Communication Services: Think Small for Opportunities in This Shifting Sector

Industry gearing up for upcoming streaming wars.

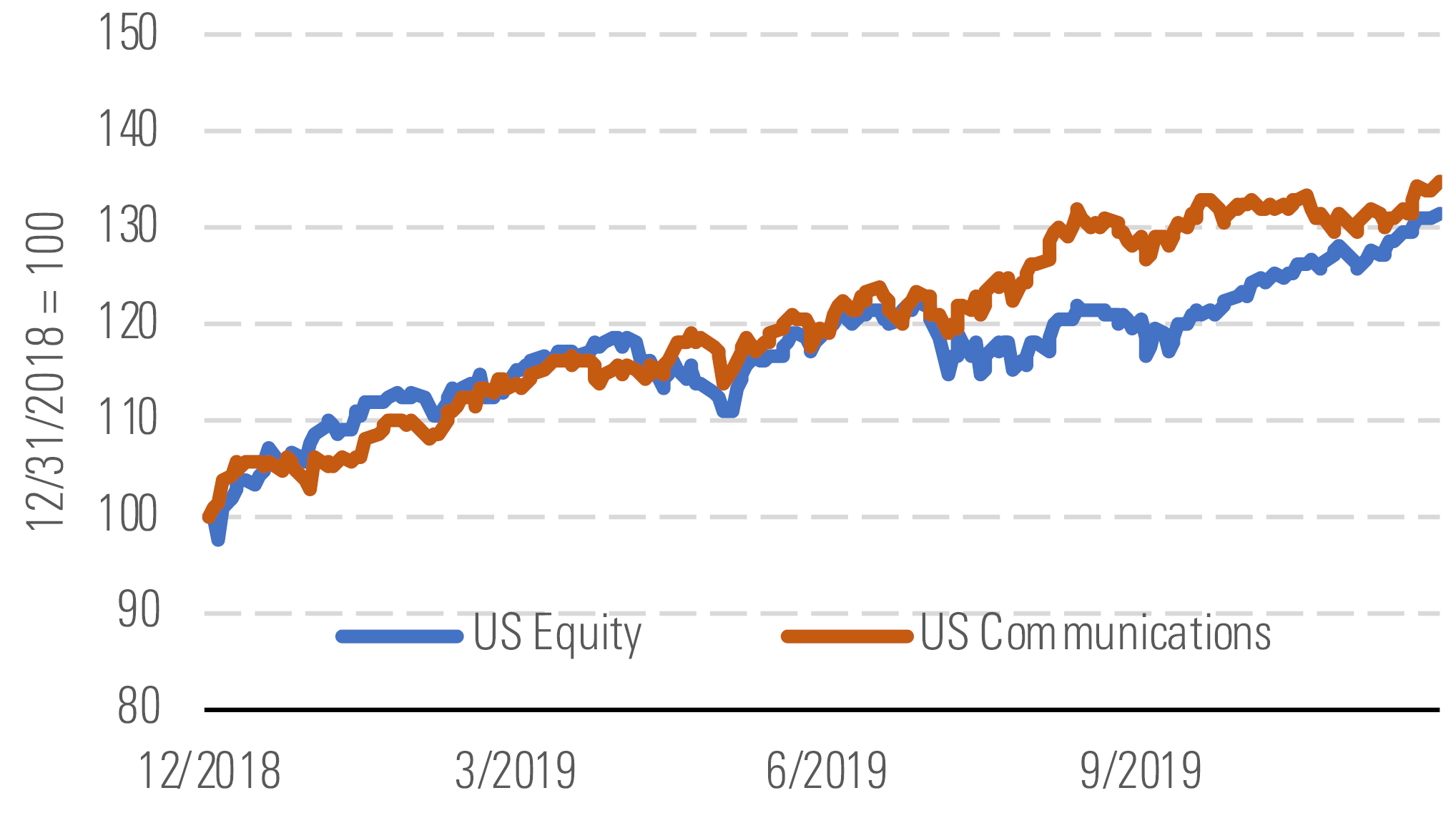

After setting a torrid pace through the first three quarters of 2019, the Morningstar US Communication Services Index took a breather to end the year (Exhibit 1). The index inched up less than 1% over the past three months, lagging a 6% gain for the broader market. Traditional phone companies AT&T and Verizon, along with cable giant Comcast, dominate the index and largely dictate its direction. AT&T shares have held steady recently following an eventful summer that saw renewed optimism on the involvement of activist hedge fund Elliott Management. At present, we don’t see significant opportunities among large-cap telecom firms.

