10 Sustainable Investing Stories of 2019

We examine the developments and consider their implications for 2020.

1. The Growing Immediacy of Climate Change Directly experiencing extreme and volatile weather events will spur increased investor concern about climate risk in their portfolios. Climate change is becoming a more immediate concern as people everywhere are directly experiencing extreme and uncommon weather events. The hottest July on record occurred this year, and 2019 is on track to be the second hottest year since modern temperature data collection began in 1880. These trends and events, as well as those beyond our direct experience, are constantly in the headlines, interpreted in the context of climate change and set alongside a steady stream of scientific reports all pointing to the same conclusion: that human-caused climate change is warming the earth and changing its climate, and the worst effects can still be avoided by drastically reducing greenhouse gas emissions over the next two decades.

I expect investors to become increasingly concerned about the impact of climate change on their portfolios. They'll want to reduce climate risk, and there is some academic evidence they are already doing so. A group of Swiss researchers found that funds Morningstar labeled as "low carbon" experienced higher net flows compared with otherwise similar funds.

I expect more investors will want fossil-fuel-free portfolios, while the demand to address climate-change solutions via investments will also grow. Asset managers, meanwhile, will increase their focus on the physical risks of climate change. Wellington Management, for example, has partnered with Woods Hole Research Center to map the areas of the world where climate change will make it increasingly difficult for companies across many industries to operate.

2. The Shift Toward Stakeholder Capitalism Sustainable investors can help bring about stakeholder capitalism. The world is shifting its thinking about the purpose of the corporation, as illustrated by the Business Roundtable's statement on corporate purpose released in August. A significant departure from the long-standing view that the primary purpose of a corporation is to maximize shareholder value, the Business Roundtable statement said the purpose of a corporation is to serve and create value for all stakeholders.

While sustainable investment strategies vary in their particular investment approaches, at some level most of them are trying to identify companies that are pursuing stakeholder value, avoid those that aren't, and engage as shareholders with the ones they own to urge them in that direction.

Corporations are more likely to adopt a stakeholder-centric view if they have a base of investor support for it. Sustainable investing raises the bar on traditional investing by supporting the transition to this new paradigm of stakeholder capitalism.

