The Oddest Charts in Mutual Funds Tell a Good Story

Investors are supposed to chase performance, right? They're not.

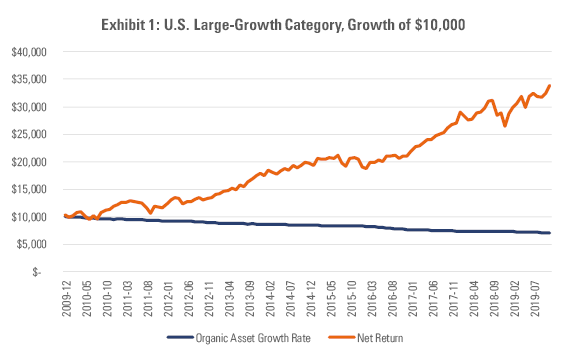

Wanna see something weird? Here's one of the odder sights in the mutual fund world these days.

- Source: Morningstar

What you're seeing is the return of the average large-growth fund since Dec. 1, 2009 (expressed as the growth of $10,000). That's the orange line, jutting ever higher. The average large-growth fund--not the best, mind you, the average fund, after fees--gained a cumulative 239% through Nov. 30, 2019, more than tripling. That showing bests all but three of the 95 Morningstar Categories we tracked over that span.

You'd think that would be catnip for investors, who'd pile into large-growth funds in droves. But that's not at all what's happened. In fact, investors have been repelled. They've sold and sold and sold some more. That's that sad blue line arcing downward. It might not look like much, but investors have pulled around 30% of the category's assets over the past decade, during which large-growth funds have beaten nearly all comers.

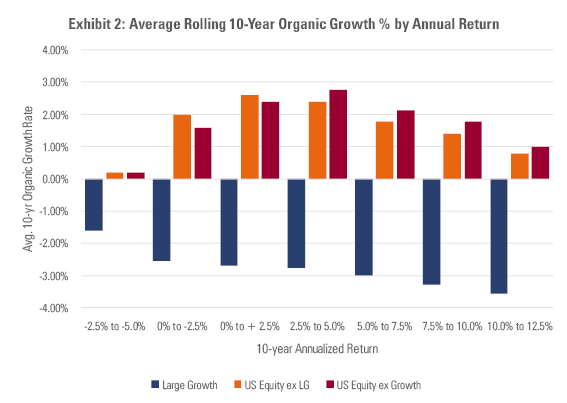

In fact, outflows have gotten worse as returns have improved. To illustrate, we compiled the rolling 10-year annualized returns of the nine U.S. equity category averages for the 20-year period ended Nov. 30, 2019. Then we tallied up the annual organic asset growth in those categories in the same rolling periods, comparing them. Usually, the better the returns in an area, the stronger the inflows, and vice versa. But that didn't hold for large growth, the category for which no good deed went unpunished.

- Source: Morningstar

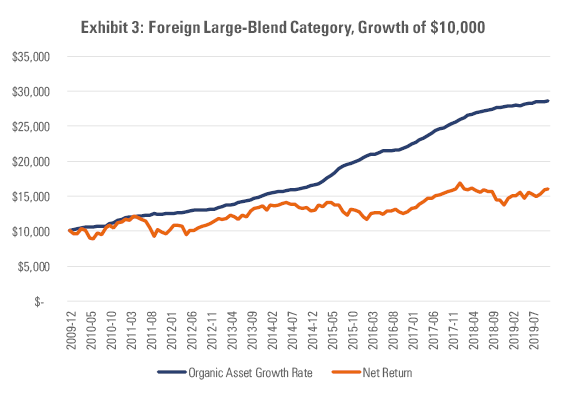

We've seen this scenario play out in reverse in the foreign large-blend category. Unlike large growth, foreign large blend has been a rather pedestrian performer over the past decade; the average fund gained only about 4.8% per year through Nov. 30, 2019. Nevertheless, investors have pumped money into foreign large-blend funds with abandon, as shown by the category's nearly 186% cumulative organic growth rate since December 2009.

