Using Morningstar's New Factor Profiles

Another tool for understanding stock funds.

The Power of Pictures Tuesday's column introduced Morningstar's Factor data. Morningstar has calculated the returns attributable to seven stock "factors" (or characteristics, if you prefer) for its global equity database, going back to 2004. Those factors are:

- Style (Growth versus Value)

- Yield

- Momentum

- Quality

- Volatility

- Liquidity

- Size

Since 2004, the best-returning factors have been volatility, size, and momentum. All things being equal, riskier stocks have outgained their safer rivals; smaller companies have surpassed larger firms; and issues with high price momentum have beaten those that were temporarily unpopular. Unsurprising, given that factor returns are unadjusted for risk, these three tactics are aggressive, and the time period was a bull market (save for the very notable exception of 2008).

All fine and good, but somewhat theoretical. Absent additional information, it’s difficult to gauge a fund’s exposure to these factors. Sure, a small-company fund will have a low size score, and a fund that calls itself “value” will usually (although not always, as labels occasionally deceive) have high exposure to the value factor. But in most cases, estimating a fund’s factor exposures without doing the calculations is mere guesswork.

Enter Morningstar’s Factor Profiles. Debuting this month for all equity mutual funds and exchange-traded funds, assuming that the fund is at least 90% invested in stocks (that threshold is too high; I have lobbied the powers that be to lower it), Factor Profiles depict each fund’s exposure to the seven factors. They can be found by clicking on the Portfolio tab within a fund report.

Three examples will provide a flavor. The first comes from one of this year’s stronger U.S. equity funds, the second from a roughly average performer, and the third from a laggard. The funds’ factor exposures visually explain why.

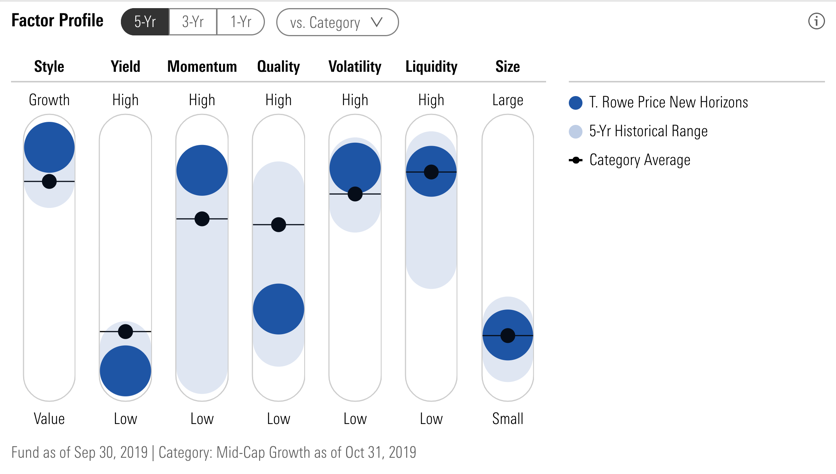

T. Rowe Price New Horizons The landmark emerging-growth stock fund--New Horizons' PRNHX 1960 launch inspired dozens of copycats--has enjoyed a banner year, gaining 36.4% through Wednesday. It could hardly have been otherwise. As with the full 2004-19 time period, this year has handsomely rewarded volatility and momentum, each of which New Horizons delivers. As shown by its Factor Profile, the fund outdoes the mid-cap growth Morningstar Category average (shown by the black lines) on both accounts.

Indeed, as the Factor Profile demonstrates, New Horizons is something akin to a mid-cap growth fund, squared. Overall, the category has a growth style, tending to own liquid, volatile, high-momentum, high-quality stocks that have low yields. New Horizons is all that and more, except that its quality score is below the group norm. (The fund willingly holds companies that are not currently recording strong profits, but which are expected to improve their fortunes.)

New Horizons’ financial ratios and sector weightings support the thesis that the fund aggressively represents its category. It pays more for its businesses than do its rivals, as measured by price/earnings, price/book, and price/cash flow ratios. It also weights the group’s favorite sectors more heavily, owning more technology, healthcare, and industrials stocks than does the mid-cap growth average.

In short, the Factor Profile supports the evidence offered by the surrounding data tables, in a picture that can more readily be interpreted.

Fidelity Contrafund Another famous entry. Just as T. Rowe Price New Horizons was the face of the Go-Go 1960s, Fidelity Contrafund FCNTX strutted through the 1990s. The fund entered the decade managed by future Tampa Bay Lightning owner Jeff Vinik, who then was promoted to Fidelity Magellan FMAGX, before leaving to start his a hedge fund. Will Danoff succeeded him and has never looked back. Almost 30 years later, Danoff is still in charge.

