Healthcare: Overvalued, but Opportunities in Drug and Biotech

We don't expect a major overhaul of the U.S. healthcare system.

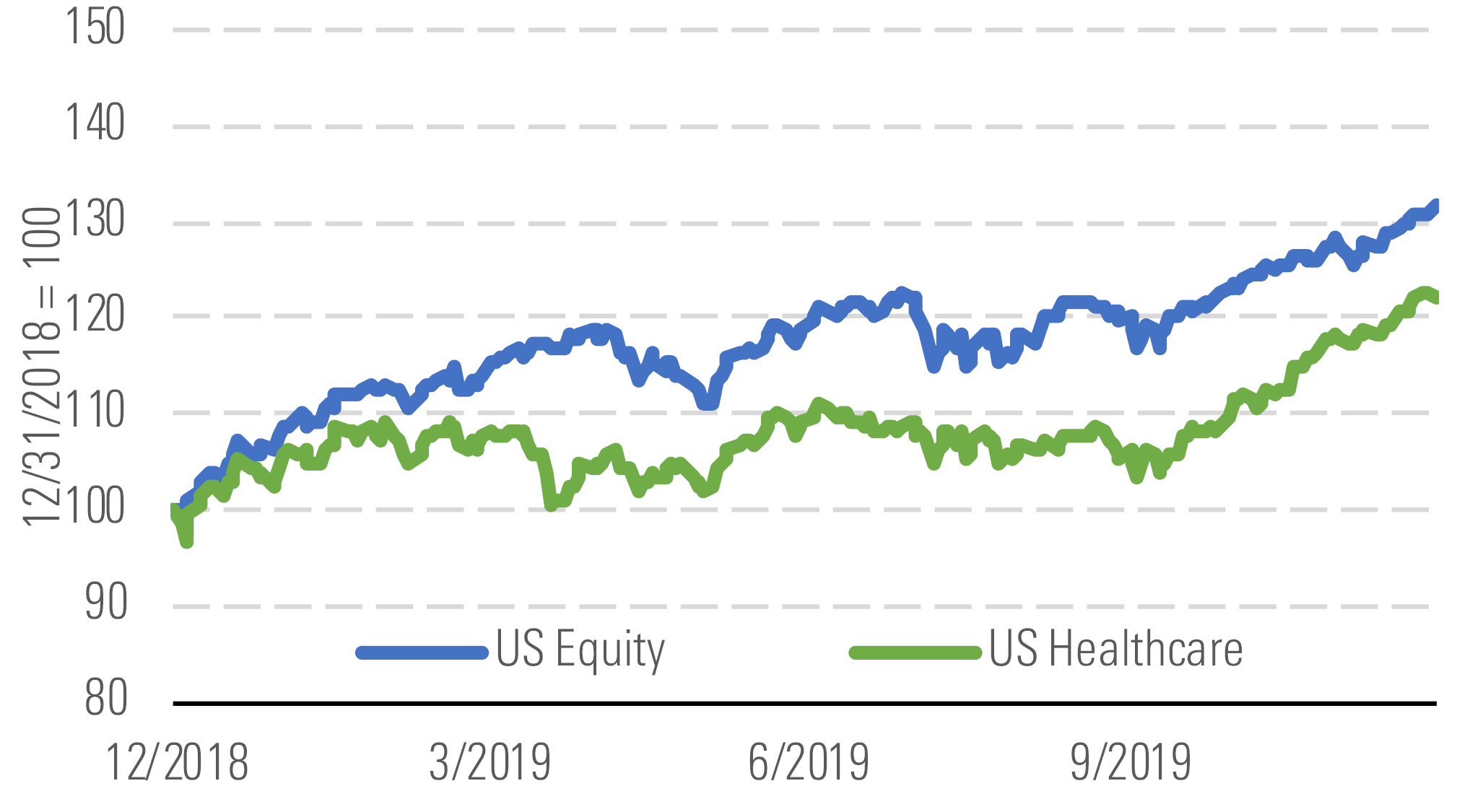

Morningstar's US Healthcare Index has increased 22% over the trailing 12 months amid solid underlying fundamental performance (Exhibit 1). However, the returns have underperformed the broader equity market performance of 31%. We believe concerns around potential changes in U.S. healthcare policies have become more elevated, with politicians increasing rhetoric for the upcoming presidential election. The heightened fears around potential healthcare policy changes have increased the sector’s uncertainty and weighed on healthcare’s relative performance.