- Source: Morningstar

Sweeping Changes Are investors losing their marbles? While these examples might seem to suggest they've gone astray, rest assured they haven't. In fact, the examples highlight several important underlying trends that on balance have likely worked to investors' benefit.

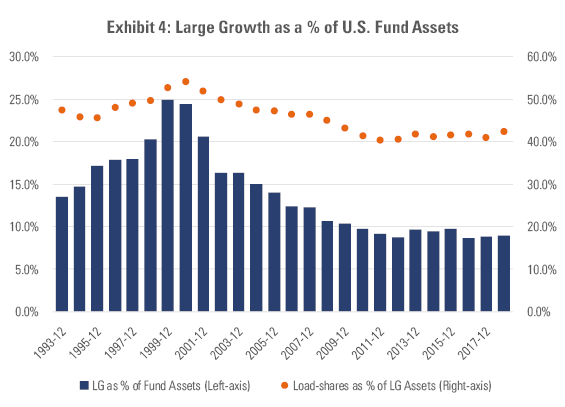

Out With the Stories Was there a bigger "story" sales pitch than "Who wouldn't want to invest in the stocks of high-flying, fast-growing U.S. firms?" as the fund industry took flight in the 1990s? Probably not and the numbers show it, with large growth eventually accounting for around one fourth of the fund industry's assets by the year 2000.

- Source: Morningstar

True, the tech-stock bubble inflated that figure, but the fleets of commission-based brokers peddling growth funds from "load" shops had something to do with it, too. Indeed, nearly three fourths of all inflows to large-growth funds in 2000 went into "load" share classes. Thus, those share classes came to soak up 54% of the category's assets near the peak, a higher share than any of the other U.S. equity categories. Saying large-growth funds were oversold is probably putting it mildly.

Sure, performance has been great over the past decade, but the category entered that decade still bloated from the multiyear bender it had gone on. Against that backdrop, it's no wonder large growth has been a tough sell. In fact, investors' reticence has probably been healthy given the likelihood that at least some of them had been overallocated to such funds to begin with.

In With the Solutions Large growth has also been a casualty of the trend toward diversified "solutions." Investors have sought to spread assets more widely across asset classes. And when they've done so they've often opted for the "core" option within each asset class. That's been a double whammy for large growth, which has not only gotten clipped by investors reallocating to other asset classes but also by those simplifying their U.S. equity stake to favor a blend of value and growth.

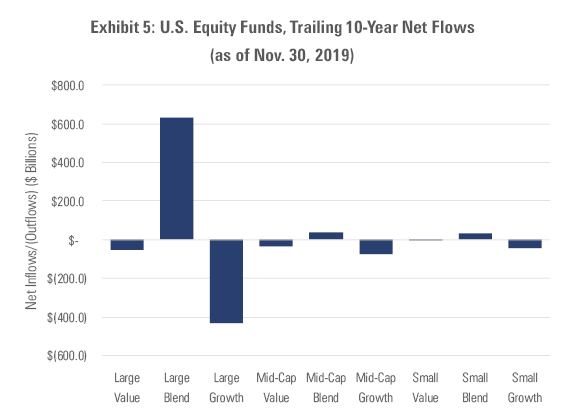

We can see this clearly in the pattern of flows to U.S. stock funds over the last decade. In short, the large-blend category has cleaned up while most other categories--especially large-growth--have seen outflows.

