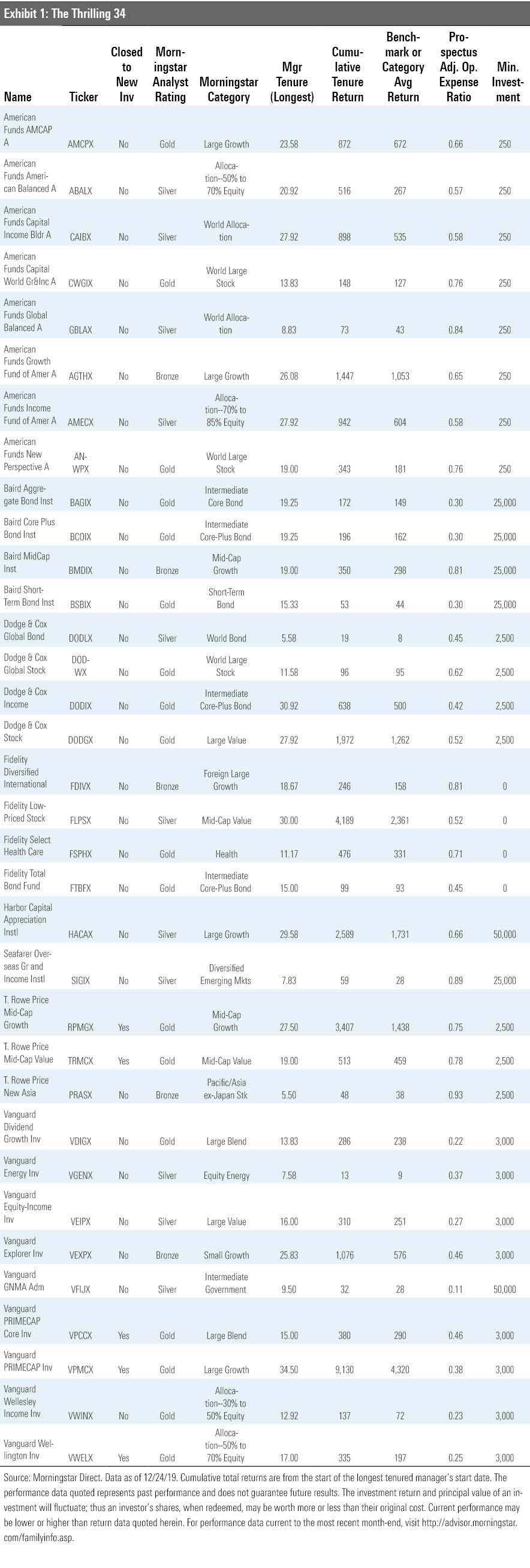

The Thrilling 34

Only 34 funds passed all my tests.

Every year I write about the Thrilling 34--although the number varies slightly each time. The idea is to focus on the most important factors and let them do the weeding for me. The goal is a short list of outstanding funds accessible to individual investors. This isn’t a list for huge pension funds.

You can be awfully picky when you have 8,000 funds to choose from. The criteria have largely been the same, with some minor tweaks over the years.

Here are the tests I used this time:

- Expense ratio in the category's cheapest quintile.

- Manager investment of more than $1 million in the fund.

- Morningstar Risk rating below the High level.

- Morningstar Analyst Rating of Bronze or higher.

- Parent rating better than average/neutral.

- Returns above the fund's benchmark over the manager's tenure for a minimum of five years. In the case of allocation funds, I also used category averages because benchmarks are often pure equity or bond and therefore not a good test.

- Must be a share class accessible to individual investors with a minimum investment no greater than $50,000.

- No funds of funds.

The only real change to the above list is that I used prospectus adjusted operating expense ratio. I didn’t make the switch just because it’s a catchy name. It’s the measure we use for our analyst ratings, too. It includes rolled up fund-of-funds fees but does not include transactional costs such as leverage or shorting. This avoids an apples-to-oranges comparison.

A more subtle change is that we have moved to the enhanced analyst ratings methodology, which rates funds on a share class level and has resulted in some rating changes. In particular, the ratings adaptation has led to downgrades in low-return categories such as short-term bond and munis, because our methodology is particularly unforgiving of middling fees in low-return categories. However, because I already set the bar at cheapest quintile, it isn’t likely to knock many of this list’s candidates out of the box.