In the old communications sector, performance has cooled. - source: Morningstar

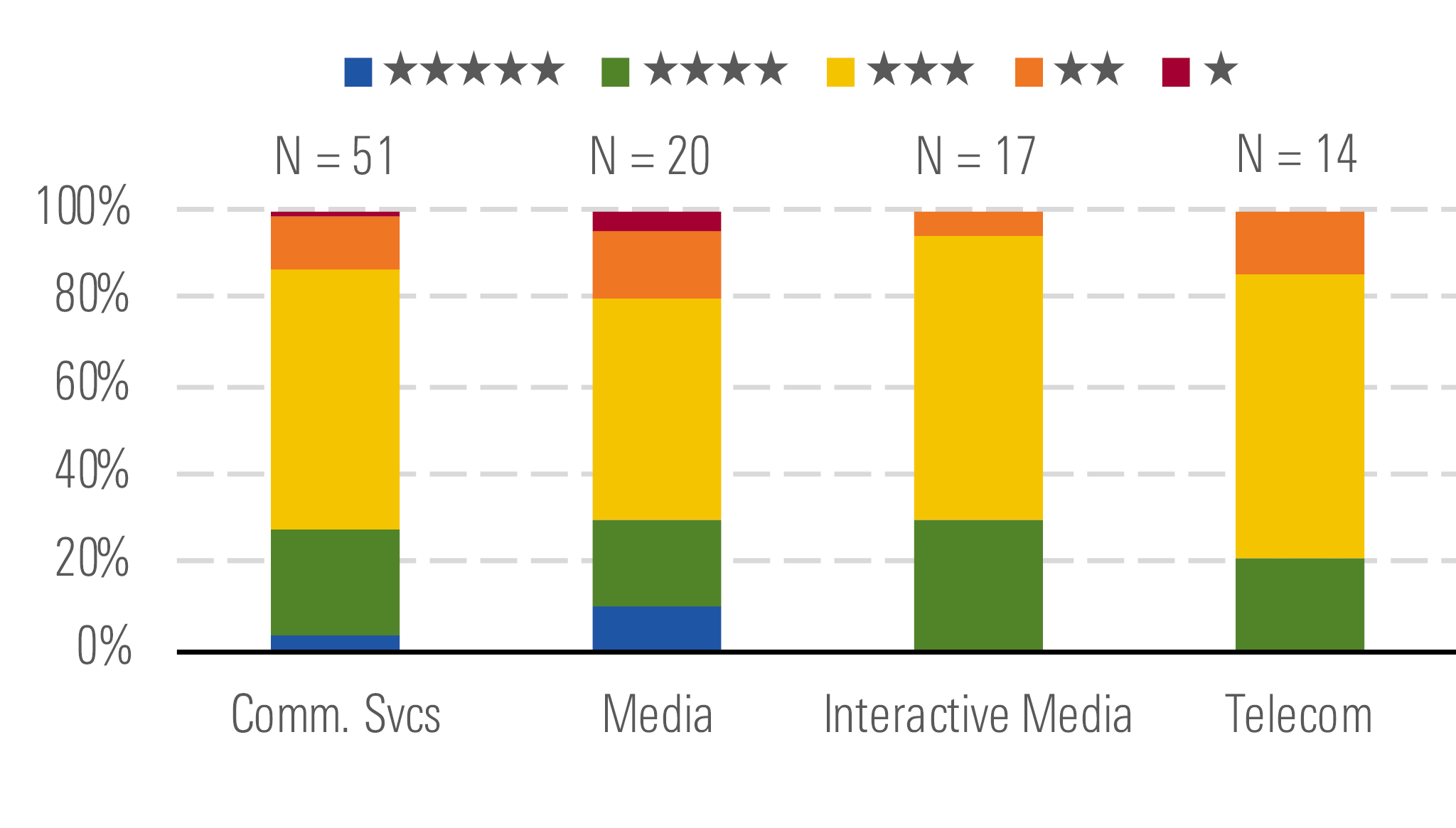

In the new communications sector, we see opportunities in media. - source: Morningstar

The communication-services sector index underwent a major overhaul recently, with the diversified and interactive media industries joining traditional telecom firms. This change better reflects the increasingly blurred lines between these firms and better aligns Morningstar’s schema with other industry data sources.

