ESG Tax-Deferred Retirement-Saver Portfolios for Mutual Fund Investors

Anchored in actively managed funds, these portfolios were developed with serious ESG investors in mind.

Sustainable mutual funds—which are also called ESG funds—have soared in popularity over the past decade.

Interest in environmental, social, and governance investing comes from investors of all ages, but younger investors appear to have a particular affinity for investing in line with their personal principles. According to Morgan Stanley research, 90% of millennials (people born between the early 1980s and 1996) say they are interested in pursuing sustainable investments for their retirement plans.

With the heightened level of interest in mind, I’ve created a series of ETF model portfolios geared toward people who are still accumulating assets for retirement inside tax-sheltered accounts (IRAs and so on).

About the Portfolios

I’ve created portfolios composed of exchange-traded funds as well as this series, which features mutual funds. The ETF portfolios are designed to incorporate investments that pass muster on the ESG front but have low “tracking error,” meaning that the portfolios’ performance is likely to hew closely to that of a portfolio consisting of plain-vanilla, non-ESG ETFs. With the mutual fund portfolios, I’ve incorporated mutual funds, mainly actively managed ones, that garner very high Morningstar Sustainability Ratings.

For example, the largest domestic-equity holding in the portfolios, Parnassus Core Equity PRBLX, has long been a leader in the ESG investing space, and applies rigorous ESG standards to each of the holdings that comes into the portfolio. In addition to excluding companies that derive significant revenue from alcohol, tobacco, weapons, nuclear power, or gambling, Morningstar senior analyst Stephen Welch notes they seek companies with sustainable competitive advantages, increasingly relevant products or services, exemplary management, and ethical practices.

As with the other model portfolios, I relied on the Morningstar Lifetime Allocation Indexes to help set the portfolios’ asset-class exposures. I worked with Morningstar’s Jon Hale and Morningstar’s manager researchers to populate the portfolios with holdings that have strong ESG and investment merits. Because the mutual fund portfolios encompass a heavier ESG emphasis than do the ETF portfolios, I would expect them to exhibit performance that differs more meaningfully from market benchmarks. In particular, the portfolios tend to lean toward the growth side of the Morningstar Style Box, whereas the ETF portfolios are better balanced along the value-blend-growth spectrum. And because the mutual fund portfolios are anchored with active equity funds, their costs are obviously higher, too. I focused on funds that are widely available from major brokerage-firm platforms without a load or transaction fee.

The portfolios are geared toward investors’ tax-sheltered retirement accounts, so I didn’t consider holdings tax efficiency when populating the portfolios.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes only when individual holdings encounter fundamental problems or changes, or if they no longer rate as Morningstar Medalists.

