Financial Services: Investors Have a Clearer Picture of Sector's Threats

Market overestimated likelihood of a recession; financial-services stocks trading at a premium to our fair values.

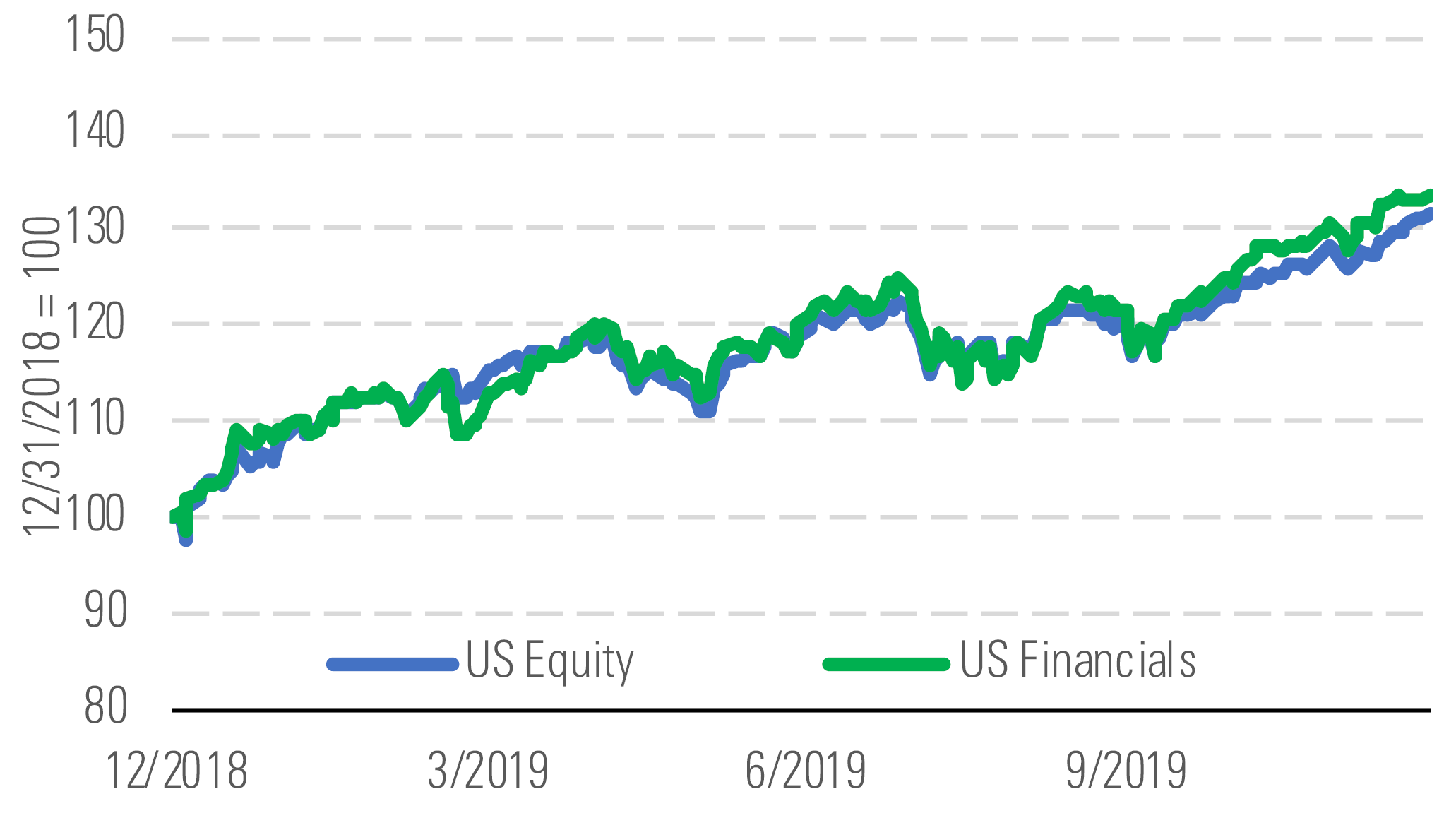

The Morningstar US Financial Services Index has outperformed the Morningstar US Market Index in the fourth quarter, up 9.6% compared with 9.0%, and year to date, up 33% compared with 31% (Exhibit 1) as of Dec. 31. The median North America-based financial-services stock trades at about a 2% premium to its fair value estimate, so we consider the North American financial sector slightly overvalued. This is in contrast to a year ago, when many financial-services stocks were undervalued by more than 15%.