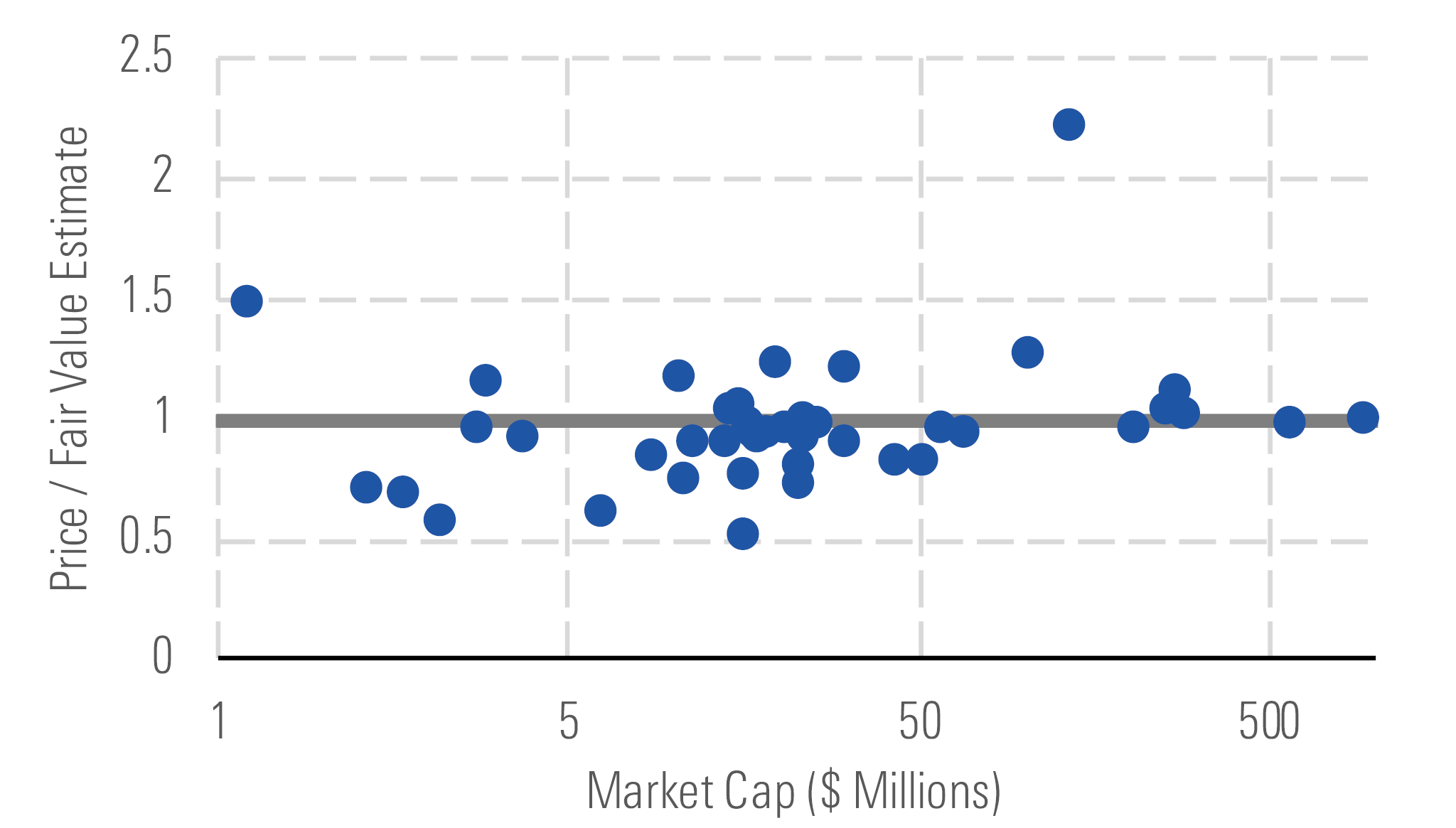

Among traditional media firms, the launch of Disney+ in November marked the first of several major services set to challenge the industry. Disney’s stock has moved up sharply in 2019 on increasing optimism concerning its ability to remain relevant with consumers regardless of how the market shifts. We’ve long believed that Disney has the strongest position of any media firm, but we don’t think the current share price adequately reflects the risks still facing the business. In contrast, we think that excitement around the looming streaming wars has led some investors to discount the ability of smaller firms to compete. While these companies may need to bulk up over the longer term, several, like ViacomCBS and AMC Networks, are well positioned to benefit as the big streaming platforms look for content to differentiate their offerings.

But we generally believe smaller firms are more attractive. - source: Morningstar