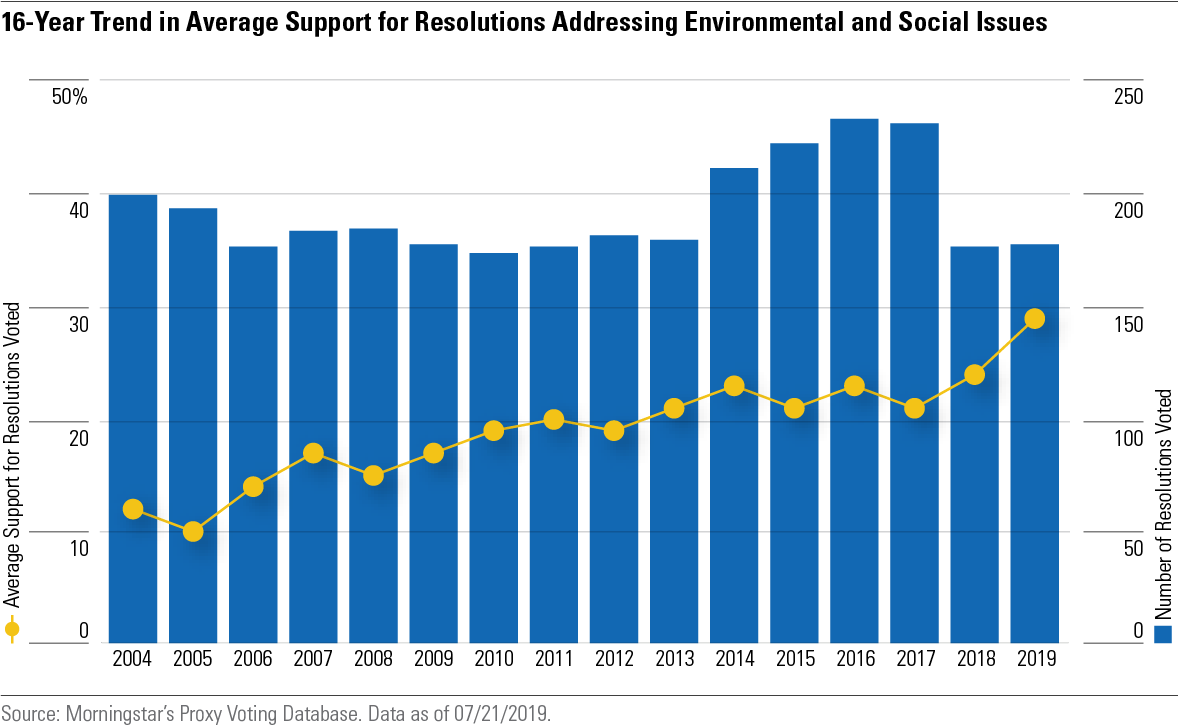

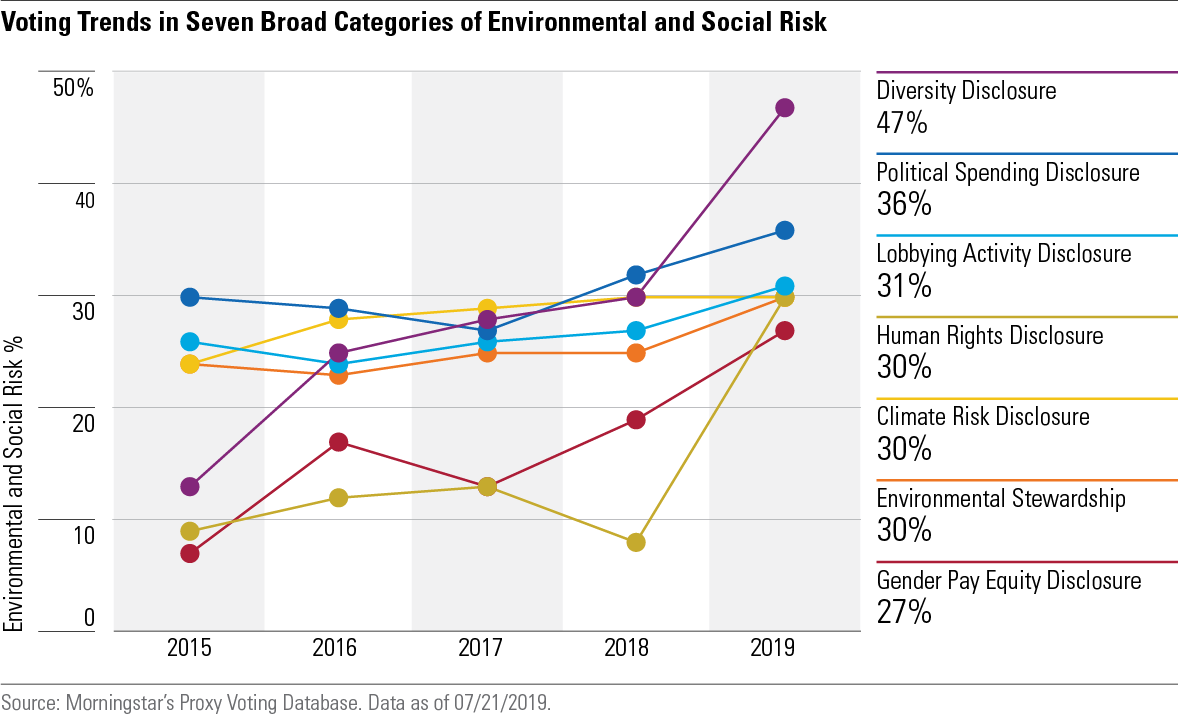

3. Proxy Voting and Shareholder Engagement Take Center Stage Active ownership is central to sustainable investing. Investors continued the trend of greater support for ESG-related shareholder resolutions in the 2019 proxy season. ESG resolutions drew the support, on average, of nearly 30% of the shares voted at the annual general meetings of U.S. companies. That's the highest level of support over the 16 years for which Morningstar has proxy voting data.

Sustainable investors have also ramped up their direct engagements with companies, taking on ESG-related issues like guns, opioids, gender equity, and climate change in 2019. The Climate Action 100+, for example, is a group of global investors who engage with systemically important greenhouse-gas-emitting companies about aligning their business strategies with the goals of the Paris Agreement. The group's progress report for 2019 outlines its progress in urging companies to set emissions-reductions targets and to implement concrete strategies to achieve them.

Many larger asset managers prefer to engage privately with companies about ESG issues and often oppose most shareholder resolutions that bear on these same issues unless they believe their engagement efforts have failed. While every ESG resolution doesn't necessarily deserve automatic approval, a blanket policy of voting routinely against (and in favor of company management) ESG resolutions dilutes the influence sustainable investors can have on these issues.