Healthcare sector index vs. market index. - source: Morningstar

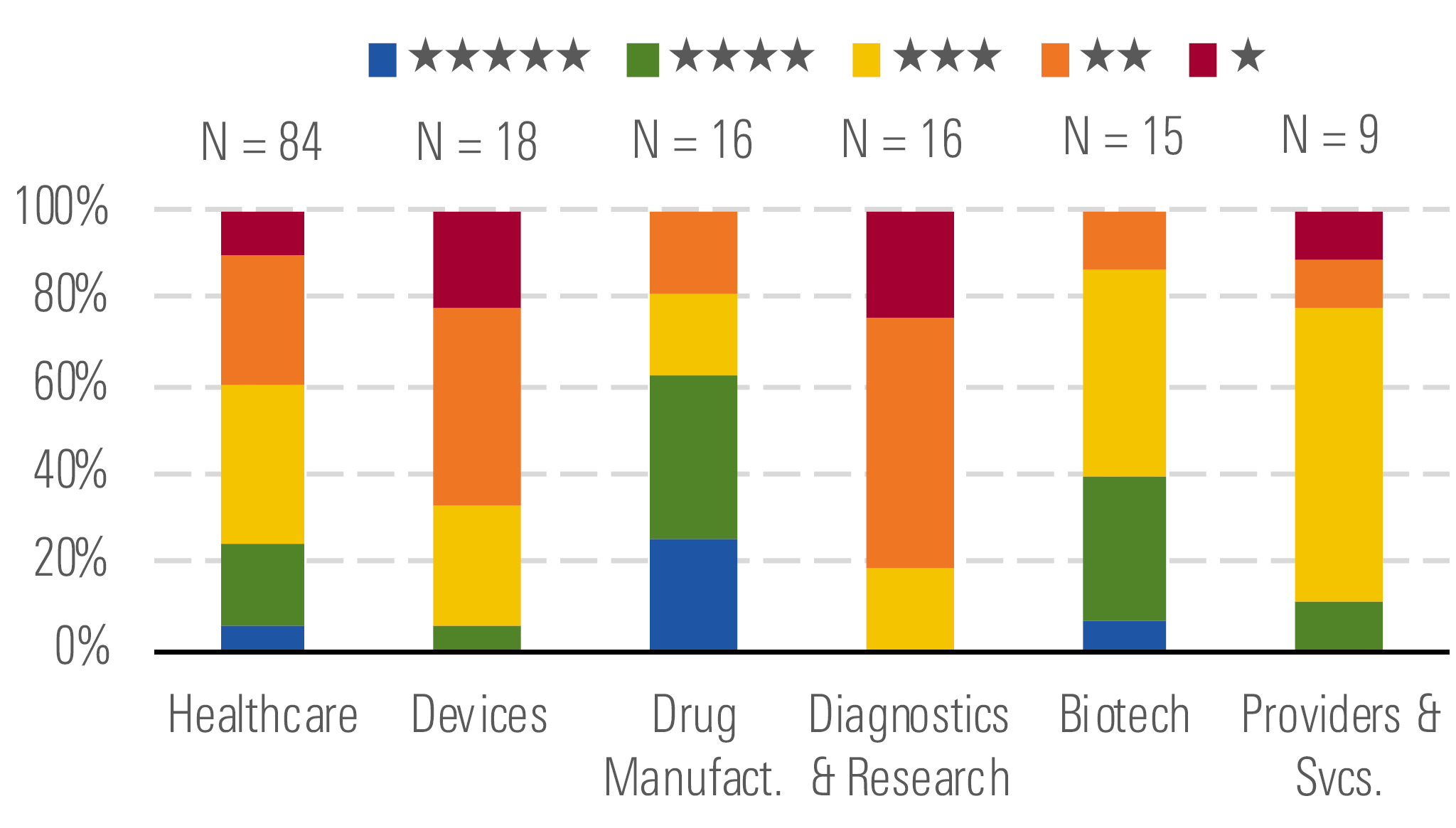

Overall, we view the healthcare sector as slightly overvalued. Our coverage trades at a slight premium to our overall estimate of intrinsic value, with the median price/fair value at 1.05. Given the slightly higher valuations in the sector, we only see a few buys, with only 12% of our coverage rated 5 stars (Exhibit 2).

Drugs and biotech have the most undervalued stocks. - source: Morningstar

The most overvalued stocks are in the device and diagnostics industries, where performance has generally been strong, but not strong enough to support current valuations. We believe the valuations in these industries show overly optimistic projections and could reflect the market's desire for exposure to healthcare but not in the pharmaceutical industry that is facing potential policy changes in the U.S.