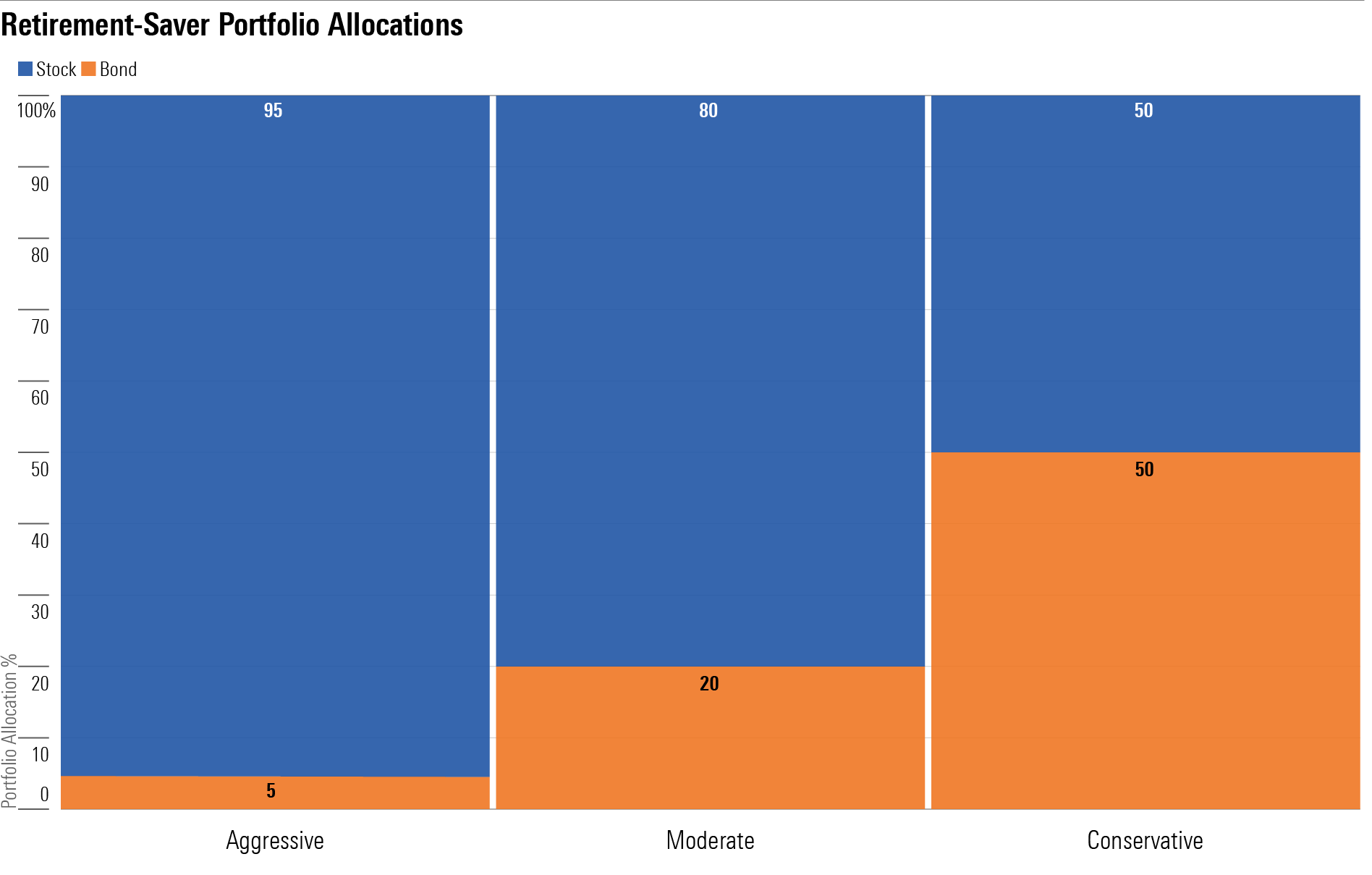

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive Portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Retirement-Saver Portfolio Allocations

Aggressive ESG Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 15%: Parnassus Core Equity PRBLX

- 10%: Calvert US Large Cap Value Responsible Index CFJAX

- 10%: Brown Advisory Sustainable Growth BIAWX

- 15%: Parnassus Mid-Cap PARMX

- 5%: Boston Trust Walden Small Cap BOSOX

- 40%: Fidelity International Sustainability Index FNIDX

- 5%: Pimco Total Return ESG PTSAX

Moderate ESG Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 15%: Parnassus Core Equity PRBLX

- 10%: Calvert US Large Cap Value Responsible Index CFJAX

- 10%: Brown Advisory Sustainable Growth BIAWX

- 8%: Parnassus Mid-Cap PARMX

- 5%: Boston Trust Walden Small Cap BOSOX

- 32%: Fidelity International Sustainability Index FNIDX

- 20% Pimco Total Return ESG PTSAX

Conservative ESG Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 13%: Parnassus Core Equity PRBLX

- 7%: Calvert US Large Cap Value Responsible Index CFJAX

- 5%: Brown Advisory Sustainable Growth BIAWX

- 7%: Parnassus Mid-Cap PARMX

- 3%: Boston Trust Walden Small Cap BOSOX

- 15%: Fidelity International Sustainability Index FNIDX

- 30% Pimco Total Return ESG PTSAX

- 10% Vanguard Short-Term Federal VSGDX

- 10% Vanguard Short-Term Inflation-Protected Securities Index VTAPX

A version of this article was published on April 16, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)