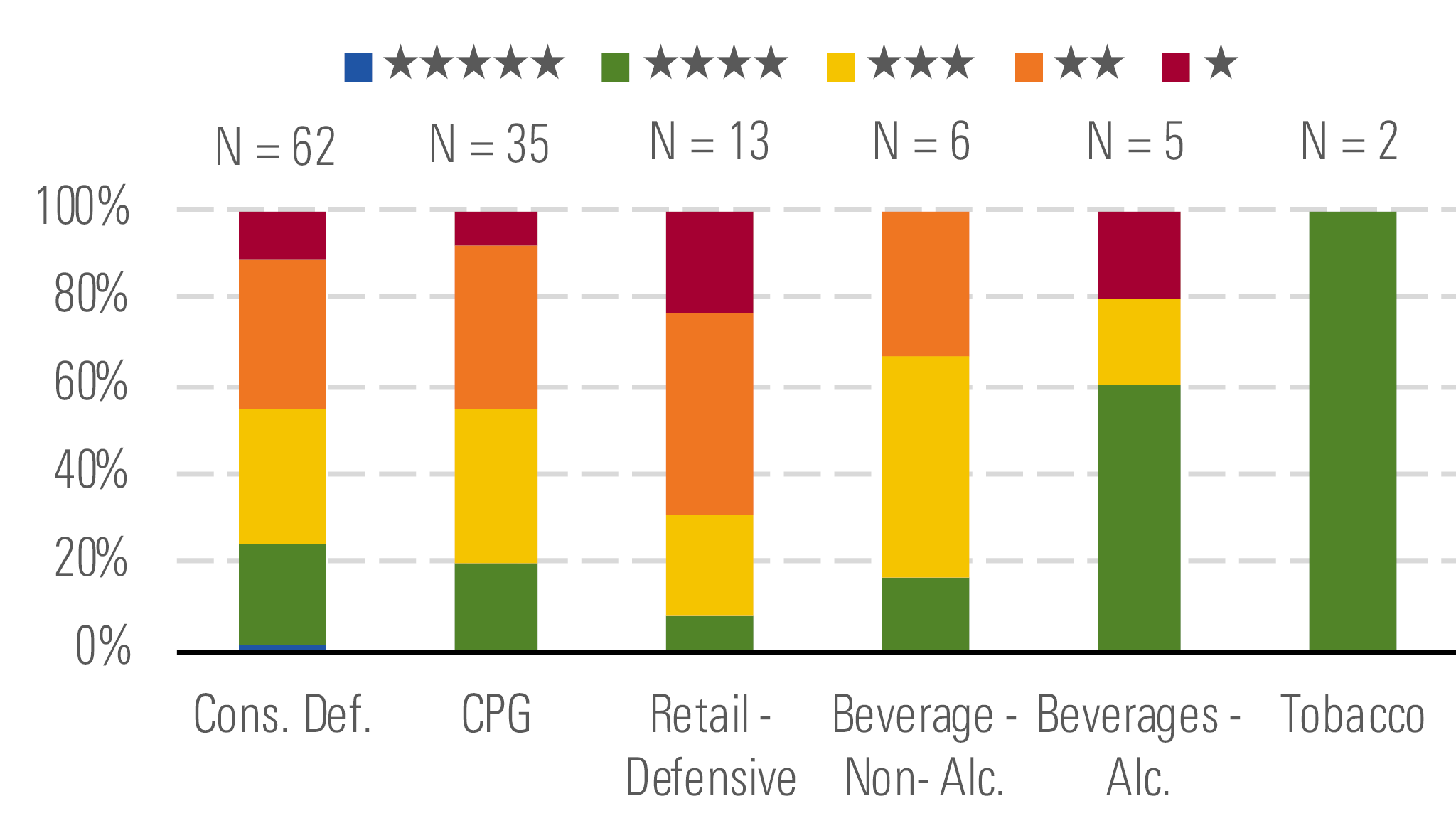

When taken together, we view the consumer defensive sector as overvalued, with the median stock trading at an 8% premium to our fair value estimates. Within the sector, we consider retail defensive overvalued, trading at a 20% premium to our assessment of intrinsic value. However, we see opportunities in tobacco and alcoholic beverages, which in the aggregate trade 14% and 10%, respectively, below our valuations.

With the sector overvalued in aggregate, tobacco looks attractive. - source: Morningstar