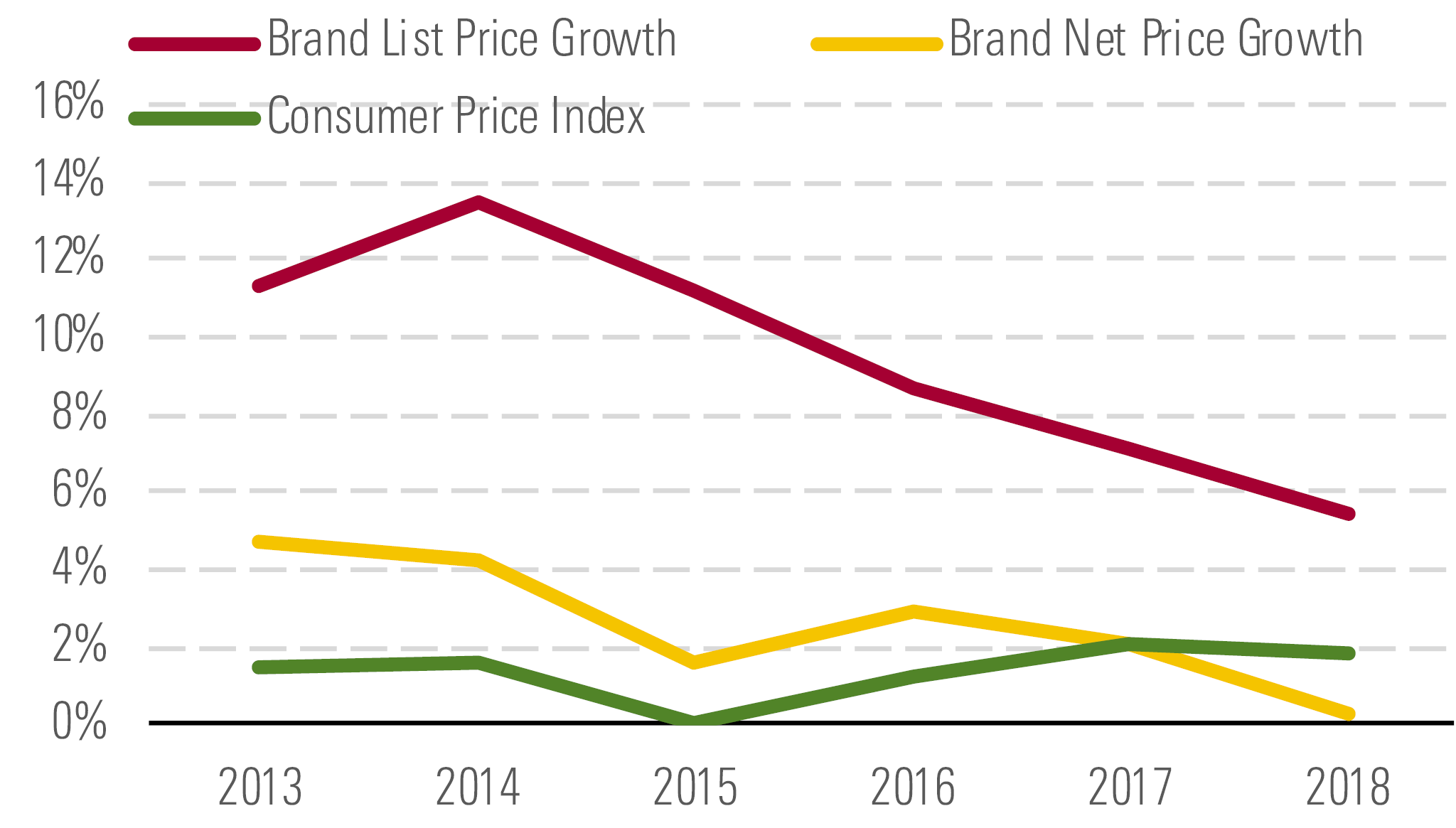

While the overall sector looks slightly overvalued, there are some pockets of undervalued stocks. The highest number of 4- and 5-star stocks are in the drug and biotech industries. While U.S. politicians have continued to focus on new policies limiting drug pricing power, we don’t expect radical change in the industry. With growth in net drug prices (the price paid after discounts) decelerating to below inflation, we believe drug pricing is less of a problem (Exhibit 3). Therefore, even though some form of U.S. policy reform is probable, a major overhaul seems unlikely. We expect drug pricing power to largely hold steady through potential new U.S. policy changes.

Drug list and net price increases versus overall inflation. - source: Morningstar

