10 Most Popular Stocks, Funds, and ETFs of 2019

Here are the most-viewed securities on Morningstar.com this year.

Last week, Google released its Year in Search report. The most popular Google search in the United States in 2019 was Disney Plus. Actor Cameron Boyce, rapper Nipsey Hussle, Hurricane Dorian, and former NFL player Antonio Brown rounded out the top five most popular searches.

On Morningstar.com, we're also sharing "most popular" content. Yesterday, we covered the most popular stories on the site in 2019. Today, we're looking at the most frequently viewed securities--stocks, funds, and exchange-traded funds--on the site for the year.

Note: Morningstar.com migrated to a new page-view tracking system in July; as such, these rankings are based on page-view data after that time.)

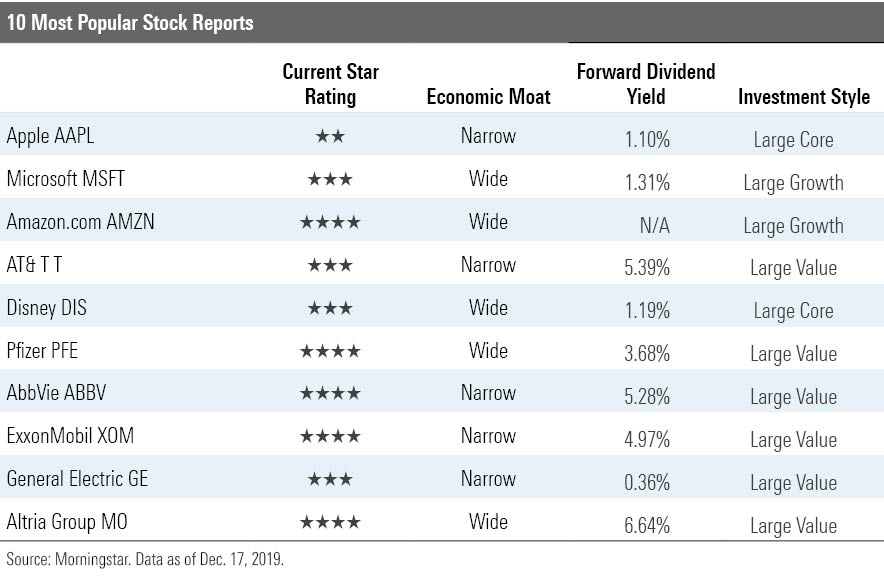

Not surprisingly, the list of most-often-viewed stock reports consists solely of high-quality large companies (meaning the companies have carved out economic moats). What's a little surprising, though, is that several stocks on the list (Apple AAPL, Microsoft MSFT, and Disney DIS among them) carry modest dividend yields--surprising, because our readers typically eat up content about dividend-paying stocks.

Also notable: Despite the ongoing dominance of growth stocks for most of 2019, the most-popular stocks list skews slightly toward stocks landing on the value side of the Morningstar Style Box. And half of the stocks are trading in buying range today according to our metrics.

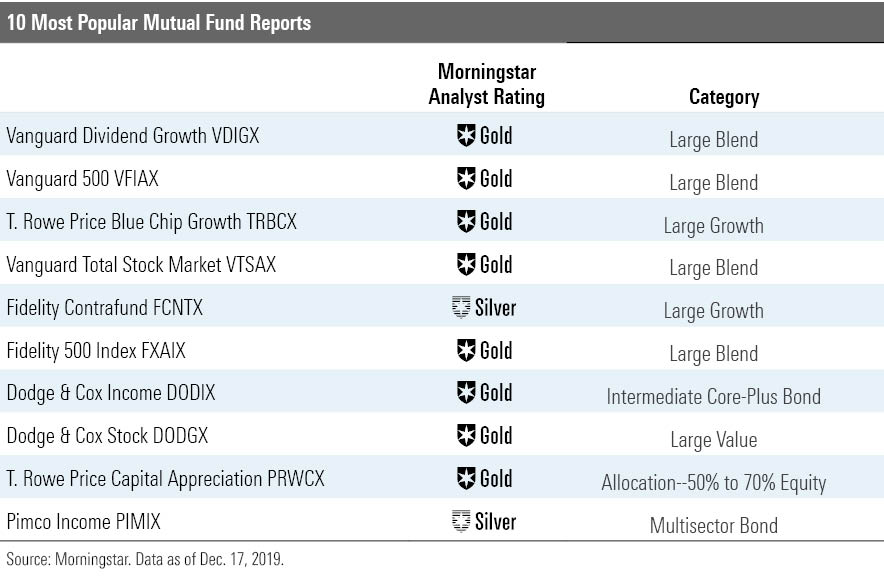

Pivoting to funds, the most popular mutual fund list is, as one would expect, dominated by core-type stock and bond funds earning Morningstar Analyst Ratings of Gold. Although a few passive strategies make the list--Vanguard 500 VFIAX, Vanguard Total Stock Market VTSAX, and Fidelity 500 Index VTSAX--the majority practice active strategies. And despite readers' general interest in all things Vanguard, funds from other topnotch families including T. Rowe Price, Fidelity, Dodge & Cox, and Pimco are also among the most popular.

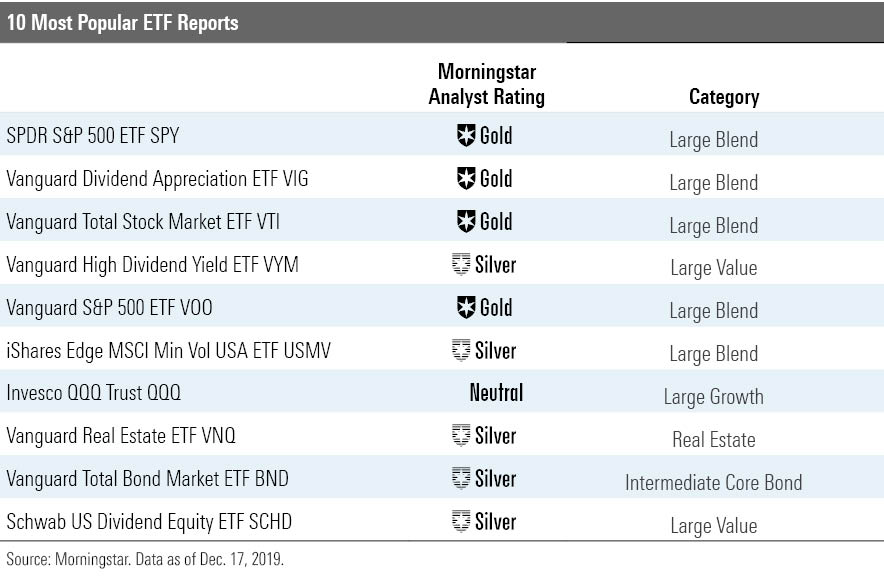

On the ETF front, the story is a little different. Yes, the list is dominated by core-type ETFs. But it is also dominated by Vanguard. And it includes several ETFs following explicit dividend strategies: Vanguard Dividend Appreciation VIG, Vanguard High Dividend Yield VYM, and Schwab US Dividend Equity ETF SCHD.

Moreover, two of the ETFs on the list are a little more nichelike than you might expect for a “most popular” list. For starters, iShares Edge MSCI Min Vol USA ETF USMV isn’t your standard large-blend portfolio; it seeks to reduce volatility while preserving diversification. And Vanguard Real Estate ETF VNQ is, as its name suggests, a sector fund.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)