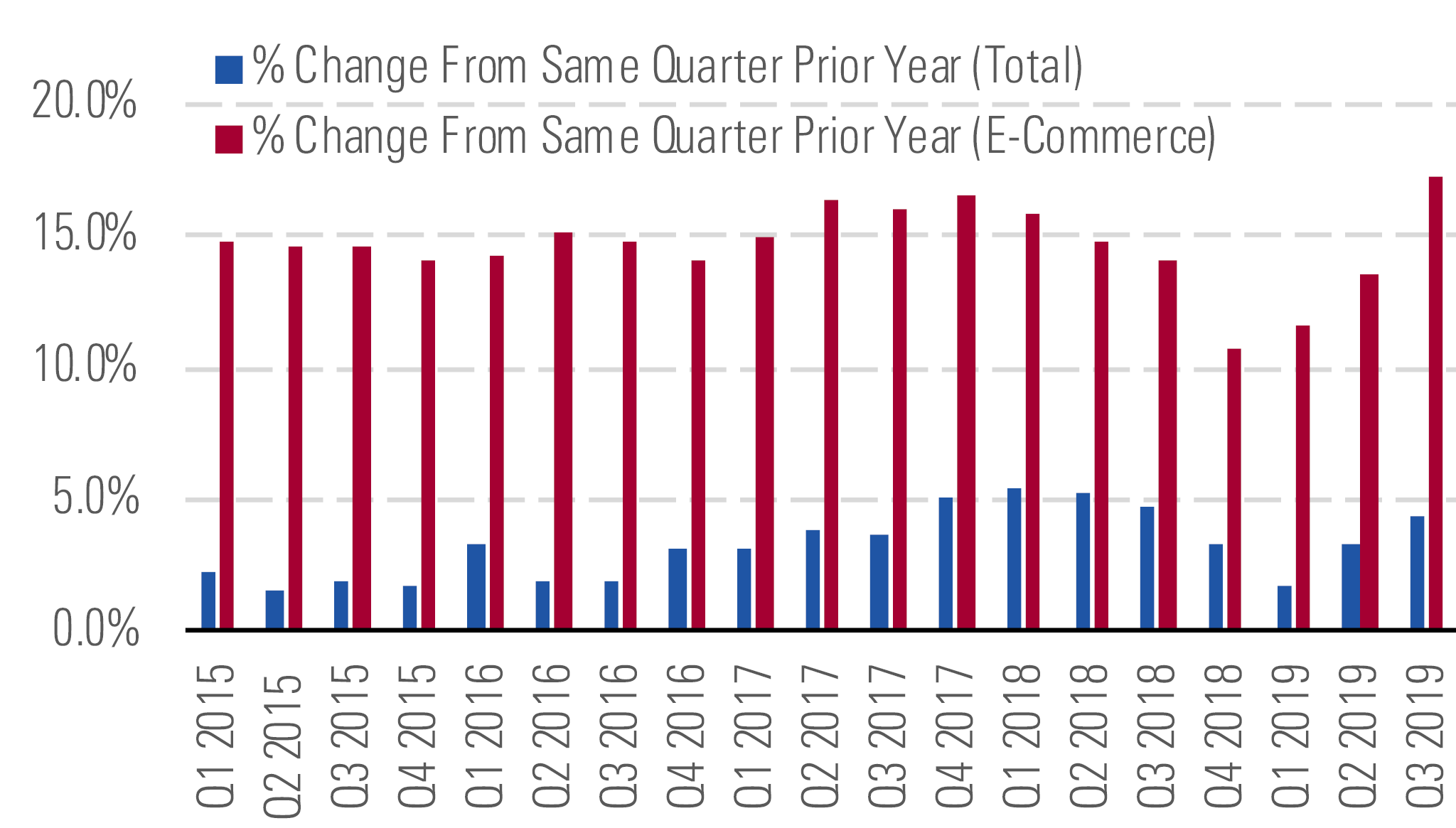

We think the digital channel remains an area of opportunity for consumer goods firms, as e-commerce penetration has been steadily increasing over the past decade. Retail spending through e-commerce grew 17.3% for the third quarter of 2019, far surpassing the 4.4% growth in total retail spending (Exhibit 3). While this channel has helped lower the barriers to entry for niche competitors, particularly by reducing the need to secure shelf space at brick-and-mortar retailers, firms that keep investing in their brands should be able to defend against competition, both in-store and online.

Growth in e-commerce has far surpassed total retail spending. - source: Morningstar