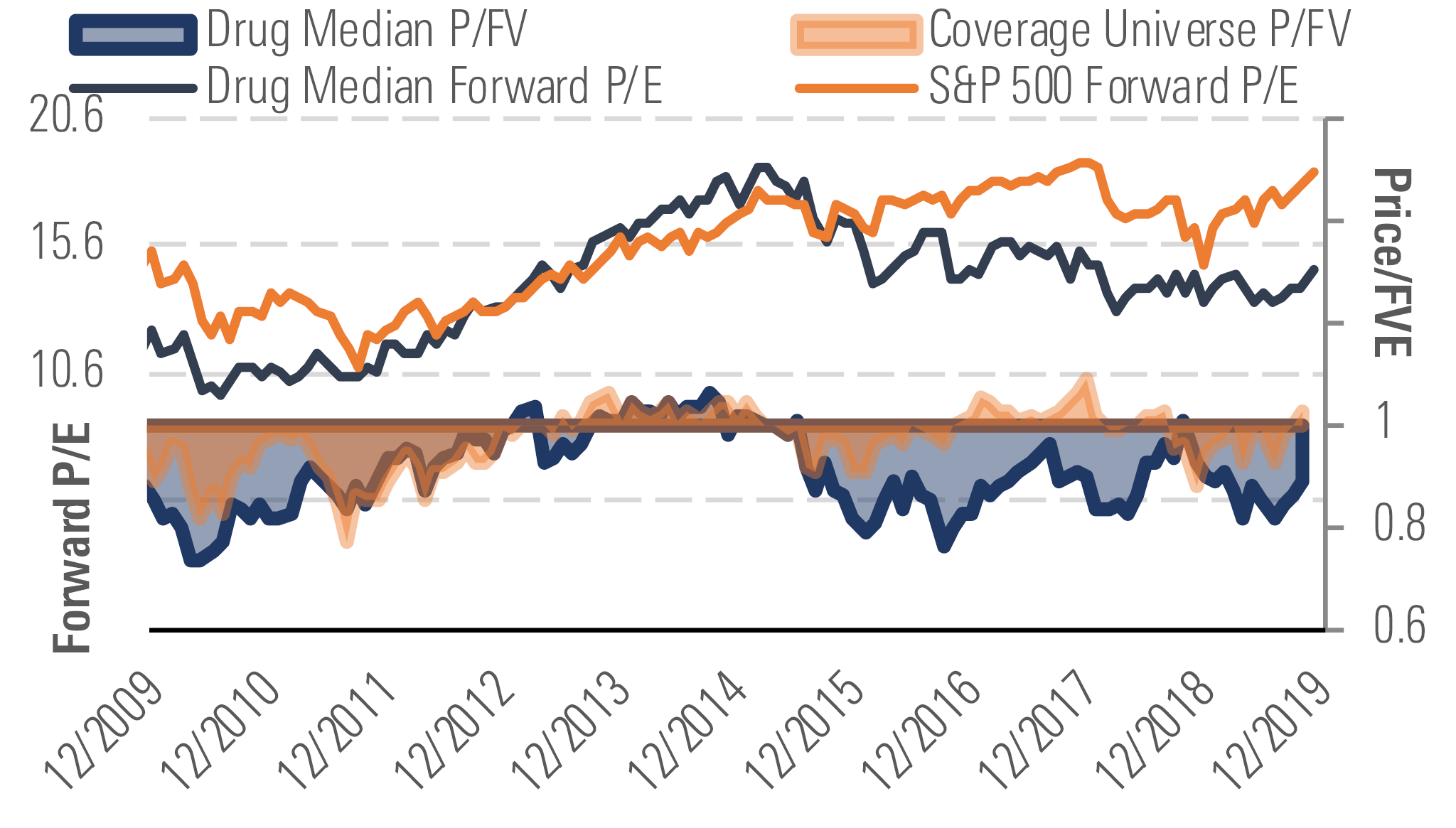

On the valuation side, we base all our valuations on discounted cash flow analysis, but looking at a P/E trend (Exhibit 4), the drug and biotech stocks look more expensive than the bargain basement prices of 2010 but less expensive than 2014 (before pricing pressures became more of a concern).

Pharma/biotech valuation versus the P/E multiple over the last 10 years. - source: Morningstar

Top Picks

Pfizer PFE Economic Moat: Wide Fair Value Estimate: $46 Fair Value Uncertainty: Low

The market is underappreciating Pfizer's next-generation drugs, which should drive strong long-term growth. Further, the pipeline drugs focus on areas of unmet medical need where pricing power is strong. Additionally, the company is facing very few major patent losses over the next five years, which should also support steady growth. Lastly, the divestment of the established products group Upjohn to Mylan creates a new entity with robust cash flows, likely supporting a strong dividend.

Biomarin Pharmaceutical BMRN Economic Moat: Narrow Fair Value Estimate: $119 Fair Value Uncertainty: Medium

BioMarin's orphan drug portfolio and strong late-stage pipeline support a narrow moat, and we think the market underappreciates the firm’s entrenchment in current markets as well as its potential in new markets, particularly with its emerging gene therapy pipeline. BioMarin has several products on the market to treat rare genetic diseases; these products generally see strong pricing and have limited competition because of a solid combination of patent protection, complex manufacturing, and BioMarin’s close relationships with patients who rely on its therapies for chronic treatment.

CVS Health CVS Economic Moat: Narrow Fair Value Estimate: $92 Fair Value Uncertainty: Medium

CVS' ownership of the largest national pharmacy benefit manager provides it substantial negotiating leverage and cost advantages in claims processing, allowing for best-in-class operating costs per claim. Further, the firm's combination with Aetna should put the company in a much more attractive competitive position as the industry moves toward preferring a more integrated service offering. Lastly, investors should benefit from meaningful cost and selling synergies associated with the combination of a leading medical benefits business with the largest PBM and retail pharmacy network in the country.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)