Financials have outperformed as headwinds lessen. - source: Morningstar

We believe that much of the outperformance of financial stocks over the previous quarter and year stems from investors having a better sense of the headwinds facing the sector. Coming into 2019, many investors were worried about a downturn and how low U.S. interest rates might fall. With the U.S. stock market up about 27% for the year, it seems the market had overestimated the likelihood of a recession in 2019.

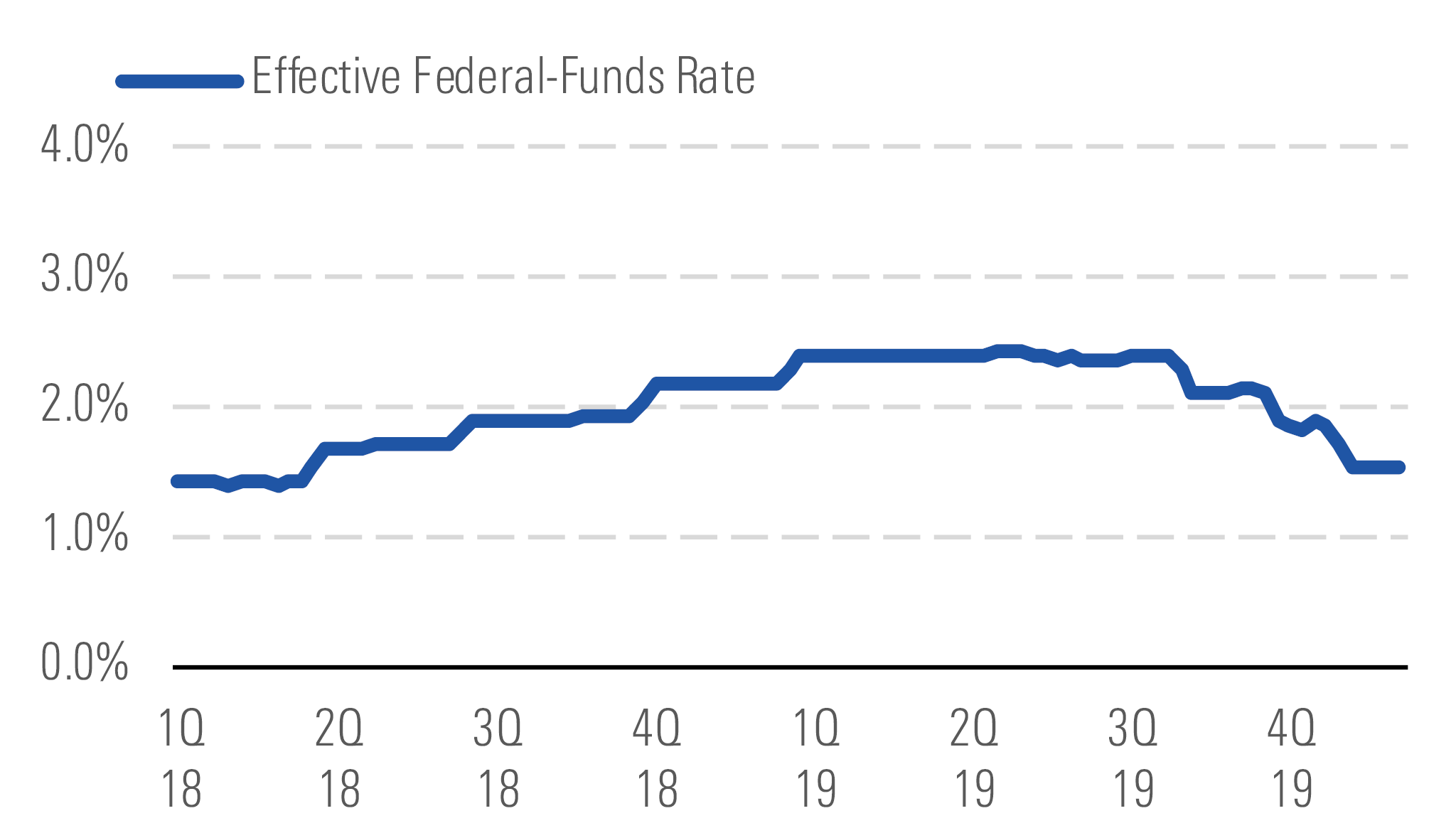

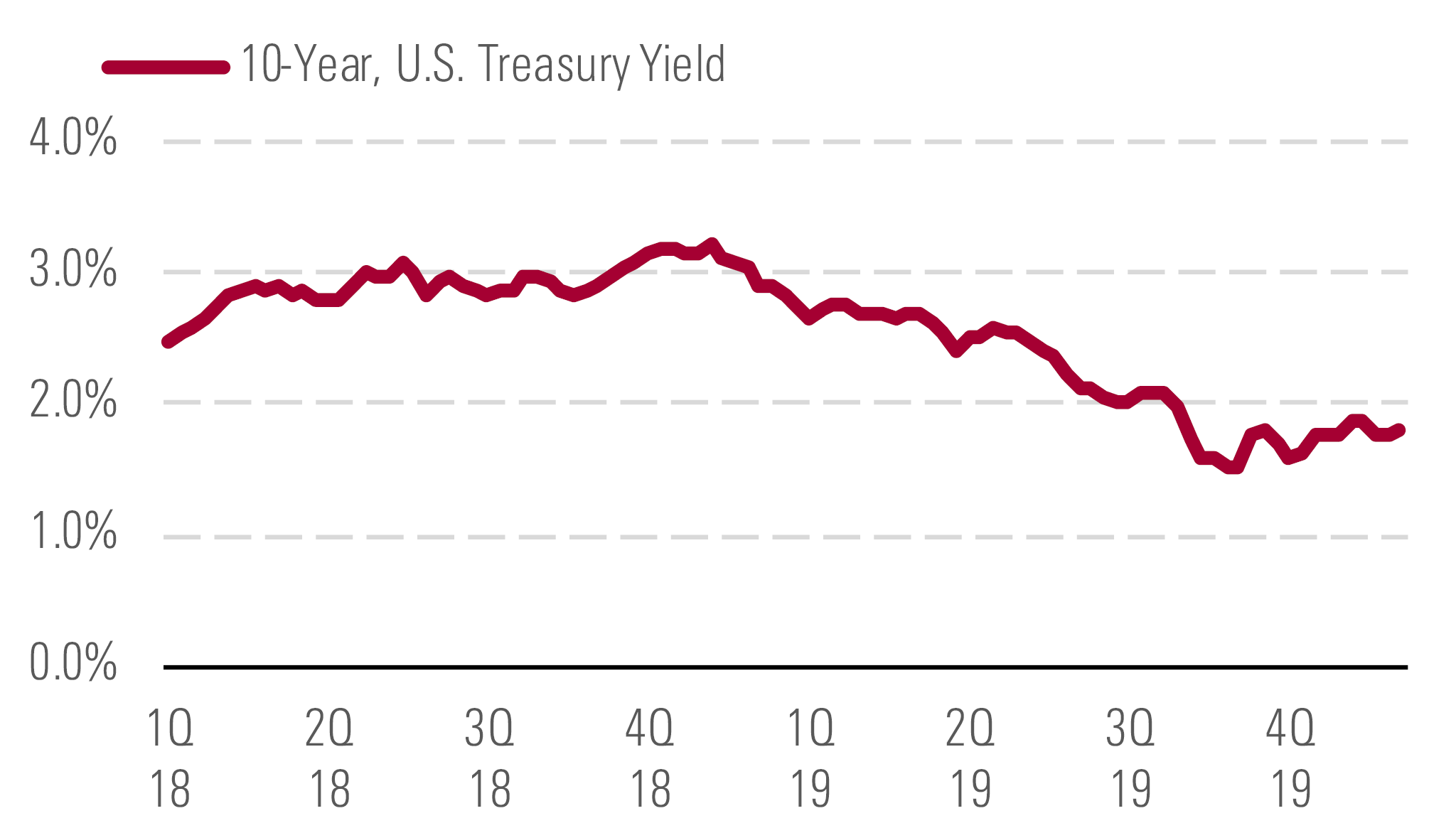

Regarding interest rates, concerns were warranted. The Federal Open Market Committee cut the federal-funds rate three times since midyear to a target range of 1.5% to 1.75%. The 10-year U.S. Treasury yield has also fallen from a high of approximately 3.25% in the fourth quarter of 2018 to recently around 1.75% (Exhibits 3 and 4). That said, near-term uncertainty about how low interest rates might go seems to have lessened. According to the CME Group FedWatch Tool, investors largely believe that the fed-funds rate will hold steady or only decrease another 25 basis points through 2020. The 10-year Treasury yield has also rebounded nicely to around 1.8% from 1.5% in August 2019. Given our view on interest rates, we’re not anticipating significant declines in net interest income for most of our U.S. banking coverage from current levels.