Asset managers need to be more transparent about communicating their ESG engagements to shareholders. And those that generally oppose ESG-related shareholder resolutions need to reconsider that stance, as more investors will use proxy voting to gauge asset manager commitment.

4. Turning Back the Clock at the SEC A partisan SEC seeks to limit shareholder proposals and change the proxy voting process. Shareholder proposals are a critical means of communications between companies and their shareholders--especially individual shareholders who are able to propose resolutions alongside big institutional shareholders. Over the years, shareholder resolutions have helped put ESG issues front-and-center on many companies' radars, helping them attend to issues before they suffer the financial consequences of ignoring them.

At a time when proxy voting and shareholder engagement are becoming more central to corporate governance, the U.S. Securities and Exchange Commission is moving to limit these activities. During this year's proxy season, the SEC was more willing to allow companies to leave shareholder resolutions off the proxy ballot because they were deemed to be about ordinary business and beyond the scope of shareholder oversight.

In November, the SEC voted 3-2, with Republican commissioners in the majority, to raise the thresholds for shareholders to propose resolutions at annual company meetings and to increase the thresholds for resubmitting such resolutions in subsequent years. The commission also proposes to limit the influence of proxy advisors, which assist asset managers in the proxy-voting process.

The SEC rulemaking process remains under way, subject to public comment, so the rules aren't final. They are being pushed by Washington-based corporate trade groups closely aligned with the three Republican commissioners, who aren't pleased with the growing support for shareholder proposals about climate risk and better disclosures on corporate political and lobbying expenditures.

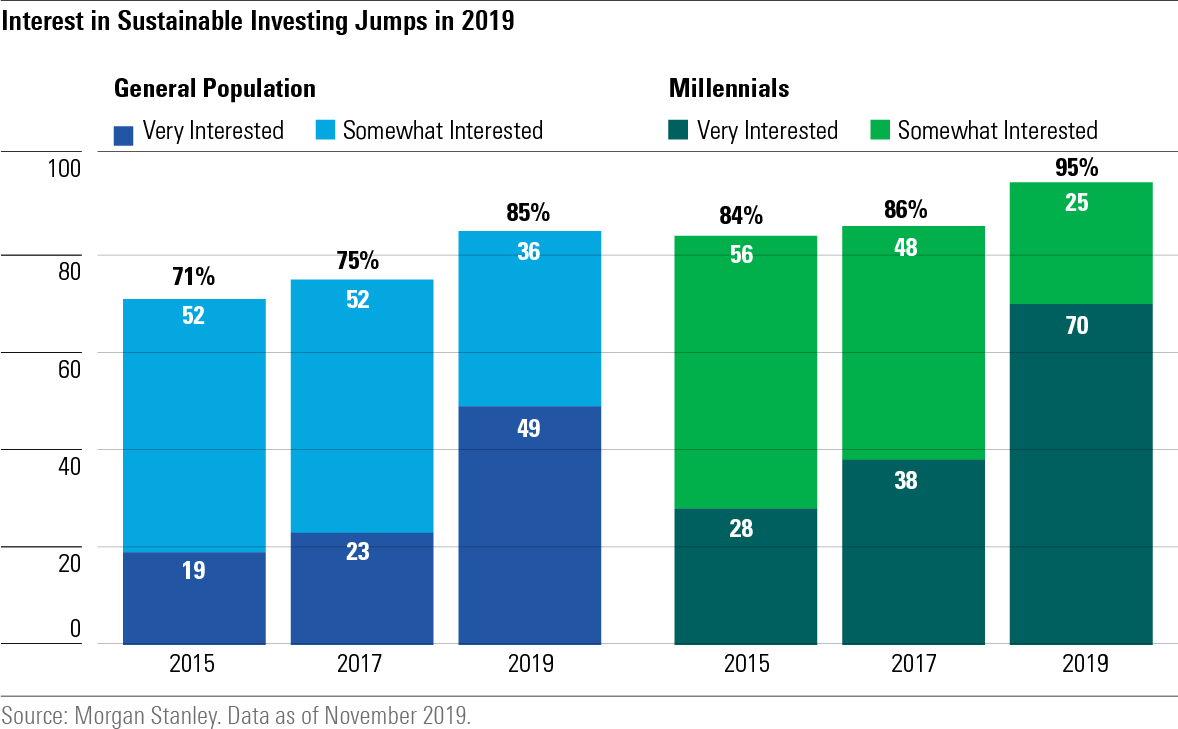

5. Interest in Sustainable Investing Continues to Rise Among Individual Investors A tsunami of assets to follow? Every other year since 2015, Morgan Stanley has surveyed individual investors about their interest in sustainable investing. In 2015, 71% indicated an interest. This year, 85% indicated an interest (and 95% of millennials). And perhaps more tellingly, a much greater proportion in 2019 said they were "very" interested in sustainable investing. In 2015 only 19% said they were "very" interested, but this year 49% said so.