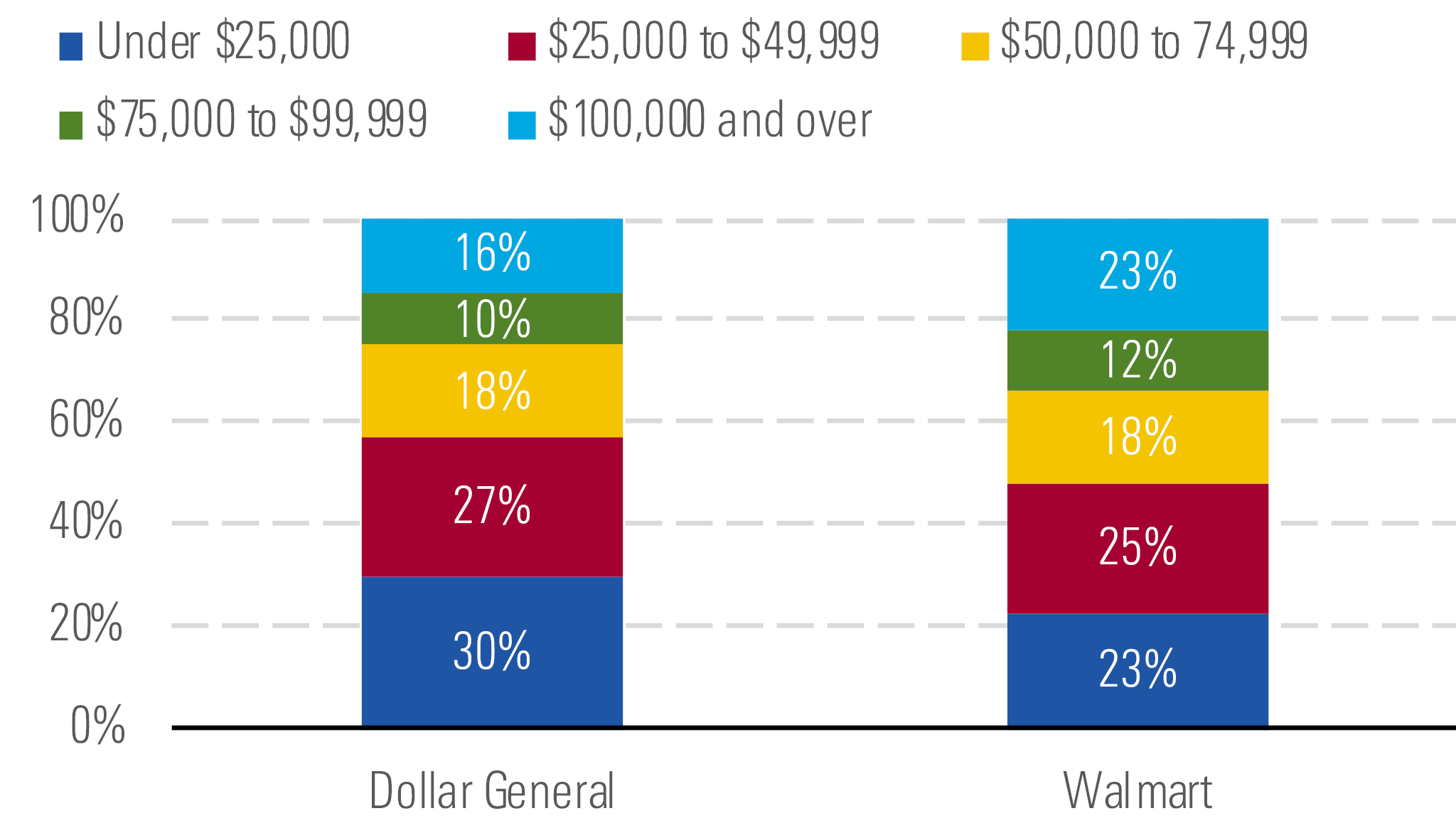

This shift to online shopping has not only caused disruption for manufacturers, but also retailers with a large brick-and-mortar presence. However, some retail segments are more resistant to this trend. As an example, we think the discount/dollar stores and off-price apparel sellers can withstand this threat, given their focus on convenience and small formats for the former and the hard-to-digitize treasure hunt for the latter. Discount/dollar stores tend to target lower-income customers, with 30% of customer households earning under $25,000 a year (for Dollar General specifically, but which we believe is a proxy for the space; Exhibit 4). These customers often must minimize absolute dollar costs, leading to repeat visits for smaller packaged necessities that can carry higher retailer margins, but would be costly to ship if ordered online.

A lower-income cohort limits the e-commerce threat at dollar stores. - source: Morningstar

Top Picks

Anheuser-Busch InBev BUD Economic Moat: Wide Fair Value Estimate: $116 Fair Value Uncertainty: Low

We think investors should give wide-moat Anheuser-Busch InBev a look, trading more than 30% below our assessment of intrinsic value. After its dividend cut, we believe the firm is now poised to pay down debt and enhance its financial flexibility. We see growth opportunities for AB InBev in emerging markets, such as Africa and Latin America. AB InBev has fixed-cost leverage and pricing power in procurement in these markets, (especially after acquiring SABMiller in late 2016), which is demonstrated by their excess returns on invested capital and impressive working capital management.

Kraft Heinz KHC Economic Moat: None Fair Value Estimate: $50 Fair Value Uncertainty: High

Kraft Heinz is an attractive opportunity for a patient investor, with shares currently trading 36% below our $50 fair value estimate. With its past focus on bolstering profitability, the firm has impaired its brand intangible assets (both its retail relationships and brand mix) and suffered from lackluster sales. However, we believe new CEO Miguel Patricio is looking to author a new chapter. His experience suggests he understands the need for consumer-valued brand spending. We also see opportunity to remove inefficiencies, which should allow the firm to reinvest in its brands with only a modest erosion in profitability.

Hostess Brands TWNK Economic Moat: Narrow Fair Value Estimate: $17.60 Fair Value Uncertainty: Medium

We think investors underappreciate the growth potential of narrow-moat Hostess. In our view, the firm’s organic growth, like its expansion into new categories like breakfast pastries and snack bars, combined with inorganic pursuits (Cloverhill and Voortman Cookies) have set Hostess on a promising path. We also expect operating margins to increase from 2018’s 15.6% to 22.1% by 2021, as Hostess improves profitability of the acquired Cloverhill business and divests the lower-margin in-store bakery business. With shares trading at a 21% discount to our fair value estimate of $17.60, we think investors should consider Hostess.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)