Federal-funds rate should be stabilizing. - source: Morningstar

10-year Treasury yield has recovered from August low. - source: Morningstar

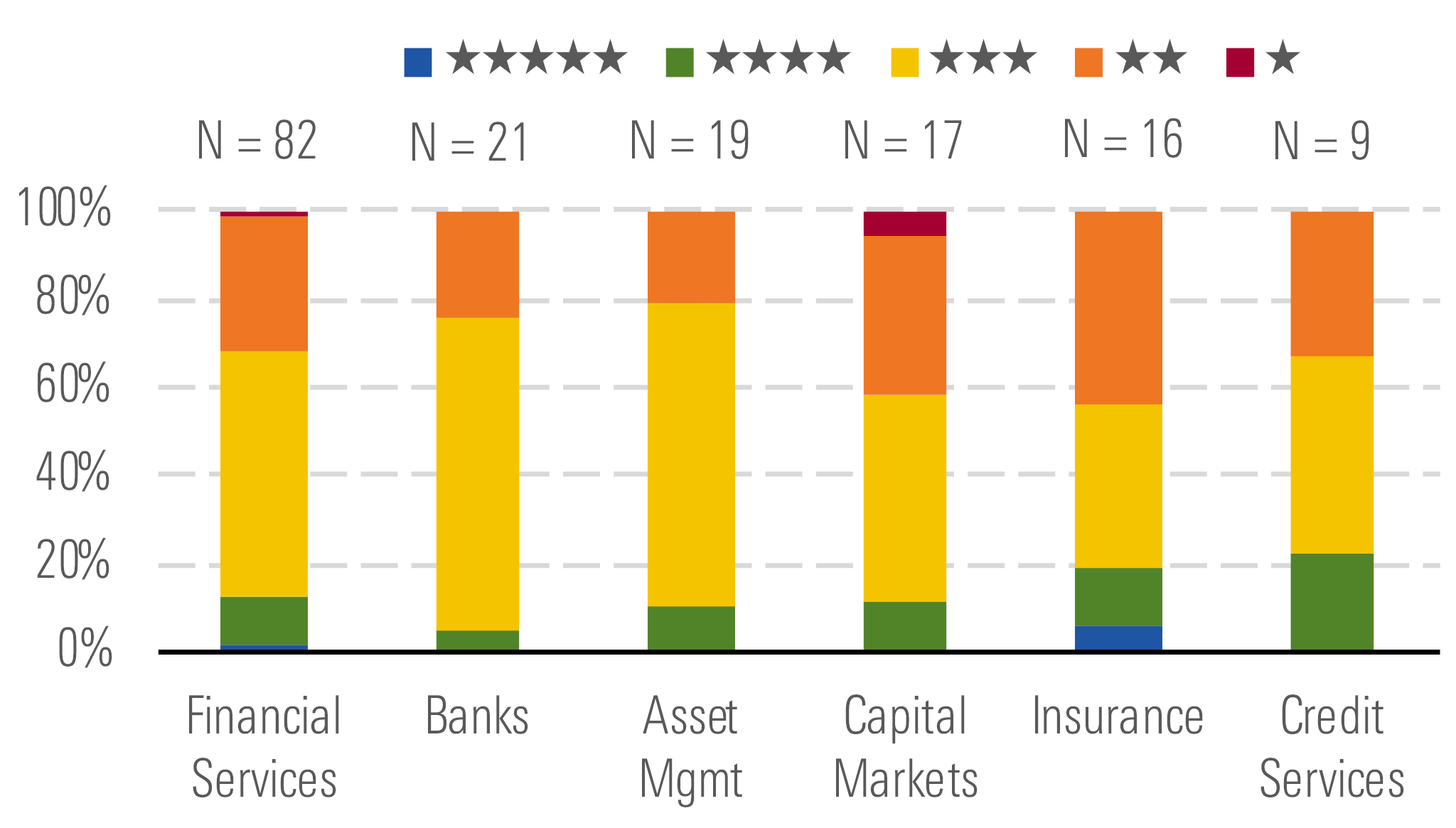

As we assess the median financial stock as slightly overvalued and because there are more overvalued 2- and 1-star-rated stocks in our coverage than undervalued 4- and 5-star names, we believe investors should be cautious (Exhibit 2). Most of the undervalued financial stocks in North America either have company-specific issues that we believe the market isn’t appropriately pricing or are more economically sensitive names. While there are near-term risks to the companies we currently believe are undervalued, they also have the greatest probability of long-term outperformance.

Overvalued stocks now outnumber undervalued stocks. - source: Morningstar

Top Picks

American International Group AIG Economic Moat: None Fair Value Estimate: $76 Fair Value Uncertainty: Medium

We believe CEO Brian Duperreault is a good fit for solving American International Group's main operational issue: commercial property-casualty insurance underwriting. He was a primary architect behind peer Chubb's strong franchise that has generated industry-leading underwriting margins. He has pledged that AIG will generate an underwriting profit in 2019 and the company is on track to reach that goal. Given that we see no structural issues in its core operations, we believe AIG is gradually trending toward peer results. The current market price equates to about 0.8 times book value, implying a long period of poor returns.

Berkshire Hathaway BRK.B Economic Moat: Wide Fair Value Estimate: $253 Fair Value Uncertainty: Medium

We are impressed by Berkshire Hathaway's ability to generate high-single- to double-digit growth in book value per share. Believing it will take some time before Berkshire succumbs to the impediments created by the size of its operations, and that the ultimate departure of CEO Warren Buffett and Vice Chairman Charlie Munger will have less of an impact on the business than many believe, we are always looking for opportunities to put money to work in the name. Berkshire currently has a ton of cash on hand and a disciplined share-repurchase program, making it an ideal defensive name in a slowing economy or a down market.

Capital One Financial COF Economic Moat: Narrow Fair Value Estimate: $136 Fair Value Uncertainty: Medium

The market is starting to give Capital One credit for its cardholder growth, which should eventually translate into higher balances and increasing net interest income. We've always maintained that Capital One's investments in technology, marketing, and customer acquisition shouldn't be viewed as recurring costs, but rather, as valuable investments in the company's future. Furthermore, we believe Capital One's expertise in technology is a valuable asset that will enable the company to lower costs and offer new products to consumers and businesses.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)