So why hasn't that interest translated into invested assets? Being interested in sustainable investing doesn't speed up someone's investing activities. Most individuals change their investments only on occasion, and often only when a new occasion presents itself (an inheritance, for example, or a large bonus). In the case of millennials, many are still in the early stages of their personal investing. Interest in sustainable investing doesn't suddenly turn people into investors. But when they are ready to invest, they're going to do so sustainably. That's why I believe we're still in the early days of sustainable investment asset growth. A September Bank of America report concluded that a "tsunami of assets is poised to invest" sustainably over the next two decades.

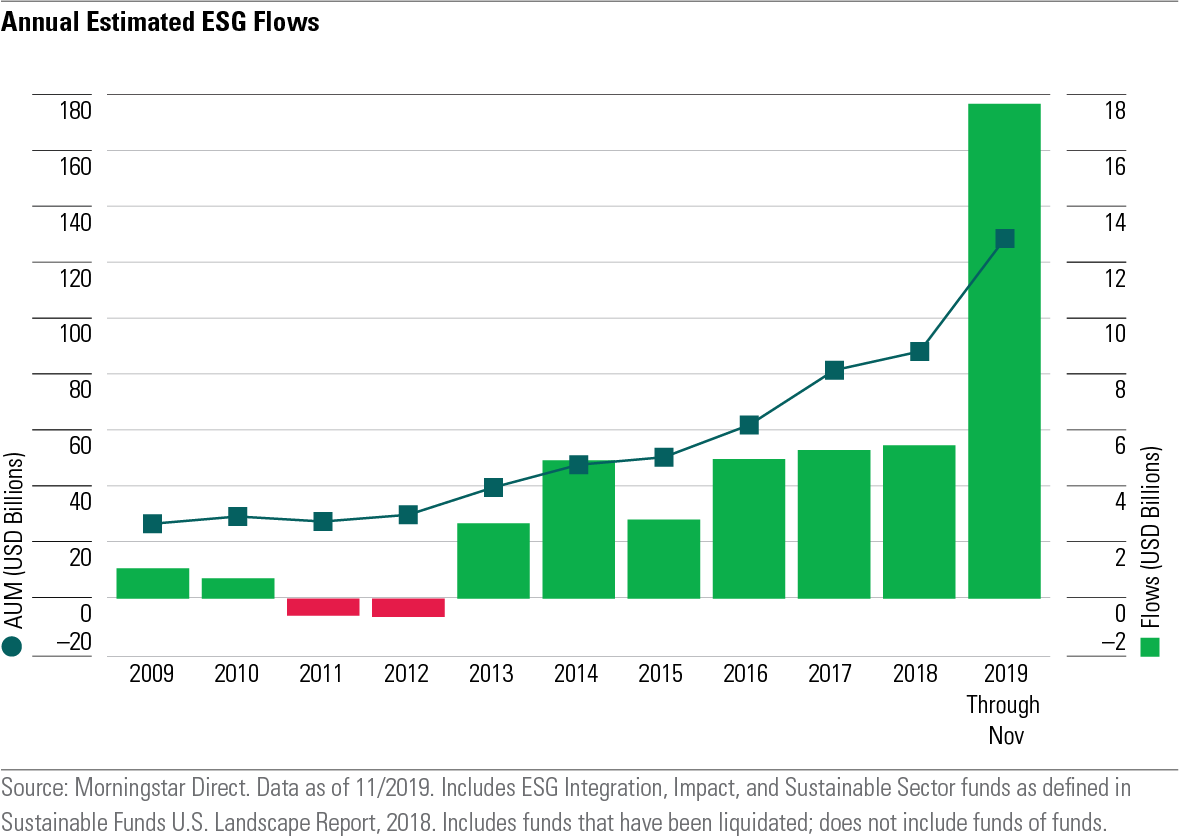

6. Flows Into U.S. Sustainable Funds More Than Tripled in 2019 Fourth year in a row of record flows. If not exactly a tsunami, a big wave of flows came into sustainable funds this year. Estimated net flows into open-end and exchange-traded sustainable funds available to U.S. investors reached $17.7 billion through November. That's more than triple the record for an entire calendar year, set in 2018.

