Best of Breed Domestic-Equity Funds

The active/passive debate doesn't have to be an either/or choice.

While index funds have been steadily gaining ground and now make up more than half of equity-fund assets, the active/passive debate doesn't have to be an either/or choice. Active investing works better in some areas of the market than others, so it's worth considering if you're willing to put in some extra time and research on the areas where it has the greatest potential.

As part of the recent methodology upgrades to the Morningstar Analyst Rating, we took a deep dive to see where active management has the greatest potential payoff or penalty across investment styles. The details are complicated, but the upshot is that in some areas nearly all active funds had similar results (as measured by pre-fee alpha, a measure of value added versus an index), but other areas had a wider range of outcomes. When returns tend to be tightly clustered, there's less of a potential payoff for active management. When there's a wider dispersion of returns, there's a greater potential reward--or penalty--for straying from a market benchmark.

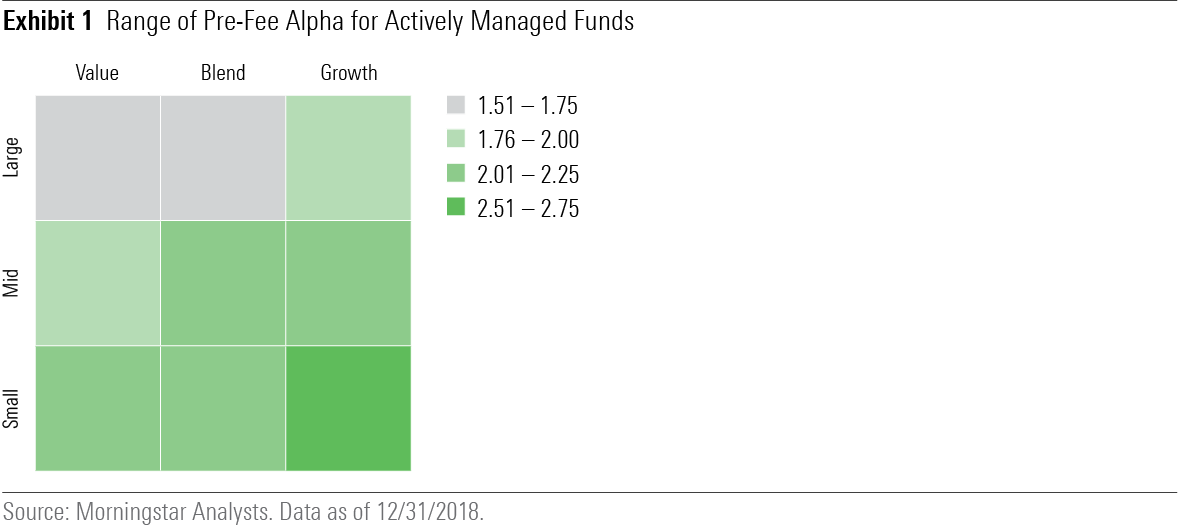

The chart below illustrates the range of pre-fee alphas for actively managed equity funds across the Morningstar Style Box. (This article focuses on domestic-equity funds; we'll cover international and fixed-income offerings at a later date.) The areas shaded in gray (large-value and large-blend) have the smallest dispersion of returns, while the small-growth square had the biggest range of returns.

Part of the reason for the broader distribution of outcomes among small-cap funds probably relates to more limited capacity for active managers. By definition, small-cap stocks have less dollar value in terms of shares outstanding, and it can be tough for funds to continue adding value as they gather more assets. To prevent this problem, the most successful small-cap funds will often close their doors to new investors.