- Source: Morningstar

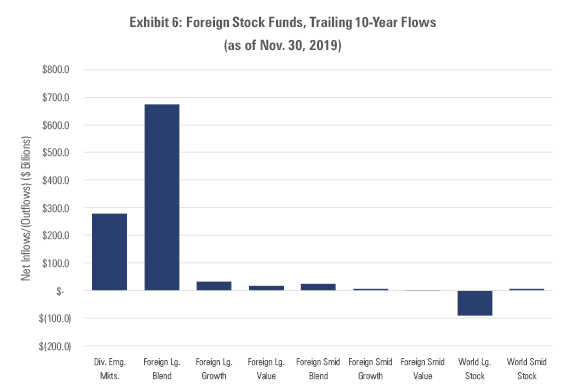

On the other hand, these same trends have been a boon for foreign large blend, which is easily the biggest recipient of inflows among the major foreign-stock categories.

- Source: Morningstar

What explains the sudden zeal for asset allocation, core fund options in particular? Two key trends have catalyzed it:

- Fee-based advice. A big shift in the financial advice business toward a fee-based model has discouraged commission-based "product" sales and encouraged portfolio construction using low-cost, widely diversified building blocks. Advisors who formerly focused on trying to beat the market by picking hot mutual funds have turned to offering comprehensive financial plans, of which diversified asset allocation is a key piece. (This also explains why story-based commission selling has been on the outs.)

- Allocation funds. The other key trend is the rise of programmatic, all-in-one fund investments. The signal example of this trend is target-date mutual funds, which commonly spread their assets across a handful of funds representing the major asset classes. For instance, Vanguard Target Retirement 2030 and its institutional sibling Vanguard Institutional Target Retirement 2030 have funneled nearly $45 billion in net inflows over the past decade to just four funds it holds: a U.S. total stock market index fund, a foreign total stock market index fund, a U.S. total investment-grade bond market index fund, and a foreign total bond market index fund.

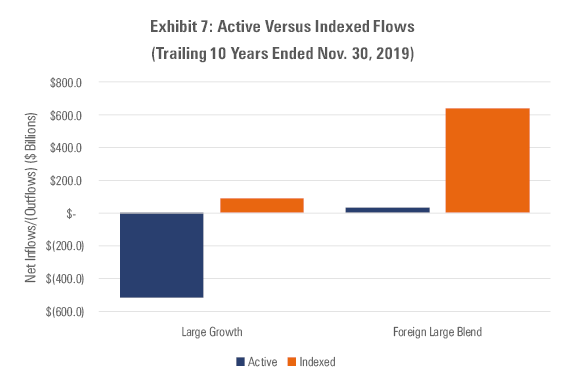

Index or Go Home Finally, investors have gotten religion about cutting costs, which has made indexing the investment format of choice in recent years. Large growth is probably not much less conducive to indexing than foreign large blend. In fact, both saw net inflows to the stable of index funds and exchange-traded funds that called each category home. Yet it's foreign large blend where indexing has really taken off. Why the difference?

- Source: Morningstar

The large-growth category was much more heavily saturated with active fund assets at the outset. Less than 10% of large-growth assets were being indexed in late 2009 versus around a third of assets in foreign large-blend. This made large growth much more vulnerable to the shift toward low-cost passive funds than foreign large-blend. And, indeed, the subsequent outflows from pricey active large-growth funds swamped whatever was coming into the category's cheap index funds and ETFs.

Foreign large blend was not immune to this same dynamic: The category's active funds just barely managed to notch positive outflows over the past 10 years. The difference was one of magnitude, with foreign large blend's active fund offerings coughing up less in assets than large growth did, likely attributable to the two shifts we noted earlier: Foreign-stock funds were less likely be oversold and also were better-suited to the "solutions" that would come into vogue.

Odd as it might look, investors' coolness to high-flying categories like large growth and enthusiasm for mediocrities like foreign large blend is a positive development. It indicates the extent to which the fund and financial advice industries have changed. Investors are increasingly opting for low-cost, diversified solutions as part of a broader financial plan or being opted into cheap investment options like target-date funds that do the choosing for them. And they're probably getting less-conflicted advice from advisors who have less incentive to sling product or tell fanciful stories than before. When investors are paying less, achieving broader diversification, and getting better advice than before, that marks real progress.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)