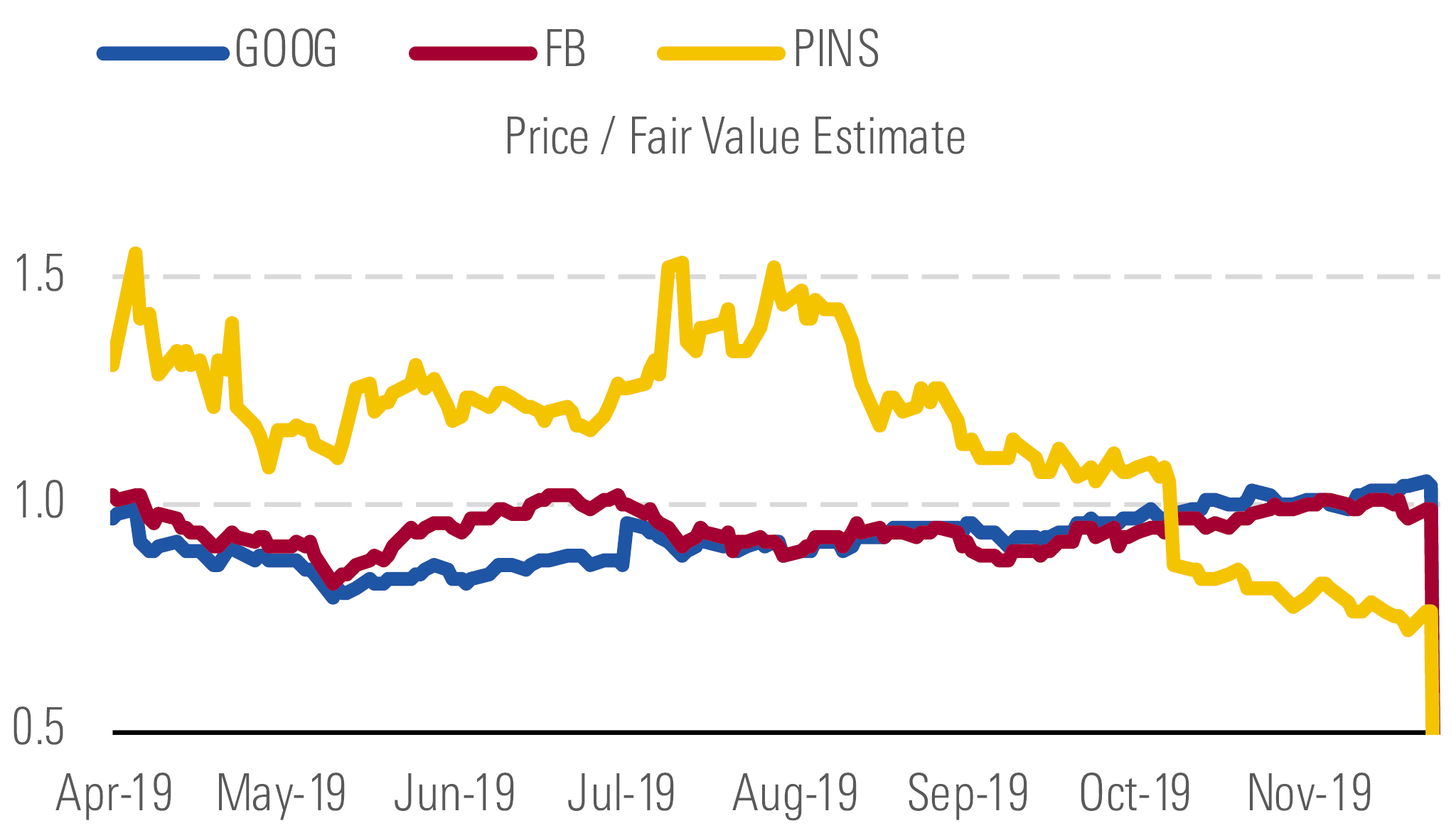

In the online world, shares of both Google and Facebook have rallied nicely since taking a beating on renewed regulatory scrutiny last spring. While we don’t believe regulatory pressures will meaningfully threaten either business, we view the risk and reward as well balanced for both stocks. Here again, we would look to smaller firms for opportunity, with stocks like Pinterest trading down to sharp discounts versus our fair value estimates recently.

For example, Pinterest is more attractive than Facebook and Alphabet. - source: Morningstar

Top Picks

ViacomCBS VIAC Economic Moat: Narrow Fair Value Estimate: $77 Fair Value Uncertainty: High

The long-discussed merger of CBS and Viacom finally closed in December, leaving management to focus on running the combined firm. ViacomCBS' competitive advantages lie in the CBS broadcast network, a valuable portfolio of cable networks with worldwide carriage, multiple production studios, and a deep content library. We believe that the firm is well positioned to benefit from the streaming wars roiling the industry, since it has its own direct outlet (CBS AllAccess) and the ability to sell content to other platforms, as seen in the recent sale of South Park to HBOMax. The shares trade at a scant 7 times our 2020 earnings forecast.

CenturyLink CTL Economic Moat: None Fair Value Estimate: $18 Fair Value Uncertainty: Very High

While CenturyLink is well known as a residential phone company, three fourths of its revenue is now derived from business customers. We expect revenue to decline in the coming years, especially in the consumer business, but we believe the market is overlooking the firm's substantial margin expansion opportunities as the business shifts to more modern technologies. At current levels, the stock is trading at about 5 times projected 2019 free cash flow and offers a dividend yield of 7.5%. We project free cash flow to remain steady over the next few years, which should allow the firm to avoid additional dividend cuts.

Pinterest PINS Economic Moat: Narrow Fair Value Estimate: $24 Fair Value Uncertainty: Very High

Pinterest is attractive for the first time since its April 2019 IPO, trading at a 23% discount to our fair value estimate following mixed third-quarter results. The firm posted sharper deceleration in U.S. revenue growth than expected, but we aren’t concerned. We think Pinterest can steadily increase ad inventory as user growth attracts more advertisers. We expect this narrow-moat firm to reach profitability by 2021, driven by a network effect around its customers and the ability to use data to deliver highly targeted ads. In the meantime, any early indications of operating leverage could push the stock higher.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)