7. A Strong Year for U.S. Sustainable Fund Performance Sustainable funds top performers across a range of categories. Through November, the returns of nearly two thirds (65%) of open-end and exchange-traded sustainable funds ranked in the best half of their respective Morningstar Categories. The returns of 37% placed in the best quartile, while those of only 15% placed in the worst quartile. The returns of sustainable funds placed in the best quartile of 27 different categories.

Among large-cap blend funds, the returns of nearly half (48%) of sustainable funds are ahead of the S&P 500 for the year to date, compared with only 22% of large-blend funds overall.

These results, coming on the heels of similar results in 2018, provide further evidence that concerns about performance should be laid to rest. Sustainable funds are not all the same; they differ in how they apply ESG criteria and in their overall investment approaches, but across a range of categories they are demonstrating competitive performance.

8. Many More Funds "Considering" ESG Does it make any difference in how they're run? Over the past year, many conventional funds in the U.S. have added ESG criteria to their prospectus, bringing the total to about 500. This trend reflects the realization on the part of many asset managers that consideration of material ESG issues results in a more complete investment analysis. Yet there is little evidence thus far of whether ESG "consideration" is actually having an impact on these funds.

I expect this trend to continue, but fund managers will need to do a better job showing what difference ESG consideration makes in order to be credible with sustainable investors.

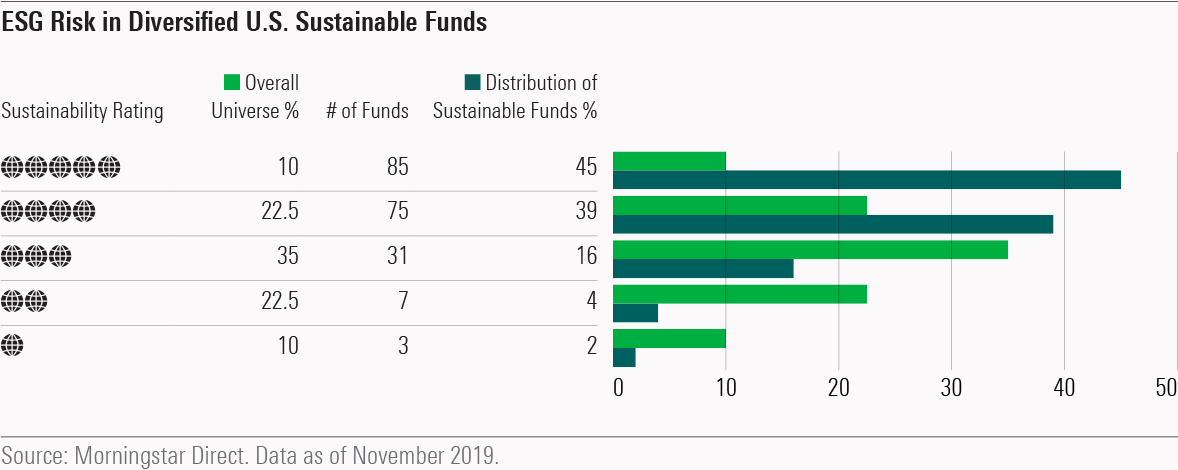

9. Enhancement to Morningstar Sustainability Rating A more robust assessment of the ESG risk embedded in a portfolio. The enhanced Morningstar Sustainability Rating was released in November, with a greater focus on the financial materiality of ESG issues. It now reflects both within-industry and across-industry assessments of ESG risk.

An overwhelming majority of diversified sustainable funds receive 4 or 5 globes, far more than the percentage of ESG consideration funds or conventional funds that receive 4 or 5 globes.

10. Impact investing Making a difference. If ESG risk is one watchword of sustainable investing, impact is the other. Making a difference through one's investments resonates with people. Funds that practice active ownership through engagement and proxy voting can help companies meet their sustainability challenges and lower ESG risk while creating positive societal impacts beyond financial returns.

We saw the launch of several explicitly impact-oriented funds in 2019, and I expect to see more in 2020. In addition, I expect more asset managers to publish reports that communicate the societal impacts of their sustainable strategies. Many of these will use the UN's Sustainable Development Goals as a framework.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)