You may recall that I detailed past performance of prior lists earlier in the year here. In all six lists over the years, at least two thirds or more of the funds outperformed peers. And in five out of six lists, a majority outperformed their benchmarks. Of course, there are no guarantees that this list will match the prior lists’ performance.

In the case of funds where multiple share classes qualified, I chose the one with the lowest minimum. For example, Vanguard’s Admiral shares and Investor shares qualified for the nine funds that made the list, but because the investor share class also qualified, I used the investor share class.

I often get questions about this list that imply I should have chosen fund B over fund A. To be clear, it’s a series of screens. I’m not picking the funds and there is no set number of funds. Over the years it has bounced from the 20s to the 40s.

My last note is that I included funds closed to new investors because their shareholders want to know if they still pass the test.

Here then are the Thrilling 34 in reverse alpha order.

Vanguard Vanguard got nine funds on the list, the most of any firm. As Vanguardians like to say, it's not active versus passive, it's low cost versus high cost. The list of nine features active funds with fees as low as 21 basis points. When a fund is that cheap, it's a lot easier to deliver good performance and beat the benchmark.

Vanguard Wellington VWELX leads the way at just 0.25% for a classic balanced fund run by a strong team at Wellington. It’s so easy to own that I recommend it just about as much as any other fund. And, no, it isn’t closed--you just have to invest directly with Vanguard to get in.

Vanguard Wellesley Income VWINX is closely related to Wellington. It just has more bonds and more income, though less return potential.

Speaking of funds I recommend the heck out of, Vanguard Primecap VPMCX and Vanguard Primecap Core VPCCX are two of the best growth funds I know of. They are both closed, but their slightly pricier cousins Primecap Odyssey Stock POSKX and Primecap Odyssey Growth POGRX are both open to new investors. Senior analyst Alec Lucas just recorded a video discussing Primecap that you can watch here.

Vanguard GNMA VFIIX delivers straightforward GNMA exposure for 0.21% if you invest $3,000 and 0.11% if you invest $50,000.

Vanguard Explorer VEXPX delivers very boring small growth exposure for 0.46% and a $3,000 investment.

Vanguard Equity-Income VEIPX is a standout in the equity-income world with excellent management and a solid yield.

Vanguard Dividend Growth VDIGX has a great but simple strategy. It aims to find companies that are likely to raise their dividends over time. That’s very basic, but companies that are likely to raise their dividends have to have healthy balance sheets and good growth prospects, too, and that makes for a fund with good defensive characteristics in recessions.

T. Rowe Price I'm a big fan of T. Rowe Price, but many of its funds are just outside the cheapest quintile and so only three qualify. Still, they are among the best.

T. Rowe Price New Asia PRASX is a new entrant to the list because manager Anh Lu passed the five-year tenure mark a few months ago. We like Lu and the team of analysts supporting this fund. Its growth-oriented strategy looks like many other T. Rowe funds’ emphasis on earnings growth and barriers to entry.

T. Rowe Price Mid-Cap Value TRMCX is a disciplined value fund that has delivered great results over David Wallach’s 19 years. However, disciplined value has been a tough place to be as the fund’s weak three-year results indicate. But I see plenty of reasons to hold on at this closed fund.

T. Rowe Price Mid-Cap Growth RPMGX has been in clover in this growth rally. Brian Burghuis has found winners upon winners at this closed fund.

Seafarer Overseas Growth and Income SIGIX has a $25,000 minimum for this share class, so don’t let the institutional tag throw you. Andrew Foster has done a fine job here and at previous funds he ran for Matthews. The fund did have a setback in the recent departure of comanager InBok Song.

Harbor Capital Appreciation HACAX is likewise an accessible institutional-labeled fund. Here the Jennison team makes the most from large growth rallies like the one we’ve just experienced.

Fidelity Fidelity got four funds on the list this time. Like T. Rowe, many of its active funds fall just short on fees.

Fidelity Total Bond FTBFX is a great bond fund that mixes aggression and caution. Ford O’Neil has the flexibility to position this fund more or less aggressively on credit risk. But it also boasts the strong issue selection we’ve come to expect from Fidelity’s bond funds.