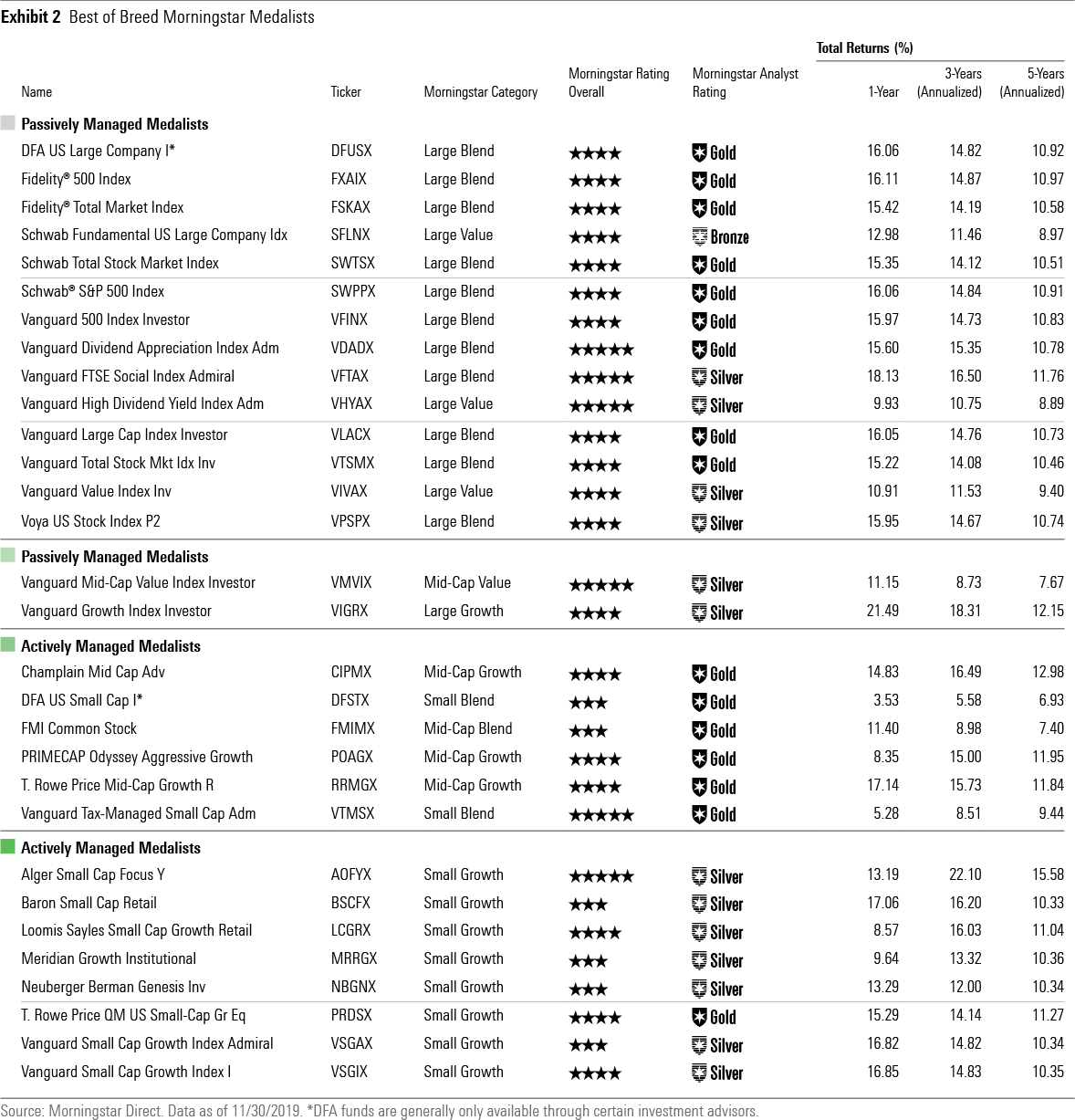

Putting these results in practice, then, implies that investors who are willing to put in the extra time to do research on actively managed funds that are still open--and are also willing to take on the risk of a negative outcome--should concentrate their efforts toward the bottom right-hand sections of the style box. This helps narrow down the range of potential investments you might want to consider. The list below highlights some of Morningstar's Medalists, focusing on passively managed funds for the large-cap categories (and mid-cap value) and actively managed funds for the other areas.

As always, a few caveats apply. Just because active management has potential doesn't mean it will pay off. Indeed, it's important to remember that the dispersion of alpha cuts both ways: There's more potential on both the upside and the downside. If you want to take a risk on an active fund, make sure you have the fortitude to stick with it when times get tough.

It's also worth noting that the range of pre-fee alphas has been contracting over time. That's less true on the fixed-income side, but the dispersion of returns has been getting narrower across all of the domestic-equity categories in the study. It's just not as easy to find an equity fund with the potential for performance that diverges from its index as it used to be.

Another key point: Fees matter. Morningstar's research has consistently found that expenses are by far the most predictive factor behind fund performance. Fees are so important that the revised Morningstar Analyst Rating places significantly more weight on expenses, making it even tougher for funds with higher costs to excel in our system. Taxes are another important factor to consider. Because the tax drag from taxable capital gains can easily offset any advantage from active management, make sure to look at a fund's distribution history to avoid sacrificing any extra returns to the IRS.

Investors who want to keep things simple can do perfectly well by indexing their entire portfolios. But those who want to take a more nuanced approach can improve their odds by focusing their efforts on areas where active management has the greatest potential.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)