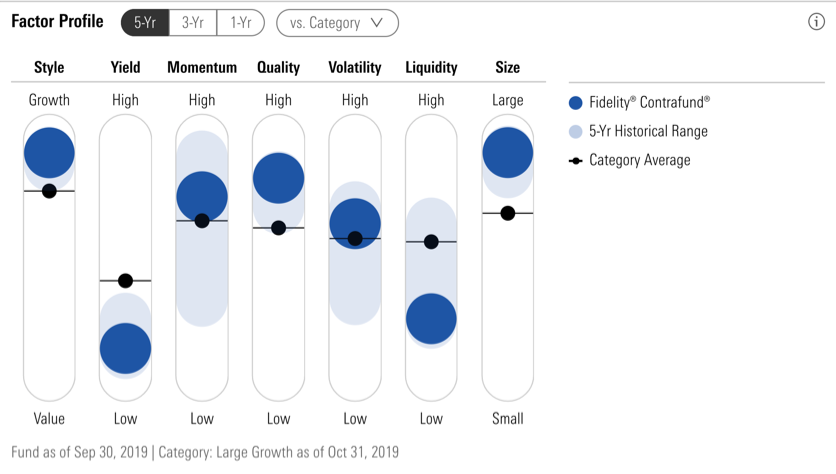

The $120 billion fund is not what it once was, though. For one thing, Danoff long ago abandoned any pretense of being “contrarian” (the source for the fund’s name). Contrafund is as conventional as a fund can be, with four exceedingly familiar firms accounting for a full 25% of its portfolio (Facebook FB, Amazon.com AMZN, Berkshire Hathaway BRK.A, and Microsoft MSFT). Its performance has followed suit. The fund reliably places near the large-growth fund average.

Contrafund’s Factor Profile confirms that its youthful eccentricities--at one point during Vinik’s reign, its largest holding was a controversial biotechnology startup--are long behind it. The fund owns larger companies than even most of its rivals, and they are of even better quality. In some markets, those attributes would provide safety, but recently they have somewhat slowed the fund. Better to have pursued higher momentum and volatility.

DFA U.S. Small Cap Value In the grand scheme of things, Contrafund isn't that different from New Horizons. Its companies are much bigger and better known, but two funds are similar in that each uses growth strategies, and each usually holds high-momentum stocks. For the most part, a market climate that favors one of those two funds will be, at worst, neutral for the other. The two funds sail in roughly the same direction.

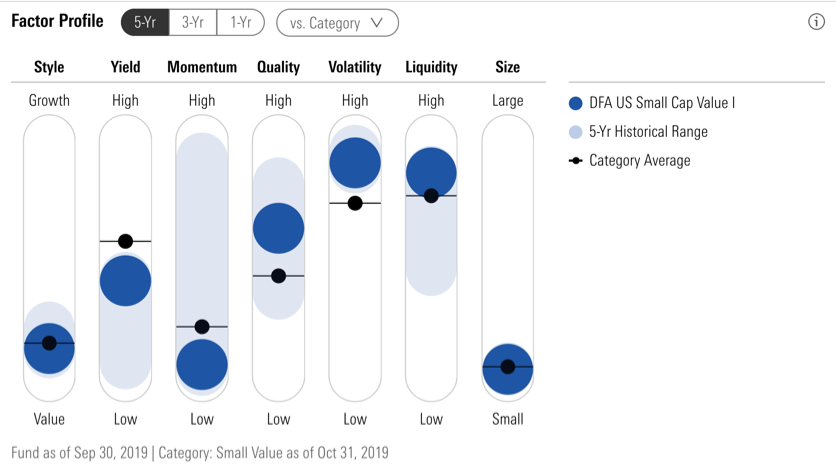

DFA U.S. Small Cap Value DFSVX travels somewhere else entirely. That is scarcely news, being evident both in the fund’s name and in its position in the bottom left-hand corner of Morningstar’s Style Box. The fund’s Factor Profile also instantly signals Small Cap Value’s unusual positioning, along with offering a couple of additional clues.

Now that’s dramatic! Not only are the fund’s holdings unusually small and cheap, but the portfolio’s momentum score is rock-bottom. Unlike the previous two funds, DFA Small-Cap Value owns securities that have performed relatively poorly over the past year. That has been a problem for this year’s stock market, in which the winners have kept winning and the relative losers have continued to lag. The fund also has notably high exposure to the volatility factor. That would help it through some bull markets--but not one that has been led by momentum stocks.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)