Fidelity Select Health Care's FSPHX Morningstar Analyst Rating was recently upgraded to Gold. We’re fans of the deep team supporting this fund and it’s nice to get it at a reasonable fee.

Fidelity Low-Priced Stock FLPSX is the same brilliant fund it’s always been under Joel Tillinghast.

Fidelity Diversified International FDIVX has been a nice steady performer since Bill Bower took over in 2001. He looks for quality growth names and that has made the fund into a mild-mannered winner.

Dodge & Cox Dodge & Cox is another firm that was made for this list. (American and Vanguard are the others.) Dodge has long-tenured managers, low fees, and nearly all of its managers invest more than $1 million of their own money in their funds. So, on a fundamental basis you have funds that are quite consistent year over year, even if their returns can be buffeted when value hits a rough patch.

Dodge & Cox Stock DODGX, Dodge & Cox Income DODIX, and Dodge & Cox Global Stock DODWX are well-known standouts with teams of great managers.

Dodge & Cox Global Bond DODLX is the new kid on the block. Its rating was recently upgraded to Silver as we’ve become more comfortable that it could successfully apply its approach from the Income fund to global bonds and currencies. Launched five and a half years ago, the fund has produced excellent results but still has less than $1 billion in assets.

Baird Baird's institutional funds carry a $25,000 minimum, thus making my hurdle. The Milwaukee-based team has grown on us, leading us to upgrade the trio of bond funds to Gold. Baird Aggregate Bond BAGIX, Baird Short-Term Bond BSBIX, and Baird Core Plus Bond BCOIX lean toward the cautious side of their peer groups yet still produce solid returns. The Core Plus fund is obviously the most aggressive of the three but it still has good risk-awareness to keep it from going too far out on a limb.

Baird MidCap BMDIX, the lone equity entrant from Baird, is a solid pick, too. However, as the Bronze rating indicates, we don’t have it at the same level as the firm’s bond funds.

American Capital Group's long-term focus dovetails nicely with the long-term focus of this screening exercise. Managers and analysts tend to make a career of their time at the firm. You can see that in the sober way the funds are managed, the long tenures, and the sizable investment managers make in their own funds. Costs are reasonable, too. (You can get American funds for no-load in most NTF supermarkets.)

American Funds New Perspective ANWPX illustrates how widely the firm’s analyst and manager staff reaches. They’ve long had offices around the globe and brought excellent fundamental research to markets near and far. Not many firms have the depth to run a great world-stock fund, but they do.

American Funds Income of America AMECX highlights another strength: dividend investing. The firm has a variety of dividend-oriented funds that produce solid income without sacrificing returns or taking bad risks. That focus does mean the fund has faced recent headwinds due to its tilt toward value and overweighting in foreign equities. But at some point, the market will rotate in its favor.

Bronze-rated American Funds Growth Fund of America AGTHX is quite diversified due to its large asset base. It spreads assets out among more managers than it typically does and that means a rather diffuse portfolio. So, this is not a thrilling growth fund but one with good fundamentals nonetheless.

American Funds Global Balanced GBLAX is a relative newcomer launched eight years ago. The fund targets a 60/40 stock to bond allocation. Many of its peers make top-down calls, but this one focuses on issue selection, which makes sense for American.

American Funds Capital World Growth & Income CWGIX takes Capital’s dividend skills on the global stage and the result is a fine core holding.

American Funds American Balanced ABALX is a massive $157 billion fund with six equity managers and one balanced manager making allocation decisions. The main attraction remains stock selection and defensive characteristics combined with low fees.

American Funds AMCAP AMCPX seeks out capital appreciation and it has done a fine job of it. That mandate is broader than large growth and that’s held it back somewhat in this growth-driven rally. But there’s no reason it should depress returns for the next 10 years. Over longest-tenured manager Claudia Huntington’s 23 years, returns have been excellent.

The information, data, analyses and opinions contained herein do not constitute investment advice offered by Morningstar, are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and are not warranted to be correct, complete or accurate. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Opinions expressed are as of the date written and are subject to change without notice. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.

Before making any investment decision, investors should read and consider all the relevant investment product’s offering documents and information. Customers should also seriously consider if the investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)